Today’s Animal Spirits is brought to you by Jensen Investment Management:

See here for more information on the Jensen Quality Growth ETF

The Compound Podcasts:

Listen here

On today’s show, we discuss:

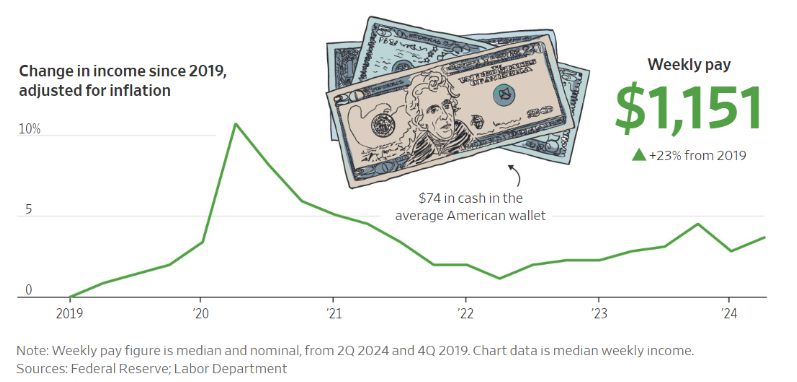

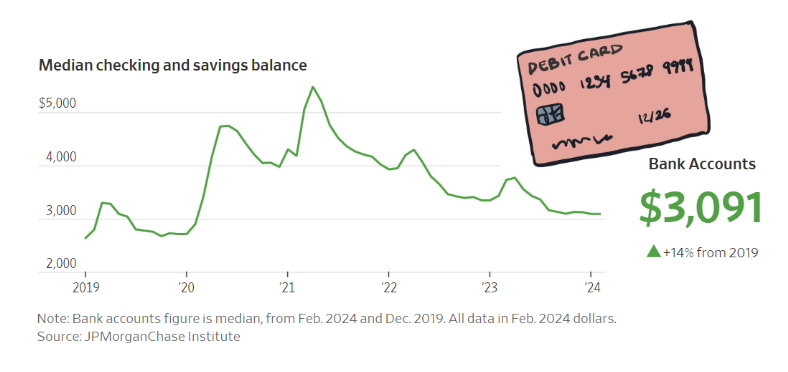

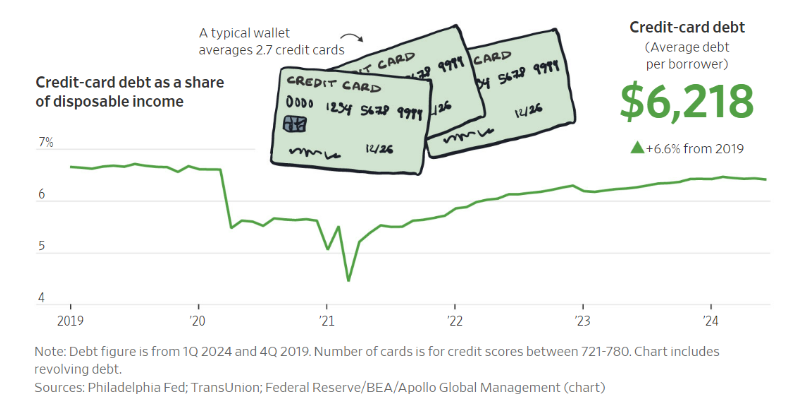

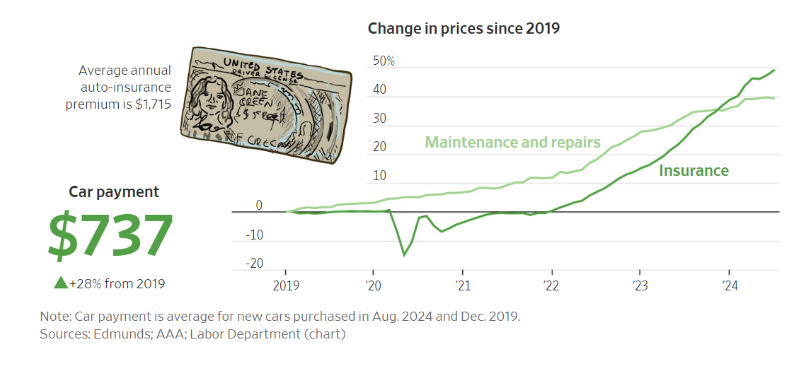

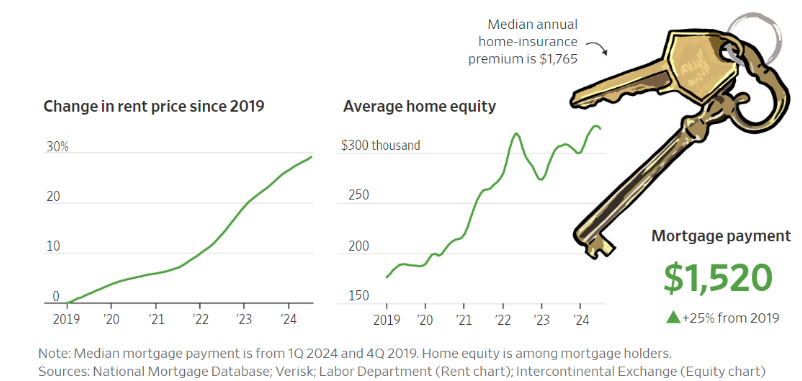

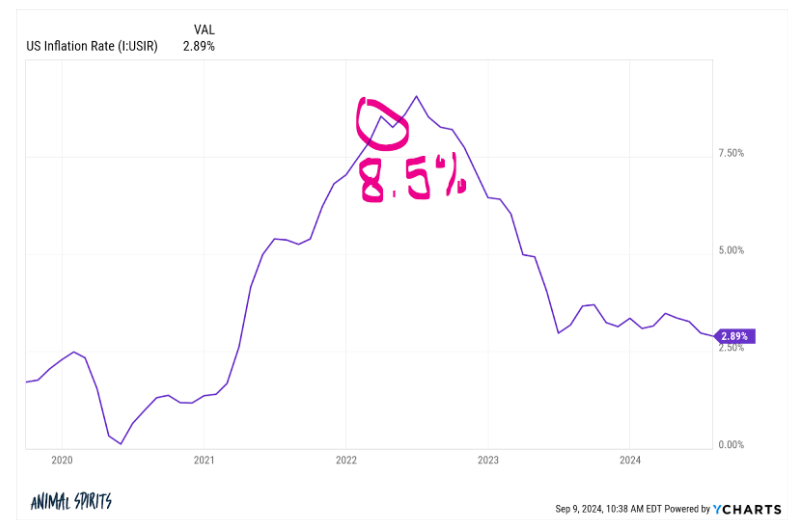

- The State of America’s Wallet

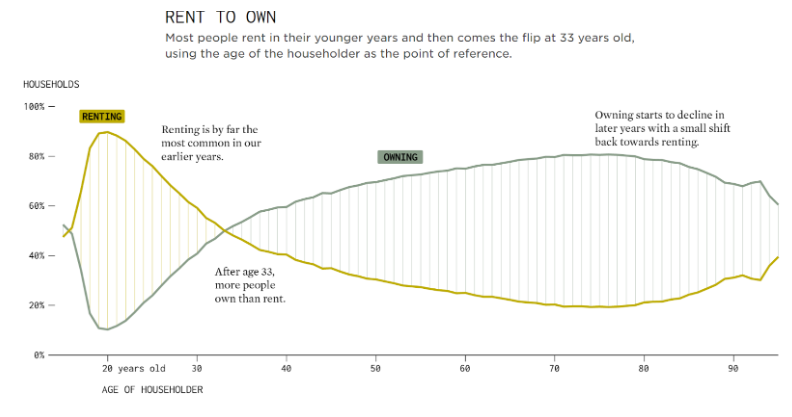

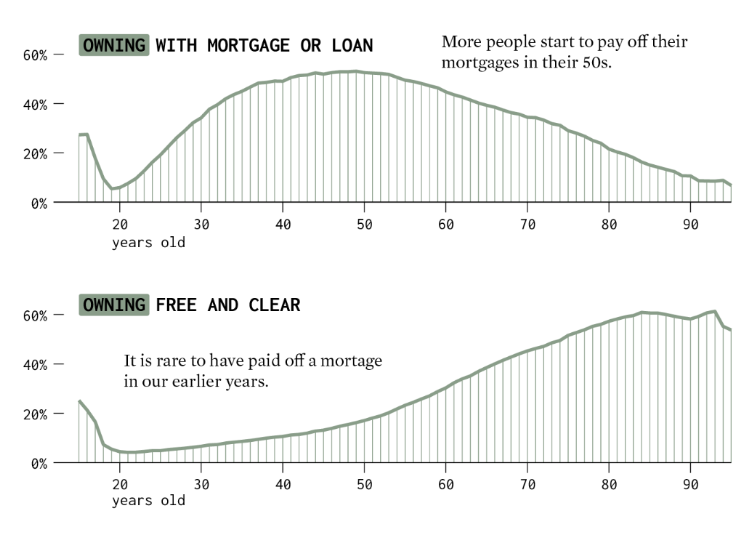

- Renting vs. Owning a Home as We Get Older

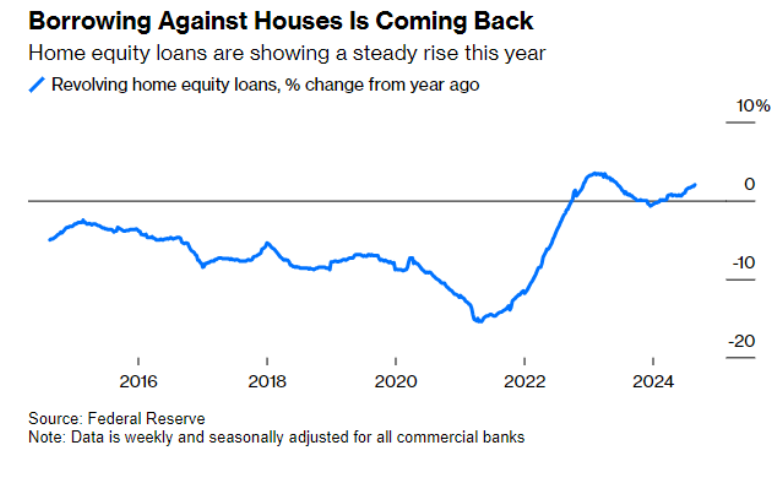

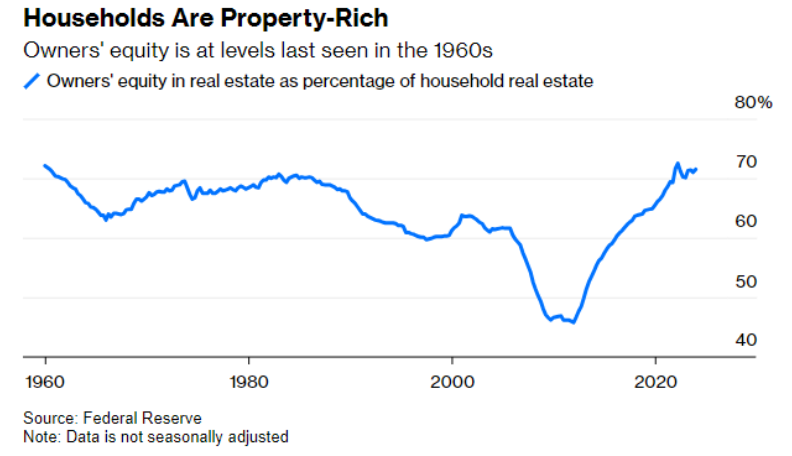

- Americans Have a New Piggy Bank to Raid — Their Houses

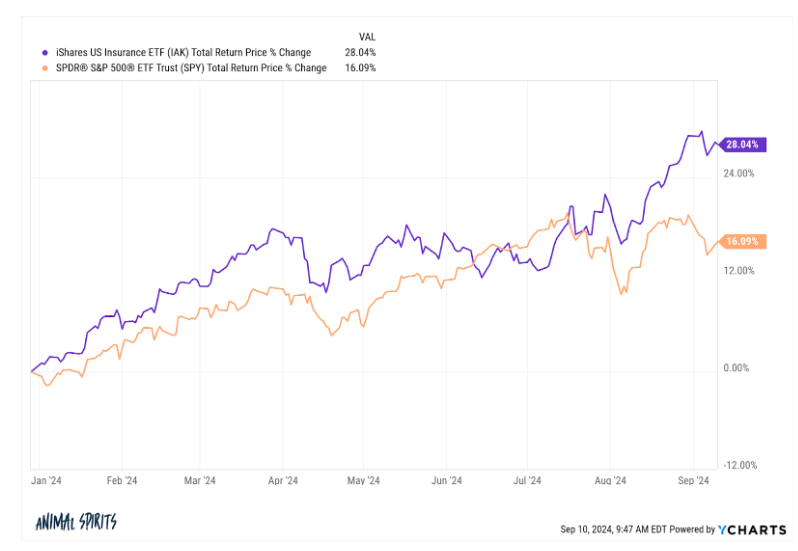

- Home Insurance is a Really Big Problem

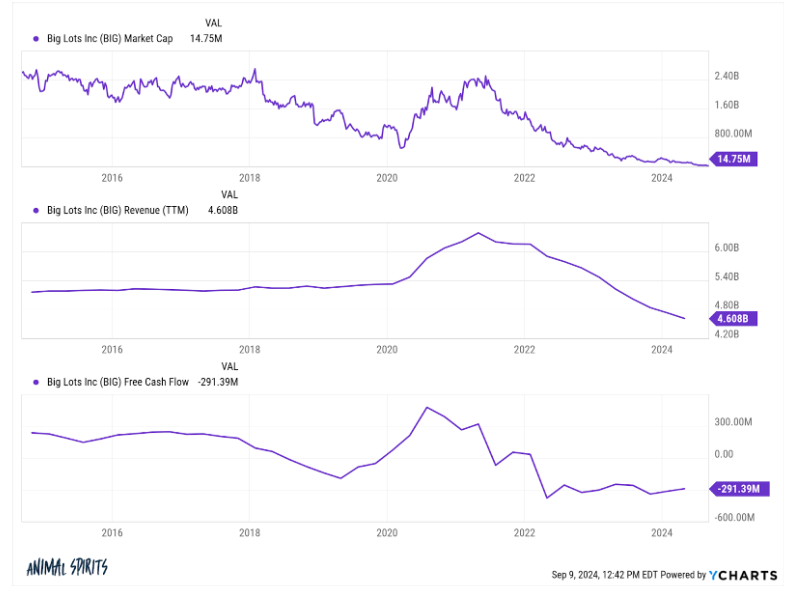

- Discount Retailer Big Lots Files for Bankruptcy

- Big Lots files for bankruptcy protection, sells to private equity firm as it promises to keep offering ‘extreme bargains’

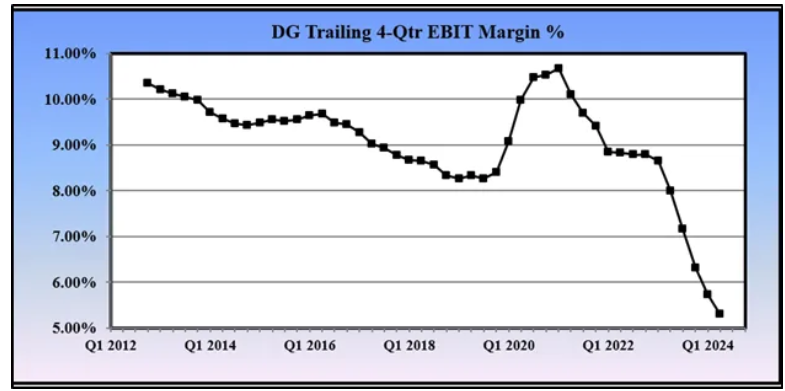

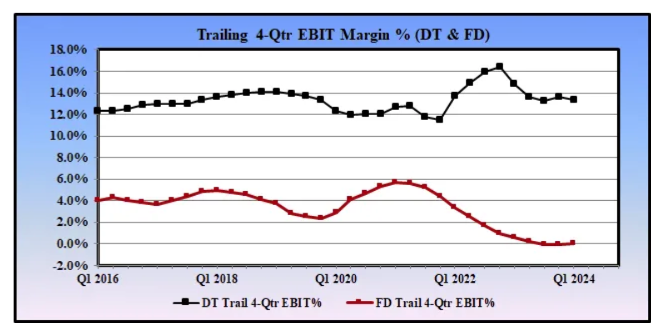

- Dollar General’s CEO in Need of an Intervention

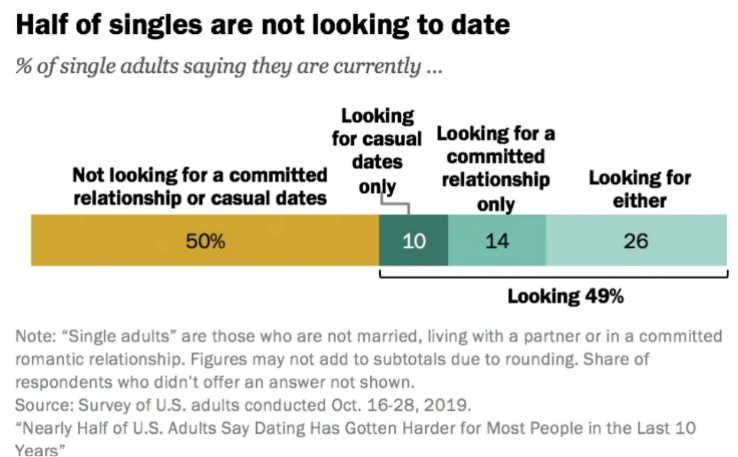

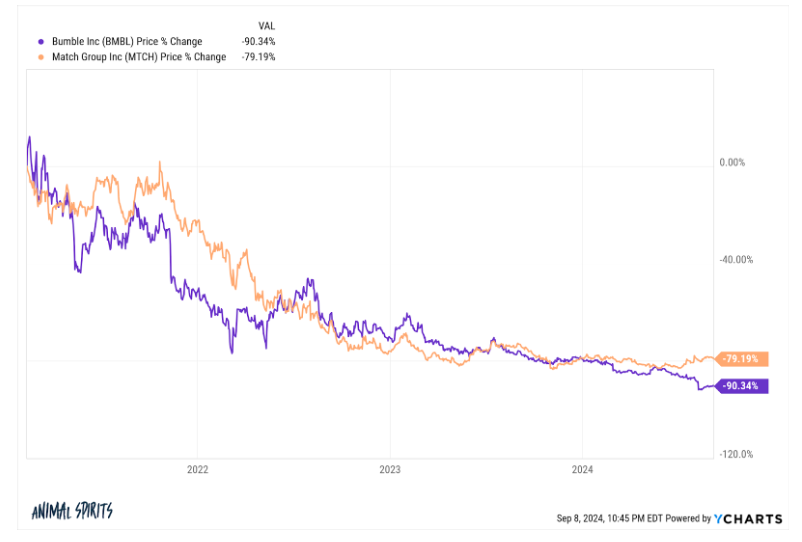

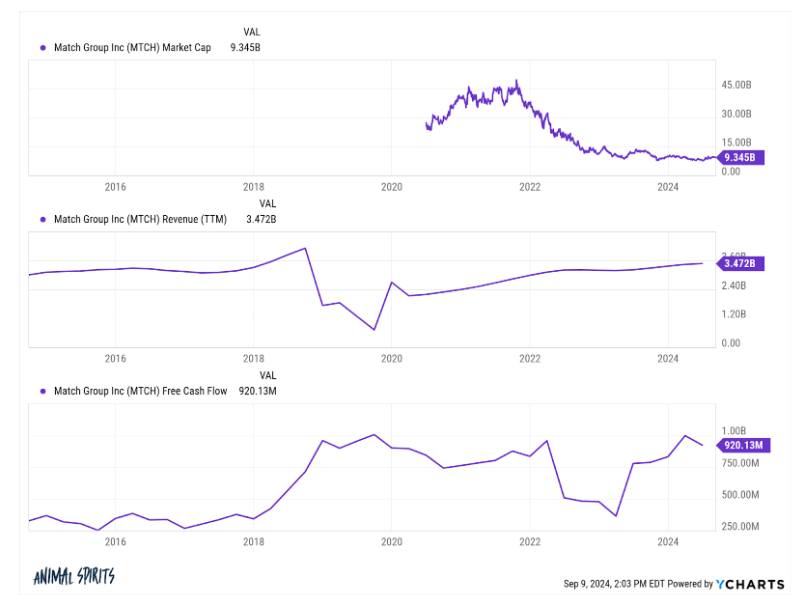

- How Dating Apps Contribute to the Demographic Crisis

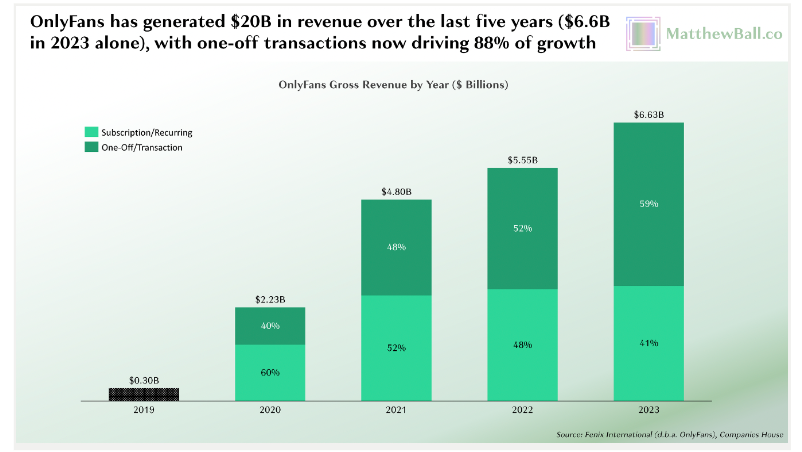

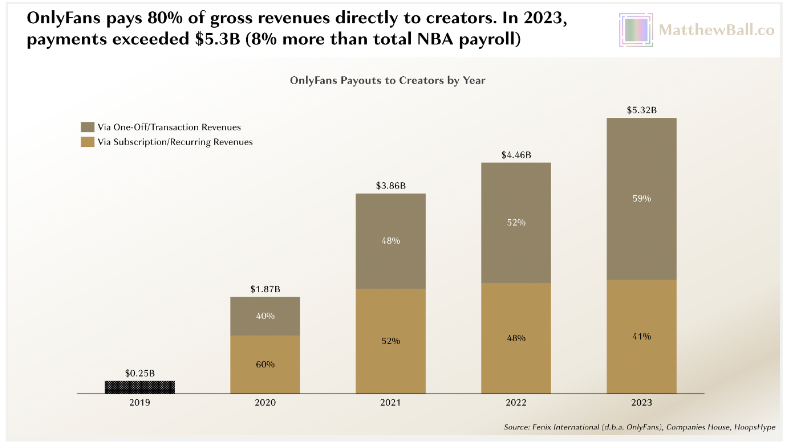

- Breaking Down OnlyFans’ Stunning Economics

- Andreessen Horowitz Ditches Miami Two Years After Opening Office

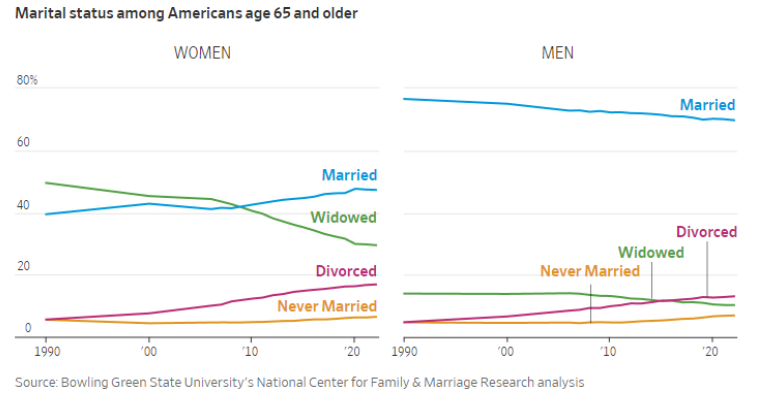

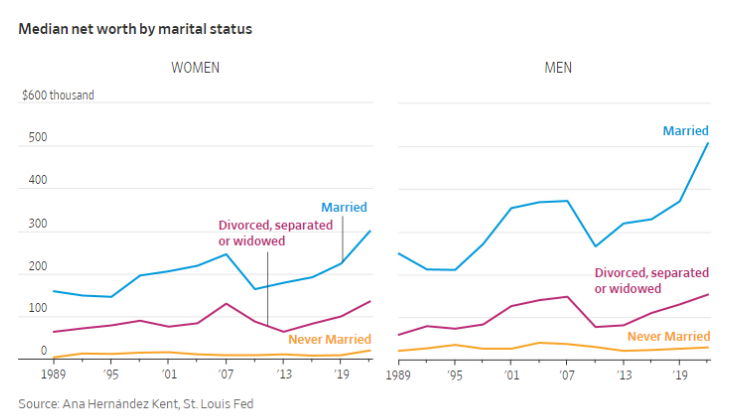

- One Husband Is Enough: Women in Their 60s See No Need to Remarry

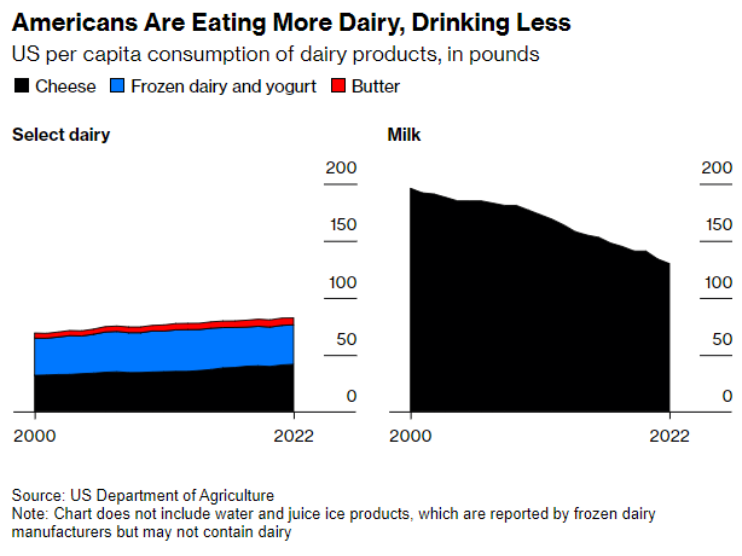

- The Average American Eats 42 Pounds of Cheese a Year, and That Number Could Go Up

- Behind Neon’s Banner Year and Rivalry With A24

- Nobody Was Reading Him. Now He’s the World’s Best Spy Writer.

Recommendations:

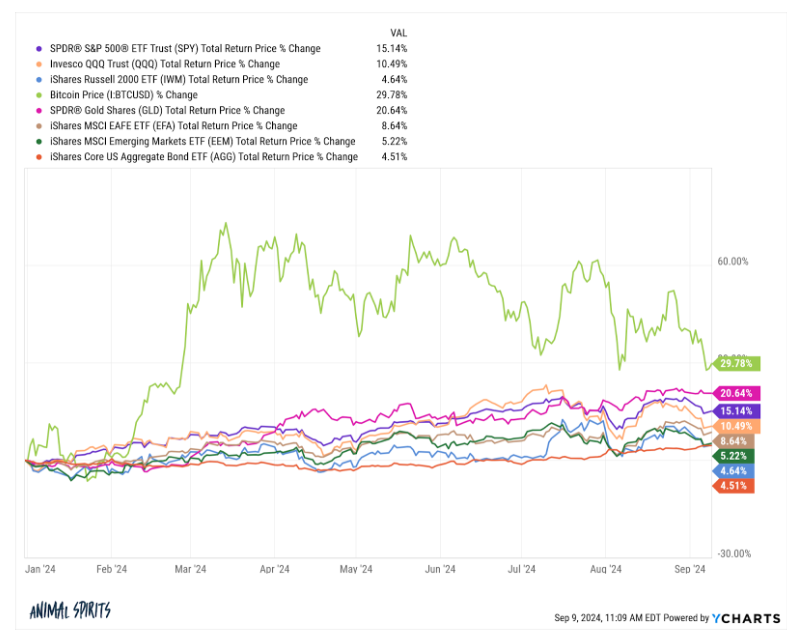

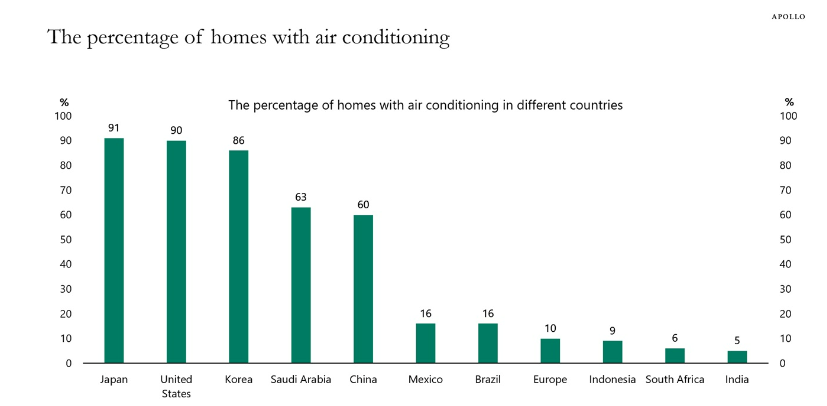

Charts:

Tweets:

All-country world ex-US $ACWX trades 13x earningshttps://t.co/VzUA3OIgF4 pic.twitter.com/2xElqeWHVo

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) September 3, 2024

Mario Draghi's new report on EU competitiveness doesn't mince words.

"Across different metrics, a wide gap in GDP has opened up between the EU and the US, driven mainly by a more pronounced slowdown in productivity growth in Europe. Europe’s households have paid the price in… https://t.co/xWNi2vLtqY

— Patrick Collison (@patrickc) September 9, 2024

BLACKROCK'S JEFFREY ROSENBERG WARNS A 50-BP RATE CUT COULD SIGNAL ECONOMIC WORRY, NOT REASSURANCE

— *Walter Bloomberg (@DeItaone) September 6, 2024

Jim is wrong here: Investment advisors are adopting bitcoin ETFs faster than any new ETF in history.

Let's look at his own data, focused on IBIT, the BlackRock ETF.

Per his table, IBIT has attracted $1.45 billion in net flows from investment advisors. He calls this "small"… https://t.co/0Sis9lIWDp

— Matt Hougan (@Matt_Hougan) September 9, 2024

Uber: from venture backed startup to IPO to issuing 30 year bonds at 5.35% to buy back tons of stock. Truly the American dream. pic.twitter.com/H8Dot4vpkO

— modest proposal (@modestproposal1) September 5, 2024

$CASY on the consumer: pic.twitter.com/8gyrDPUJCZ

— Conor Sen (@conorsen) September 5, 2024

ah, the median voter pic.twitter.com/SNh0Q22GUh

— Armand Domalewski (@ArmandDoma) September 8, 2024

Another brutal quarter for pay TV. Down 1.6mm subs. That’s a 6.9% drop.

MoffettNathanson: 'It is becoming increasingly clear that there is no longer any floor'. pic.twitter.com/XOBz6QBZBv

— Peter Kafka (@pkafka) September 3, 2024

A terrific / terrifying example for teaching externalities.

Folks choose heavier cars because they're less likely to die in a crash (gray line). But that choice makes it much much more likely that you'll kill the other guy (red line).https://t.co/j0IhJhXleU #TeachEcon pic.twitter.com/OtyHaaFLFC

— Justin Wolfers (@JustinWolfers) September 3, 2024

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.