It’s now well-documented that 2022 is one of the worst years in history for financial markets.

Last year was one of the worst years ever for stocks and the worst year ever for bonds.

The logical next step is to look at what has happened next following the prior worst years for stocks, bonds and diversified portfolios.

Past performance tells us nothing about future performance but studying market history can provide some context around market behavior following big events historically.

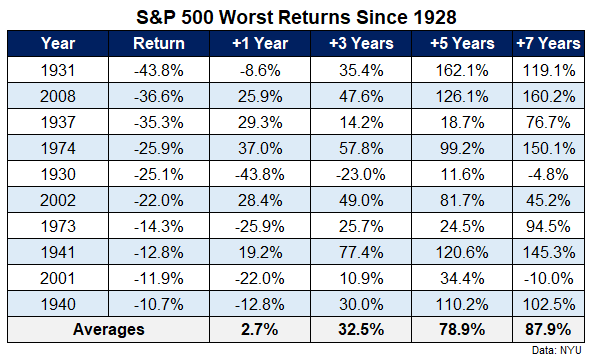

These were the 10 worst years for the S&P 500 before 2022 along with the forward 1, 3, 5 and 7 year total returns:

The average returns don’t blow you away but they’re not bad. There were some bad years that followed bad years. And there will always be outliers like the lost decades of the 1930s and 2000s that are more painful.

But even the 1970s saw good long-term returns after the bad years in 1973 and 1974.

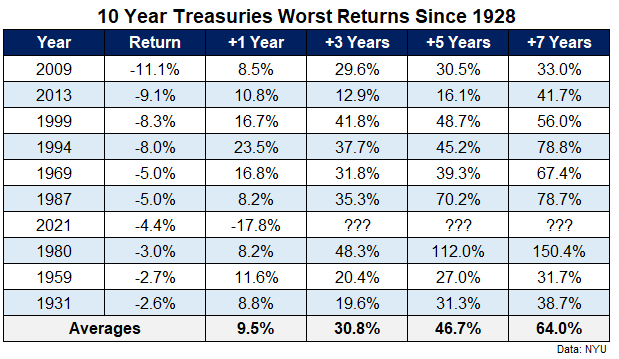

Returns for 10 year treasuries have also been solid following big down years:

Over the short-term (1 and 3 years) bonds have actually had better performance coming out of a bad year than stocks. It is worth noting that 2022 followed a poor year in 2021 but outside of that bonds have exhibited strong mean reversion from unpleasant performance in the past.

I should mention interest rates were higher in many of these periods than they are today so it’s hard to see a repeat of the returns we saw in the 1980s and 1990s. But it makes sense for expected returns on bonds to rise following an awful year because it simply means yields have moved higher.

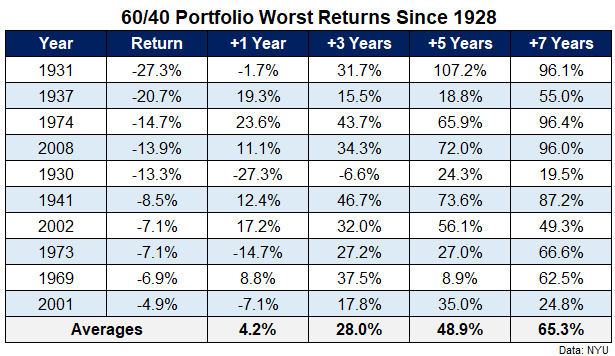

With stocks and bonds both getting hammered in 2022, a diversified portfolio had a rough go at it last year. A 60/40 portfolio of stocks and bonds has also shown resilience in the past when it comes to performance coming out of a dreadful year:

That’s not bad. A handful of repeat performances a year later but looking out 3, 5 and 7 years, things have looked pretty good in the past following a down year.

Markets would be easier if there were guarantees in terms of future returns. Unfortunately, you don’t get the potential for higher returns without the possibility of higher risk.

So I can’t make any promises here. Markets could languish for a while. It’s not out of the realm of possibilities.

But time is your friend when it comes to investing in risk assets.

This is especially true when investing in asset classes that are in the midst of large drawdowns.

If you have the ability to be patient the expected returns for financial assets should be higher now than they were a year ago.

Further Reading:

2022 Was One of the Worst Years Ever For Markets