When everyone discovered the new pope was from Chicago people immediately dug into Pope Leo’s back story.

From Chicago.

White Sox fan, not Cubs.

Probably liked Portillos, Malort and Lou Malnati’s.

It was also uncovered the Pope’s childhood home on the southside of Chicago was listed for sale.

It was a relatively small house built in the 1950s with 3 bedrooms, 3 bathrooms, measuring in at 1,050 square feet. The house was recently updated but listed for just $199,000 which is low by today’s standards.1

That kind of house is an anomaly these days.

We don’t build enough small houses anymore and we don’t build enough affordable houses.

I blame HGTV.2

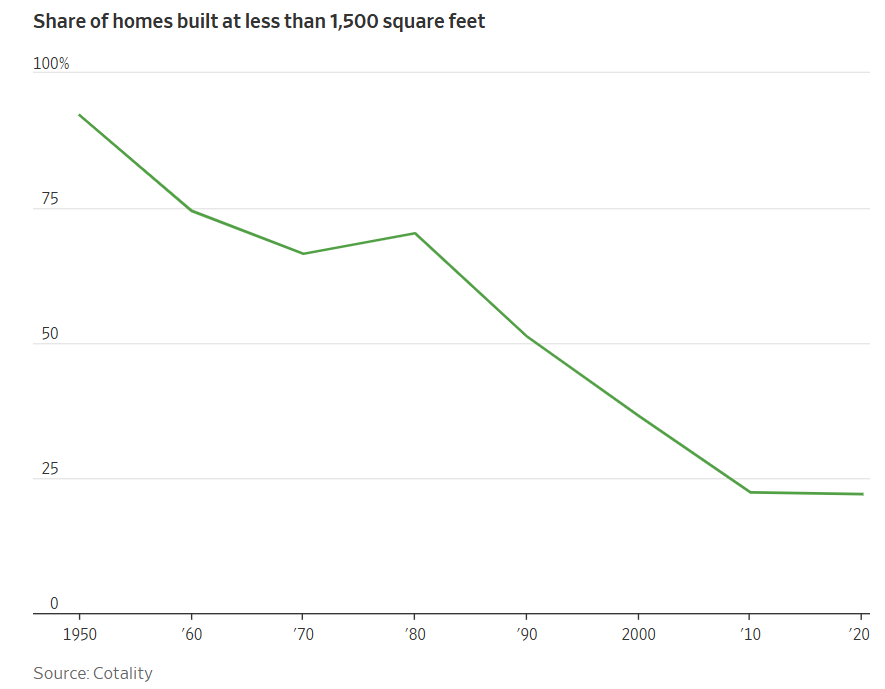

The Wall Street Journal shows that in 1950 more than 90% of all homes built in America were 1,500 square feet or less:

That number is down to 22% in the 2020s.

The Journal explains what happened:

Over the following decades, Americans came to prefer larger homes. People moved out of crowded cities to the suburbs, where land was cheaper and building regulations weren’t so strict. Builders focused on larger, more-expensive homes, which also tended to be more profitable. Today, there aren’t as many starter homes available.

It’s consumer and builder preference.

The houses built during the 1950s were nothing like we see today. They were assembly line, cookie-cutter dwellings with no frills and not a lot of space. David Halberstam wrote about a suburban communities called Levittown that embodied this idea in his book The Fifties:

The first Levitt house could not have been simpler. It had four and a half rooms and was designed with a young family in mind. The lots were 60 by 100 feet, and Bill Levitt was proud of the fact that the house took up only 12 percent of the lot. The living room was 12 by 16 feet. There were two bedrooms and one bathroom. A family could expand the house by converting the attic or adding on to the outside. The house was soon redesigned with the kitchen in the back so that the mothers could watch their children in the yard.

These houses weren’t much more than 1,000 square feet. No open floor plans. No spaces to entertain. No huge master suites with walk-in closets and enormous bathrooms. No McMansions or 3-car garages.

But they were building.

At the height of production, Levittown was completing 36 new houses a day in the 1950s. Plus, they were sold directly by the developer, William Levitt, so there were no closing costs, fees, or middlemen to take a cut. The price was the price, and that was roughly $9,000 or so.

We don’t build a lot of houses anymore so the typical American home just keeps getting older.

Sherwood has a great chart that proves this:

They note that just 9% of all existing homes in the U.S. were built in the 2010s, which is the lowest number for any decade since the 1940s.

Unfortunately, the housing bust left deep scars on the homebuilders. We still haven’t recovered.

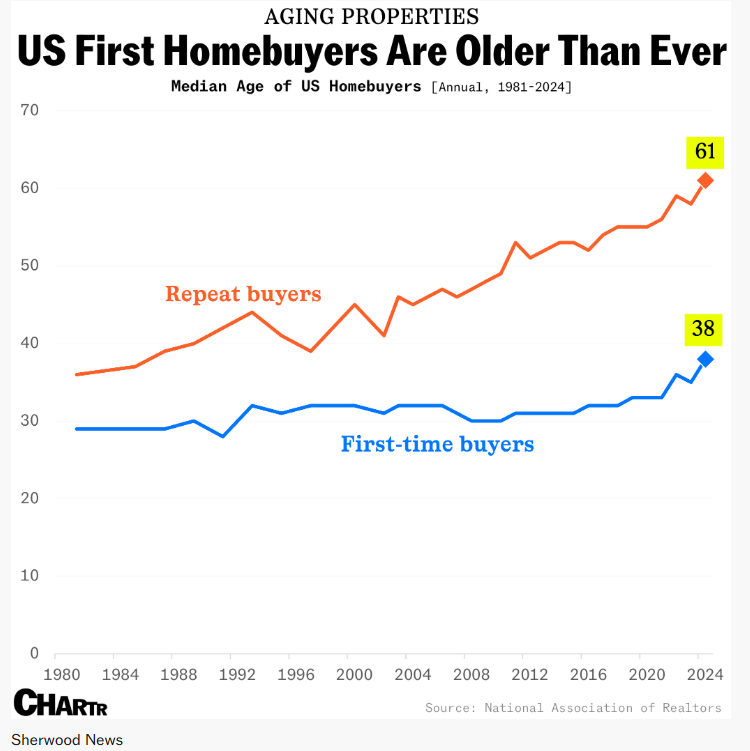

Some combination of a lack of building, much higher home prices and 7% mortgage rates mean the average age of homebuyers is now higher than ever (because they’re the only ones who can afford it):

Older homes and older buyers likely mean lots of renovations in the years ahead to bring the existing fleet up to today’s HGTV standards.

I’m coming to the conclusion that it might take intervention from the federal government to force more building.

The baby boom helped on the demand side of housing in the 1950s but one of the reasons so many people were able to buy is because the government provided low interest rate mortgages to veterans through the GI bill. They also backed many of the loans so homebuilders didn’t have much risk when building which led to lower down payments and lower risk for lenders.

The government was supportive to homebuilders and homebuyers alike.

I hope we get back to that place again someday.

Further Reading:

When Does Housing Become THE Issue?

1So much interest in the property the town itself took ownership of the house.

2I’m only halfway kidding about that.