“You can’t control what markets can do, but you can control the costs you pay. The less you pay to the purveyors of investment services, the more there will be for you. The quintessential low-cost investment vehicles are index funds, which should comprise the core of every investment portfolio. The high fees charged for active management cannot be justified.” – Burton Malkiel

John Bogle’s Costs Matters Hypothesis (CMH) goes as follows:

“Investors in aggregate will earn the gross return of the total stock market before costs, but share only in the amount of that return that remains after costs.”

And here’s a longer version:

“The case for indexing isn’t based on the efficient market hypothesis. It’s based on the simple arithmetic of the cost matters hypothesis. In many areas of the market, there will be a loser for every winner so, on average, investors will get the return of that market less fees.”

Bogle has long been a proponent of lowering the cost of doing business for investors. The competition for new investors in products like ETFs has led to consistent cost cuts across the board which is a great thing for long-term investors because once they are lowered it’s nearly impossible to raise those costs.

Multiple studies over the years have proven that cost is one of the major determinants of investment performance over the long-term.

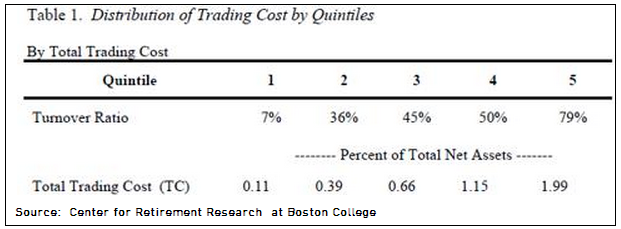

Costs come not only from expense ratios on mutual funds, but also through transactions costs. Take a look at this chart that shows how higher turnover can affect the ultimate costs that you bear:

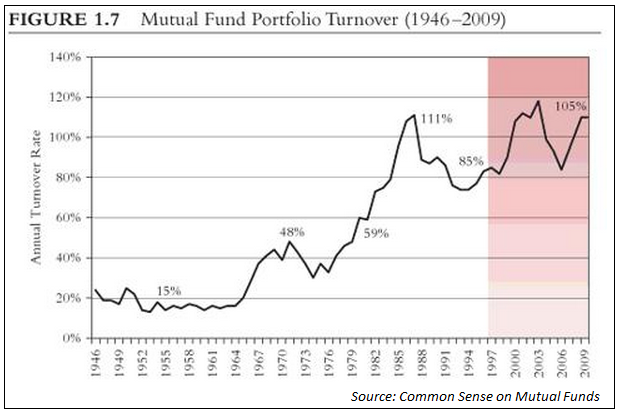

Now look at the increase in the amount of turnover through trading in active mutual funds:

Mutual fund managers have only become more and more active in recent years. Short-term investing in a long-term world means lower net returns for investors.

The more you trade, the higher your costs will be. The higher your costs, the lower your returns will be. It’s that simple. Higher cost products must clear a higher hurdle than lower cost investments.

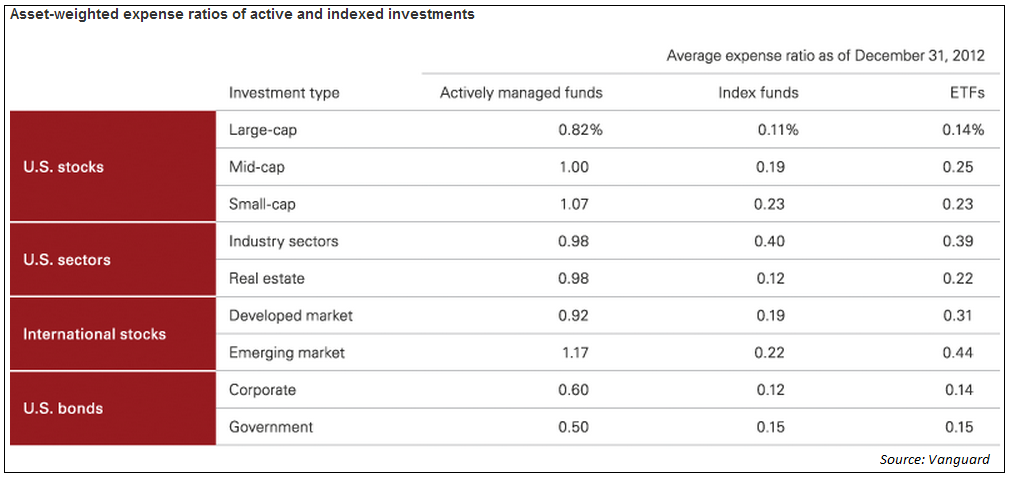

Now check out the average cost of investing in actively managed mutual funds versus the corresponding costs of an average index fund or ETF:

It’s not even close. Remember, some of these funds do outperform, but they tend to change from year to year and over the long-term fewer outperform because of these higher costs. As Bogle has shown, it’s simple arithmetic. Investing is a zero-sum game less all costs invovled.

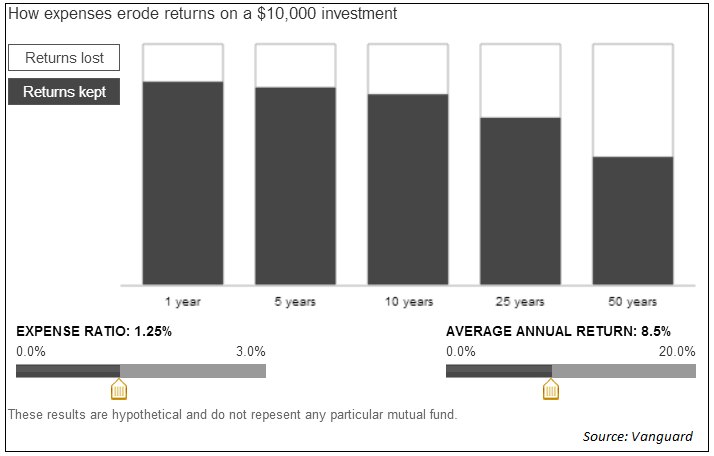

Sick of graphics yet? How about one more? OK, here’s another one from Vanguard that shows how much money in dollar terms you keep or lose over time based on different expense ratio and return assumptions:

This is real money, especially once you start talking in terms of decades (see the link at the bottom to play with different assumptions at Vanguard’s website to see how costs impact your returns).

Here are some things to remember to keep your costs low:

- If you have to choose an active manager, all else equal, choose the one with the lowest costs. Stay away from front-load funds or other add-on fees that add no value.

- Not all index funds or ETFs are created equal. Make sure you check the expense ratio before investing and look at all of your options. The Vanguard expense ratio table comparison is a good place to start. A high fee index fund makes no sense if there are lower fee investment options available through other fund providers.

- Keep your transactions low, especially if you are not invested in index funds. The more trading you do in and out of investments, the higher your costs and the greater chances you have of being wrong.

- It’s perfectly acceptable to do nothing most of the time. Active investing does not equal smarter investing. Being inactive is perfectly acceptable behavior.

See how expenses affect your take-home returns:

Principle 3: Minimize Cost (Vanguard)

And read more reasons why active managers underperform:

The underperformance culprit: active management or active managers? (Smead Capital)

It would be nice to see this in comparison with buying individual stocks. Your expense ratio goes away and you only have commissions in play. If you do not trade, you should get a better result right?

Yes, since the commissions on stock trades are now so low at the brokerage firms and the fact that you wouldn’t be paying ongoing expense ratios as you do with ETFs and mutual funds, holding individual stocks for a very long time is a great way to decrease costs and taxes as well.

This has always been one of Buffett’s biggest contentions.

Good post Ben. I agree with the other comment. This is partly the reason why holding individual stocks for decades makes sense. Once these stocks are DRIPping, like CDN banks, telcos and pipelines, the income is on auto-pilot and you have no money management fees, including commissions to worry about.

That’s how I roll 🙂

Mark

Thanks Mark. Decades is the key word there. Compound interest works on gains and costs.