When Barack Obama was elected president the U.S. economy and markets were in rough shape.

From the peak in October 2007 through election day the S&P 500 was already in the midst of a 35% drawdown. By the time he was inaugurated in January 2009, the market was down nearly 50% in total.

By March, a Bloomberg opinion piece was calling it the “Obama Bear Market”:

President Barack Obama now has the distinction of presiding over his own bear market. The Dow Jones Industrial Average has fallen 20 percent since Inauguration Day, the fastest drop under a newly elected president in at least 90 years, according to data compiled by Bloomberg.

Michael Boskin of Stanford’s Hoover Institution wrote an op-ed in the Wall Street Journal on March 6, 2009 with the following headline: “Obama’s Radicalism Is Killing the Dow.” He explained:

It’s hard not to see the continued sell-off on Wall Street and the growing fear on Main Street as a product, at least in part, of the realization that our new president’s policies are designed to radically re-engineer the market-based U.S. economy, not just mitigate the recession and financial crisis.

The stock market bottomed three days later.1

From the day that op-ed was published through the remainder of Obama’s terms in office, the S&P 500 was up 230% in total.

All the talking heads were wrong, mostly because people were stuck in a doom loop from the Great Financial Crisis.

The talking heads were wrong when Trump took office after Obama as well.

Paul Krugman2 from the New York Times made the following prediction the day after the election:

Still, I guess people want an answer: If the question is when markets will recover, a first-pass answer is never.

The disaster for America and the world has so many aspects that the economic ramifications are way down my list of things to fear.

Dallas Mavericks owner Mark Cuban made a similar statement before Trump was elected:

In the event Donald wins, I have no doubt in my mind the market tanks. If the polls look like there’s a decent chance that Donald could win, I’ll put a huge hedge on that’s over 100% of my equity positions… that protects me just in case he wins.

The stock market did just fine during Trump’s presidency, gaining more than 90% in total from inauguration day to inauguration day.

Trump himself was the one who predicted the stock market would crash if Biden were elected in 2020:

The stock market did just fine under Biden too, up more than 90% since he took office in January 2020.

Often times these predictions are politically motivated, but they are also driven by the momentum of the day. There’s a lot of herding after an election.

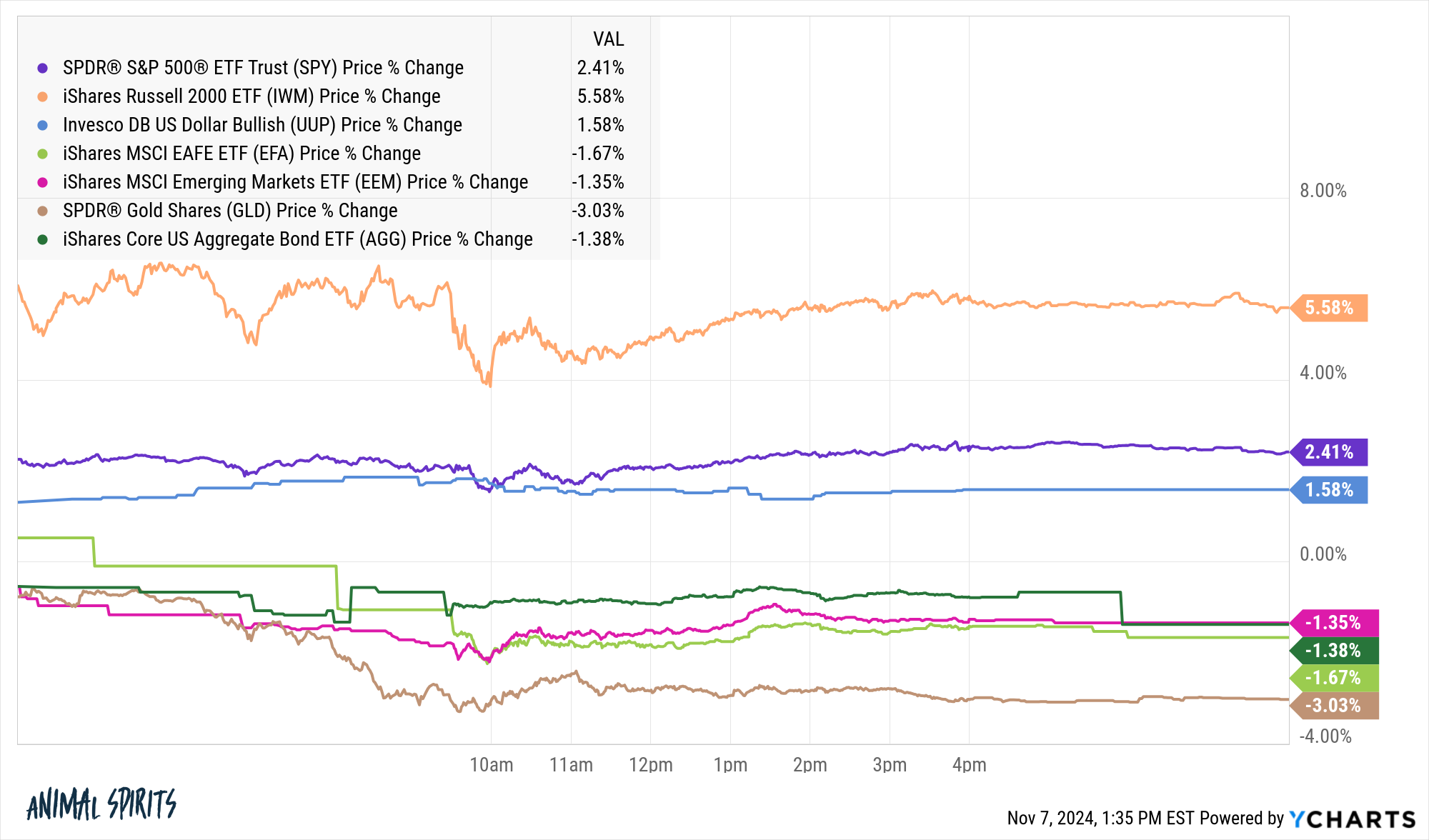

Which brings us to the current election. The market’s reaction was resoundingly positive the day after Trump was elected:

Here’s the summary:

- The S&P 500 was up bigly (+2.4%)

- Small cap stocks were up massively (+5.6%)

- The U.S. dollar was up (+1.6%)

- Foreign and emerging market stocks were down (-1.7% and -1.4%)

- Gold was down (-3.0%)

- Bonds were down (-1.4%) because rates were up

- Bitcoin also charged to new all-time highs.

That was certainly a big reaction considering the stock market was already up 20% in total coming into election day.

No one seems to be making any crash predictions this time around. It’s (mostly) everybody in the pool. I’m almost certain markets are overreacting in some way here but I can’t say for sure where it’s taking place.

Small caps have given investors plenty of head-fake rallies over the years. Interest rates have been rising and falling for a couple of years now too. It seems like a sure-thing bitcoin is going to benefit but crypto’s history is littered with booms followed by busts.

If I had to pick one I think investors are too worried about the rise in rates. We’ll see. I’m no good at predicting this stuff.

I guess what I’m trying to say here is don’t take the initial reaction of the markets, the pundits or the economists as gospel. No one knows how this will turn out, good or bad.

The problem with politicians is they make many promises on the campaign trail, many of which never come to fruition. So the markets are guessing about what will happen before we have any of the details. This is what markets do, of course. Sometimes right, sometimes wrong but never in doubt.

Making predictions based on short-term price movements is always a fool’s errand but it’s probably even more important to avoid overreacting after an election when emotions are running high.

Josh, Michael, Callie and I went live at The Compound on Wednesday evening to talk all about the market and economic impacts of the election:

And Michael and I gave some thoughts on politics and investing the day before the election:

Make sure to subscribe to The Compound’s YouTube channel so you never miss any of these videos.

Further Reading:

Don’t Mix Politics With Your Portfolio

Now here’s what I’ve been reading lately:

- The 2024 election and who tells your story (Eye on the Market)

- Slaying some of the biggest passive investing boogeymen (FT)

- Investing lessons from the 2024 election (Big Picture)

- We need to talk about retirement spending (Morningstar)

- How to deal with disappointment (The Atlantic)

Books:

1On March 3, 2000, Obama said it might be a good time to buy stocks. He wasn’t pounding the table but it’s funny how there was actually pushback on that idea at the time.

2To be fair, Krugman did recant that statement a few days later.