A reader from down under asks:

You guys have been talking a lot about US economic exceptionalism in recent years with the caveat that houses are too expensive. Fair enough. But check out housing prices in Australia where I live. It’s madness! People have been saying it’s a bubble for years while prices just keep going higher. I don’t really have a question. Just wanted to point out that prices in the states look tame by comparison. Cheers.

I am in complete agreement with my Australian friend here.

While it seems like the U.S. housing market is completely broken and prices are out of reach for millions of Americans, the situation is much worse in other countries. Especially Australia.

The median price for an existing home in the United States is around $410,000. In Australia it’s more than $800,000. In Syndey, the median price of a home is well over $1 million.

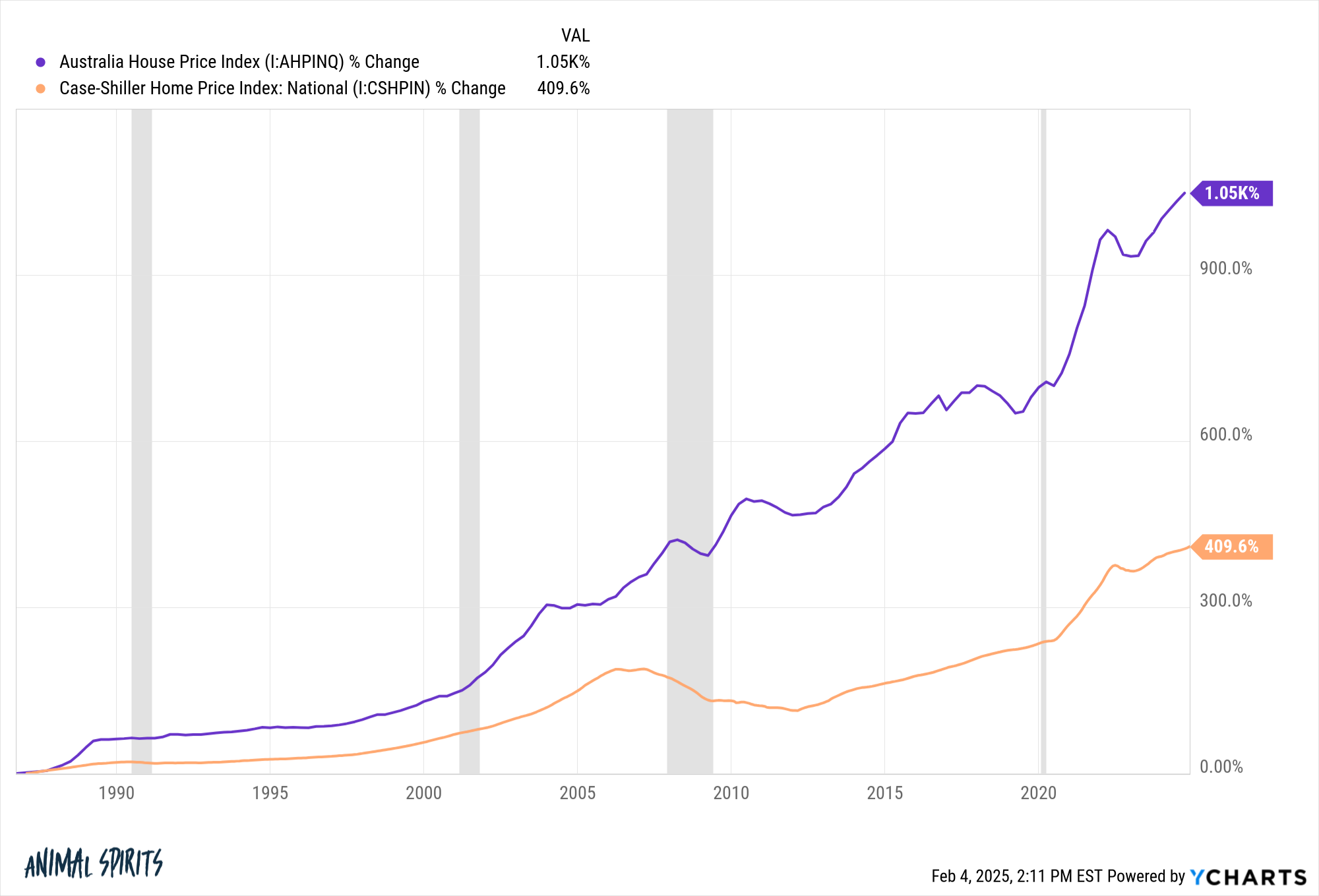

Homeowners in the U.S. have experienced incredible gains over the past 30-40 years but we’ve got nothing on Australia:

Since the late-1980s, housing prices down under have more than doubled up our returns on homeownership.

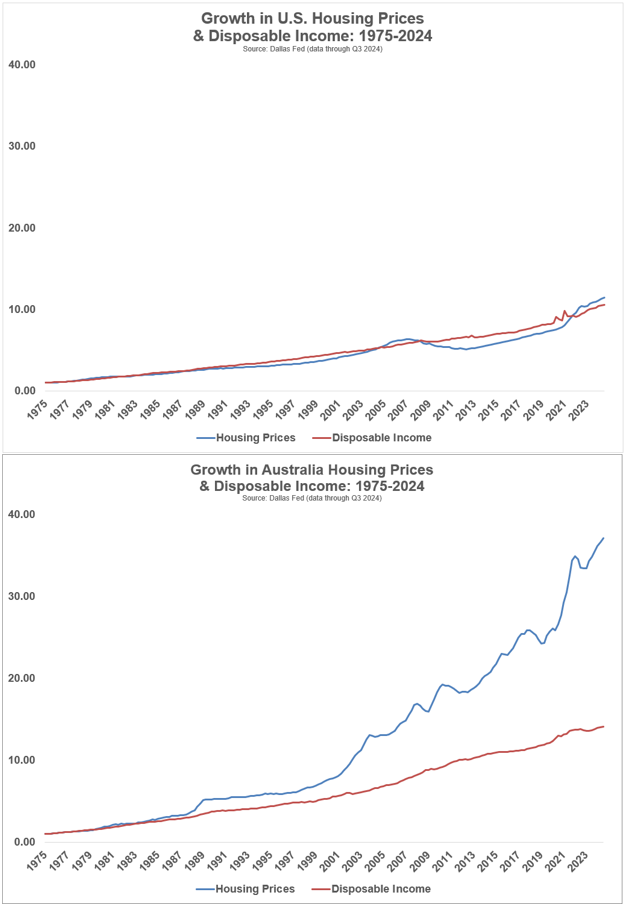

It’s also import to put these price gains into context in terms of affordability. I like to do this by comparing price gains to wage gains.

These charts show housing price growth versus the growth in disposable income for both the United States and Australia going back to 1975:

I put these time series on the same scale to show just how out of whack this relationship is in Australia. In the U.S., housing prices and disposable incomes have grown roughly in lockstep with one another. Not so in Australia where the chart looks like an alligator opening wide and showing off its teeth.

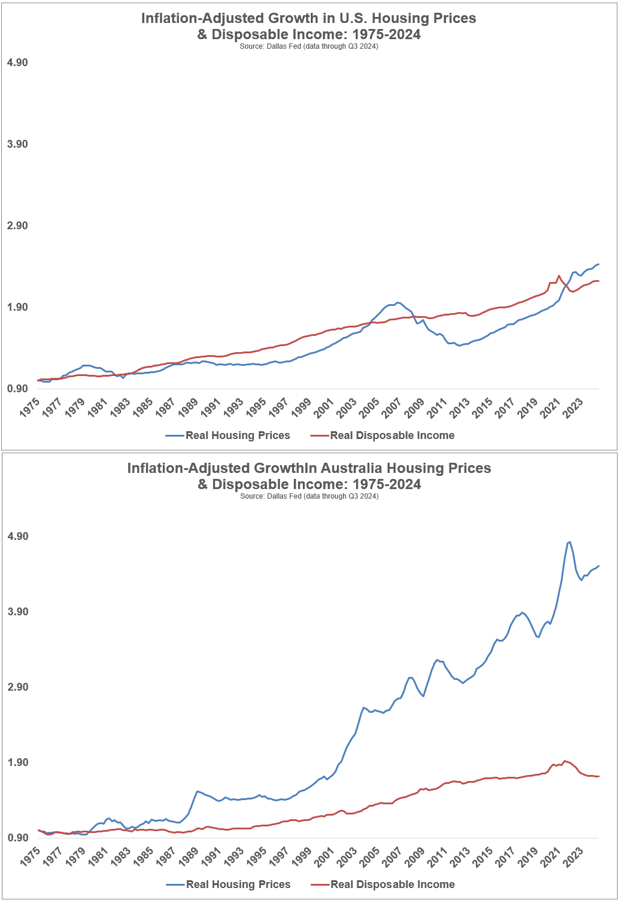

Some people prefer using inflation-adjusted data when making comparisons across borders:

The real data paints a similar picture.

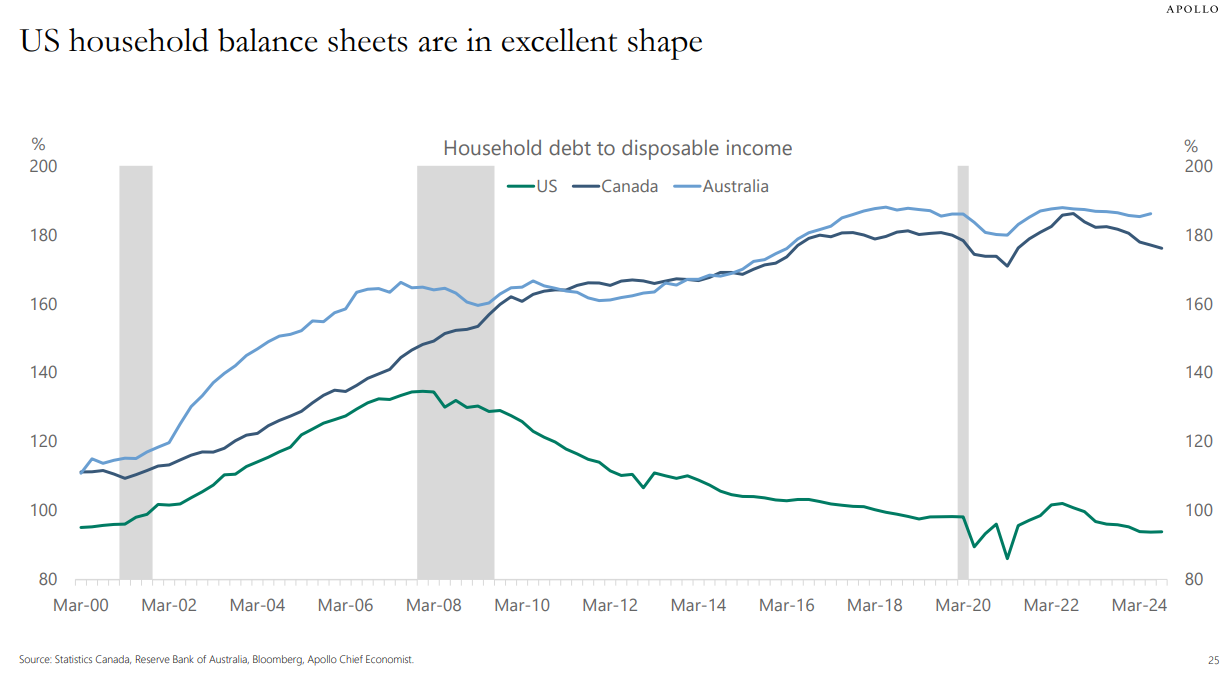

Torsten Slok has a great chart that compares household debt to disposable income in the U.S., Canada and Australia:

Canada and Australia have seen debt-to-income ratios rise for years now while U.S. households have been repairing their balance sheets ever since the Great Financial Crisis. Higher housing prices are obviously the main culprit here

Mortgage debt makes up 70% of household debt in the U.S. I don’t have the exact figures for Australian households but I’m guessing it’s a similar profile.

But it’s not just higher housing costs that are hurting Australian household balance sheets. Higher interest rates in recent years have hurt most homeowners because of how their mortgage market is structured.

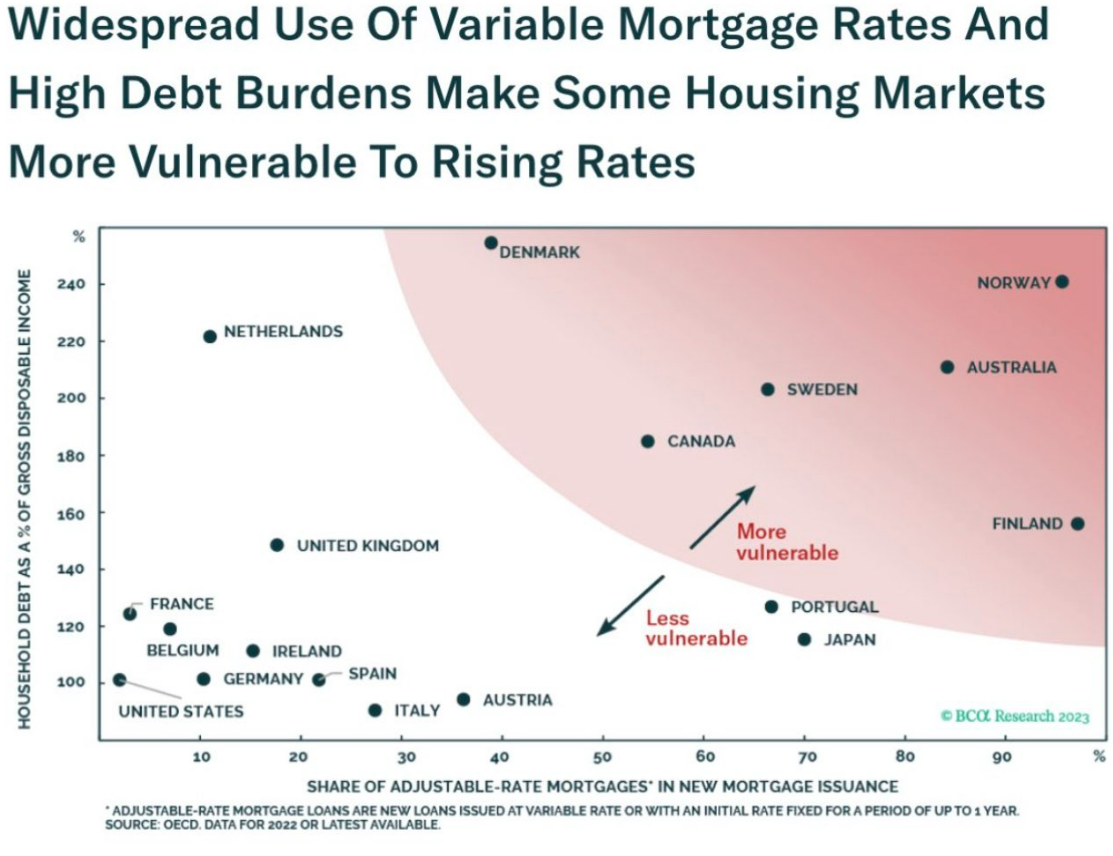

The following chart shows debt to income by country plotted against the usage of variable rate mortgages:

You can see Australia has one of the highest shares of variable-rate mortgages. As far as I can tell you’re able to lock in your rate for around 5 years and then it resets. This was a wonderful set-up when rates were falling, but now that we’re in a higher interest rate world, it is more expensive for current and new homeowners alike.

U.S. homeowners were able to lock in 3% mortgage rates during the pandemic to shield themselves from a rising rate environment. That’s not the case in many other countries because they don’t utilize 30 year fixed rate mortgages like we do.

Does looking at someone else’s situation make those struggling to buy a home in America feel any better about their own situation?

Of course not!

But it’s worth pointing out that as bad as the housing market seems right now in the U.S. from an affordability perspective it could always be worse. It is worse in plenty of other countries.

And it’s possible we could see affordability get even worse here if we don’t make it easier to build more homes to fix our housing shortage.

We covered this question on the latest episode of Ask the Compound:

Bill Sweet joined me on the show this week to discuss questions about the tax benefits of owning rental properties, the tax implications of an inheritance, retirement planning for military service members and how tariffs work.

Further Reading:

The U.S. Housing Market vs. The Canadian Housing Market