During three separate interviews this week I was asked if I was seeing any signs of complacency among investors, markets, or clients.

If anything, the people I talk to are more concerned with the high probability of lower market returns in the future but my view is surely clouded by the clientele and readers I deal with on a regular basis.

Whether my sample size is representative or not, measuring market sentiment is getting harder and harder these days. Everyone now has a megaphone to voice their opinions — social media, blogs, 24-hour financial television, podcasts, conferences, magazines, financial news websites, etc.

I don’t see how you can reliably track sentiment when it comes at you every day like a wave that changes form and shape depending on people’s mood that day. There’s just not much signal in all of the noise anymore.

Of course, investors have been given plenty of excuses to be complacent. It feels as though volatility and bear markets have been outlawed in 2017 and stocks in the U.S. haven’t seen a down year since 2008.

Since I don’t see any reliable way to track the potential complacency of investors as a whole, I tend to look at different ways investors can be complacent depending on which type of market environment we’re in.

For example, last month I read the Schroders Global Investors Study which surveyed over twenty thousand investors from around the globe to get their expected portfolio returns over the coming 5 years. The results show this group was a tad ambitious:

Investors expect an annual return of 10.2% on their investments over the next five years, according to a major new study.

The Schroders Global Investor Study (GIS) 2017, which surveyed 22,100 people from around the globe who invest, found millennials even more optimistic. Those born between 1982 and 1999 expected their money to make average returns of 11.7% a year between now and 2022.

Older generations were more realistic. The Baby Boomer generation – born in the two decades after the Second World War – anticipated 8.6% a year.

Millennials (born 1982-1999, aged 18-35): 11.7% Generation X (born 1965-1981, aged 36-52): 9.8% Baby Boomers (born 1945-1964, aged 53-72): 8.6% Silent Generation (born 1923-1944, aged 73+): 8.1%

Double-digit annual returns over the next 5 years from current valuation and interest rate levels seems like a stretch to me. I could be wrong but investors with such lofty expectations after we just went through a period of above-average returns (at least in the U.S.) seems to be somewhat complacent to me.

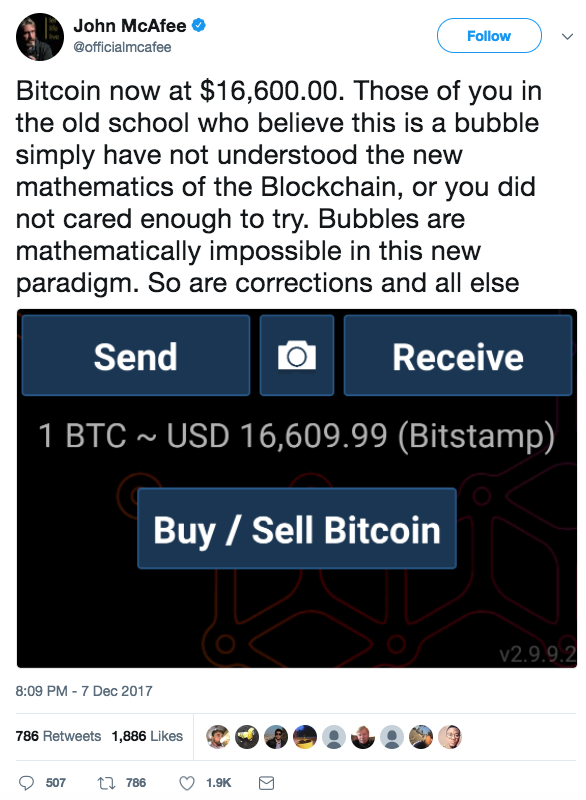

Here’s another example (although this is more delusional than complacent):

Here are some more examples of what I think a complacent investor looks like right now:

Other investors are screwed because of lower expected market returns but I’ll be fine.

Everyone else will panic during the next bear market and get crushed but not me.

There are no marginal sellers so the price of this asset will never go down.

It’s not the bull market that’s responsible for my gains; I’m a genius.

Markets are easy and so is making money.

Low volatility is here to stay.

I expect to see 10-15% returns every single year.

Why would I need to diversify when I’m making so much money on this one holding?

I’ve got it all figured out.

I’ll just never sell. Buy and hold is so easy.

I’ll be able to time the peak and get out before the next downturn hits.

I don’t need to rebalance my portfolio.

Why doesn’t everyone invest just like me?

That person has made a lot of money lately. I think I’ll just blindly follow them into their next trade.

The truth is there will always be risks and unknown events that catch investors off guard whether they’re being complacent or not. There are always investors who are positioned the wrong way because that’s what allows markets to function.

Cash becomes an addiction to some during a bear market. Chasing yield is always a temptation during a low rate environment. Those trying to perfectly time tops and bottoms are almost always wrong. Sideways markets frustrate everyone.

During the next downturn there are sure to be investors caught over their skis who have too much risk in their portfolios for their own good. I’m sure some of them will overcompensate and panic in the other direction.

I don’t know how many investors are complacent right now and I suppose it doesn’t matter for me personally. The best you can do as an investor is to create a portfolio that is durable enough to withstand most, but not all (that’s impossible), market risks.

From there your best defense against complacency is a heavy dose of humility with a side of self-awareness.

Further Reading:

Volatility is Not Your Enemy