Today’s Animal Spirits is brought to you by Nasdaq and Fabric:

See here for more information on the largest U.S. equities exchange by market share

Go to meetfabric.com/spirits for more information on life insurance from Fabric by Gerber Life

On today’s show, we discuss:

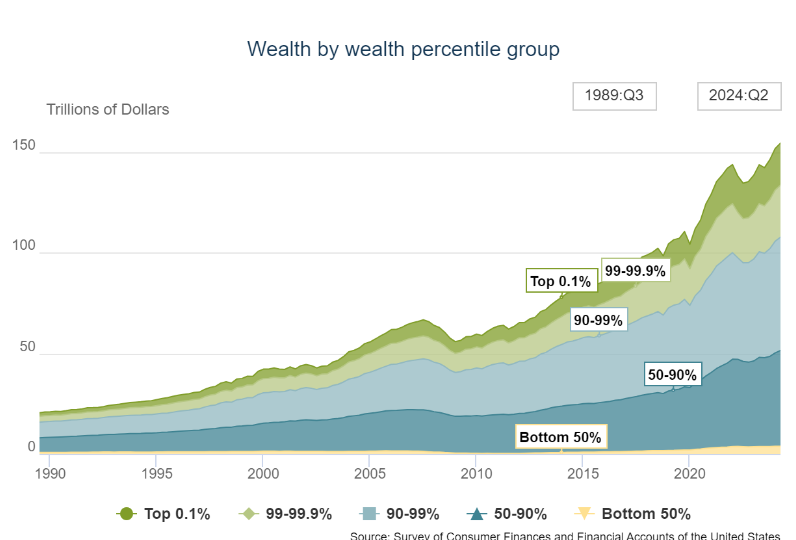

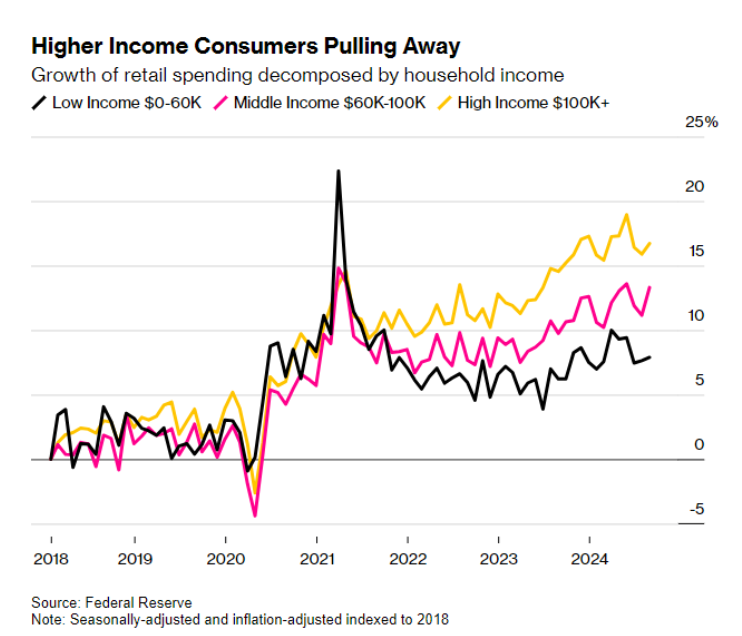

- US Consumer Spending Is Increasingly Driven by Richer Households

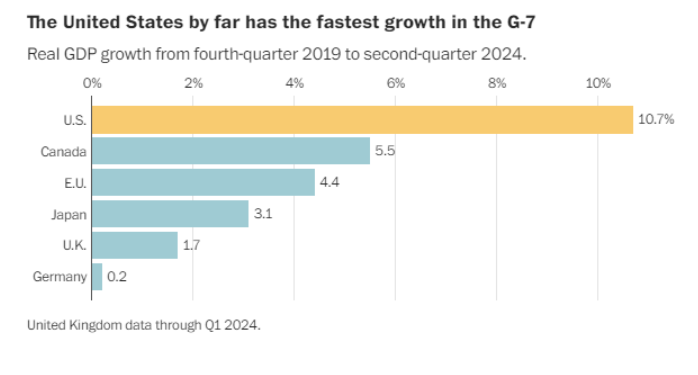

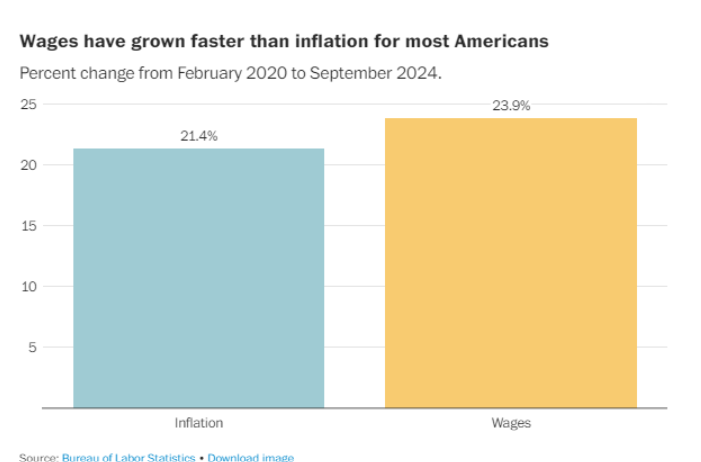

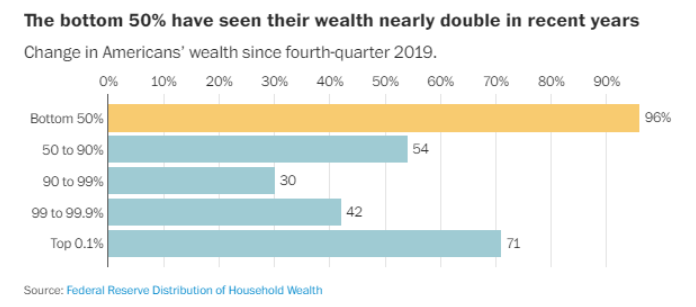

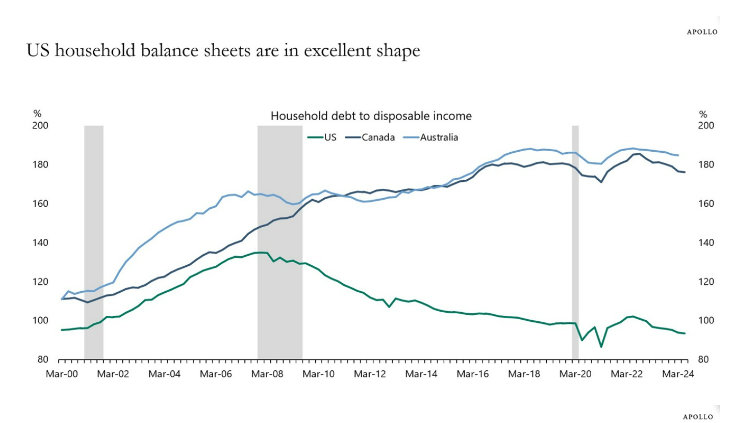

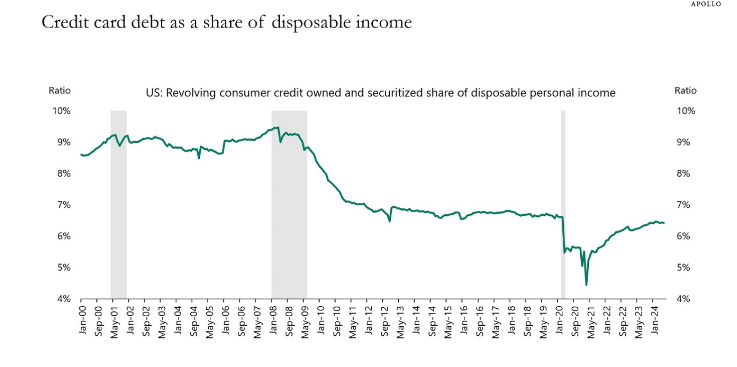

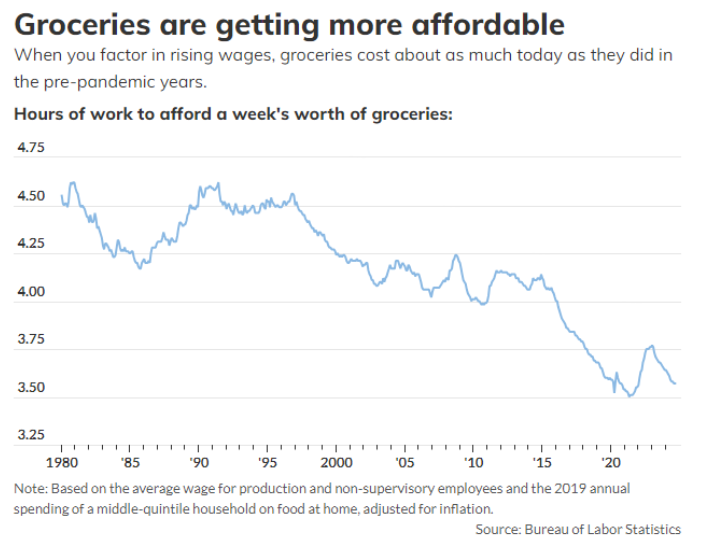

- This is a great economy. Why can’t we celebrate it?

- U.S. Incomes Climbed Last Year, Census Bureau Says

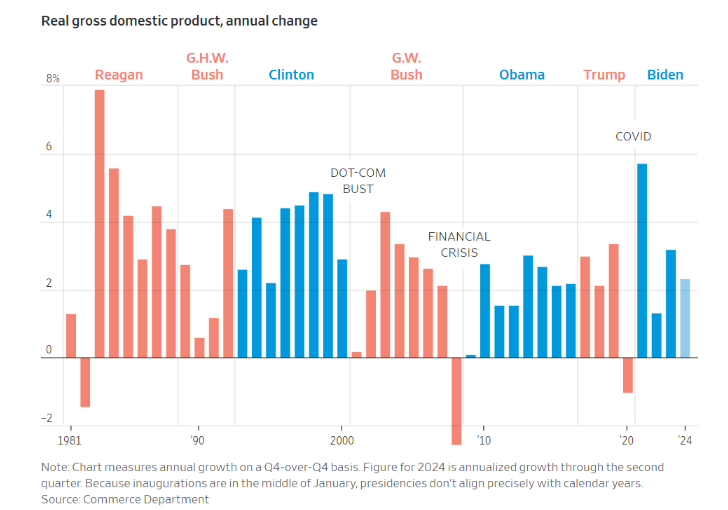

- The Economy Under Trump vs. Biden

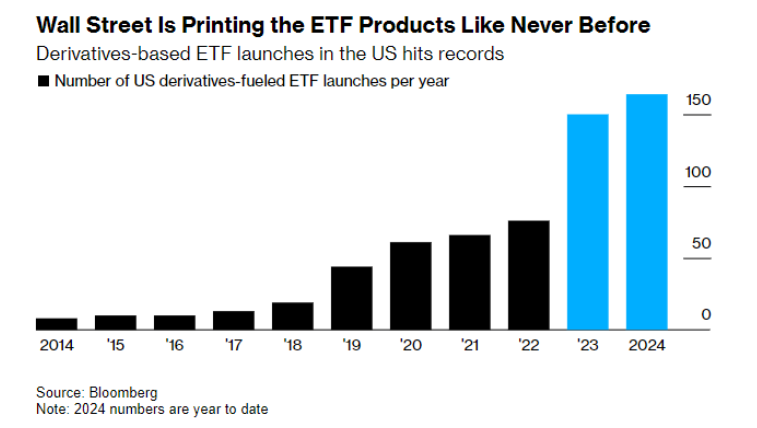

- ‘100%’ Yields Are Fueling a Retail Boom in New Quick-Buck ETFs

- The Rise of the Quick-Buck ETF

- Waymo says it has doubled its weekly paid robotaxi trips to 100,000 since May

- Is the Midwest a ‘climate haven’? Business owners certainly think so

- Do Car Seat Mandates Reduce the Number of Children Families Have?

Listen here:

Recommendations:

- The Blair Witch Project

- Seth Godin – This is Strategy

- The Lyle and Erik Menendez Story

- The Penguin

- It’s What’s Inside

- Terrifier 3

Charts:

Tweets:

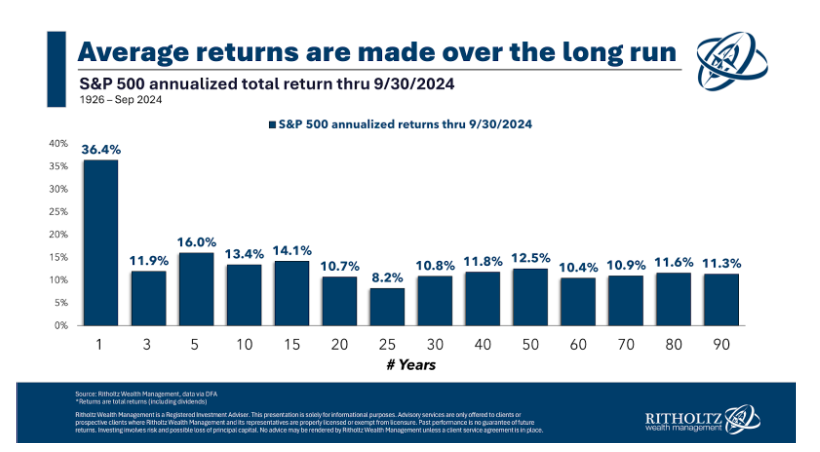

Since May, 2021, stocks have gotten 19% cheaper.

– In May, 2021, PE was 33.1x

– Now it's 26.7x

– So 19% cheaperYet over the same timeframe, stocks have rallied +38%.

How?

Earnings growth. Not "speculation."

— Matt Cerminaro (@mattcerminaro) October 14, 2024

Real wages are growing, and they're growing at a rate at or even above the pre-pandemic trend. pic.twitter.com/8d6V5tsQf7

— Justin Wolfers (@JustinWolfers) October 10, 2024

Airbnb is down 7% since going public in late-2020

The S&P 500 is up more than 66% in that time

Good companies/products don't always make for good stocks (and vice versa)

Signed,

Guy who bought the stock at the IPO pic.twitter.com/wEwDqbRxhe

— Ben Carlson (@awealthofcs) October 10, 2024

Growing up I was solidly middle class.

I also…

-Lived an hour further outside the city than my parents would have preferred

-Went to a sit down restaurant ~1x / month

-Was a latch key kid starting in 3rd grade with two working parents

-Never would have even contemplated the…— Jake (@EconomPic) October 10, 2024

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.