I am a middle-aged person so that means I check Zillow regularly.

I’m not in the market for a house. I just like checking real estate prices. That’s what you do when you get older. You become interested in real estate.

I do it every time I travel somewhere.

Our favorite spring break destination these past few years has been Marco Island, FL.

So I had to do some price checks to see how much our Airbnb house was worth plus get a sense of property values in the area. We’re not planning a move to Florida but it’s fun to see how far your money would go depending on the location. It’s a pretty pricey market with loads of 7-figure homes for sale.

After the trip Zillow flooded my email with listings of houses for sale in Marco. It’s a good sales tactic. This is what all of those emails have looked like:

There are dozens like this. They come in every day. The price cuts are going wild while buyers sit on the sidelines waiting for better entry points and lower mortgage rates.

This could be a Florida phenomenon. The state saw a huge influx of people during the pandemic. It’s possible they pulled demand forward, price increases were overdone and this is now the correction.

Either way, it’s a buyer’s market in Florida right now.

But it’s not just Florida. This is turning into a nationwide thing.

Redfin has a new report that shows sellers now outnumber buyers by a wide margin:

Here’s what they found:

There are an estimated 1.9 million home sellers in the U.S. housing market and an estimated 1.5 million homebuyers. In other words, there are 33.7% more sellers than buyers (or 490,041 more, to be exact). At no other point in records dating back to 2013 have sellers outnumbered buyers by this large of a number or percentage. A year ago, sellers outnumbered buyers by just 6.5%, and two years ago, buyers outnumbered sellers.

There haven’t been this many home sellers since March 2020. There haven’t been this few buyers at any point in records dating back to 2013 aside from April 2020, when the onset of the coronavirus pandemic brought the housing market to a halt.

This is the first time in years that homebuyers have received some good news.

Sellers have had the upper hand for some time now. Prices boomed during the pandemic. There were bidding wars and sales that went through without contingencies or inspections. People were forced to pay over asking.

Those days should be over for now.

This is all good stuff. Buyers can finally negotiate in some areas. If I were in the market, I would be putting in some low-ball offers.

Now for the not-so-great news.

Inventory is still quite low.

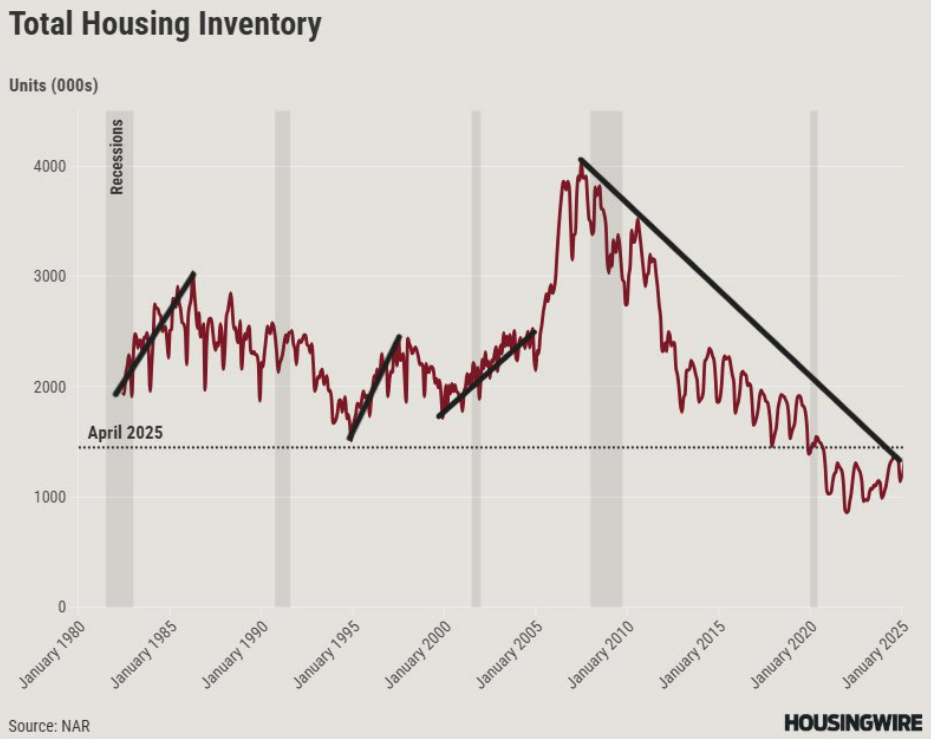

Logan Mohtashami has a chart that shows total housing inventory for sale:

It’s still quite low relative to history. A normal range is somewhere in the neighborhood of 2 to 2.5 million houses for sale. We’re just shy of 1.5 million.

This is an improvement for sure but the housing market is still not normal, if there is such a thing.

We’re just witnessing a buyer’s strike because prices or mortgage rates need to come down to make things more affordable.

The good news for sellers is there is a simple solution to this problem — lower mortgage rates. My guess is once rates fall we will see lots of buyers come off the sidelines.

I am not a fan of trying to time the housing market. You should buy a house when you like it, plan on owning it for many years, and can afford to service the debt and other ancillary costs involved.

It’s still very expensive to buy a home versus the all-in costs from just a few years ago.

But buyers finally have some leverage in this situation.

Further Reading:

How the Housing Market Has Changed America