I now do all my reading on a Kindle Paperwhite.

You don’t have any weird angles when you’re reading. You can highlight passages, read in the dark and store thousands of books on one little device.

Sometimes it feels like I have thousands of unread books on my Kindle. Because it’s so easy to download them, I buy a lot of books. Many of them I finish. Many are left unread because I didn’t care for them, lost interest or got the gist of the book in the first few chapters.

On occasion, when I’m in between reads, I’ll often go back to the Island of Misfit books. I paid for all of those unread books, so it feels like I have an obligation to read them.

But I don’t.

The money has already been spent — it’s a sunk cost — and it’s gone. Don’t cry over spilled milk or unread books.

The same is true of investment errors. Everyone makes mistakes. The trick is to avoid compounding those mistakes.

For example, a reader who emailed in last month asks a follow-up:

I was one of the guys that emailed you last month bragging about how I went to cash because I was positive Trump would do something to crash the market (hey I was right for a brief moment). That turned into a true not to brag because now markets have completely recovered and I don’t know what to do. I assumed things would get a lot worse before they got better and I would have plenty of time to buy. I’m still not convinced all of the Trump volatility is gone but I feel stuck sitting in t-bills. What’s my next move?

To summarize: sold out of stocks at the start of the year, watched the market fall 20% or so and then come all the way back. Now what?

The good news is that the market is right where it was when you sold. You missed a nice buying opportunity, but the round trip put you right back where you were.

It could have been worse.

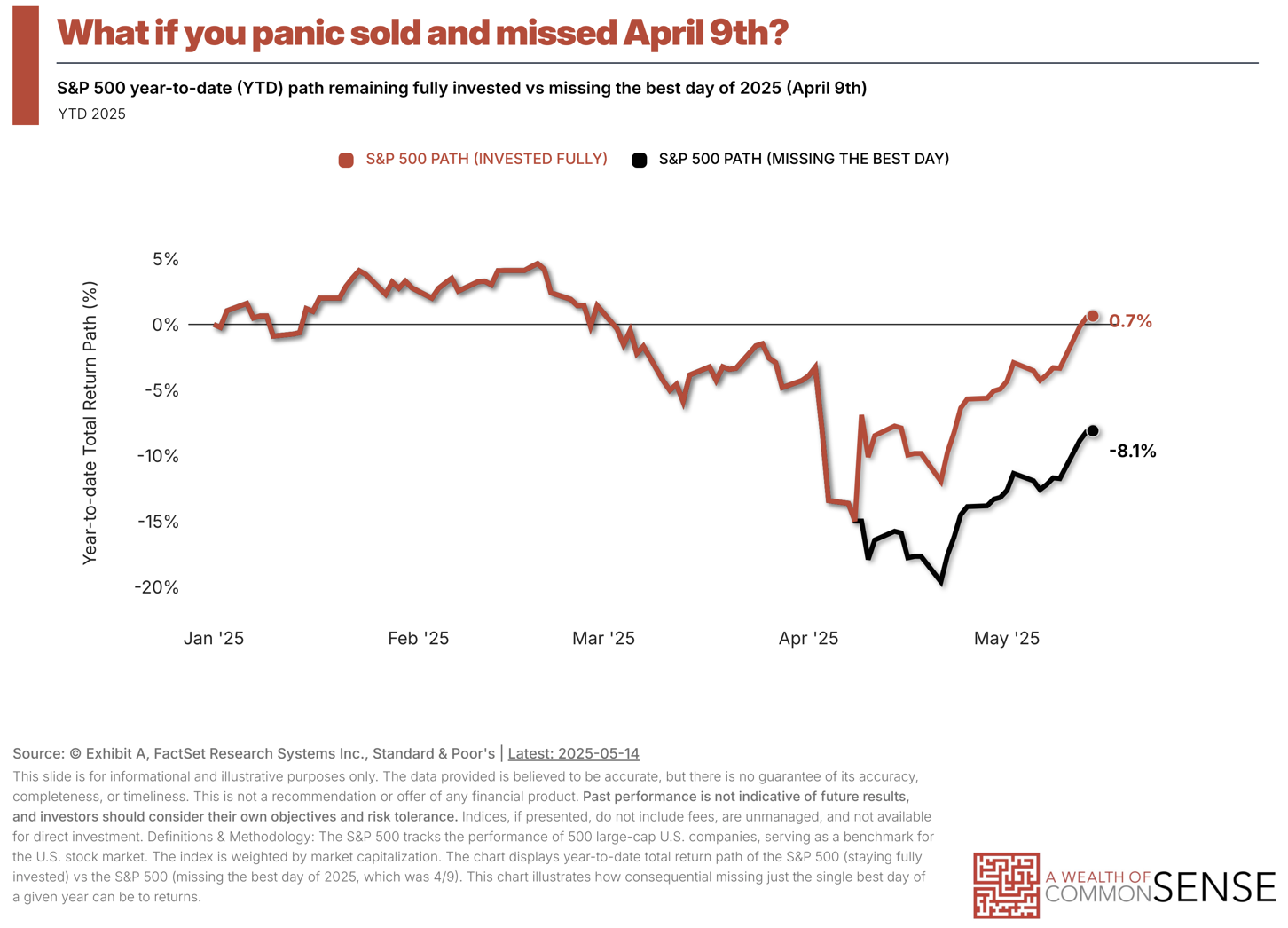

What if you panic sold right when things seemed the bleakest right before that crazy 10% up day in early April and then panic bought back in the next day:

It’s hard to believe you could miss out on an entire year’s worth of gains on a single day from one mis-timed trade.

Regardless of when you sold out of the market or the reasons, you’re in the same place. You just have to change your perspective.

Think of it like you just inherited a lump sum of cash.

What would you do right now if you were given a big lump sum to put to work? How would you invest it?

The market timing decision is a sunk cost. Move on and figure out how you want to invest going forward.

The problem with sitting on a slug of cash in your portfolio is that it can become addicting.

When markets are going up you tell yourself you need to wait for another correction to put it to work.

When markets are going down a cash position becomes your security blanket and you just keep waiting for stocks to go lower and lower to the point where you don’t ever re-invest it.

Market history would say to just buy back in and move on with your life. Human nature often makes it difficult to rip the bandaid off so most investors are more comfortable averaging back in.

Your plan of attack for putting cash to work matters less than your ability to follow said plan.

You could average back in, put it all in at once, use trend-following rules, put more money to work if/when the market falls or some combination of these strategies but the most important thing is to make a plan ahead of time that you’re willing and able to follow.

Whatever the plan is, you have to realize the market timing decision is a sunk cost. It’s over. The market moved on. It could rise or fall from here but you have to figure out how to get over a cash attachment.

Investing is hard enough without having to guess what comes next in the short-run.

Don’t make it any harder than it needs to be

Michael and I talked about panic selling, market timing and more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

If you like the chart in this post check out Exhibit A.

Further Reading:

Market Timing a Recession

Now here’s what I’ve been reading lately:

- Leveling up (Mr. Stingy)

- The Jonathan Clements saving initiative (Oblivious Investor)

- How home ownership affects your portfolio (Monevator)

- How to feel poorer than you really are (Ryan Holiday)

- What the China deal means (Discipline Funds)

- Portfolio pollution (A Teachable Moment)

Books: