This week’s Animal Spirits with Michael & Ben is sponsored by YCharts:

Mention Animal Spirits and receive 20% off your subscription price when you initially sign up for the service.

We discuss:

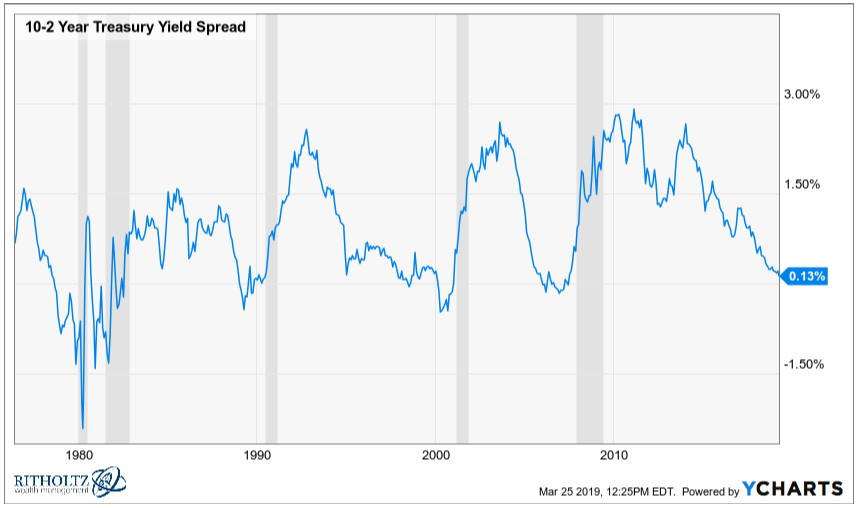

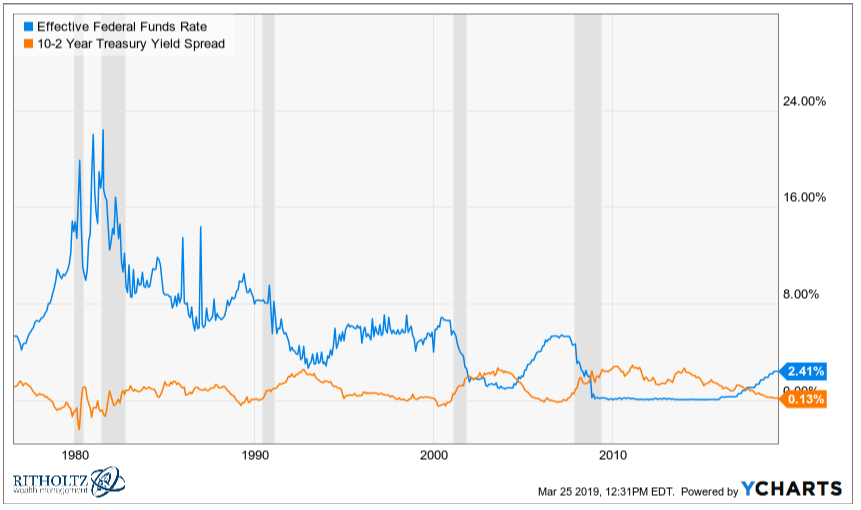

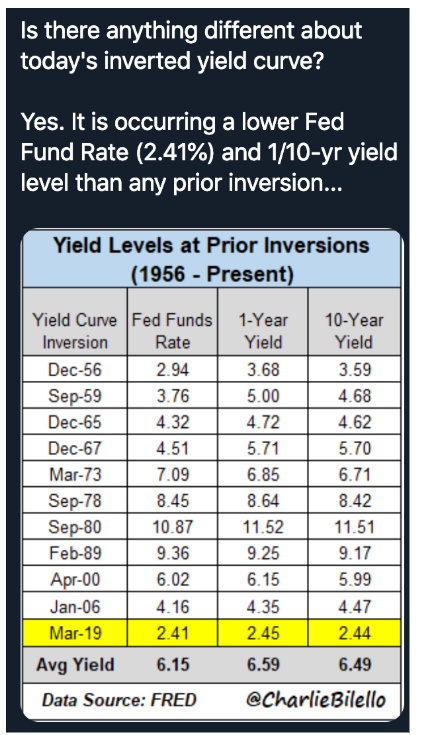

- The dreaded yield curve inversion — useful signal or noise?

- Who’s smarter — the bond market or the Fed?

- Which generation is in more trouble financially — millennials or boomers?

- Who ya got — Kahneman vs. Cialdini?

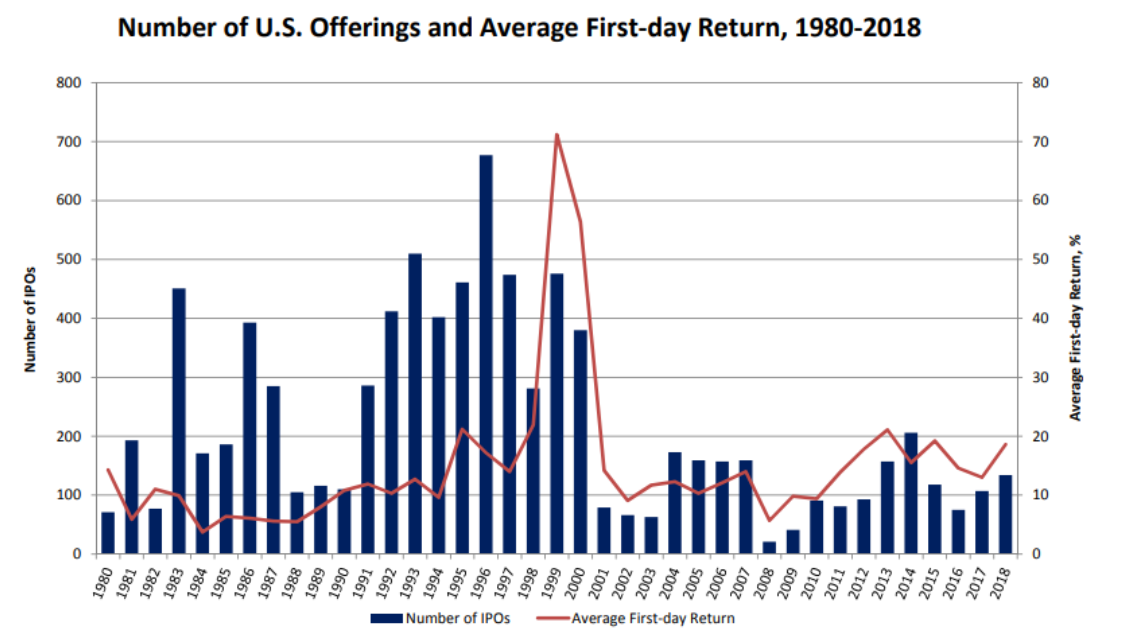

- Why IPOs are almost always oversubscribed

- Better investment — real estate or stocks?

- Bitcoin volume is fake. Do HFTs make stock market volume similarly overstated?

- New hedge funds vs. old hedge funds

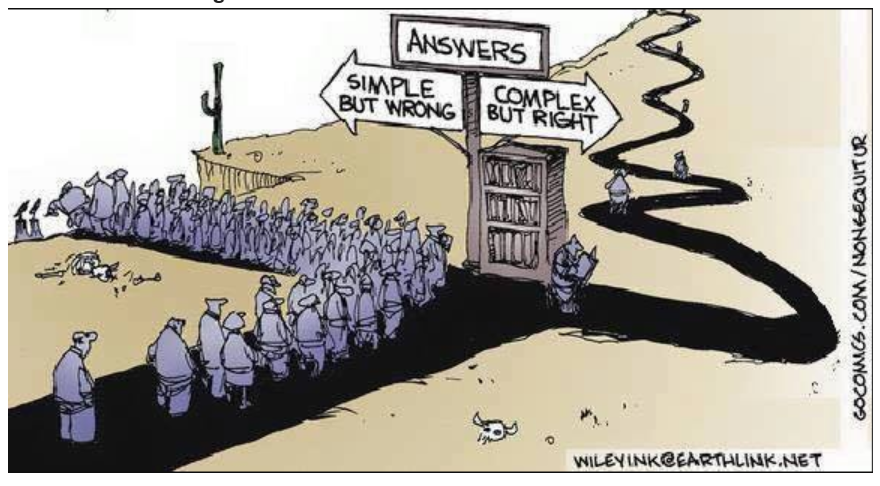

- Simple vs. complex

- Behavioral lessons from the blackjack table & much more

Listen here:

Stories mentioned:

- Yield curve inversions aren’t great for the stock market

- How your kids can ruin your retirement

- Kahneman on intuition

- Why are IPOs oversubscribed?

- Scared of stocks? Buy a house instead

- Majority of bitcoin trading is a hoax

- Hedge fund launches fall to 18 year low

Books mentioned:

- The Checklist Manifesto by Atul Gawande

- Where the Crawdads Sing by Delia Owens

- Predictably Irrational by Dan Ariely

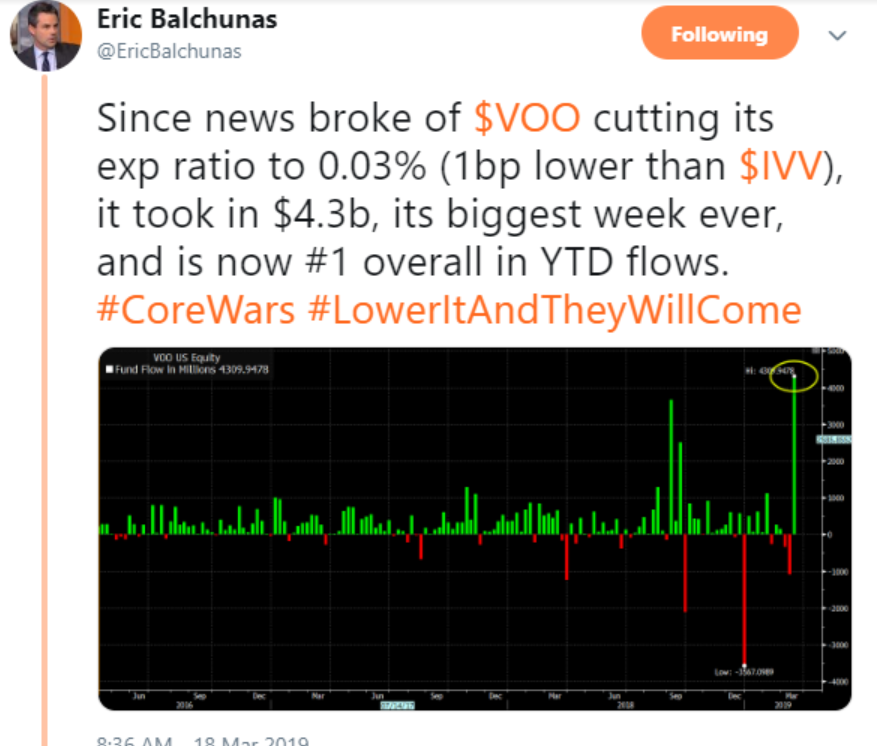

Charts mentioned:

TV Shows/Movies/Podcasts Mentioned:

- Catastrophe (Amazon Prime) – Pretty much the perfect comedy for the streaming era. It’s just 4 seasons with 6 episodes per season and each episode is only 30 minutes a piece. A hilarious and perfect take on marriage and having kids.

- Green Book – I’m not exactly going out on a limb by recommending the movie that won best picture at the Oscars but I enjoyed this one. Viggo Mortensen and Mahershala Ali were a wonderful duo.

- Us – Michael came away confused by this new horror movie from Jordan Peele.

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook.

Subscribe here: