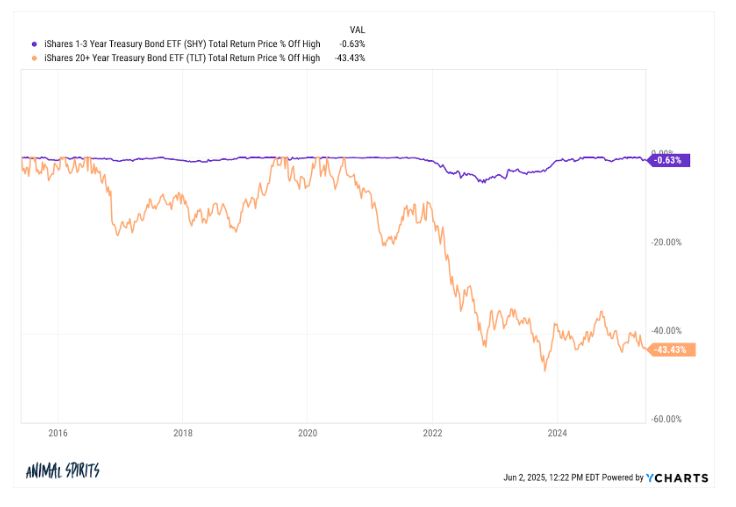

Today’s Animal Spirits is brought to you by YCharts:

See here for more information on their new Household Portfolios and Folder Capabilities

Get a random Animal Spirits chart here

On today’s show, we discuss:

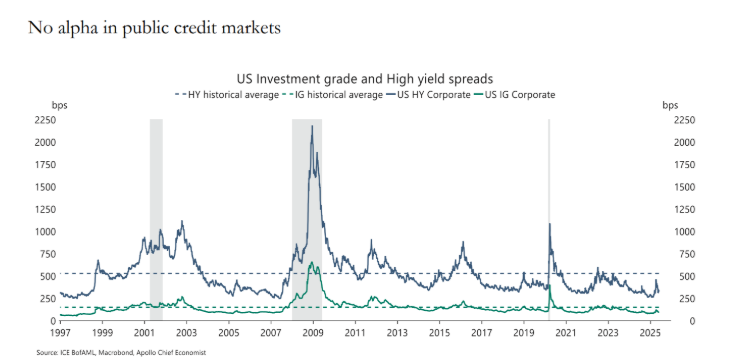

- Credit market outlook

- Why the U.S. Economy Will Muddle Through Trump’s Tariffs. Probably.

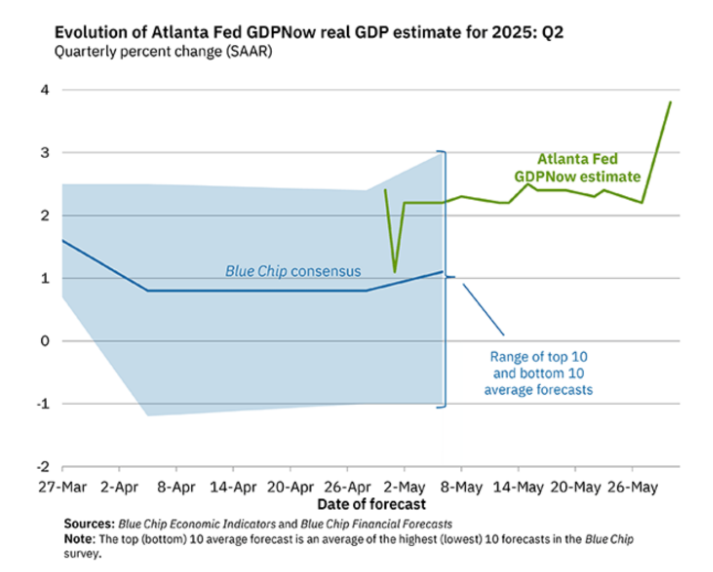

- GDPNow

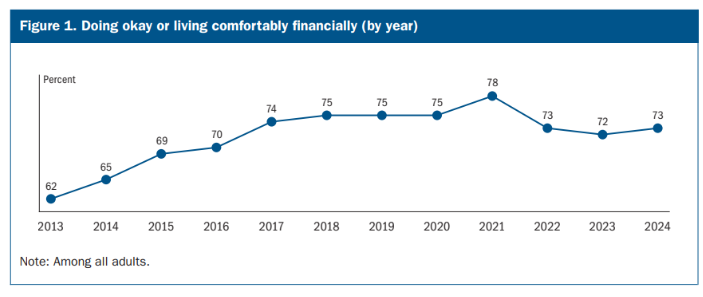

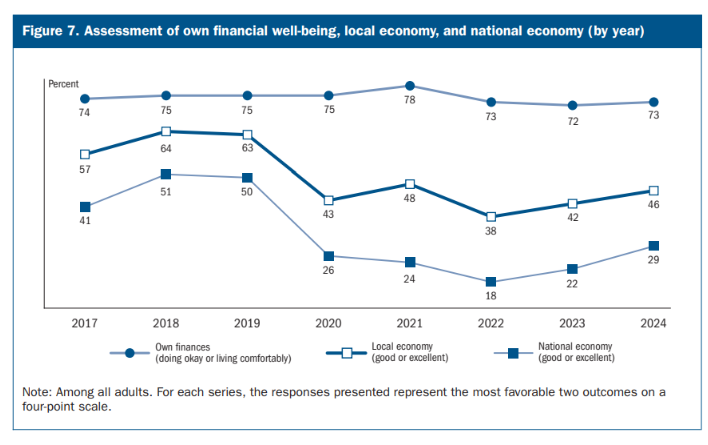

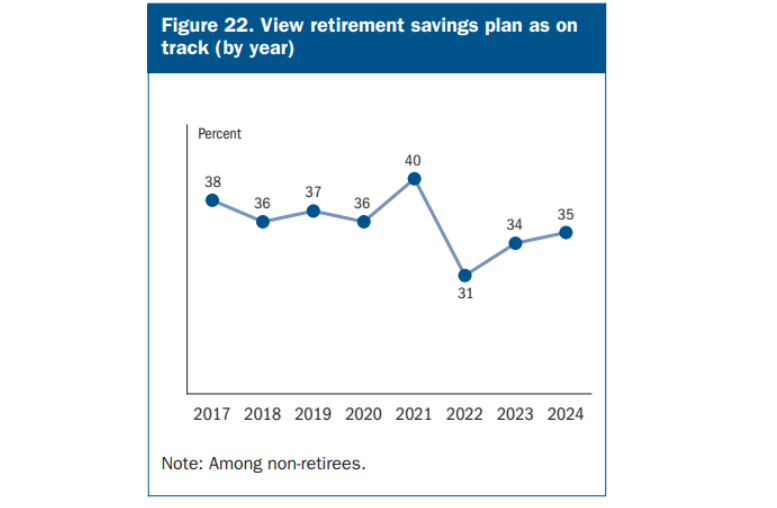

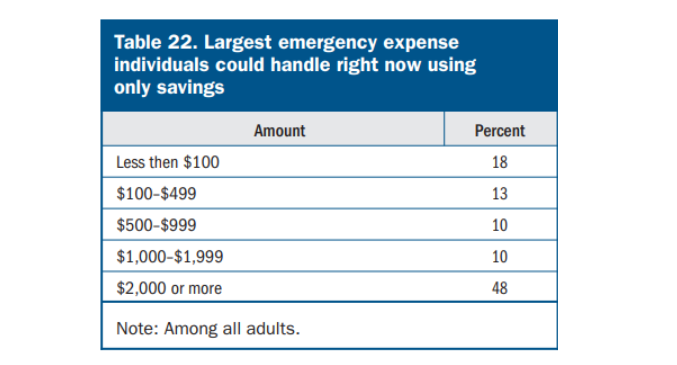

- Federal Reserve Board issues Economic Well-Being of U.S. Households in 2024 report

- The Automation Bet: How Amazon Robotics Is Transforming Its Long-term Profit Engine

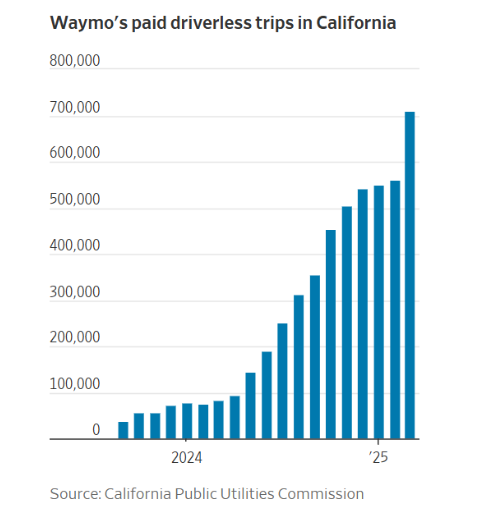

- It’s Waymo’s World. We’re All Just Riding in It.

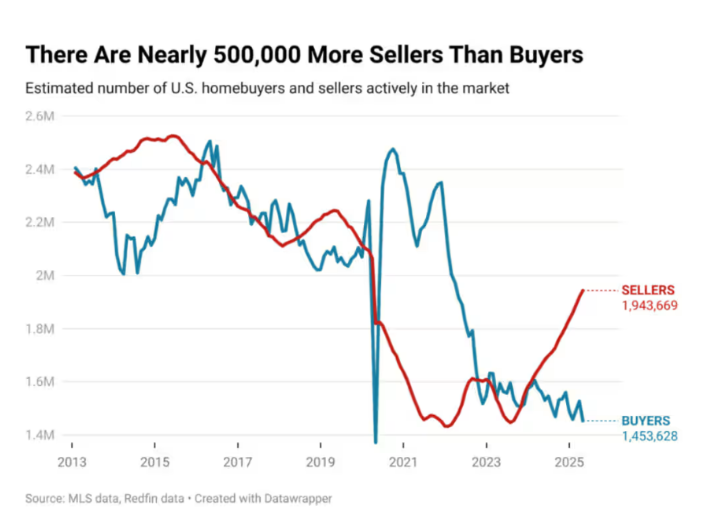

- Home Sales in April Fell for the Second Straight Month

- Home sellers face an ‘absolutely brutal’ market that’s tilting in buyers’ favor

- Is private equity becoming a money trap?

- The Status of US Sports Rights

Listen here

Recommendations:

- The new Jurassic Park

- Crazy Stupid Love

- The Last of Us

- Novocaine

- Your Friends and Neighbors

- Mountainhead

- Nonnas

- Seth Rogan and Evan Goldberg on The Town

Charts:

Tweets/Bluesky:

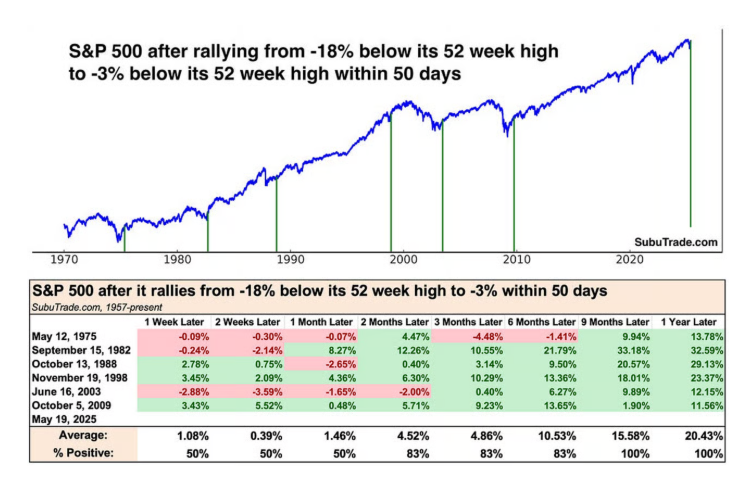

This is why you need to incorporate a little technical analysis in your framework. Sometimes the markets can "see" things that we cannot.

— Warren Pies (@WarrenPies) May 29, 2025

Market concentration is global phenomenon pic.twitter.com/rdUPpmQGHx

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) May 26, 2025

Maybe my biggest long term macro prediction.

First AI will come for services inflation.

Then the robots will come for goods inflation.

Then the govt will come with ZIRP.

10-20 years max. Maybe sooner given how fast AI is changing. https://t.co/yRLnsyUHfm

— Cullen Roche (@cullenroche) May 28, 2025

A record surge of investment in information processing equipment boosted U.S. GDP by a full percentage point in the first quarter. In other words, excluding the data center bonanza, the economy would have registered a 1.2% contraction (h/t @DoubleTGolle) pic.twitter.com/Eg99K2YfKD

— Matthew B (@boes_) May 29, 2025

🫡 https://t.co/kVKMFJNQDY pic.twitter.com/SQ6rmwRi2P

— Logan Mohtashami (@LoganMohtashami) June 1, 2025

NEW: It's not just Delta. All three of the nation's largest airlines are charging some solo passengers higher fares than groups of two or more – sometimes significantly higher.

— Kyle Potter (@kpottermn) May 29, 2025

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product