Today’s Animal Spirits is brought to you by Innovator ETFs by CBOE:

See here for more information on Innovator’s outcome oriented ETFs

See here for tickets to The Compound and Friends live in Chicago!

Get a random Animal Spirits chart here

On today’s show, we discuss:

- As Markets Swooned, Pros Sold–and Individuals Pounced

- ‘I Could Lose It All Tomorrow’: The Traders Leaning In to Wild Markets

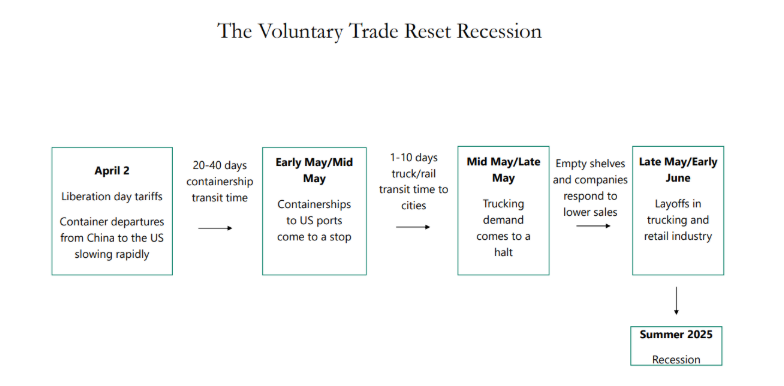

- Trump softens tariff tone amid empty shelves warning, market slump

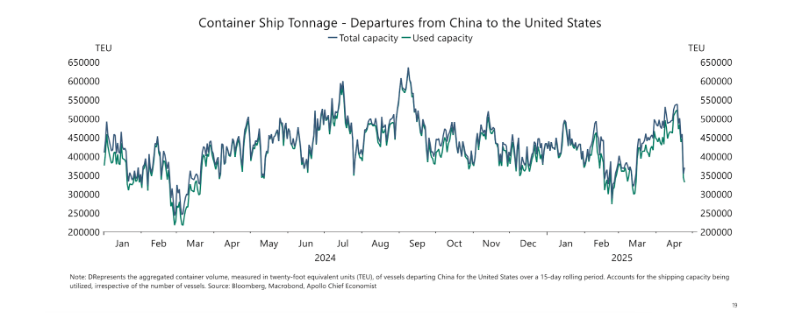

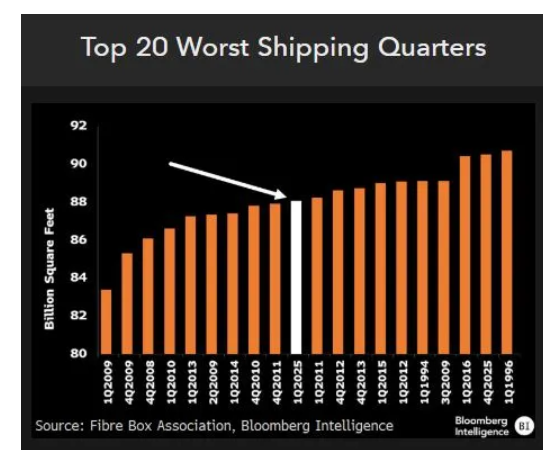

- Cargo Shipments From China to U.S. Slide Toward a Standstill

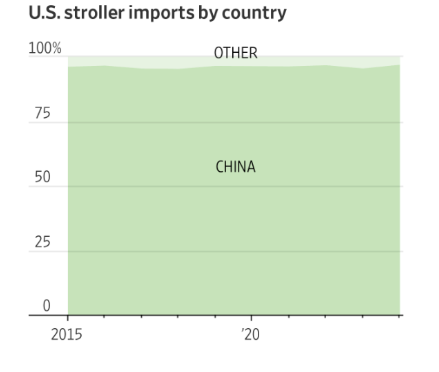

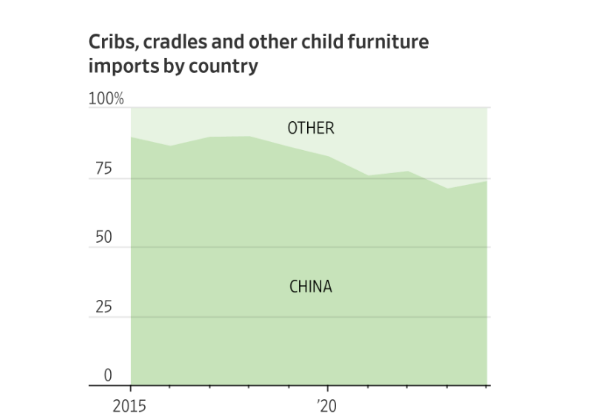

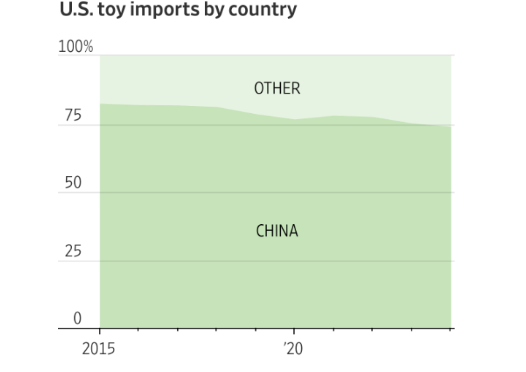

- For Baby Strollers, There’s No Way Around China Tariffs

- The Eerie Calm in the S&P 500

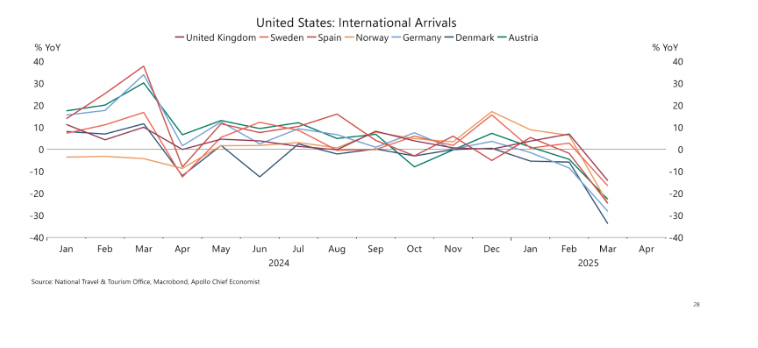

- How are US consumers and firms responding to tariffs?

- Americans Are Downbeat on the Economy. They Keep Spending Anyway.

- The Gen Z Lifestyle Subsidy

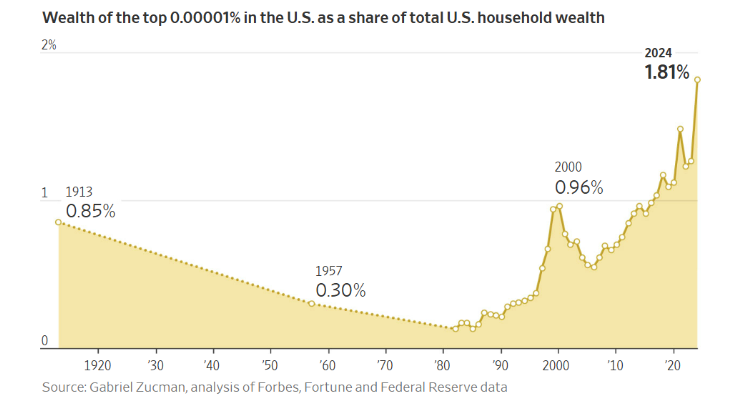

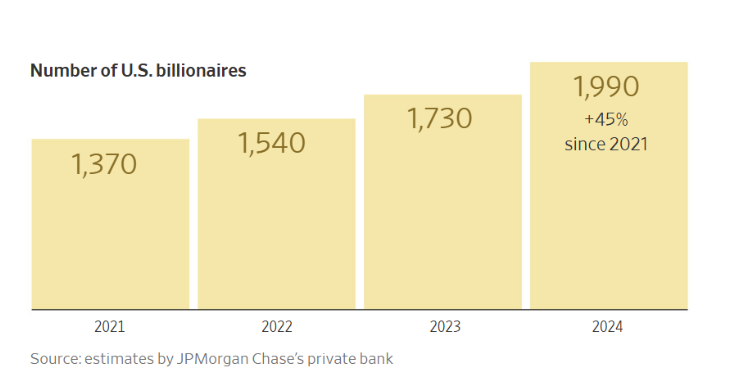

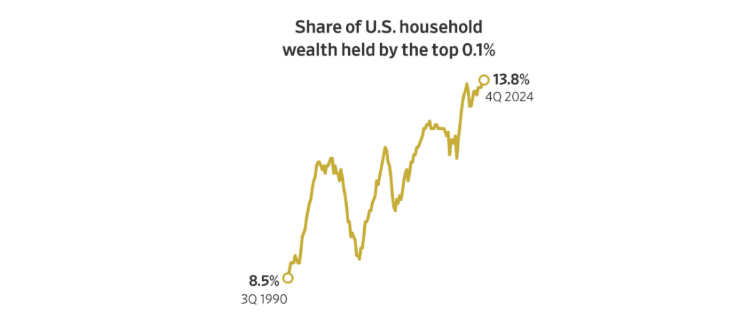

- $1 Trillion of Wealth Was Created for the 19 Richest U.S. Households Last Year

- My Stock Market Abundance Plan

- Eli Roth’s The Horror Section

- How ‘Yellowstone’ Became a $3 Billion Franchise – and Where It Goes Next

Listen here

Recommendations:

Charts:

Tweets/Bluesky:

The rare Zweig Breadth Thrust (ZBT) triggered today.

Marty Zweig discovered this signal and it has a perfect track record (using NYSE data from NDR).

This signal has been 100% accurate since WWII, with the S&P 500 higher 6- and 12-months later every single time. 19 for 19. pic.twitter.com/ofBNHBJZiU

— Ryan Detrick, CMT (@RyanDetrick) April 25, 2025

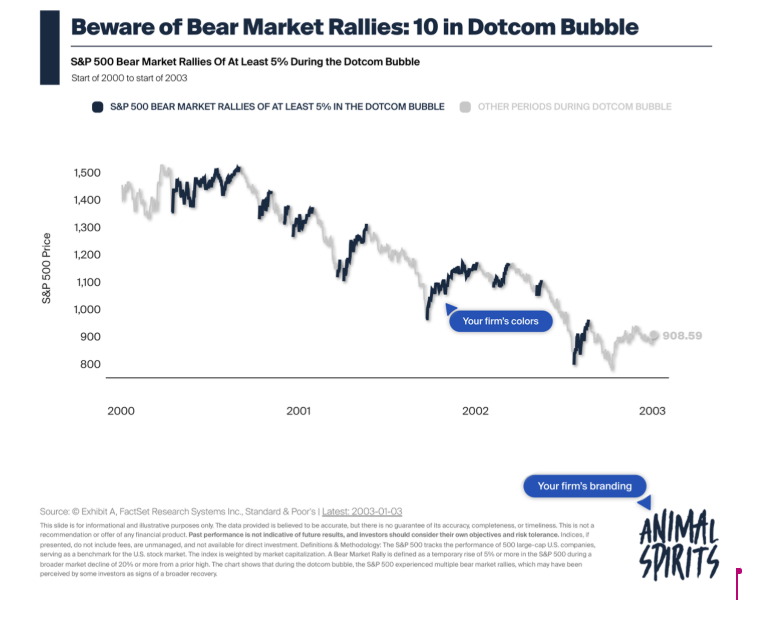

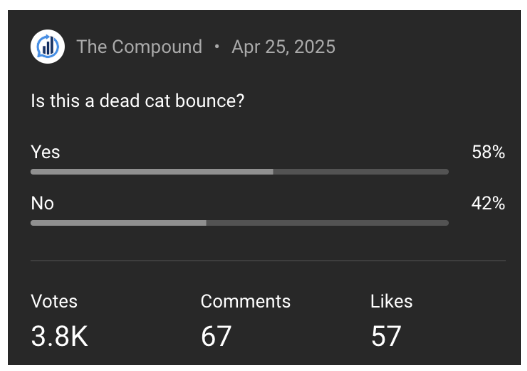

To say this one more time, what we've seen the past two weeks isn't what you see in bear market rallies.

More than 70% advancers on the NYSE six times over the past 10 days. Never lower 6- and 12-months later for the S&P 500. pic.twitter.com/l7xov3sPeP

— Ryan Detrick, CMT (@RyanDetrick) April 25, 2025

The S&P 500 is up at least 1.5% for three days in a row.

This isn't stuff you see in bear market rallies or short covering rallies. You see this before times of strong performance.

Higher 10 out of 10 times a year later and up 21.6% on average. pic.twitter.com/kfvfNKq6IK

— Ryan Detrick, CMT (@RyanDetrick) April 25, 2025

NOTHING TO SEE HERE FOLKS

THIS IS COMPLETELY NORMAL AND HEALTHY

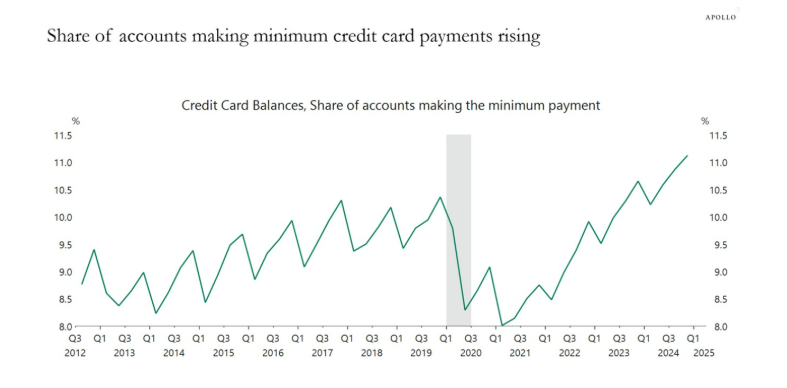

HAVE THEY CONSIDERED CUTTING AVOCADO TOAST OUT OF THEIR BUDGET pic.twitter.com/PYtLBGNprG

— Lance Lambert (@NewsLambert) April 23, 2025

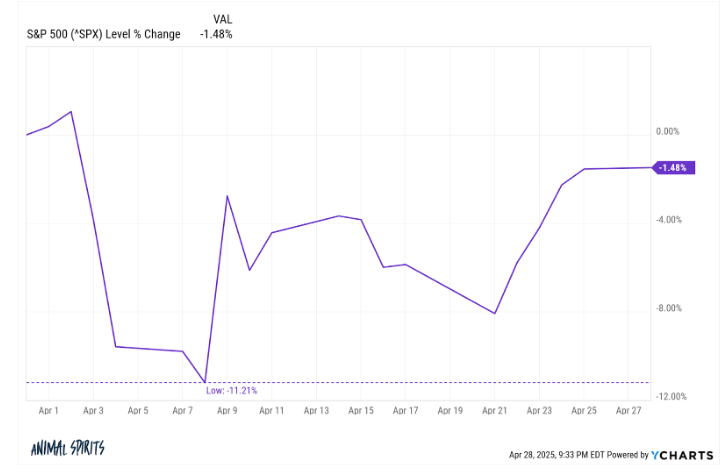

In the past 15 trading days the S&P 500 has seen runs of:

-12.1% (in 4 days)

+9.5% (1 day)

-5.5% (7 days)

+6.3% (3 days)

Like 4 months in less than one

— Ben Carlson (@awealthofcs) April 25, 2025

Who else is excited to see how we fix these problems? The USA's "broken" monetary system:

#1 in total wealth.

#1 in total GDP.

#1 in GDP growth in the G7.

#1 in global corporate profits.

#1 in GDP per capita in the G20.— Cullen Roche (@cullenroche) April 22, 2025

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product