On this week’s Animal Spirits with Michael & Ben we discuss:

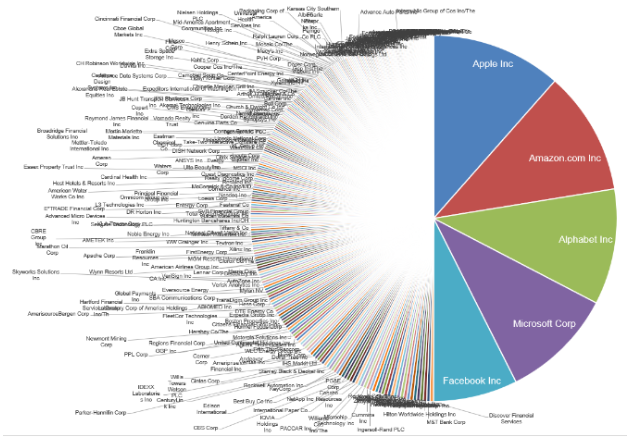

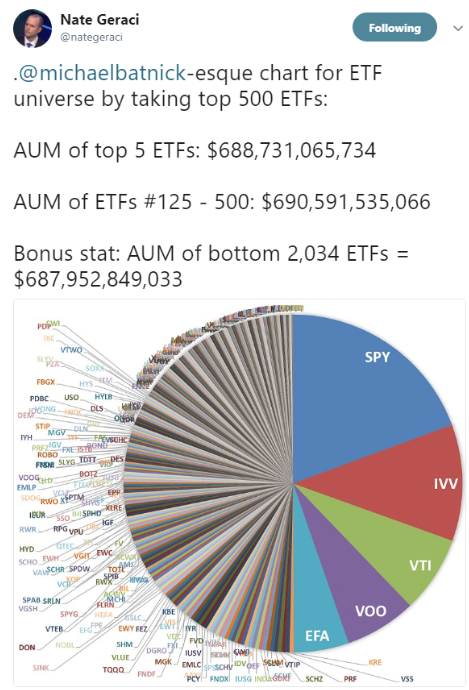

- The pie chart heard round the world.

- Why Michael didn’t create a chart crime.

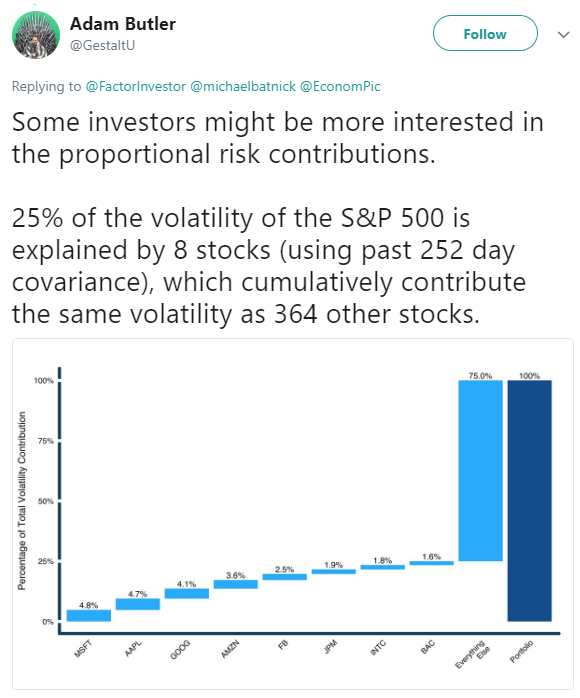

- Why concentrated gains are the norm in the stock market.

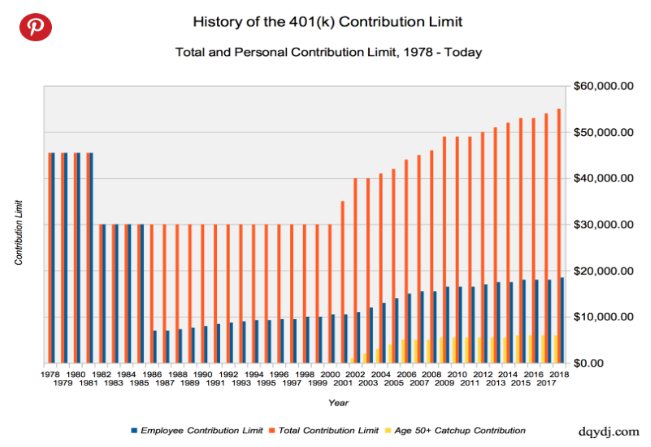

- How difficult is it to save $1 million in a 401(k)?

- The worst advice we’ve seen on 401(k)s.

- Is AQR the Vanguard of hedge funds?

- Why has value underperformed growth so severely this cycle?

- Have tech stocks changed fundamental analysis?

- What’s the thing most Americans are stressed about today?

- Why so many millennials regret buying a house.

- Could businesses benefit from working their employees less?

- The huge need for elderly care in the years ahead.

- Can we inherit hindsight bias?

- Should you sell when your investments hit new all-time highs?

- What if you had to gift one stock to someone that they have to hold over the next 20-25 years?

- Our latest movie, book, podcast, and TV recommendations and much more.

Listen here:

Stories mentioned:

- Pareto

- Concentration in the stock market

- How hard is it to become a 401(k) millionaire?

- The complete history of the 401(k) contribution limit

- Death is a way of life in liquid alternatives

- Can factor investing kill hedge funds?

- OSAM Q2 letter

- Americans are freaked out by the news

- Most millennials regret buying a home

- The four-day work week

- American is running out of family caregivers

- Can hindsight bias be inherited?

- Is a starter home one of the worst purchases you can make?

- New highs should be bought not sold

- The world’s worst market timer

Books mentioned:

Charts mentioned:

Email us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook.

Subscribe here: