Let’s take a look at the list of all-time highs we’re currently experiencing:

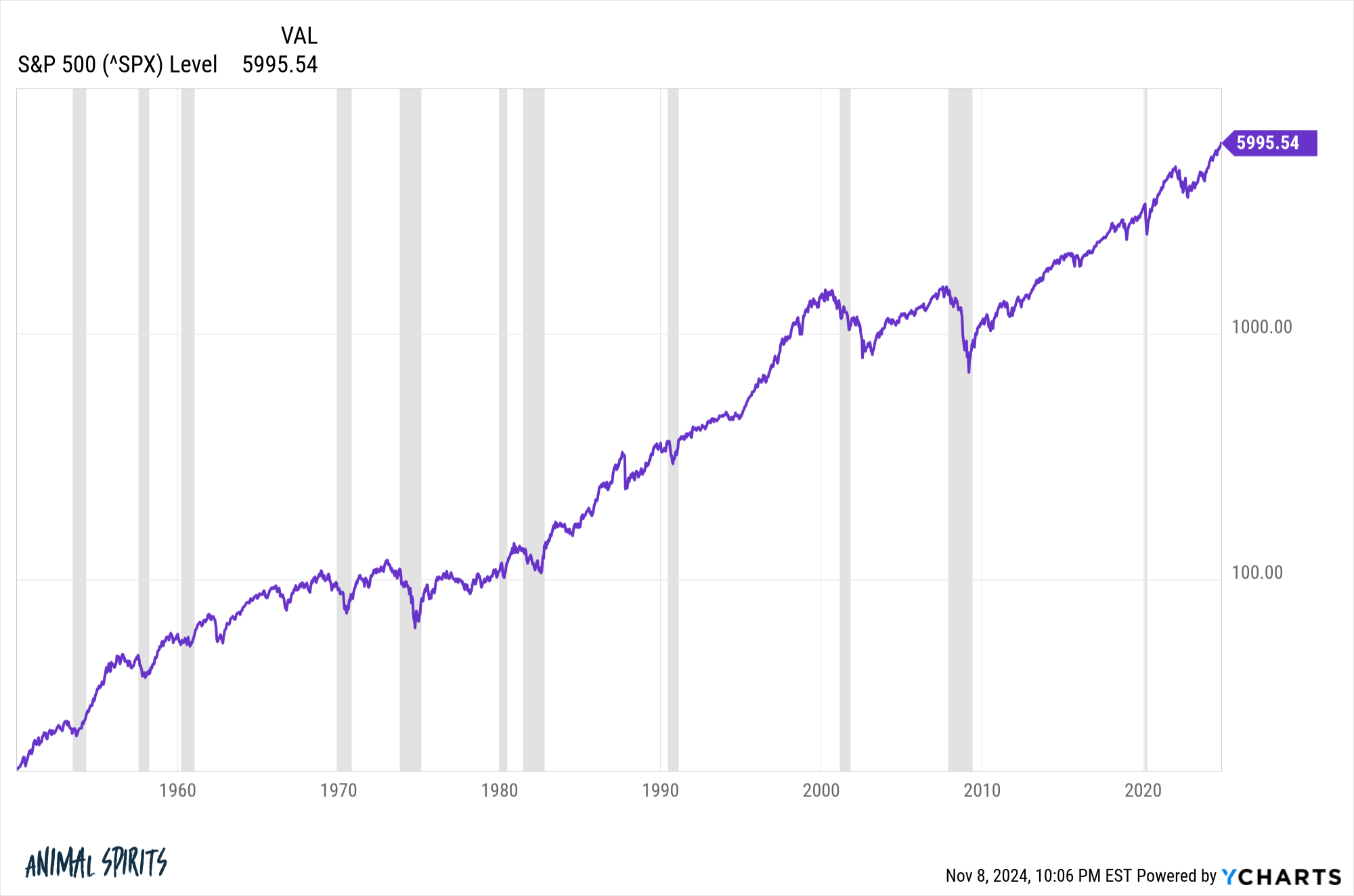

The U.S. stock market has never been higher:

The S&P 500 bottomed in March 2009 at 666. It’s now close to 6,000. The Dow has gone from roughly 6,500 to nearly 44,000.

What an incredible run.

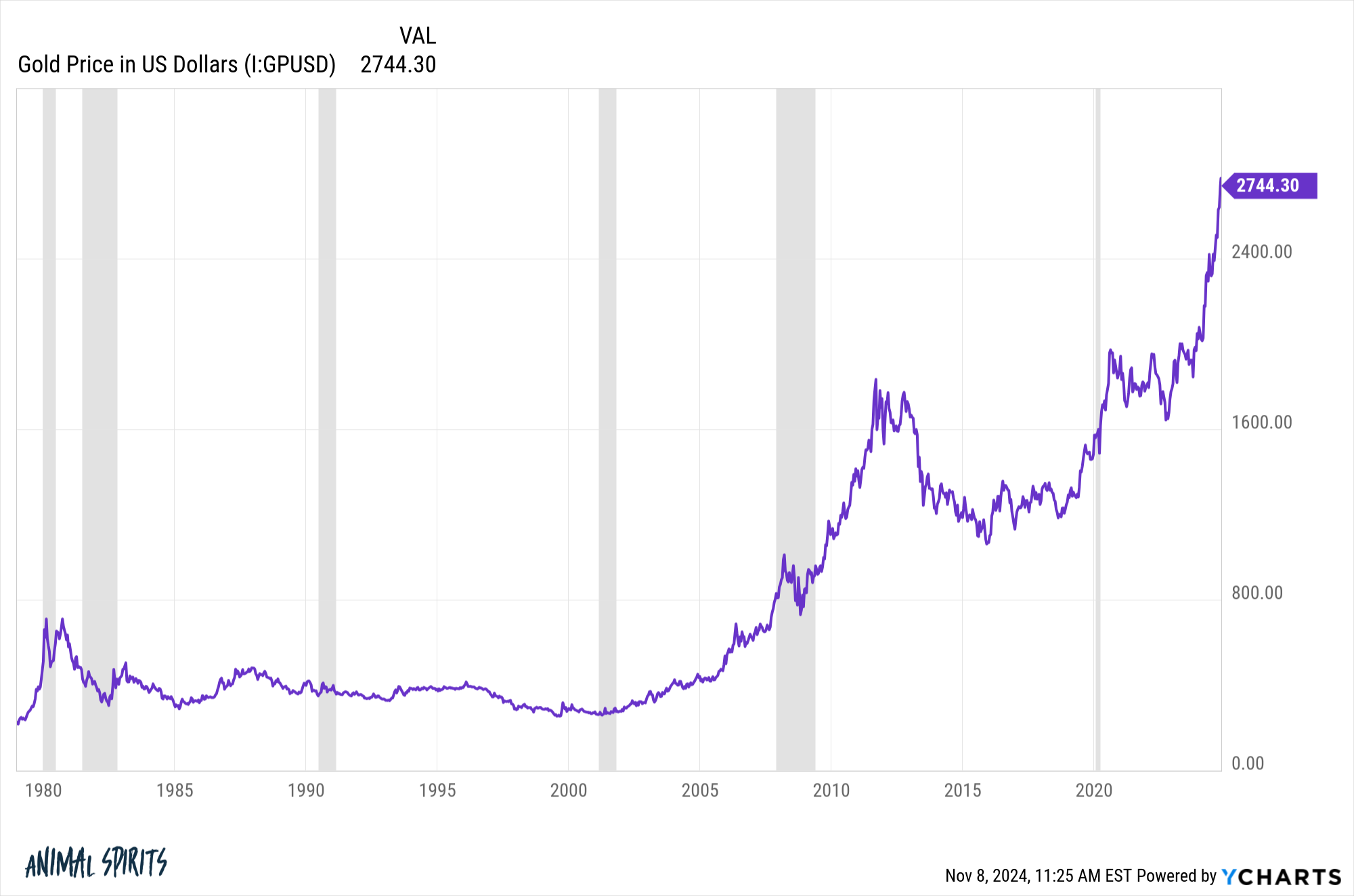

Gold is also at all-time highs:

It’s rare to see stocks and the yellow metal simultaneously taking off like this.

Bitcoin is there too, now trading over $80,000.

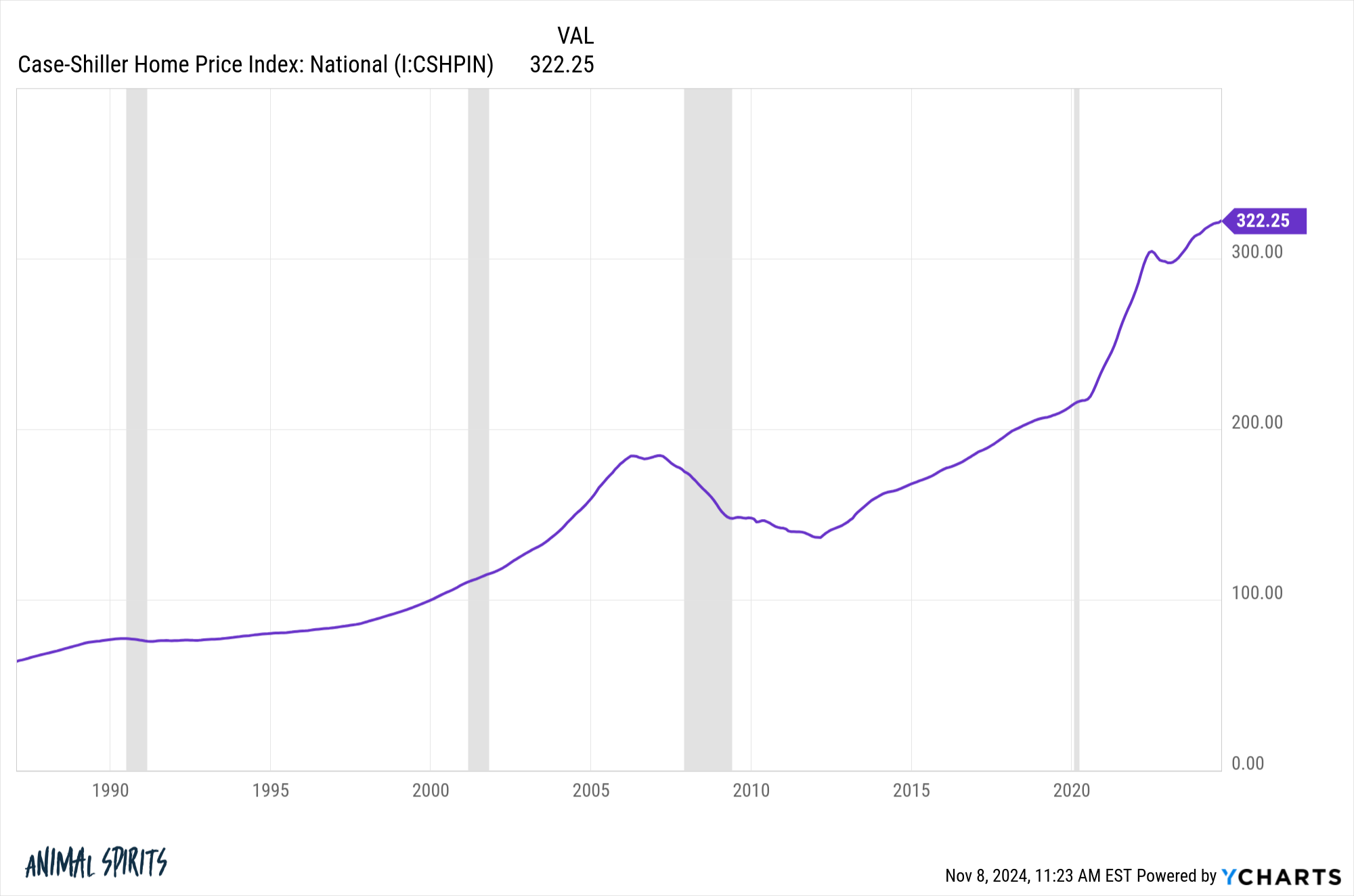

Housing prices are at all-time highs:

The fact that this is happening with mortgage rates at 7% is something else.

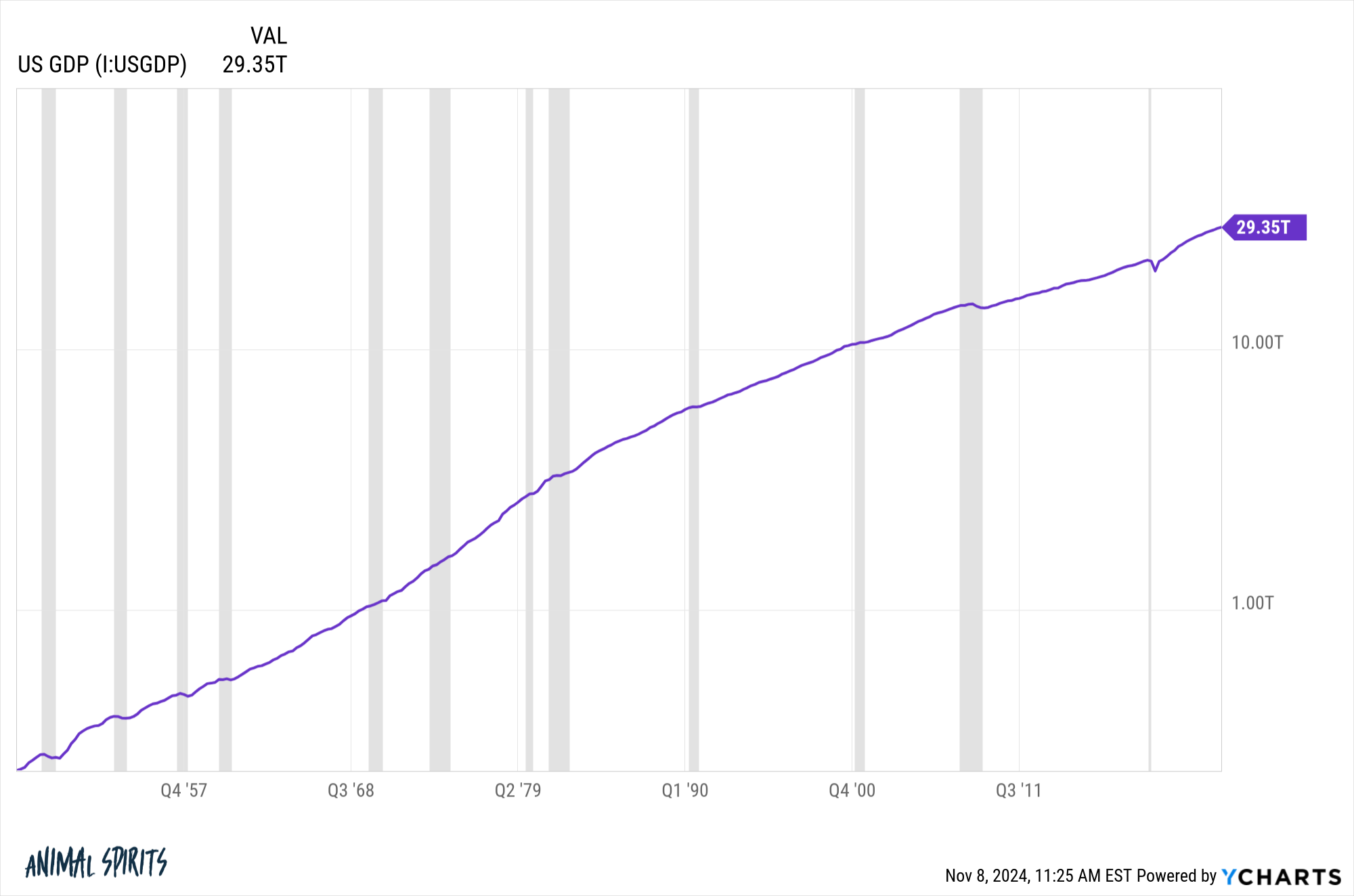

All the financial assets are going nuts so it would make sense the U.S. economy has never been bigger:

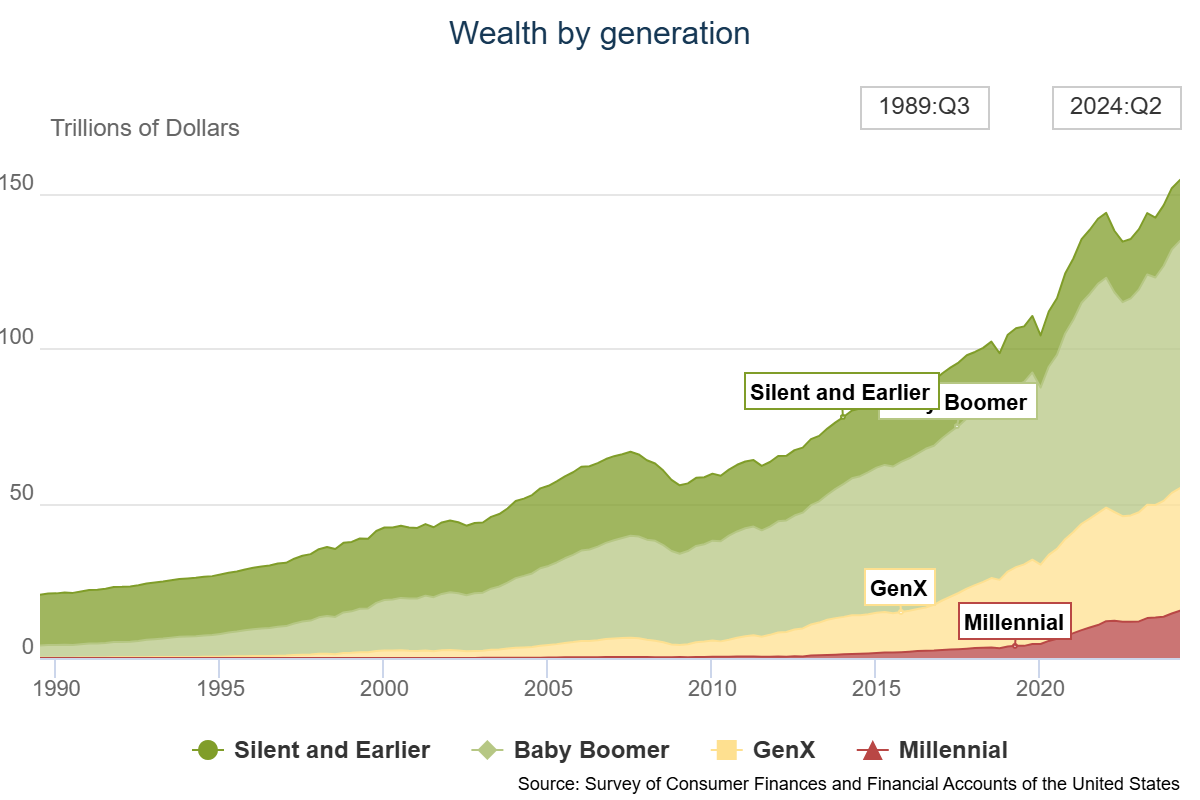

Household net worth is there too at $155 trillion:

The biggest surprise all-time high to me personally is the Detroit Lions:

I never thought I’d see the day.

We are playing better than anyone in the NFL right now (sorry Chiefs fans but you know it’s true). We have the best offense in the league. We have a boatload of exciting young players. We have a coach who goes balls to the wall.

My only worry is we’re peaking too early.

We should be the favorites in the NFC to reach the Super Bowl.1

Go Lions!

This one is a bit more subjective but it also feels like we’re currently at new all-time highs for hindsight bias following the election.

I’m always amazed at how quickly the narrative machine changes after we know the results. Everyone knows all of the answers when looking at the world through the rearview mirror.

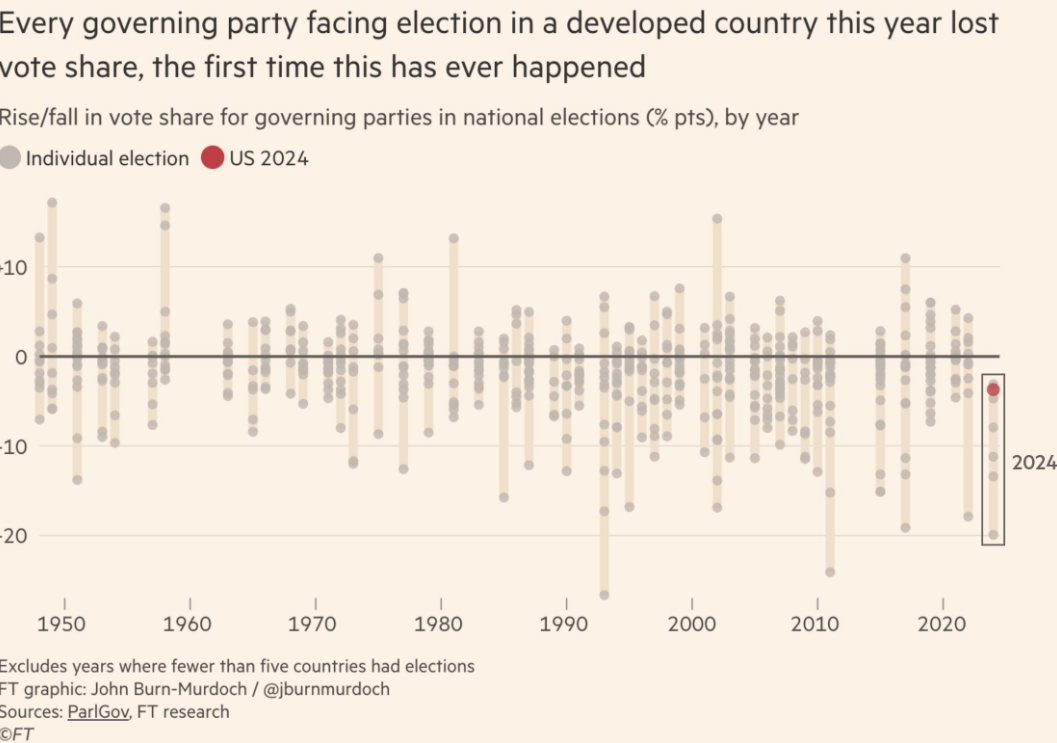

There are a lot of reasons Trump won and Harris lost. This one from John Burn-Murdoch at The Financial Times makes the most sense to me:

Incumbents around the globe lost ground. In fact, it was the first time since WWII that every incumbent party in the developed world lost vote share.

We can debate the rankings of the reasons for this shift — inflation, unpopular policies, Covid hangover, etc. — but it looks like this was a global phenomenon.

The funny thing is no one was making the incumbent point ahead of time but now everyone realizes it makes sense.

Predictions are hard, especially about the future.2

Further Reading:

The New Normal of Negativity

1I reserve the right to delete this entire section if I jinx them by writing this.

2With credit to Yogi Berra.