Roger Federer delivered an excellent commencement address at Dartmouth’s graduation recently.

This part floored me:

In tennis, perfection is impossible… In the 1,526 singles matches I played in my career, I won almost 80% of those matches… Now, I have a question for all of you… what percentage of the POINTS do you think I won in those matches?

Only 54%.

In other words, even top-ranked tennis players win barely more than half of the points they play.

When you lose every second point, on average, you learn not to dwell on every shot.

You teach yourself to think: OK, I double-faulted. It’s only a point.

OK, I came to the net and I got passed again. It’s only a point.

Federer won 80% of his matches but only 54% of the points in those matches.

Crazy, right?!

One of the most dominant tennis players of all-time won most of his matches but not always in dominating fashion. It was more like slight advantages over the short-run that compounded through consistency over the long-run.

Of course, when I heard this part of the speech, my finance brain immediately went to the stock market.1

Federer’s win and point percentage are basically the same as those of the stock market!

I’m always banging the drum about the fact that the stock market is essentially a toss-up in the short-term but has a wonderful win rate in the long-term.

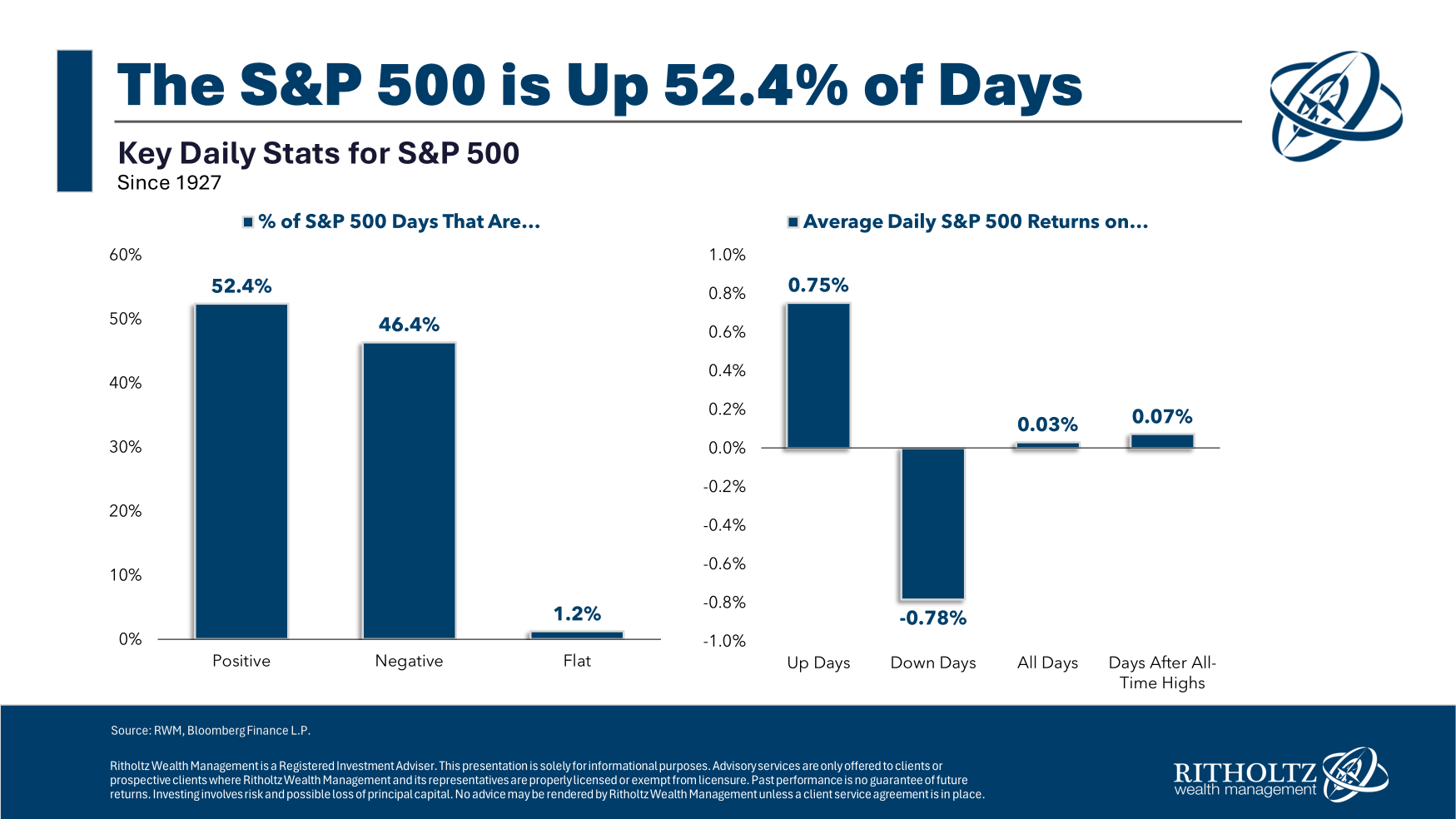

On a daily basis over the past 100 years or so, the S&P 500 has been flat or up roughly 54% of the time, just like Federer:

Shockingly, the average down day is a little worse than the average up day is good.

Despite an average daily return of just three basis points, the stock market’s compounding over longer time horizons has been breathtaking.

These daily numbers are price-only (meaning no dividends). On a price-only basis, the S&P 500 is up close to 39,000% since 1927.

The average dividend yield in that time was just shy of 3.7%. With dividends reinvested, the total return since 1927 jumps to a staggering 1.3 million percent.

I know no one actually has a time horizon that long but the benefits of compounding can be remarkable if you can just stay out of your own way.

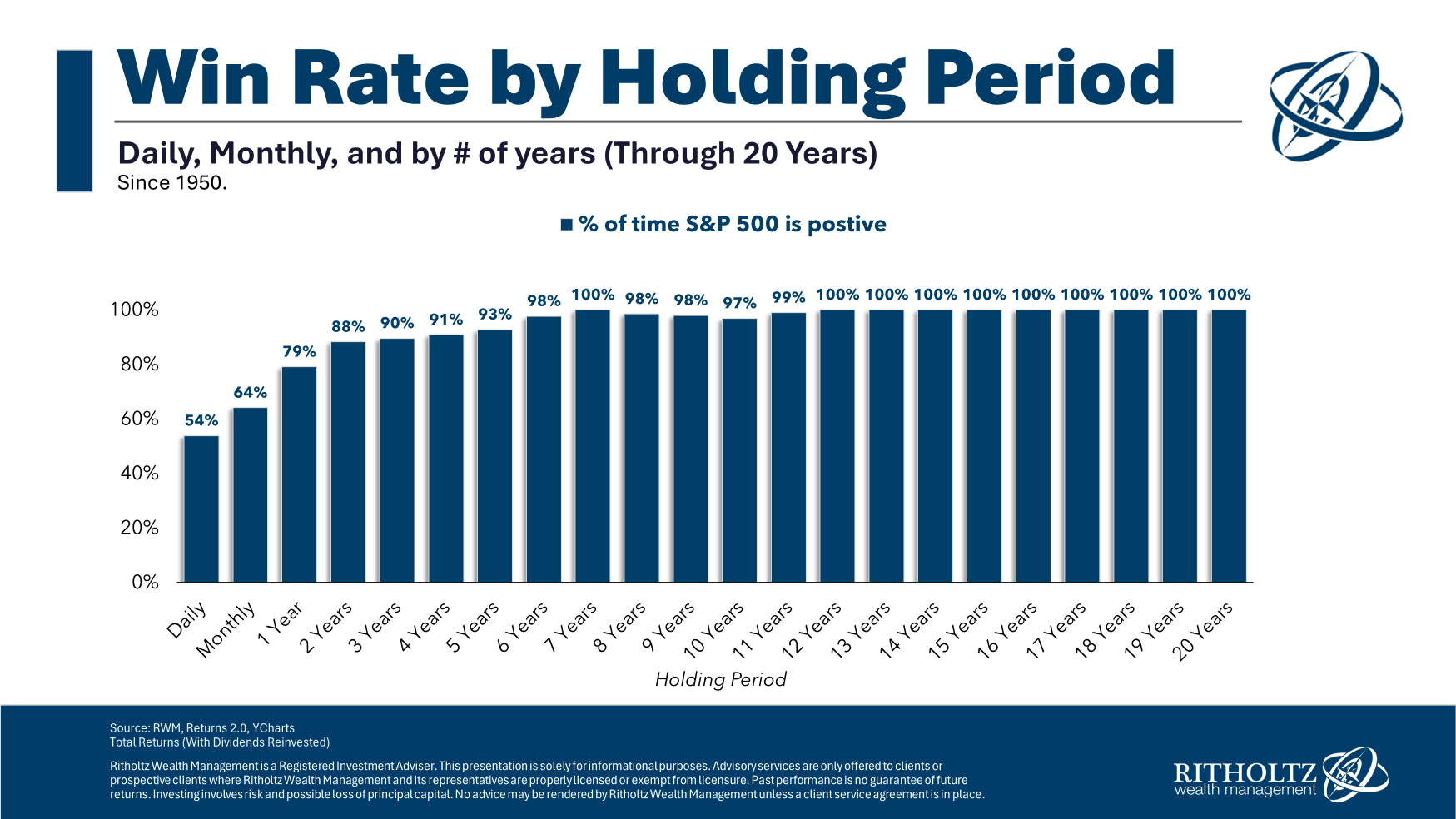

And the win rate gets higher the further out you go:

If Federer gave up every time he lost a point, tiebreaker or set, he wouldn’t have 20 grand slam titles.

If you put too much weight on short-term outcomes in the stock market, it’s hard to be a successful investor.

Minor advantages that compound over long time horizons can do wonders.

Further Reading:

The Stock Market is Not a Casino

1For some reason tennis analogies hit hard when it comes to investing. I’ve used Andre Agassi and Charley Ellis tennis examples in the past.