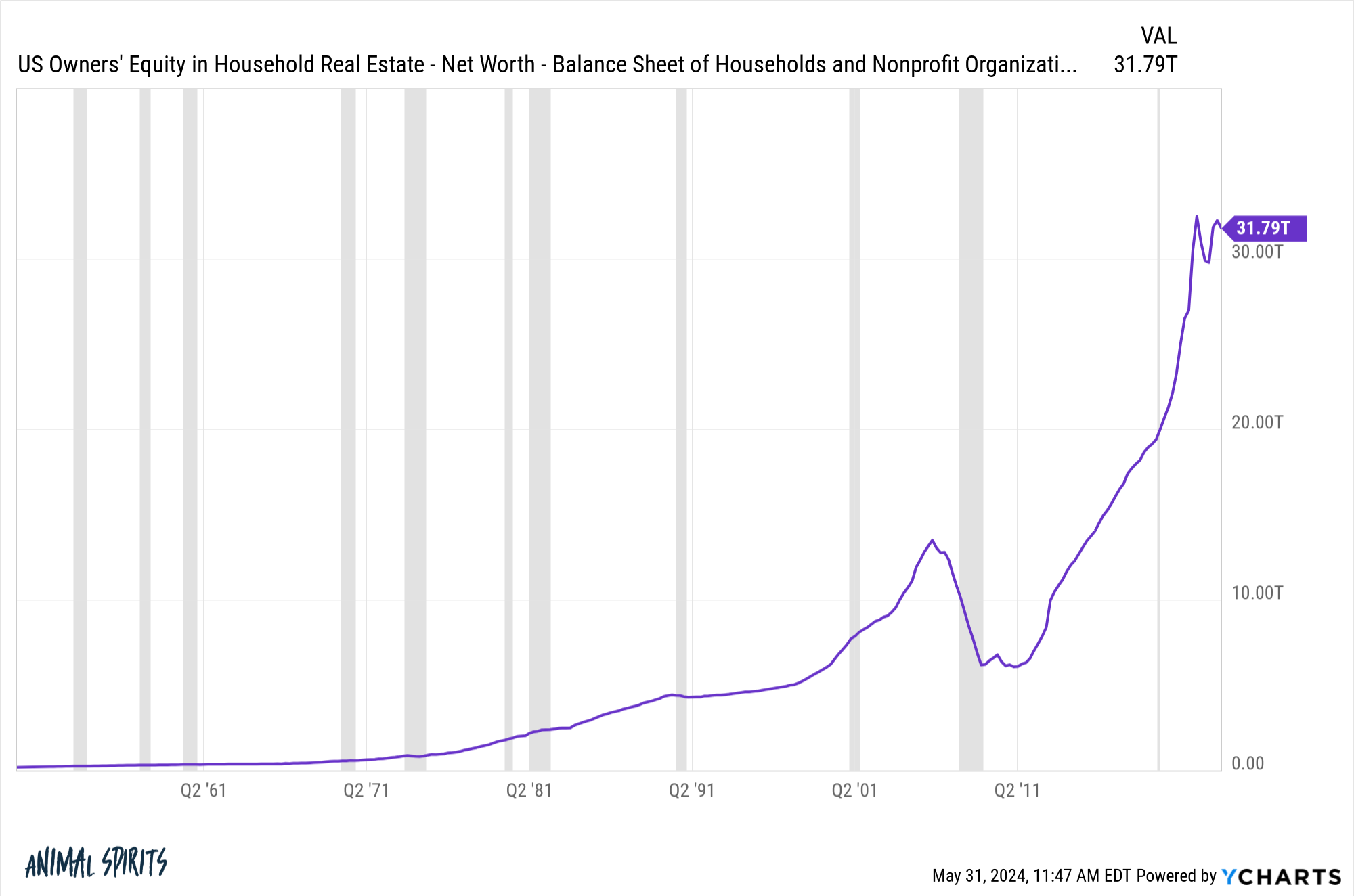

The pandemic housing boom means Americans have more home equity than ever.

Households have added roughly $12 trillion in home equity since the end of 2019:

To put this number in context, there was only ~$6 trillion in home equity following the bursting of the housing bubble following the Great Financial Crisis.

Out of the $32 trillion in total equity, let’s say half of it is tappable (meaning homeowners can cash it out).

That’s a lot of money just sitting there in an illiquid asset.

The problem is no one is tapping it right now because mortgage rates are so high. No one in their right mind wants to do a cashout refi to go from 3% to 7%.

And a home equity line of credit seems absurd. I checked my HELOC rate this week. It’s 8.3%!

If and when interest rates fall or we go into a recession, there could be a flood of homeowners looking to pull that equity out for home renovations, down payments on a new place, vacations or whatever else people spend their money on.1

Home equity is like a giant piggy bank just sitting there for homeowners.

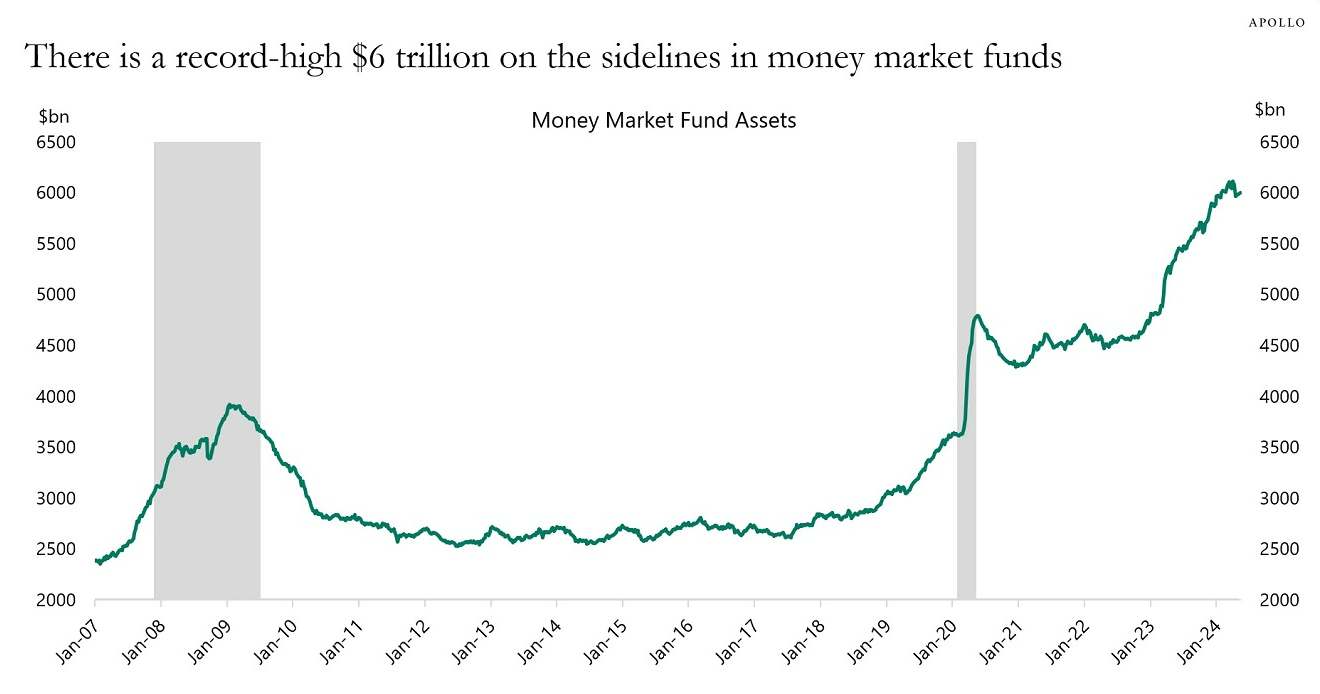

But home equity isn’t the most liquid of piggy banks. Luckily, other more cash-like options are quite full these days as well.

Money market funds have gone from around $3.5 trillion before the pandemic to $6 trillion now:

The ability to earn 5%+ helps, of course. Then there’s another $2-3 trillion in CDs, which offer similarly attractive short-term yields.

Yields on money market funds, CDs, savings accounts and short-term government paper (T-bills) tend to track the Fed Funds Rate, which has remained higher for longer than most people would have expected.

Investors and savers are taking advantage.

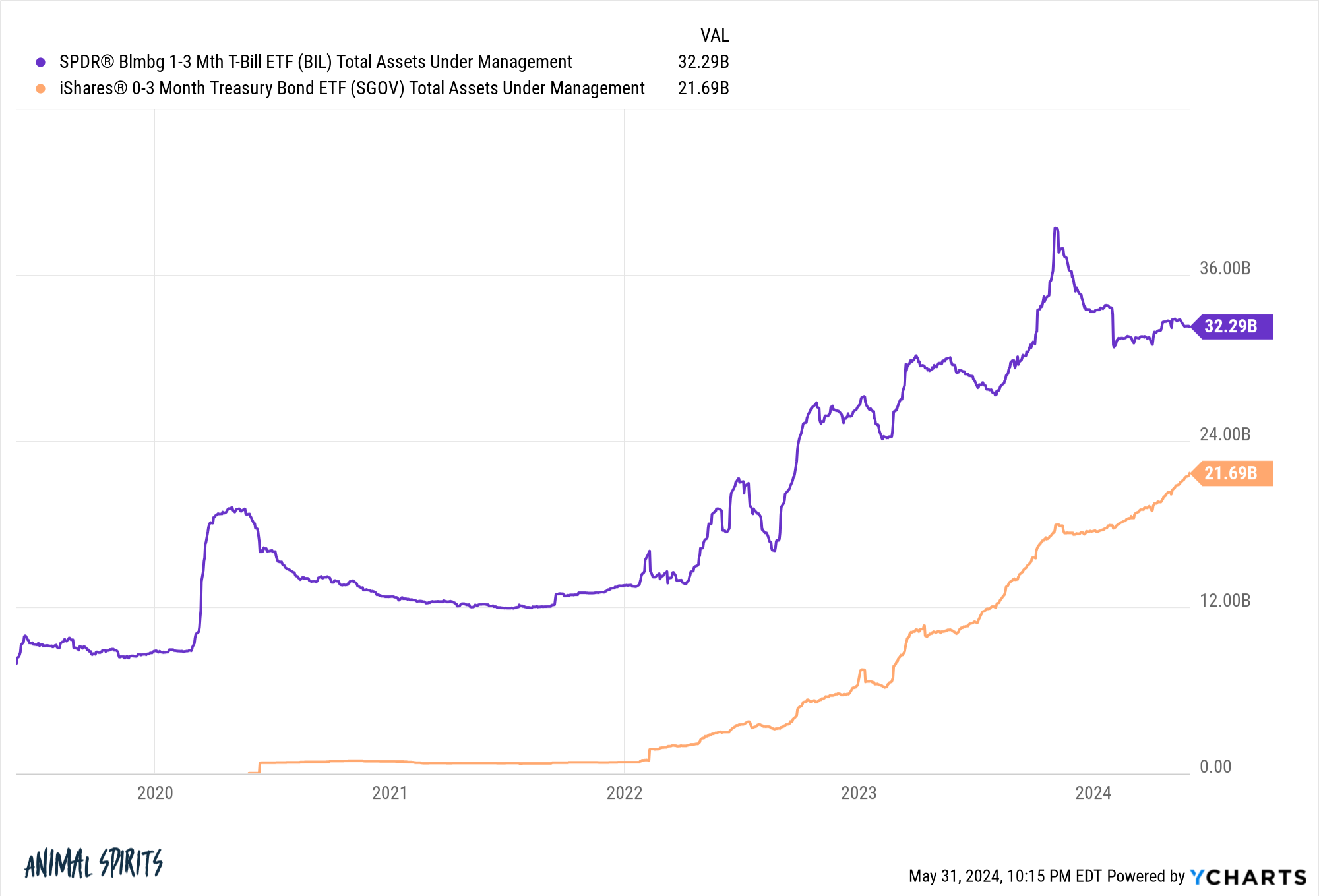

Just look at the growth in assets for the two largest T-bill ETFs:

Assets are up around 5x since 2020.

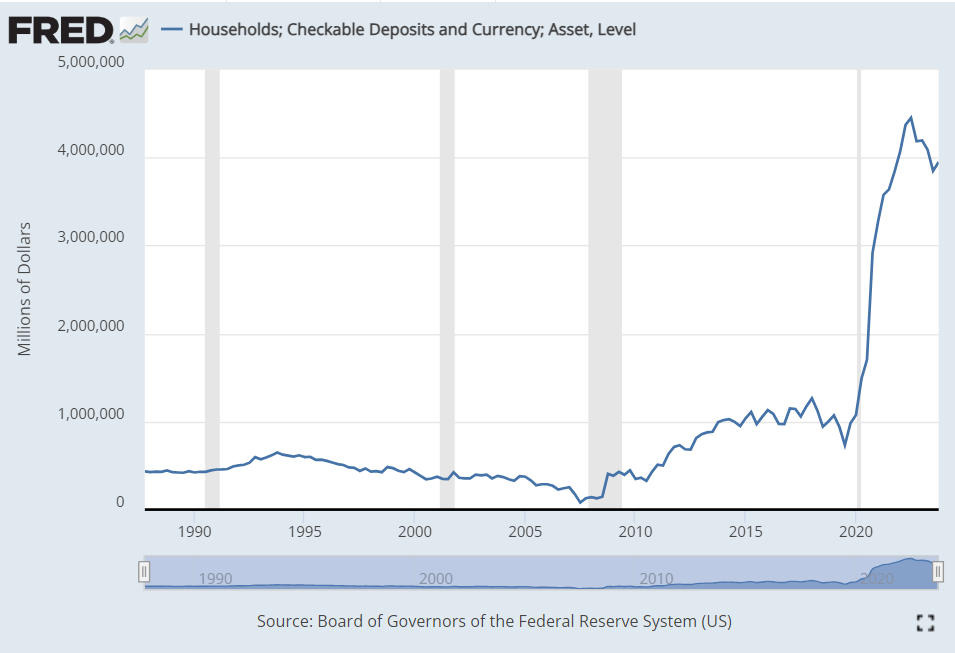

There has been a similar rise in the amount of money people hold in checking accounts:

That’s another $4 trillion, which was only around $1 trillion just before the pandemic.

The strange thing about the rise in checkable deposits is those are mostly accounts with little-to-no yield. It seems like more of a defensive strategy than anything, which doesn’t make a whole lot of sense considering how plentiful short-term yields are these days.

To each their own.

I couldn’t find any good data about online savings accounts, but if my personal experience means anything, there are far more assets in those accounts than in the 0% interest rate world.2

These assets aren’t evenly distributed (they never are) but many American households are flush with cash and other sources of liquidity like never before.

If the economy ever decides to slow down or interest rates fall or we have some sort of financial asteroid strike, there is a lot of cash on the sidelines.

I’m not saying all of that cash or home equity or money in T-bills will help stave off a recession.

But there is a backstop for a lot of people if and when the excrement hits the fan.

Further Reading:

What’s the Right Savings Rate?

1I suppose it’s possible homeowners are responsible and leave that equity alone. But I operate with the baseline that Americans love to borrow and spend money. Call me crazy.

2I’m not sitting on an excessive amount of cash but more than I was before 5% rates were a thing.