A reader asks:

I am always hearing about the strength or weakness of the US Dollar. Can you provide some basic background of what this all means? What is the weakness against other currencies, specifically, or all currencies in a basket? Is this good or bad for my portfolio which is mainly in US Stocks and Bonds? What are the major benefits and drawbacks of a strong or weak dollar?

This is a timely question because we’ve seen a big move in the dollar this year.

It’s down around 7% on the year which is a rather big move for the global reserve currency.

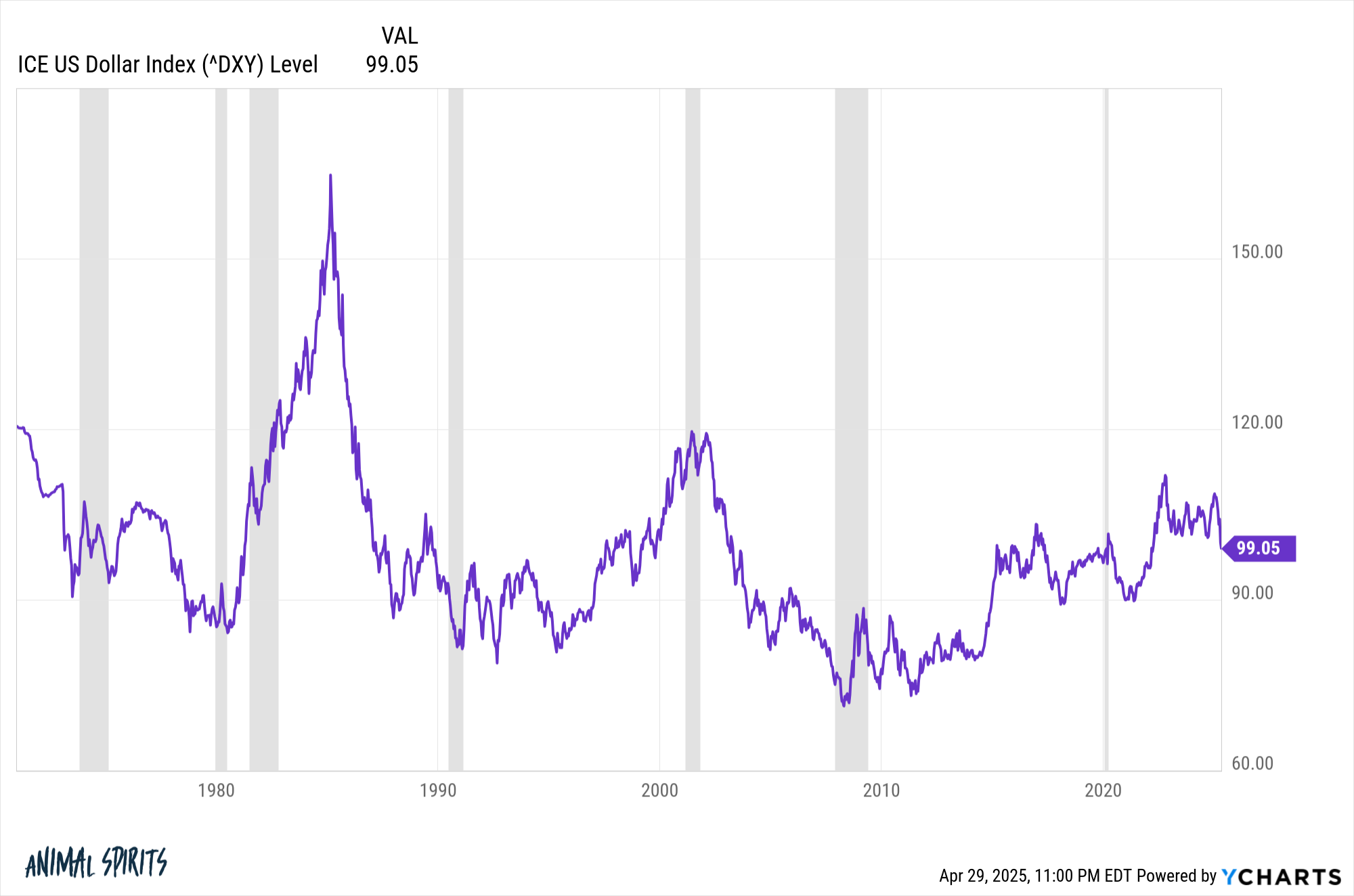

First of all let’s look at the dollar’s movements on a long-term basis:

This chart shows the dollar going back to the 1970s against a basket of foreign currencies. There have been plenty of different regimes here — strong dollar, weak dollar, sideways dollar, etc.

But over the course of five-plus decades, the dollar has more or less gone nowhere. Like a Looney Tunes character spinning their legs without going anywhere.

That strength or weakness could come about because of interest rate differentials, inflation, economic growth, or investment flows from foreign investors. There are a lot of variables that impact currencies. Trust and faith in the system are the unquantifiable ones.

A stronger dollar tends to lead to weaker sales overseas and a weaker dollar tends to lead to stronger sales overseas. When the dollar is weak you can expect international stocks to outperform U.S. equities. That’s because when foreign currencies appreciate your investments in those countries will get more bang for the buck in terms of earnings and dividends.

The opposite is true when a dollar strengthens. Think about all of the people going on vacations to Europe in recent years. The dollar has been strong, while the euro has been weak, making it cheaper for U.S. tourists to travel overseas.

This is one of the many reasons international stocks have underperformed for so long. A strong dollar is a headwind.

These currency fluctuations are another benefit of international diversification.

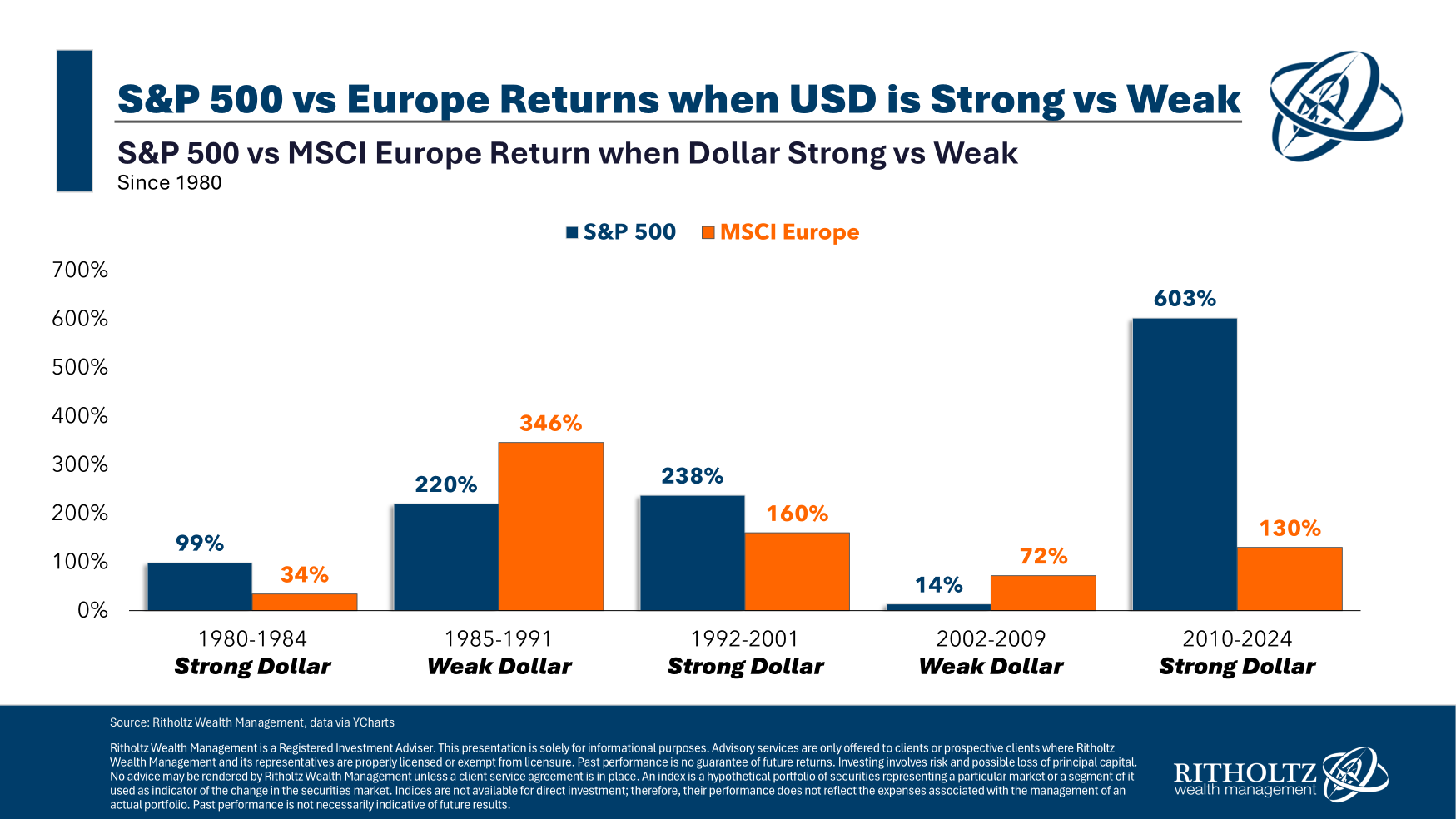

Let’s look at the historical numbers for stock market performance during periods of a strong and weak dollar:

There is a clear pattern here.

In strong dollar regimes, U.S. stocks outperform and in weak dollar regimes, foreign stocks outperform.

No market relationships are written in stone so who knows if this trend will continue but it will always be true that a weaker dollar will be better for your foreign investments and a strong dollar will make them worse off (from a currency perspective).

For the foreign audience, it’s the opposite. Those foreign investors who have been investing in U.S. stocks in recent years have earned excellent returns plus a nice boost from a rising dollar. A weak dollar will make U.S. stocks less attractive to foreign investors.

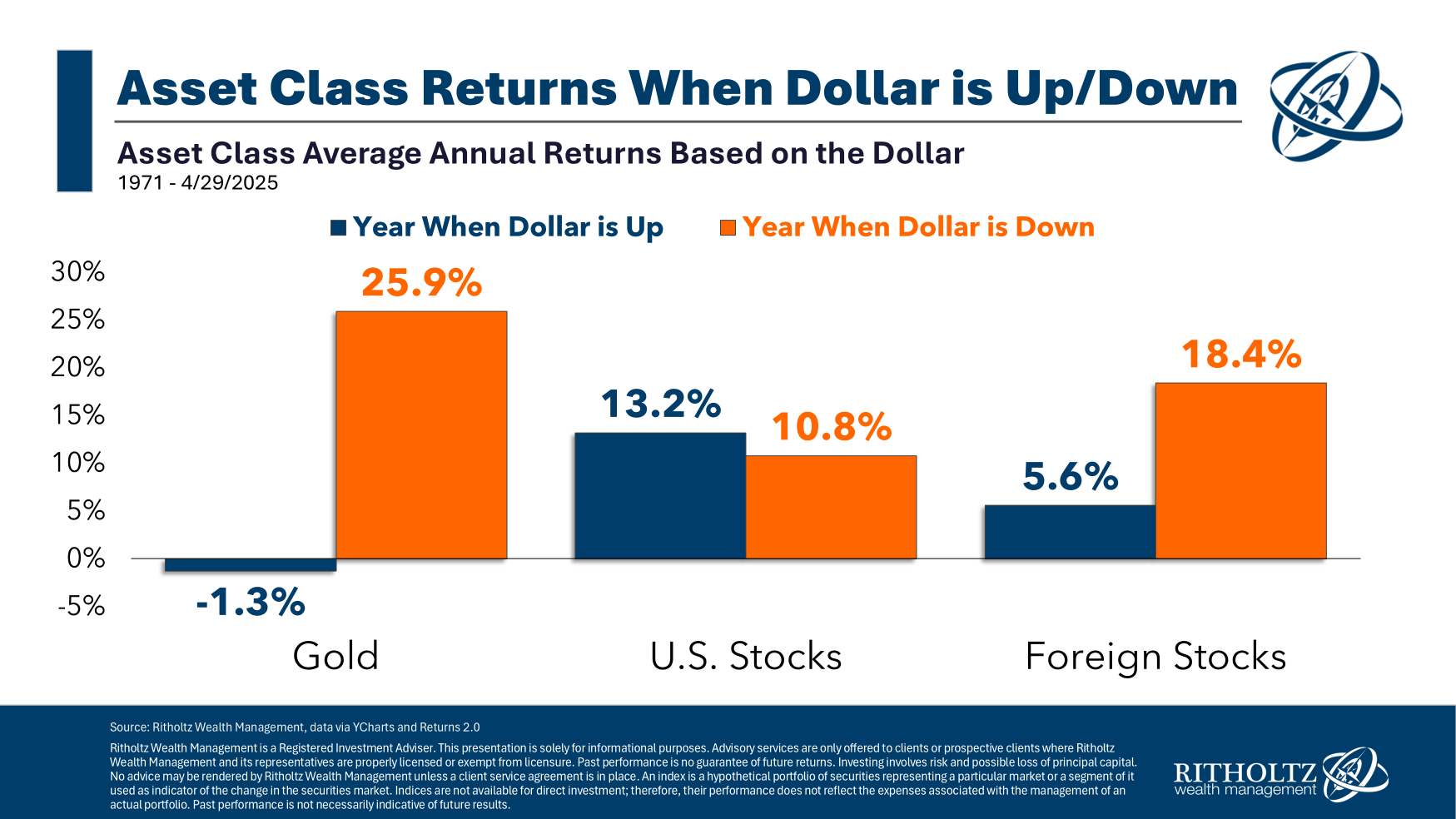

Now let’s look at the dollar’s impact on a shorter-term basis for U.S. stocks, international stocks and gold:

This chart shows what happens in years when the dollar is up or down from one year to the next.

The impact on U.S. stocks is negligible but look at how much better gold and international stocks have done when the dollar is weakening.

Again, I can’t promise these relationships will hold but this makes sense in theory too. Gold is priced in dollars globally. When the dollar weakens, it takes more of them to buy the same ounce of gold. However, internationally, you can now purchase more of it in yen, euros or other currencies.

As far as bonds go, the standard answer is you want to invest in fixed income in your home currency because that’s what you’re spending with. You also don’t want to see the yield on your bonds swamped by currency fluctuations.

I talked about this question in further detail on this week’s Ask the Compound:

We also covered questions about the crazy moves in the stock market, bonds vs. high yield savings accounts, how to plan for a layoff and what to teach high school kids about personal finance.

Further Reading:

Is International Diversification Finally Working?