Household net worth is at all-time highs.

Housing prices are at all-time highs.

The stock market is near all-time highs.

But not everyone is feeling great about their finances.

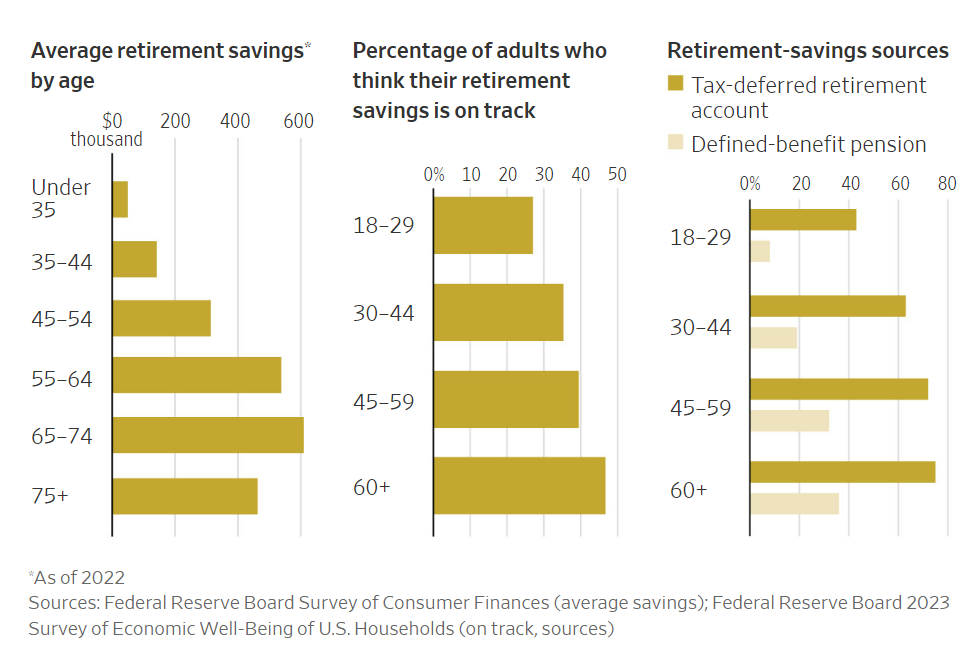

Here’s a look at average retirement balances by age along with the share of each cohort who feels like they’re on the right track for retirement:

The good news is confidence tends to increase as you age. The bad news is the share of people who feel like their retirement savings are on track doesn’t reach 50% for any age group.

Part of this stems from the fact that some people will never feel like they have enough. Retirement is a scary prospect for many households. There are countless uncertainties involved in the process.

But there are obviously plenty of people who don’t have enough saved.

Why is this?

Here are some of the biggest reasons some people don’t have enough money saved for retirement:

You don’t make enough money. This is likely the biggest reason most households don’t have enough retirement savings. Some people simply don’t earn a high enough income to have any money left over.

There are personal finance people who would like you to believe it’s all bad habits that cause people to underfund their retirement.

Many people don’t have any excess remaining after paying for necessities.

The easiest way to save more is to earn more.

You’re overwhelmed. No one teaches you how to prepare for retirement. You’re on your own.

How much should you save? Where should you save? What should you invest in? Which accounts should you open? When should you change your investments?

It can be an overwhelming process if you’re not a personal finance person or don’t get some help.

You procrastinate. Retirement is a long way away for most people. When prioritizing your finances it’s much easier to focus on the stuff that feels more urgent in the moment.

I’ll just start saving in the future when I’m ready.

By the time you’re truly ready to save for retirement, you’ve probably already missed out on the biggest benefits of compounding.

You don’t know how to save. Some people are bad with their finances.

You spend too much money. You can’t or won’t budget correctly. Delaying gratification is hard.

It’s not everyone but some people are just bad with money.

You have family obligations. Being a parent, I sympathize with people who don’t save enough for retirement because they put their kids first.

Children are expensive. You want to give them everything they want and more.

Will Flannigan at The Wall Street Journal wrote a refreshingly honest piece this week on the subject:

Here’s his explanation:

Like so many people of my generation, I’ve fallen behind in my retirement savings. The combination of entering the workforce during the financial crisis and the burden of student debt has put me and many others behind from the beginning. And the higher cost of living over the past few years has only made saving harder. Once you’re behind a little, it’s easy to keep falling farther and farther behind.

This part about his friends and their retirement savings touched the impact kids can have on this equation:

Since then, they’ve bought a home, had two children and started small businesses. Still, the amount they set aside for retirement savings maxes out at a couple of hundred dollars a month. “There’s never been a moment where we feel 100% confident to spare more money because life happens–we had kids, if something happened to our house, or we changed jobs,” says Jamie, who is now 36.

For Jamie and Anna, it’s a case of making tough choices. “There was a period where we were close to pulling money out of our retirement” savings, he says. “Do we sacrifice our retirement to pay for our kids’ college? We don’t know what’s best.”

Life happens.

They say you should put your oxygen mask on first and save for retirement before college savings. This makes sense from a personal finance perspective but most parents prefer to put the kids first.

It’s not ideal to wait but you can still salvage your retirement savings later in life.

You just have to supercharge your savings when the kids are out of the house. Once they get off your payroll you can use whatever money you were spending on college or whatever and play catch-up.

You don’t get the same compounding benefits but it’s still possible to save your retirement.

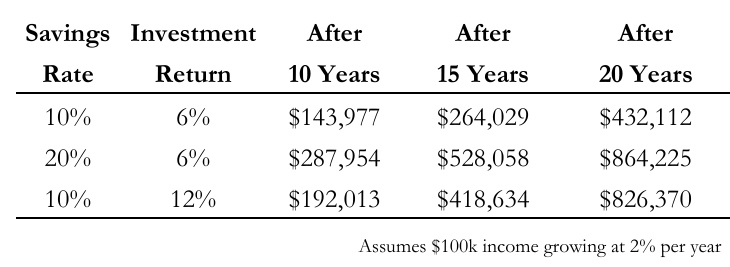

In Everything You Need to Know About Saving For Retirement I wrote about how doubling your savings rate over 10, 15 and 20 years would lead to a better outcome than doubling your investment return:

All is not lost if you’re behind on retirement savings because life got in the way.

You just have to make it a priority.

Your kids will thank you for it one day so they don’t have to take care of you in old age.

Further Reading:

You Probably Need Less Money Than You Think For Retirement