I’ve been writing lately about how investors have continued to buy the dip anytime the stock market falters (see here and here).1

We keep hitting record after record for investor inflows. This is from Bloomberg:

Retail traders went on a record dip buying spree Monday, reversing a 1% decline in the S&P 500 Index triggered by the US credit downgrade from Moody’s Ratings late last week.

Individual investors purchased a net $4.1 billion in US stocks through 12:30 p.m. in New York, the largest level ever for that time of day — and broke the $4 billion threshold by noon for the first time ever, according to data compiled by JPMorgan Chase & Co. quantitative and derivative strategist Emma Wu.

A 1% down day and we see massive buying?!

There is also a ton of money going into S&P 500 index funds:

Where is all of this money coming from?

Let’s take a look at the most likely suspects.

Bonds. The way I see it, fixed income serves four purposes for investors:

1. Volatility reduction.

2. Regular income.

3. Spending power when stocks are down.

4. Dry powder when stocks are down.

My thesis is that investors used their fixed income for option #4 during the downturn in April.

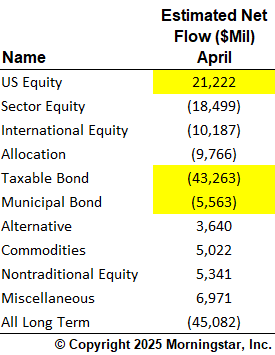

Morningstar’s Jeffrey Ptak was kind enough to run some fund flow data for me for the month of April:

Lo and behold, investors sold out of bonds and bought stocks. Not all that money went into stock funds, but much of it did.

Bonds provided some of the dry powder as investors rebalanced into the pain.

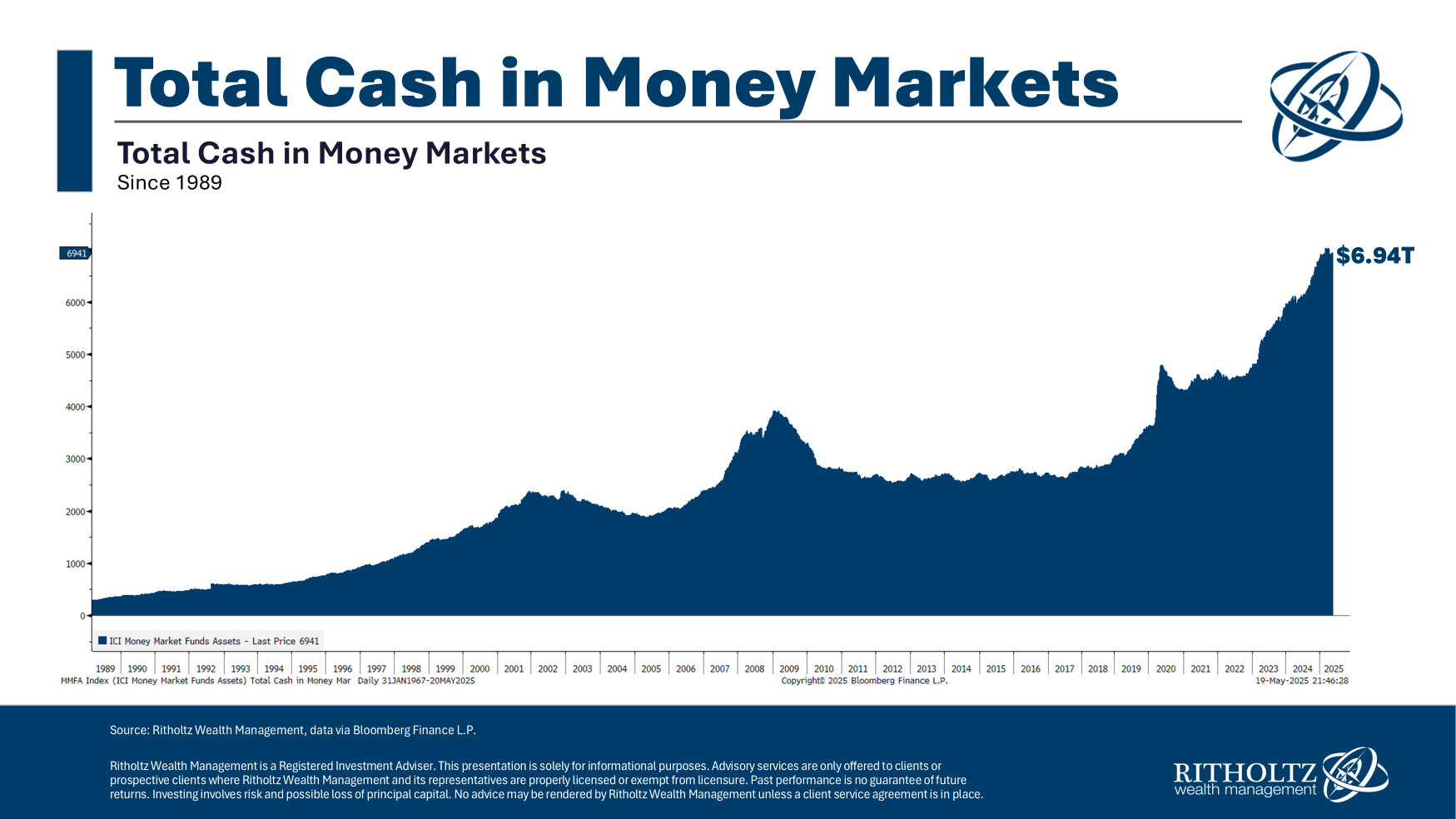

Money markets. There is still A LOT of money sitting in money market funds:

We’re still close to $7 trillion even after the Fed cut rates 75 basis points.

Is there money coming out of these funds during a downturn?

Let’s take a look:

A lot of money came out in April. Some of that was likely used to pay taxes.2 There is a seasonality component to these things as you can see stocks dipped last year at the same time.

But I’m sure some of this money poured into the stock market.

That’s what cash on the sidelines is for.

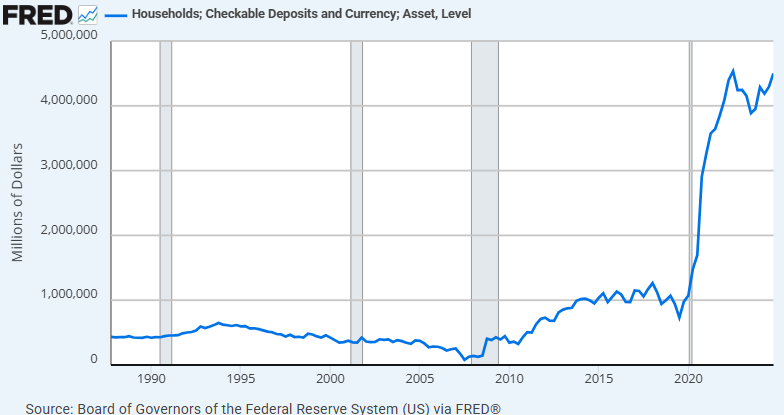

Cash. There is still a lot of money sitting in checking/savings accounts at banks:

This data is updated quarterly so we won’t know for a couple of months but it wouldn’t shock me if some investors put some cash to work during the brief bear market.

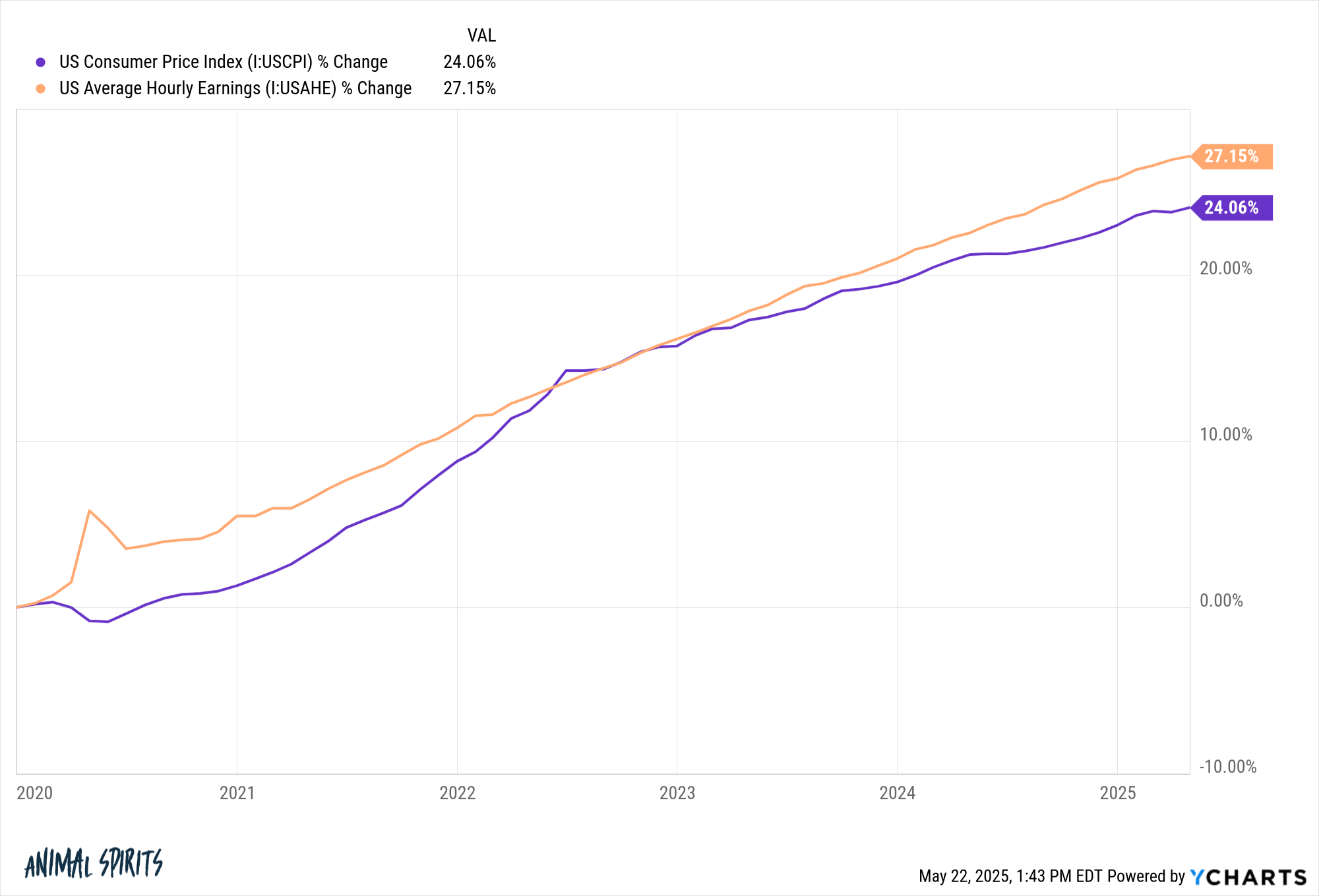

Wages. The cumulative increase in prices in the 2020s is 24% but wages have risen more than 27% in total:

That’s a big number.

It means more income available to save money. If you save a regular percentage of your income and your income goes up 30%, that’s a lot more money to save and invest on a nominal basis.

That’s another reason we keep seeing record inflows.

Add it all up and that’s where the money is coming from.

Will it last?

I don’t know.

For now, risk appetite is such that investors are willing to buy when stocks are down.

Michael and I talked about retail investors, investor education, where all of the money is coming from and more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

The Dumb Money Isn’t So Dumb Anymore

Now here’s what I’ve been reading lately:

- Performing a time audit (Contessa Advisors)

- Mamas don’t let your babies grow up to time markets (Downtown Josh Brown)

- Mental freedom (Of Dollars & Data)

- The key to financial resistance (Net Worthwhile)

- 30 quotes from financial history (CFA Institute)

- Getting down to your sleeping point (Phil Pearlman)

- Homes and homeowners are getting older (Sherwood)

Books:

1I’m old enough to remember when people were worried about excess savings being depleted from the pandemic.

2As someone who plans a lot for these things I can’t imagine having to sell stocks to pay my tax bill.