I’ve been writing about the housing market for years now.

It fascinates me to no end because housing is one of the most important decisions from a personal and financial perspective.

In recent years, much of my focus has been on how broken the residential housing market is.

Higher prices and mortgage rates have driven housing affordability to levels we’ve never seen before in the United States.

There are numerous reasons for the affordability crisis but if I had to boil it down to one thing it’s this: we simply don’t build enough housing units.

Housing is a national conversation, but everyone knows real estate is local. Different states and municipalities have different rules and regulations when it comes to building codes and such.

Certain cities have prioritized building, while others have made it exceedingly difficult over the years by adding burdensome layers of red tape.

This extends beyond single-family housing.

Cities need to build more multi-family housing as well.

Luckily, we have evidence that building more housing makes it more affordable.

Pew explains how Minneapolis made housing development in the city a priority:

Starting in 2009, the city enacted a series of policy changes that reduced and then eliminated minimum parking requirements, allowed construction of accessory dwelling units, and lowered minimum lot size requirements in residential zones, all with the goal of encouraging the construction of more housing. These changes culminated in Minneapolis 2040, a comprehensive plan that took effect in 2020 and codified the city’s commitment to expanding its housing supply, especially near commerce and transit.

And it worked!1

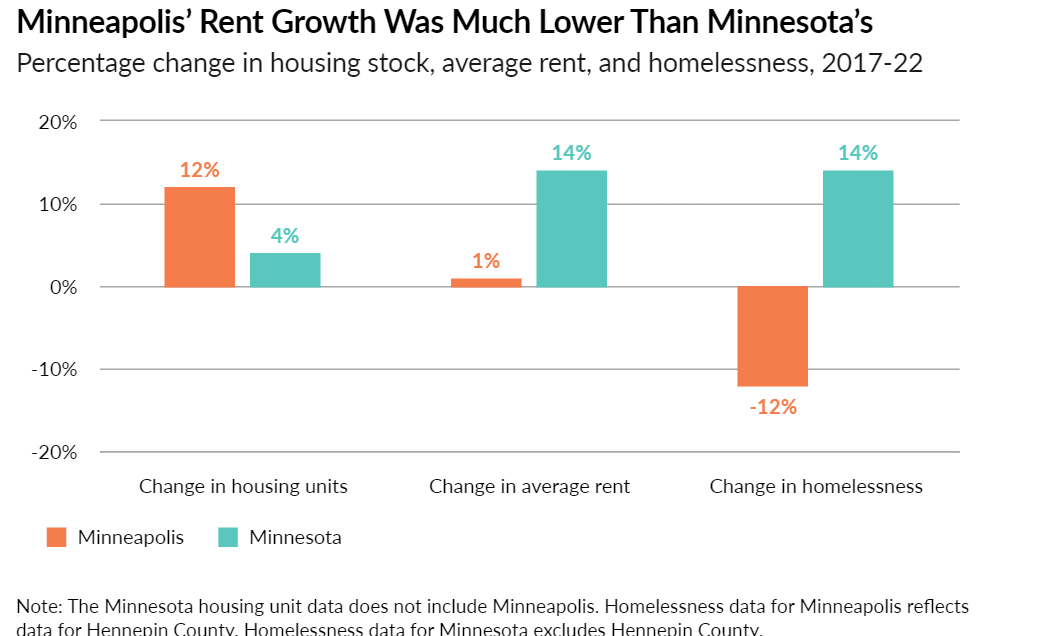

Just look at the difference between Minneapolis and the rest of the state:

More housing, slower rent growth and decreased homelessness — win, win, win.

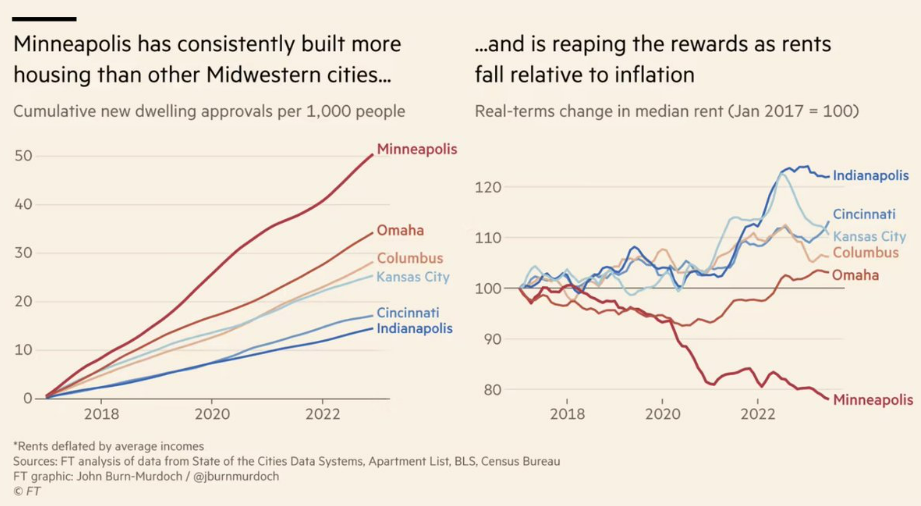

The Financial Times looked at Minneapolis housing and rent growth versus a handful of midwestern cities:

Shocker — building more housing improves affordability:

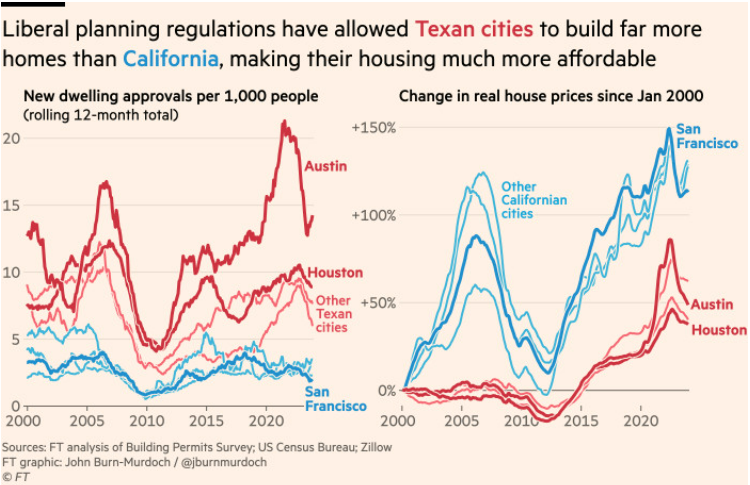

Texas offers another example of what happens when you make building easier.

The FT has a good chart comparing Texas and California when it comes to the relationship between housing affordability and building permits:

Here’s some more color:

In the year ending March 2023, construction began on 72,000 new homes in Houston, Texas, population 7.5mn: more than three times the 20,500 new homes started in London, whose population is considerably larger.

You would have to pay $1.2mn dollars for the average property on sale in the San Francisco/Oakland area today, around $800,000 for the typical homes in London and New York, but just $300,000 in Houston.

Austin is a prime example of this idea.

Austin allowed the most building permits per capita of any large metro area in the United States from 2020 through 2023. Rents fell double digits in 2023 and are down nearly 8% over the past 12 months.

Apartment List explains:

The Austin metro has seen the nation’s sharpest decline among large metros, with prices there down 7.4 percent in the last 12 months. The Austin metro is also significant for permitting new homes at the fastest pace of any large metro in the country, signaling the important role new supply plays in managing long-term affordability. Austin is not alone in exhibiting this trend. Among the ten metros with sharpest year-over-year rent declines, seven also rank in the top ten for the highest rates of multifamily permitting activity from 2021 to 2023 (Austin, Nashville, Raleigh, Jacksonville, Orlando, Phoenix, and San Antonio). Notably all of these markets are located in the Sun Belt.

So why don’t more cities take up this initiative?

NIMBYs worry building more housing will lower the value of their homes. People don’t like apartment buildings in their neighborhoods because of worries about parking, overcrowding, and aesthetics.

I get it that homeowners want to see property prices keep going up. Still, there is an element of pulling up the ladder behind you where people don’t want to afford the same opportunities they had when it comes to purchasing property or living in a great neighborhood.

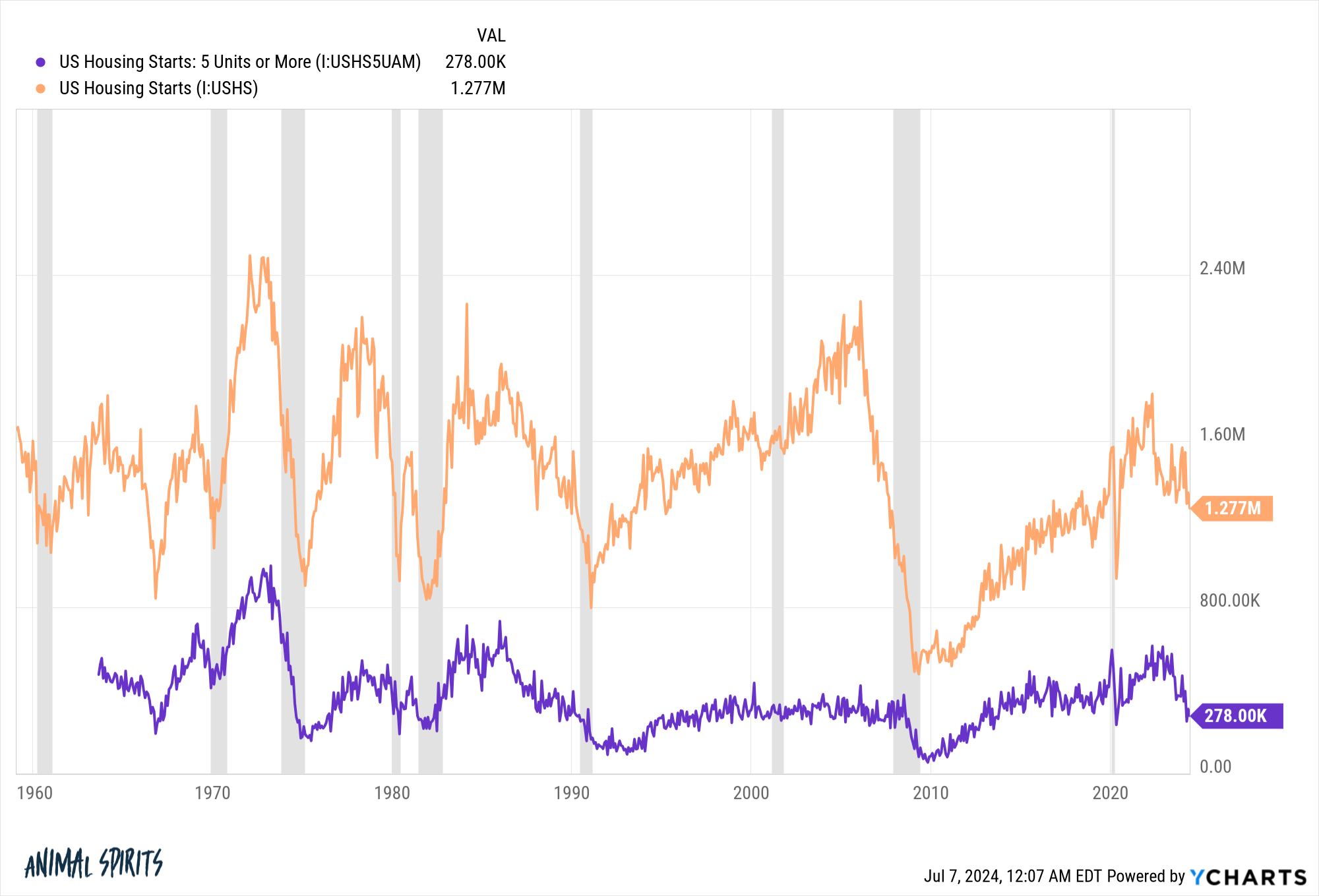

Unfortunately, higher rates are causing housing starts for both multi-family and single-family homes to roll over:

But mortgage rates alone aren’t going to incentivize homebuilders to increase supply. Municipalities need to remove all the red tape involved to make building easier.

If not, the housing market will continue to drive wealth inequality and make it harder on younger generations.

Michael and I spoke with Coby Lefkowitz on all of these dynamics, what he’s doing to build more affordable housing and much more:

Further Reading:

We Need to Build More Houses

1A single underground parking space can cost upwards of $50,000.