Here’s a crazy stat from Bloomberg:

Half of American households account for 97.5% of the wealth in this country.

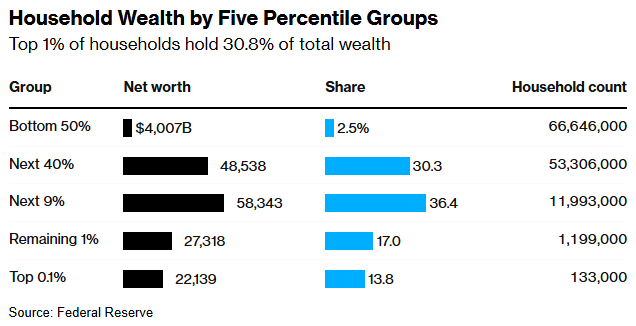

This is the breakdown from Federal Reserve data:

On the one hand these numbers — 2.5% of wealth — seem almost impossible for the bottom 50%.

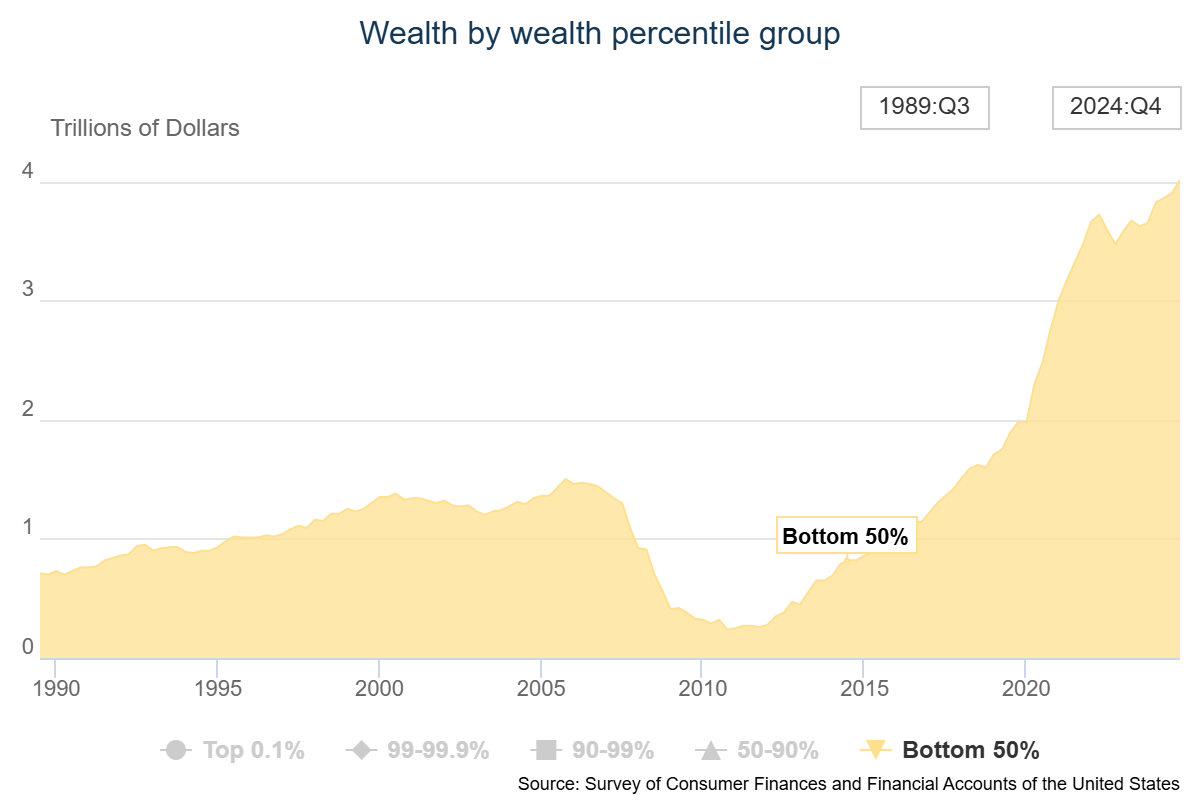

On the other hand, this is an improvement from the last decade.

It was much worse coming out of the Great Financial Crisis. In 2011, the top 50% controlled 99.6% of the wealth, while the bottom 50% accounted for just 0.4%.1

The pandemic saw a massive increase in the wealth of the bottom 50%:

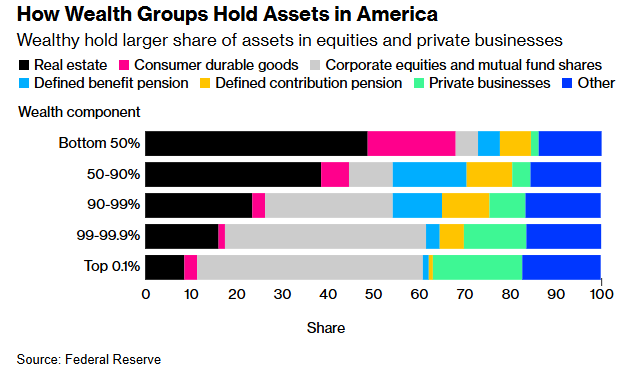

Rising home values have helped since housing makes up the majority of financial assets for the bottom 50%:

Roughly half of all wealth for the bottom 50% resides in their home while just 5% is in stocks. Those numbers for the top 10% are 19% and 36%, respectively.

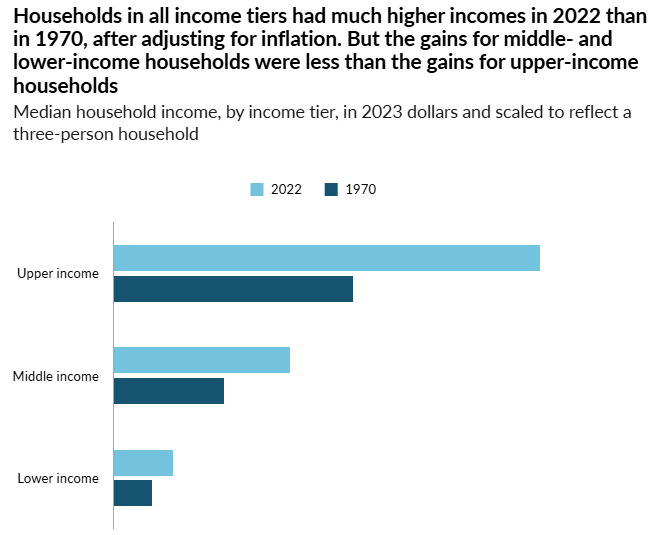

Household finances are in a strange place. The rich are getting richer, but everyone else is getting richer, too, just at a slower pace in most cases.

Pew Research shows upper income households have seen their incomes grow much faster than middle and lower income households since 1970:

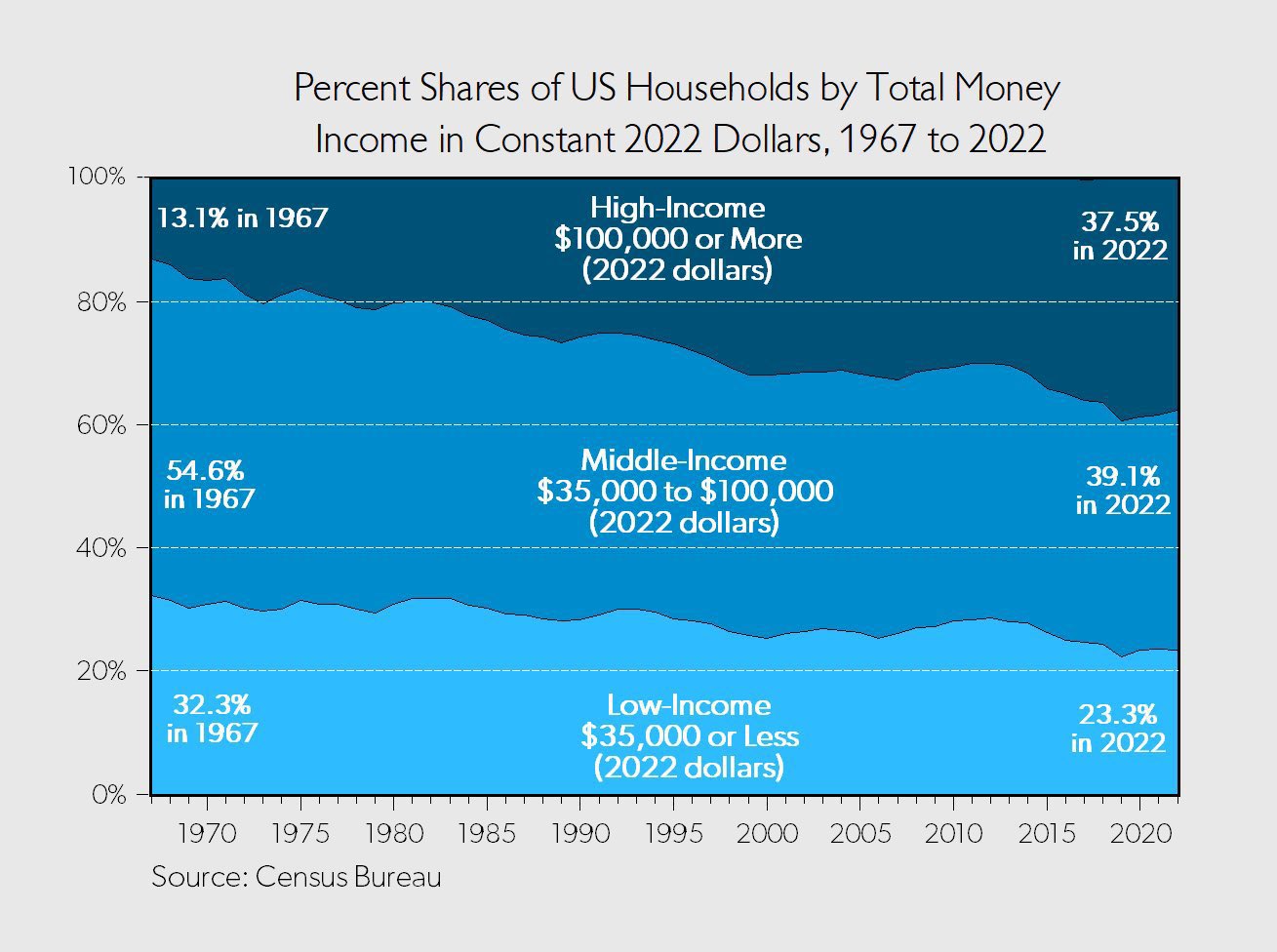

Check out this chart from Chris Freiman on the shrinking middle class:

The middle class is shrinking because more people are moving into the upper class.2 This is a good thing but it doesn’t make the people on the outside looking in feel any better about their station in life.

It is important to recognize that the people who make up these different income and wealth buckets are constantly changing over time.

I wrote about this in Don’t Fall For It:

Research shows over 50% of Americans will find themselves in the top 10% of earners for at least one year of their lives. More than 11% will find themselves in the top 1% of income-earners at some point. And close to 99% of those who make it into the top 1% of earners will find themselves on the outside looking in within a decade.

A similar dynamic is at play when it comes to net worth. It’s not static.

I was in the bottom 50% for years after I graduated college. I had student loans and a car loan. I didn’t make much, so I didn’t save much. My net worth was negative until my late 20s.

I don’t know what the right level of household wealth distribution should look like. I sympathize with the idea that our system should reward risk-taking but we should also try to lift up as many people as possible.

I’m not sure there is a balance that would ever make everyone happy.

The important thing is to get to a place where you’re happy with what you have.

Easier said than done.

Further Reading:

The Wealth Effect

1The highest share for the bottom 50% was 4% of total wealth in the 1990s.

2I know some people will quibble with his definitions of upper, middle and lower class but the point is these numbers are inflation-adjusted over time.