On this week’s Animal Spirits with Michael & Ben we discuss:

- How much brokers charged in the 1940s for stock trades.

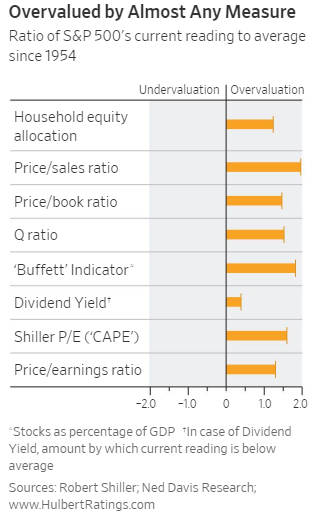

- Stocks are overvalued by almost every measure but what does that mean?

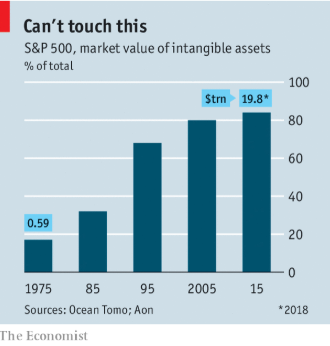

- How the growth of intangible assets has impacted the markets.

- The fallout from the crypto massacre.

- Will the finance industry stamp out Robinhood’s growth?

- Why have managed futures funds performed so poorly?

- Americans still know how to spend money.

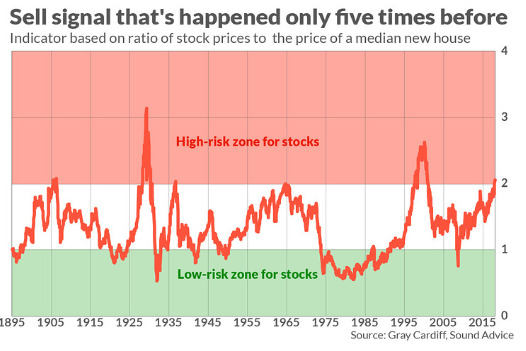

- The sell signal that’s only happened 5 times since 1895.

- Does it matter how long the bull market is?

- There will always be bad actors in financial services.

- Will our sons play football when they get to high school?

- Would you rather receive a lump sum or guaranteed monthly payouts?

- Are lottery winners happier than everyone else?

- A bad idea by Chicago to fix their pension problems.

- Is it even possible for indexing to become too popular?

- Micheal’s review of The Meg & much more.

Listen here:

Stories mentioned:

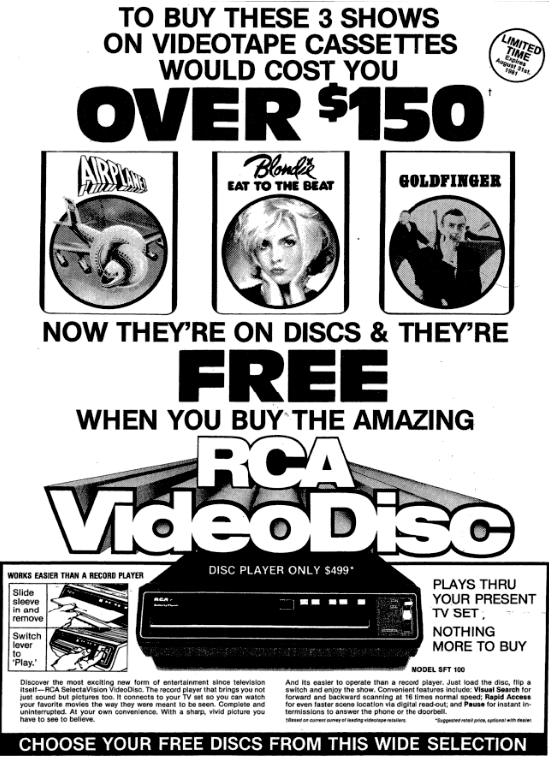

- The first modern investing advertisement

- The 8 best predictors of the long-term market

- Hard lessons for cryptocurrency investors

- JP Morgan unveils new investing app

- The big hedge fund strategy that isn’t working

- “The best consumer environment I’ve seen in my career”

- Walmart moves to compete with Audible

- The sell signal that’s only happened 5 times since 1895

- Caring for aging parents and their money

- Boiler room 2.0

- Wells Fargo pushed advisors to use high fee products, cross-sell

- Would you rather…

- Money really does lead to a more satisfying life

Books mentioned:

- The Woman in the Window by A.J. Finn

- When Hitler Took Cocaine and Lenin Lost His Brain: History’s Unknown Chapters by Giles Milton

- A World Lit Only by Fire by William Manchester

- Going Solo by Roald Dahl

Charts mentioned:

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook.

Subscribe here: