CNBC recently highlighted a survey that asked a group of Americans how much money they need to feel financially secure.

The average answer was a little more than half a million dollars.

According to Federal Reserve data, the median net worth of all families in the United States is a little less than $122,000. So it would make sense that half a million in savings would make most people feel more secure financially.

Of course, there is no right or wrong number for everyone. These things are essentially moving targets. Once you reach a certain level, most people simply adjust their goal even higher instead of being content with it.

This is both the blessing and curse of the way we think about progress.

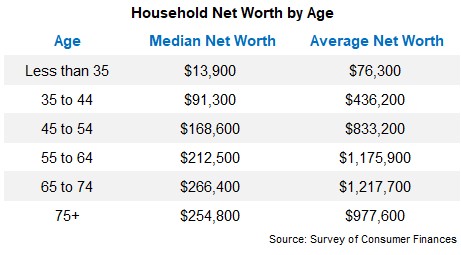

This makes sense when you look at household net worth by age:

The number someone gives in their 30s is likely going to be drastically different from their number in their 60s.

What seems like a lot of money to someone at one age may feel like not enough at another age.

What feels like an embarrassment of riches to one person could feel like a letdown to another person.

Chris Rock once put it this way:

If Bill Gates woke up tomorrow with Oprah’s money, he’d jump out a f*cking window. He’d slit his throat on the way down saying, ‘Ah sh*t. I can’t even put gas in my plane!’

Wealth is often circumstantial beyond a certain threshold.

And the biggest problem here is a specific amount in the bank isn’t necessarily going to change your habits, attitude or relationship with money.

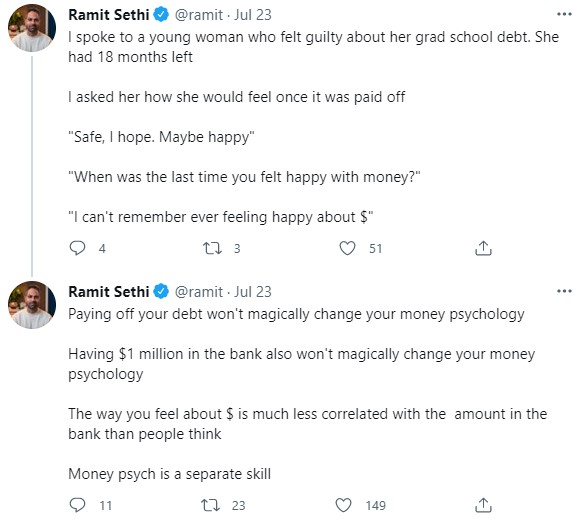

Ramit shared a story on Twitter recently that exemplifies this idea:

Your relationship with money is determined by a number of factors ranging from your upbringing, your parents, money habits you were taught or observed growing up, your personality, how much or how little money you’ve had at various points of your life, your ability to delay gratification and your emotional make-up.

This stuff doesn’t change simply because you hit some income, net worth or debt level. Money may amplify certain aspects of your personality but the money itself doesn’t change you.

This is why it can be so difficult for many retirees to go from savers to spender in their later years. Some people need permission to enjoy their money. Many people don’t know how to spend their money in a way that makes them happy.

Others need help reining in their spending. Or figuring out how to budget. Or choosing the right places to invest their money.

But money in and of itself is not going to solve these problems.

How many relationships have you had over the years where there was something about that other person you thought you were going to change? How often were you successful? In the history of relationships maybe 1% of people ever truly change in the way you want them to?

It takes work. Just like working on yourself.

Your relationship with money can change with the passage of time. The way you view money is much different at age 20 than age 50 simply because of where you are in your lifecycle, experience with your finances and how much money you have.

There are also certain life events that can force people to change their relationship with money.

Getting married is a big one. You have to get on the same page when it comes to saving, spending, debt, retirement, etc. Some people may come into the relationship with debt up to their eyeballs. One person might spend way more than the other person. Or you could be dealing with a cheapskate.

It’s rare to have two people with exactly the same feelings about money in a relationship which forces us to learn or compromise.

Having kids definitely changed my relationship with money.

On the one hand, it cemented the idea that I need to have my finances in order, for both the present and the future. We are now responsible for three other people. Those little freeloaders can’t contribute income to the family budget. It also changed the way I view risk.

But the biggest change for me was how I view spending money.

I’ve always been a saver. Having kids made me realize the importance of prioritizing spending on things like convenience, time and experiences. I don’t care about the missed future compounding on this money. What’s the point of saving if you can’t enjoy yourself now too?

Having kids brought more balance into my life from a financial perspective.

It’s difficult to change yourself in a big way but the way you view having a rich life certainly can and will change over time.

Michael and I debated whether you can really change your relationship with money on this week’s Animal Spirits video:

Subscribe to The Compound for more videos.

Further Reading:

What if Means to be Rich

Now here’s what I’ve been reading lately:

- Karsten Warholm beats Rai Benjamin with world record (SI)

- Investing influencers use social media to educate (Bloomberg)

- Do we spend less with curbside pick-up? (Art of Manliness)

- Money shouldn’t be an instrument of torture (A Teachable Moment)

- Is the Amex Platinum worth $695/year? (Bloomberg)