My first car loan was 36 months.

It was a used Ford Taurus. Not too long after it was paid off that car died.

I made the upgrade (was it?) to a Nissan Altima. The dealership was now offering 48 or even 60-month loans. Five years for an auto loans seemed like an eternity so I took the four year option.

Now those numbers look quaint by comparison to what some borrowers are pulling off.

On their quarterly earnings call last week, Ford CEO Jim Farley talked about 84-month auto loans:

I caught him on CNBC the next day and he made the case this is perfectly rational:

Customers are rational. This just happens in our industry. The quality of our vehicles is up. Vehicles are lasting longer. They are more expensive. In Canada 84 months has been a third of the business for quite some time now. I think this is just a new reality of customers adjusting their payment because they act completely rational.

Seven years is rational for an auto loan?!

More and more people think so — 20% of new vehicles purchased in the first quarter of 2025 used 84-month financing. My guess is that will continue to increase.

Why?

A few reasons.

It is true that vehicles are lasting longer than they did in the past. The average age of cars on the road is now more than 12 years. That’s good news. People can now drive their vehicles much longer than they did in the past.

However, that’s just the average age of the stock on the roads. It doesn’t necessarily mean people have been driving every automobile they buy for 12 years. The average ownership for two-thirds of households is less than 5 years.

The other reason we’re going to see more long-term loans is because cars are simply more expensive. The cost of new vehicle in the United States is up 22% since the end of 2019.1

People won’t want to see their monthly payment go up so they’ll stretch their loan out further to keep the payment similar.

For example, the best-selling vehicle in America for more than 40 years is the Ford F-150. We love trucks in this country.

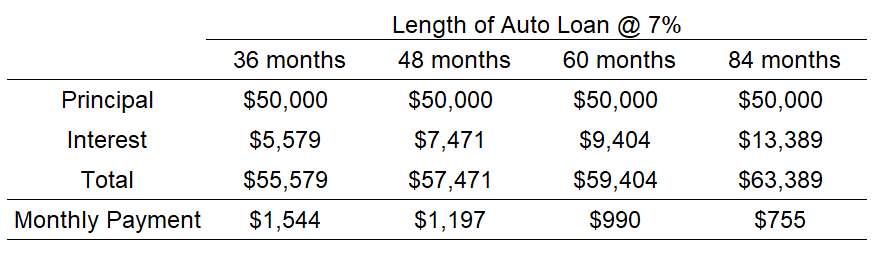

The average price for a new F-150 is around $50,000 depending on the trim and extras. I mapped out the total cost of various loan lengths along with the monthly payments from 36-84 months:

You’re looking at an extra $7,800 in interest expense by extending your loan from 36 months to 84 months. But look at how much lower the monthly payment is. People who don’t live in the spreadsheets care more about the monthly payment than the all-in cost of the loan.

I want to see both sides here but my personal finance brain won’t let it happen.

If these loans were 3% to 4% (or less), sure sign me up. But prevailing auto loans are in the 7% to 10% range. There is also a reason car dealerships aren’t offering 84-month warranties with these loans.

My worry is people take out these extended loans and then try to trade in the vehicle in five years once they get sick of it. Now you’re looking at a depreciating asset where you owe more than it’s worth and you’re stuck paying that off just so you can roll over into another new F-150.

Your financial flexibility is severely curtailed when you borrow for that long.

The good news is these loans aren’t having a materially impact on household balance sheets just yet in terms of overall financial stress:

Delinquencies are rising for auto loans but not outside of long-term averages by any means. My guess is we’ll see these numbers continue to tick up in the years ahead.

Unless you plan on driving your vehicle for a very long time, an 84-month loan is a bad idea.

It costs more, ruins your flexibility and handcuffs you to a depreciating asset for much longer than most people will drive it.

If you can’t pay off your loan in 3 to 5 years you probably can’t afford it.

Further Reading:

Is the Ford F-150 Partially Responsible for the Retirement Crisis?

1Used vehicles have experienced higher inflation, up 31% in that time.