A reader asks:

Ben, wanted to get your thoughts on my mother’s situation. She is 83 and has been an aggressive investor over the last 20 years that has turned out very well. She bought Apple in 1999 and Tesla at $35 post-split. She also owns Nvidia and Square. She has turned roughly $300,000 into $3,000,000. All good, right? A few days ago, she couldn’t sleep and sold all but 10% of her stock holdings. She has obviously locked in her gains (and tax consequences), but now what? Hate to see her leave the money in a savings account earning 20 bps. Love to hear your thoughts.

Who says Robinhood is only for the young?

I’m seeing a surprising amount of emails like this one. Obviously, this is a good problem to have but planning your finances once you create a life-altering amount of money can still be stressful.

On the one hand: What if I could somehow turn $3 million into $30 million?!

On the other hand: What if I somehow turn $3 million back into $300k?!

Reality is typically somewhere in-between these two thoughts but these are the competing ideas we’re all forced to deal with as investors.

It’s impossible to give financial advice to someone without a deep understanding of their circumstances, goals, lifestyle, needs, desires, spending habits or personality.

But here are some options to consider:

Hire an advisor. I don’t care who you are — a 10x return on your capital is amazing. It’s not easy to hold an aggressive portfolio like this over the long-term. That’s the good news.

The other side of this is now your situation is more complicated.

I’m biased but a good financial advisor could be the solution here. These are my basic guidelines for why someone should hire an advisor:

- When your financial situation becomes more complicated or you have a huge life event that requires an expert

- When you don’t have the time, inclination or expertise to manage your own money

- When you desire an objective outside opinion to help make better decisions

- When you’re worried about your spouse or family if you are the main financial decision-maker

- When you’ve made too many mistakes or reach the paralysis-by-analysis stage of money management

When I wrote the person back who sent in this question they actually said their mother probably wouldn’t work with an advisor. Which is fine. Hiring a financial advisor is not for everyone. Some people will never be able to let go of the steering wheel.

So what are the other options?

Keep an aggressive allocation in a portion of your portfolio. As someone in the financial services industry, it would be easy for me to tell this person to take all of their money, pick a balanced asset allocation that suits their risk profile and time horizon, and move on with their life.

Why keep playing the game if you’ve already won?

On paper this makes sense but it can be difficult to turn off that part of your brain. And frankly, some people simply enjoy investing this way.

But the fact that our 83-year-old investor is having trouble sleeping at night makes me wonder if it’s time to right-size her aggressive allocation.

What if she just kept that 10% as a go nuts allocation? Or maybe 20% would do it?

There’s nothing wrong with taking risk in your portfolio as long as you’re able to offset that risk elsewhere to balance your emotions.

Find a comfortable allocation. You knew this was coming, right? There’s plenty you can do from a portfolio perspective between a 20 basis point savings account and owning Apple, Nvidia and Tesla shares.

Concentration helped build this wealth. Diversification can help preserve it.

Balancing out an aggressive allocation with a more boring allocation that produces dividends, income and some stability can actually make it easier to continue investing a portion of your money aggressively.

There is no perfect portfolio allocation so creating the right mix of stocks, bonds, cash and other assets comes down to your willingness, need and ability to take risk. It’s important to remember these three things are never in equilibrium so there has to be some give and take.

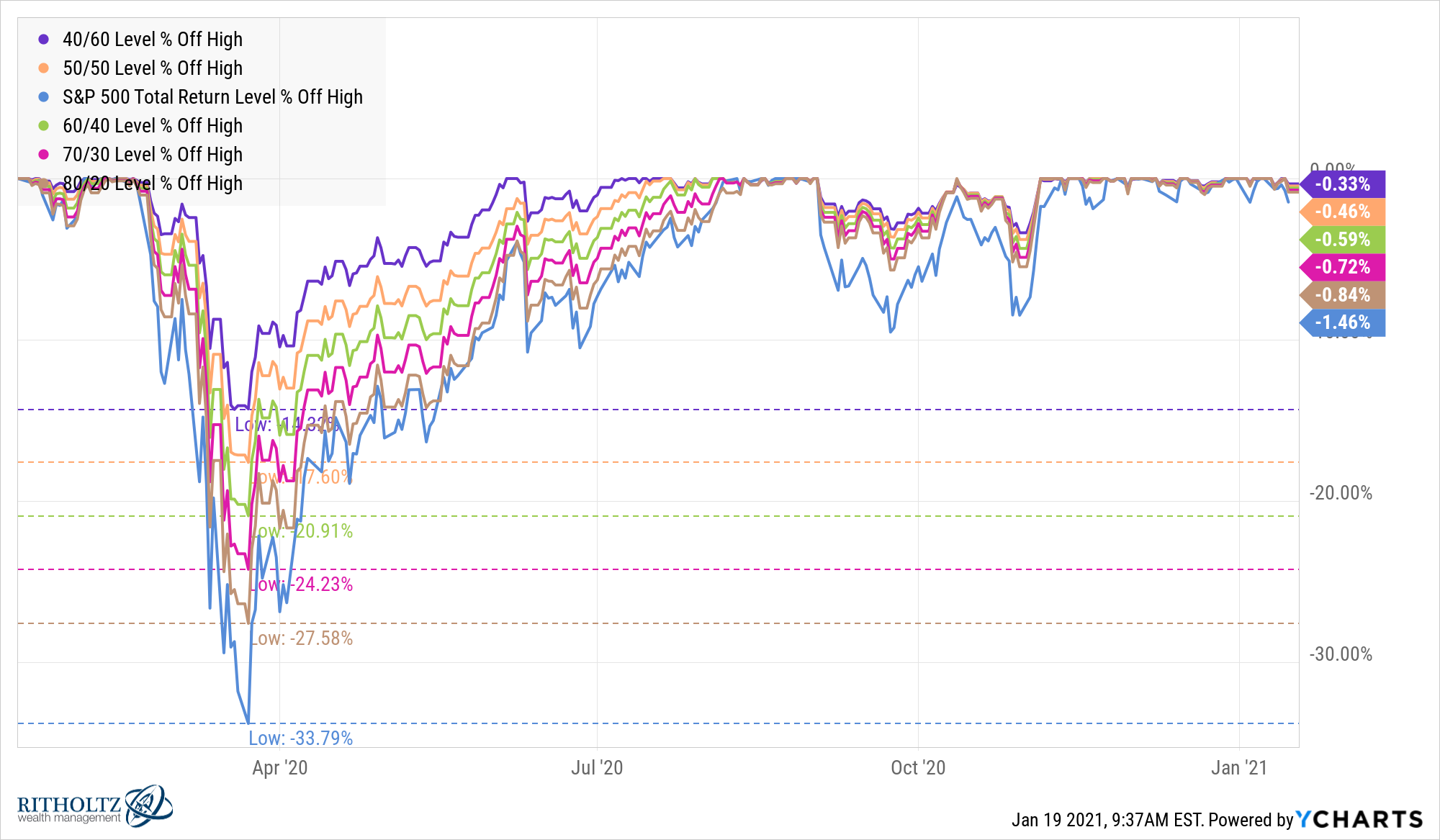

While not a precise gauge of risk, 2020 offers both sides of the coin depending on the allocation. Here are the drawdowns for a simple 40/60, 50/50, 60/40, 70/30 and 80/20 stock/bond mix:

A 40/60 portfolio lost 14% while the other allocations fell 18%, 21%, 24% and 28%, respectively. For comparison purposes, the S&P 500 was down 34%. Many individual stocks were down much more than this.

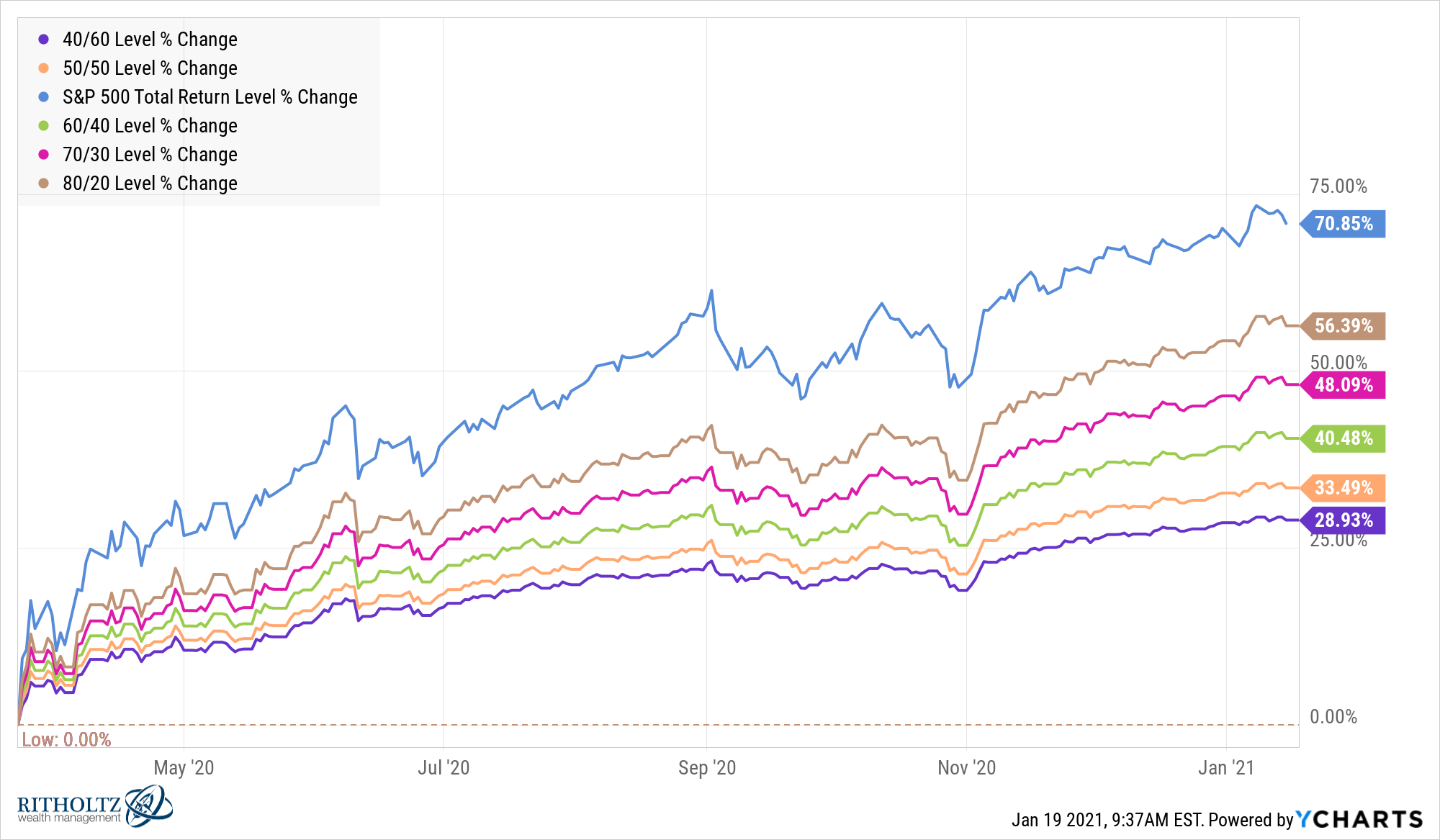

Now here are the returns from the nadir of those drawdowns:

The allocation itself isn’t nearly as important as your ability to stick with it through both good markets and bad.

Pay down some stresses. This started out as an investment question but you can’t separate financial planning from this equation. I don’t know the financial circumstances here but many people have other financial stress points in their lives.

She could pay down some debt or fix up her house or give some money away to charity or invest it for the next generation. The answer to these questions doesn’t always come down to the markets.

Sometimes the emotional returns on your capital are more important than the financial returns.

Splurge a little. It’s also important to actually enjoy some of this money. Buy a new car. Plan a huge vacation for when this godforsaken pandemic is over. Buy some new clothes. Get a hot tub. Spoil your kids (or grandkids).

The entire point of saving and investing is to eventually spend the money. A big portfolio is useless if you don’t use it for something.

So carve out a piece of your winnings and spend that money free from guilt.

You’ve earned it.

Further Reading:

How to Invest When You’ve Already Won the Game?