Every once and a while a finance-related topic comes up that makes my head hurt just thinking about it.

Here’s the latest:

I was having a discussion with a colleague last week about the insane returns in bonds over the past year or so.

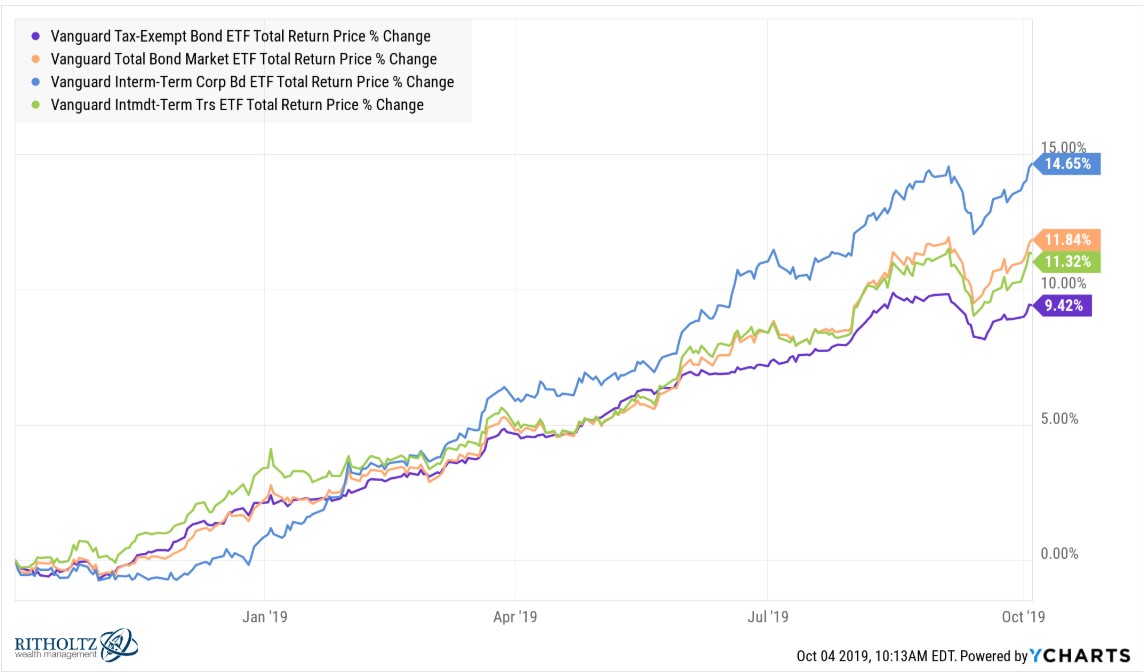

It doesn’t really matter which type of bonds we were talking about because pretty much all fixed income has done well:

These returns aren’t insane when compared to what can go on in the stock market but in fixed income land, this is something else, especially when you consider where interest rates were when this run began. The 10-year treasury yield was just over 3% at the start of this period.

But this situation presents something of a quandary for investors.

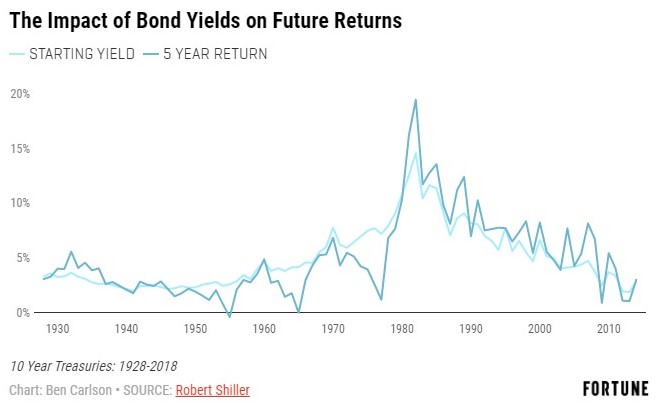

If you’ve been paying attention here you already know the long-term returns for high-quality fixed income is determined mostly by the starting interest rate:

The correlation over almost any long-term time frame for future returns on treasuries and their starting yield is somewhere in the neighborhood of 0.90 to 0.95, signaling a very strong positive correlation between starting yield and subsequent long-term returns (call it 5-10 years depending on the maturity).

So if you were invested in a high-quality bond or bond fund 12 months ago and your starting yield was 3%, you should expect to earn a long-term return of 3% or so on that security or fund.1

This means future returns have essentially been pulled forward since the current yield is now much lower than the starting yield:

The question my colleague and I were discussing is the following: Is there a way to take advantage of this situation?

And the reason this scenario makes my head hurt is that taking advantage is quite difficult. Your options are as follows:

Option 1. You could sell your bonds and put the proceeds into cash. The hope here would be that rates rise, thus allowing you to reinvest at higher yields.

The downside is, of course, rates don’t have to rise. They could continue to fall further, meaning you would miss out on any further price appreciation. Or they could stay in a tight range around the current levels, meaning you just churned your portfolio for no reason.

And sitting in cash when the market goes against you often leads to even greater mistakes.

Option 2. You could sell your bonds and put the proceeds into stocks. Going to cash from bonds is a risk because it forces you to time interest rates, something that even the experts are basically worthless at. But cash at least yields something now (assuming you don’t have your money in a savings account at a big bank).

Going from bonds to stocks completely changes your risk profile. I’m not saying the move is right or wrong, just different from an asset allocation perspective. And asset allocation is one of your more effective risk management tools as an investor.

Making changes to your mix of asset classes is not a decision you should take lightly.

Option 3. You could stay put in your current positions and avoid trying to time interest rates.

Reinvestment risk is nothing new in bonds. Investors have been dealing with this forever. Even though bonds are supposed to be the boring asset class in your portfolio, they still tempt you from time to time to make changes that introduce avoidable or unnecessary risks.

There really is no right or wrong answer because the “right” answer will be determined by the path of interest rates from here, something no one can predict in advance.

But let’s say you do sell all of your bonds at this point and nail a bottom in rates. And let’s further assume rates rise enough to entice you to put that money back to work at better prices.

Should you make a habit of this?

What makes you think you’re better at predicting the path of interest rates than all of the macro hedge fund managers, professional bond managers and economists who collectively do a less than stellar job of predicting the direction of rates?

In fact, nailing a market timing call is probably one of the worst things that can happen to an investor because it gives you hope that you can do it consistently.

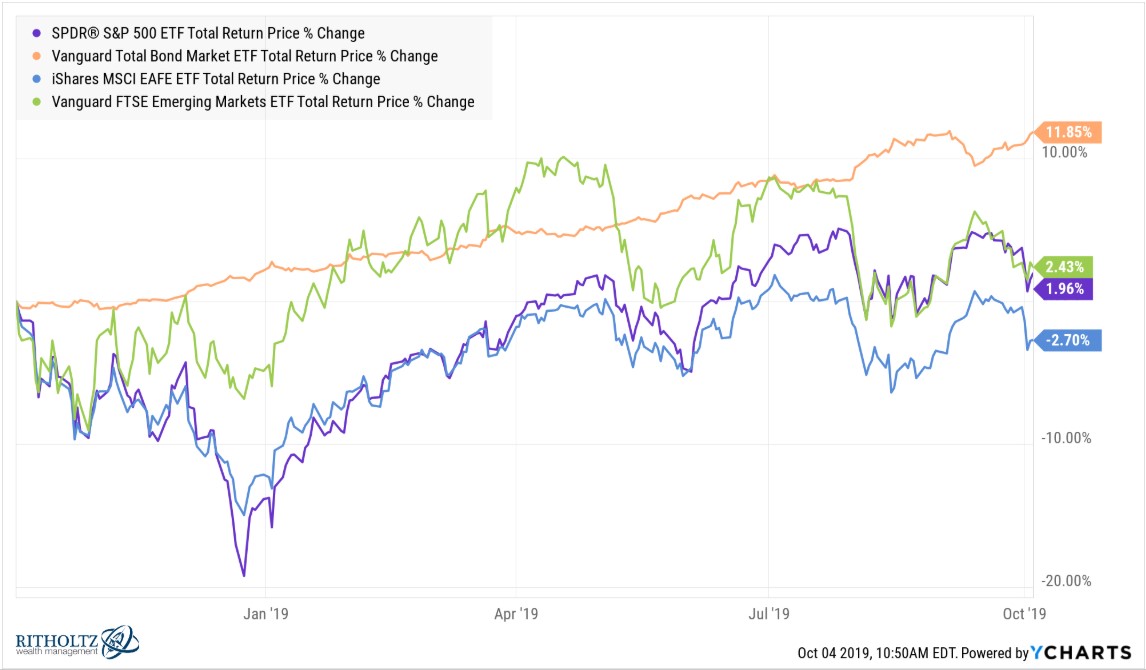

There is another option for those who are averse to making all-in or all-out market timing calls. You could simply rebalance your portfolio. Because of the stock market sell-off in the 4th quarter of 2018, bonds have outperformed stocks by a decent clip over the past year:

So if you wanted to trim some of your winnings in bonds and rebalance into stocks, that could be a prudent form of risk management to stay in line with your stated asset allocation targets.

Of course, this would also mean you trimmed your stock holdings to put some of those winnings back into bonds at some point over the past few years. Even with the mini-bear market late last year, stocks are still doing better than bonds over the past 3 years:

Rebalancing a portion of your portfolio doesn’t have the same cache as side-stepping a potential rise in interest rates but it’s a more realistic move for 99% of investors who are worried about the interest rate environment.

“No one ever went broke taking profits” is something investors often say to reassure themselves of their decision to sell an asset.

But taking profits is not always as easy as it seems when you take into account reinvestment risk and what comes next.

Further Reading:

The Best and Worst Case Scenario for Bonds From Here

1I’m ignoring things like credit risk, default risk, reinvestment risk or inflation risk in this scenario so this relationship doesn’t hold exactly for things like junk bonds, corporate bonds or mortgage bonds.