This week’s Animal Spirits with Michael & Ben is supported by YCharts:

Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service.

We discuss:

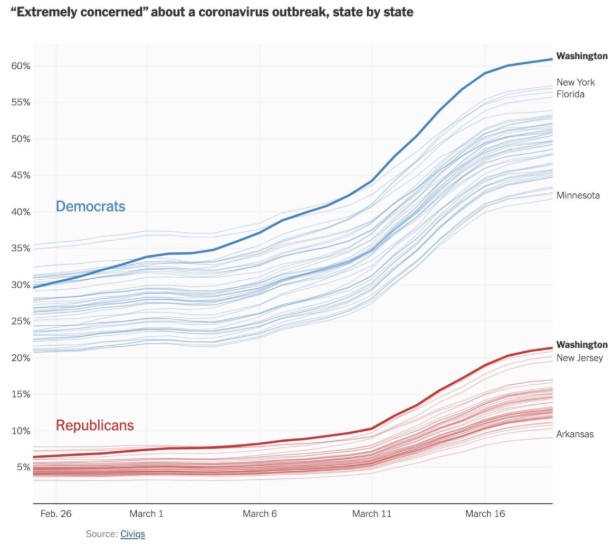

- Don’t allow political beliefs do cloud your judgment during a crisis

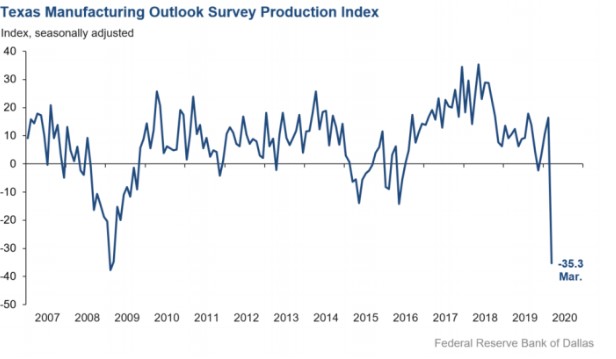

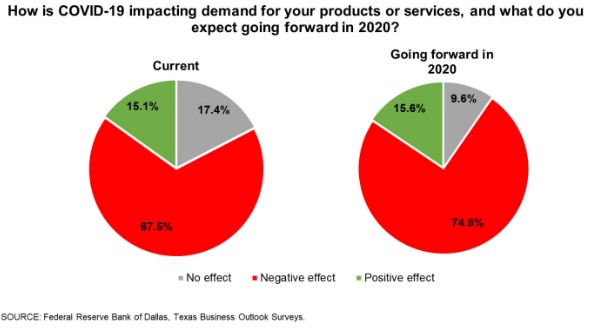

- Putting the economy on ice

- How about a no layoff pledge from CEOs?

- The response from the public sector

- When risk changes shape during a crash

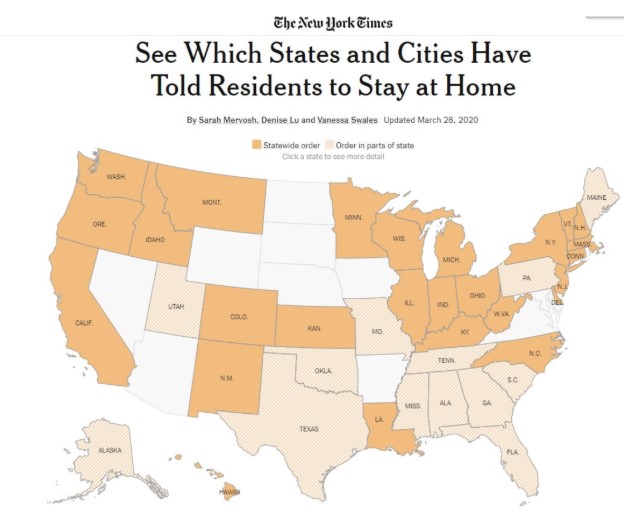

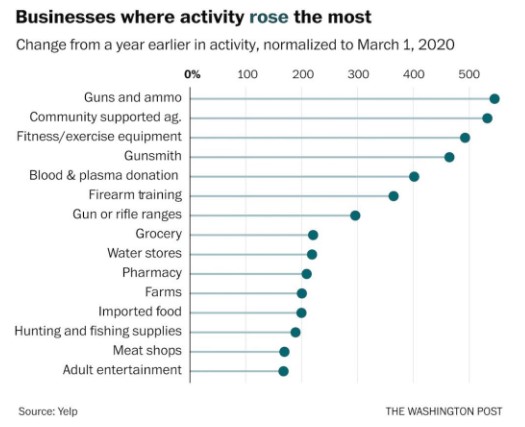

- Behavioral change and unintended consequences during the shutdown

- Our capacity for taking on debt as a country

- What if we don’t get inflation from all of this government spending?

- Why the U.S. dollar is still king

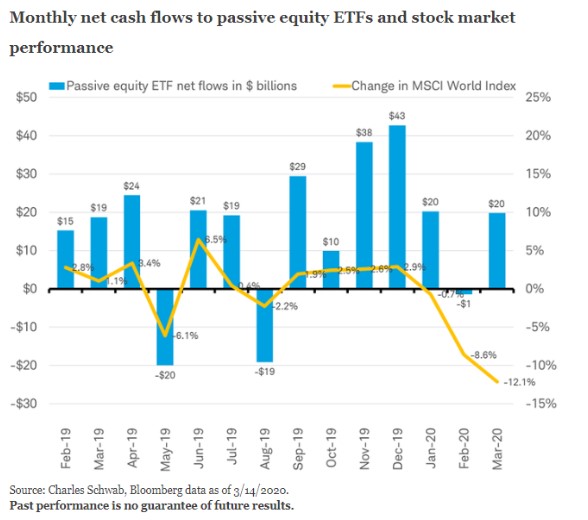

- Was that a dead cat bounce or a bottom?

- Why so many investors are going to miss the recovery (whenever it happens)

- Experience may not help you invest during a crash

- Did the 60/40 portfolio die again?

- Will rebalancing put a floor under the market?

- When should you rebalance?

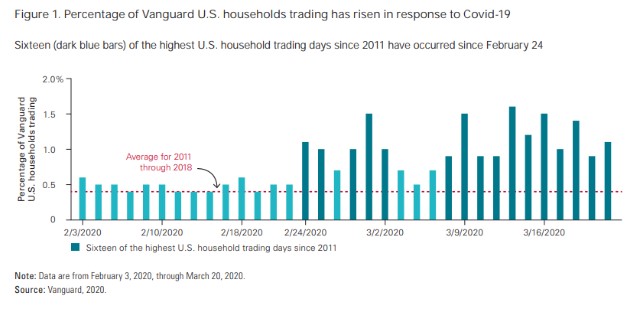

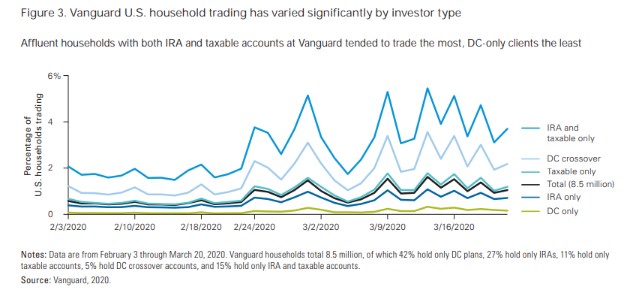

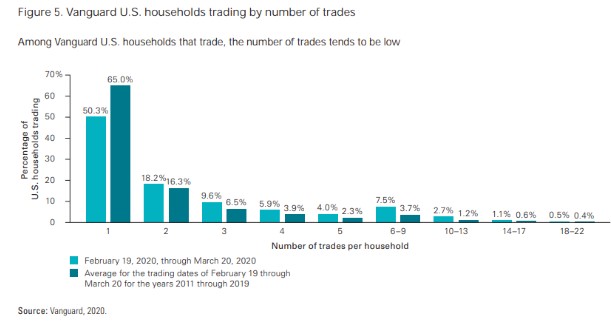

- Vanguard investors aren’t panicking yet

- Businesses that won’t be impacted by the shutdown

- The new season of Ozark and much more

Listen here:

Stories mentioned:

- Don’t re-open the economy. Put it on ice

- Coronavirus home test kits

- Foxconn secures workers at all plants

- The U.S. is about to vastly increase its debt

- After coronavirus we will have to reckon with debt

- A short history of dead cat bounces

- I became a disciplined investor over 40 years. The virus broke me in 40 days

- 60/40 portfolio loses 20% for the 4th time since WWII

- JP Morgan sees big rise in stock buying

- When should I rebalance?

- Who fueled the fastest bear market ever?

- The Drive with Peter Attia

Books mentioned:

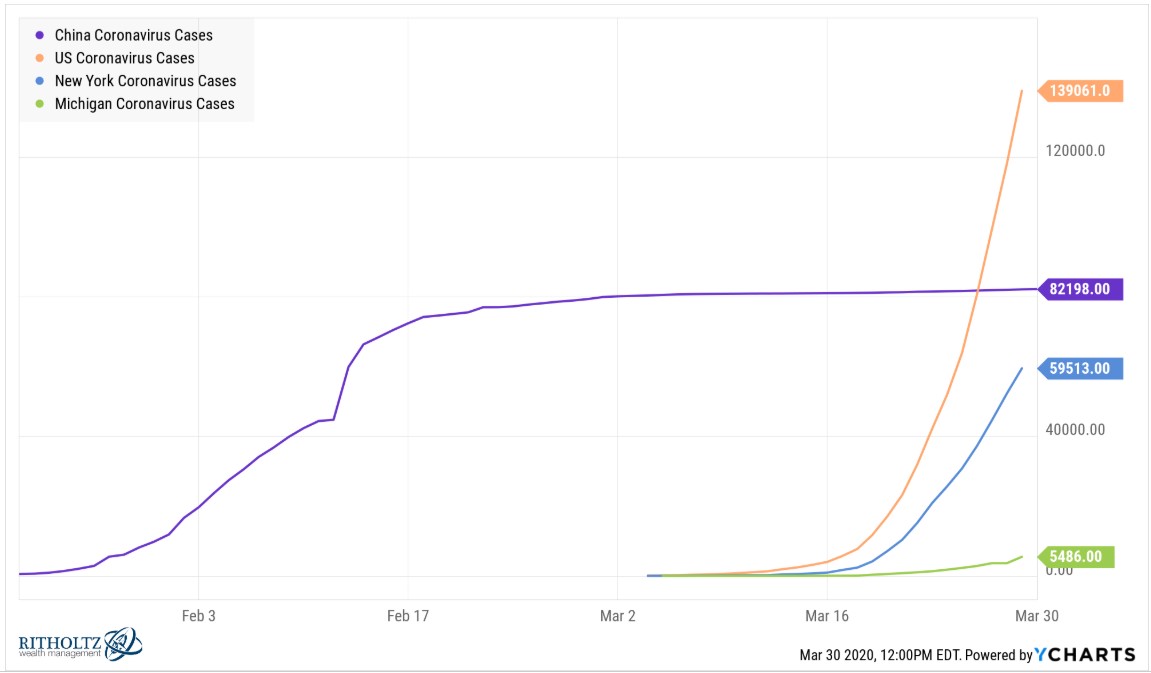

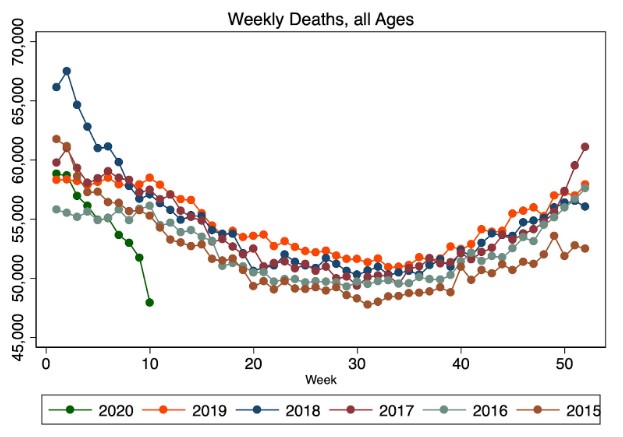

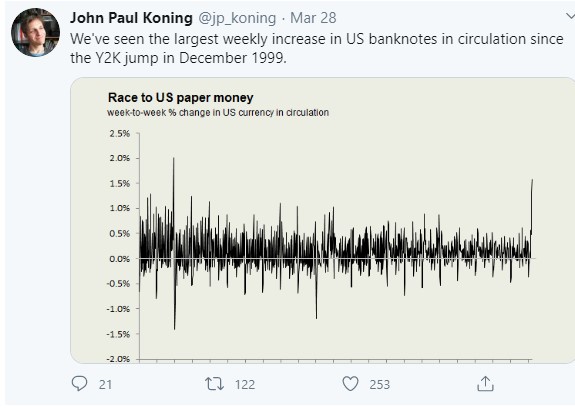

Charts mentioned:

Contact us at animalspiritspod@gmail.com with any questions, comments, feedback or recommendations.

Follow us on Facebook, Instagram and YouTube.

Find transcripts of every show on Shuffle.

Check out our t-shirts, coffee mugs, stickers and other assorted swag here.

Subscribe here: