Today’s Animal Spirits is brought to you by YCharts and Fabric:

See here for the YCharts research on how Presidential Elections affect the market

Go to meetfabric.com/spirits for more information on life insurance from Fabric by Gerber Life

On today’s show, we discuss:

- Weekly S&P 500 ChartStorm – 13 February 2022

- Was the 401(k) a mistake?

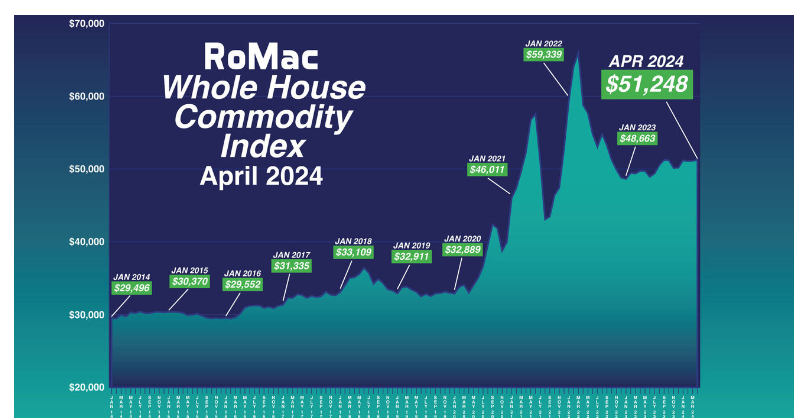

- RoMac lumber and commodity reports

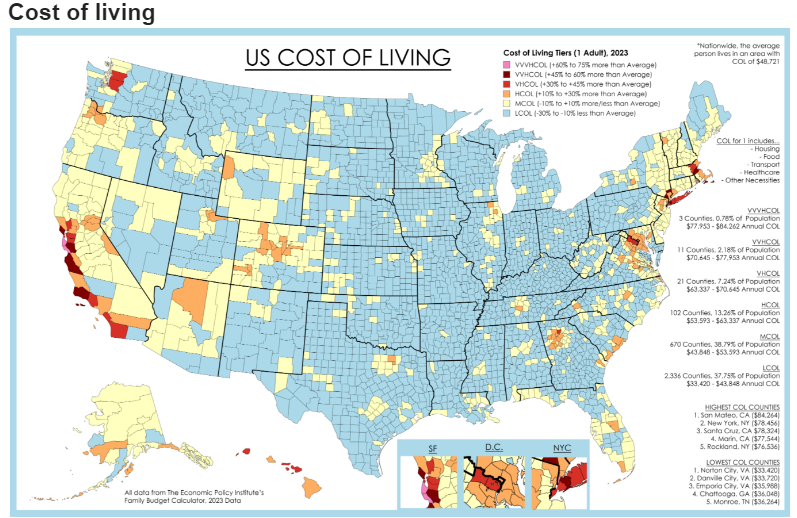

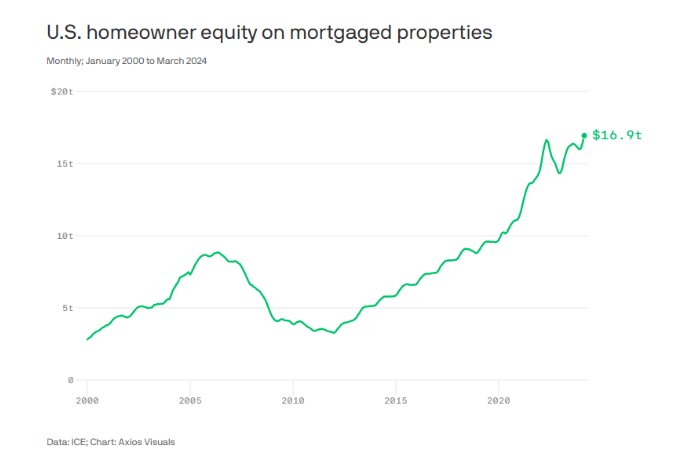

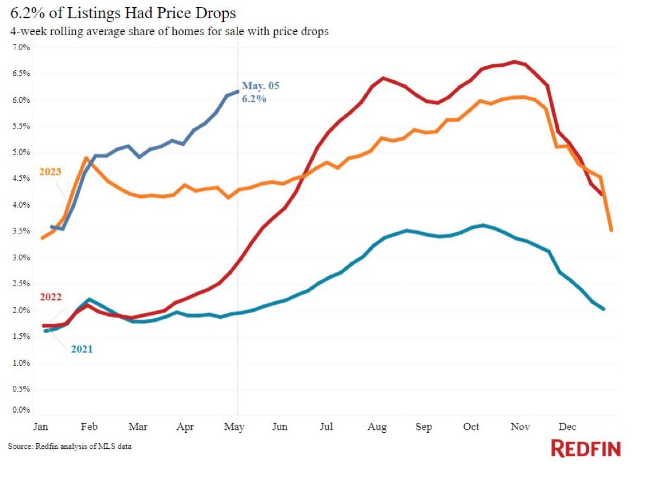

- Homeowners are getting rich. Renters? Not so much

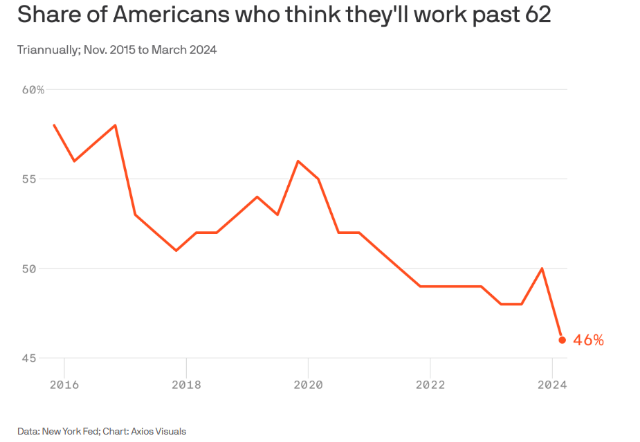

- 1 big thing: The retire-early economy

- A time we never knew

Listen here:

Recommendations:

Charts:

Tweets:

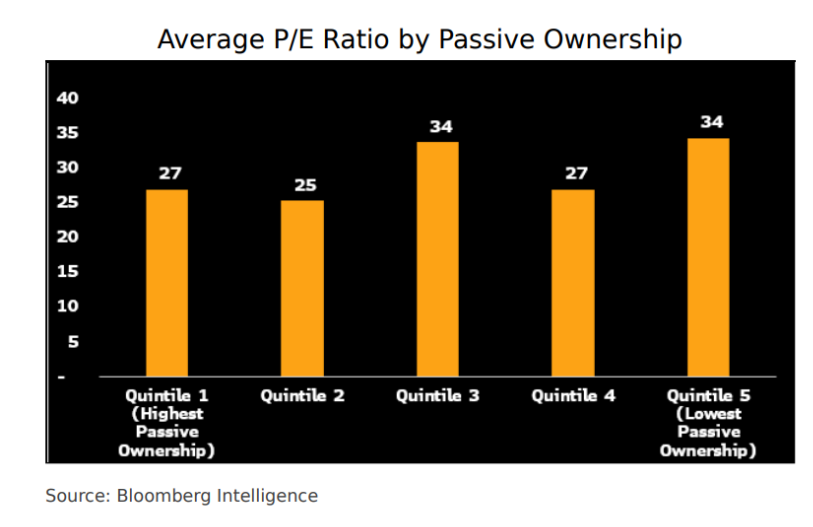

Passive fund ownership of the S&P 500 is about 24% today- up from 7% ten yrs ago. Meaning that on average an SPX stock has 24% of its shares out owned by index funds (which can incl smart-beta or themes tho). Great study out today from @JSeyff here: https://t.co/tYejH90Aa4 pic.twitter.com/0eohjr8hth

— Eric Balchunas (@EricBalchunas) April 24, 2024

coffee is very much still in CPI pic.twitter.com/67GT9svYLC

— Kyla Scanlon (@kylascan) May 12, 2024

My dad always used to say that the way you build wealth is by building equity in your home.

My housing plan would help Americans achieve homeownership by giving households $400 a month for two years when they buy their first home. pic.twitter.com/TH0BObFbRM

— President Biden (@POTUS) May 10, 2024

A record 63% of US workers are satisfied with their jobs. That’s the highest level ever for this survey which goes back to 1987. Take a look at the spike upward after the pandemic. pic.twitter.com/FSWmjQ4vnr

— Eric Soda (@EricSoda) May 8, 2024

If these numbers were the opposite, if homicides were up 19% so far this year it would be the number one, or at least top three domestic story. https://t.co/m8WWKOQCiP

— Chris Hayes (@chrislhayes) May 7, 2024

"Bone Tomahawk" director S. Craig Zahler is set to reunite with his “Dragged Across Concrete” and “Brawl in Cell Block 99” star Vince Vaughn and Oscar winner Adrien Brody for new crime thriller “The Bookie & the Bruiser. https://t.co/kUvMIfe4vn

— Variety (@Variety) May 8, 2024

Contact us at animalspirits@thecompoundnews.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.