Today’s Animal Spirits is brought to you by YCharts:

See here for YCharts’ new feature and get 20% off your initial YCharts subscription for new customers only!

On today’s show, we discuss:

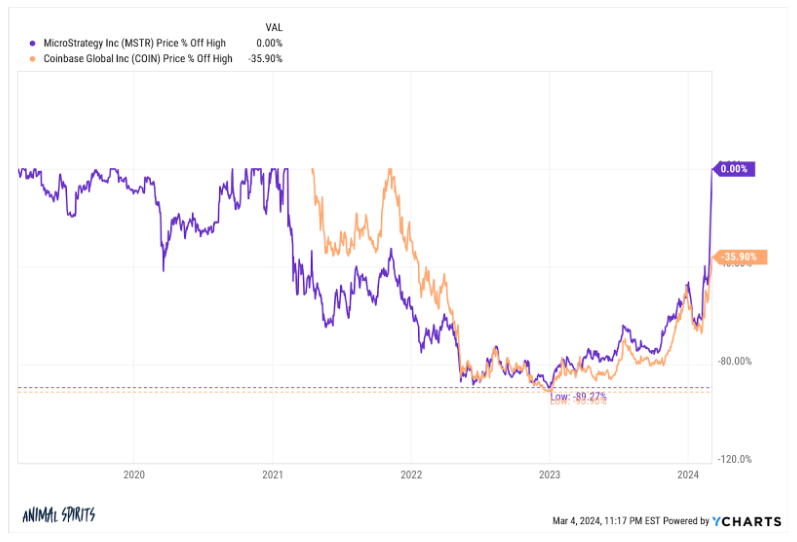

- How Bitcoin eats the equity market (via MicroStrategy)

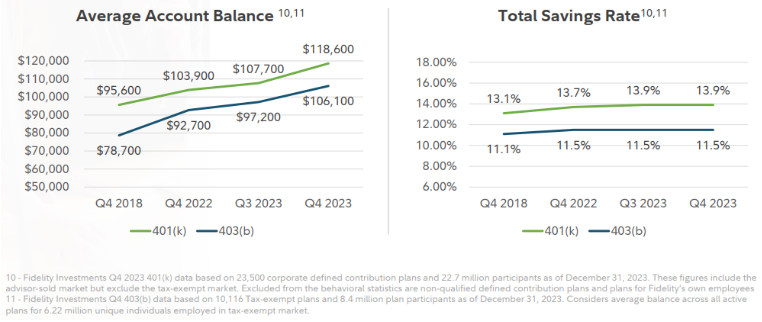

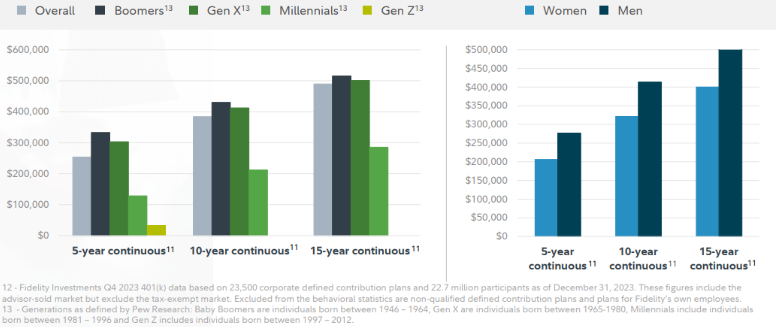

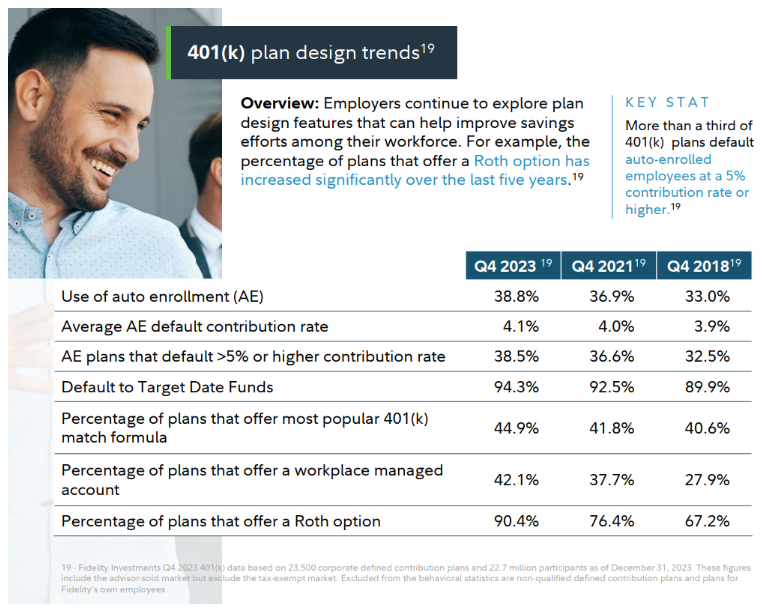

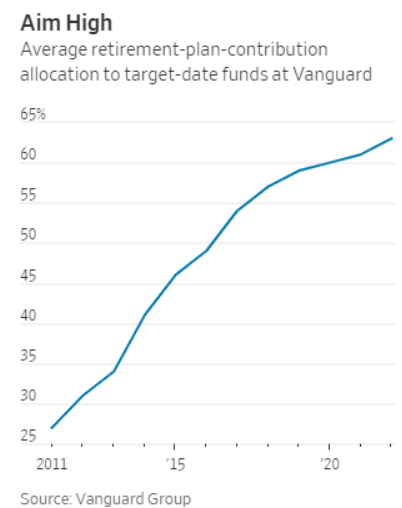

- Is your 401k destroying capitalism?

- Auto insurance spike hampers the inflation fight

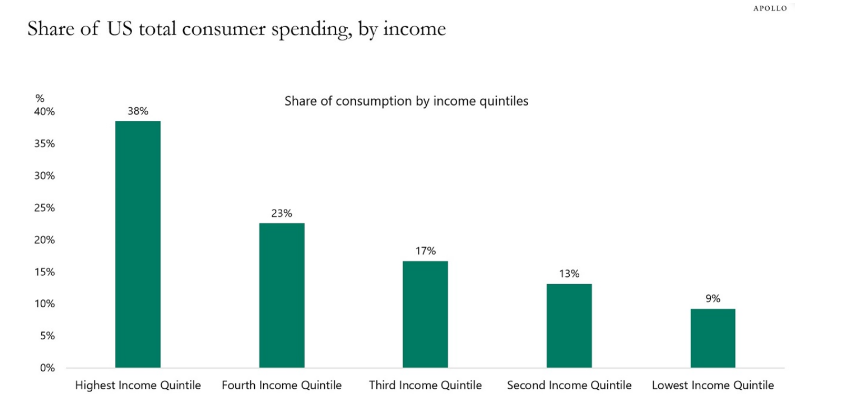

- The consumer is in good shape

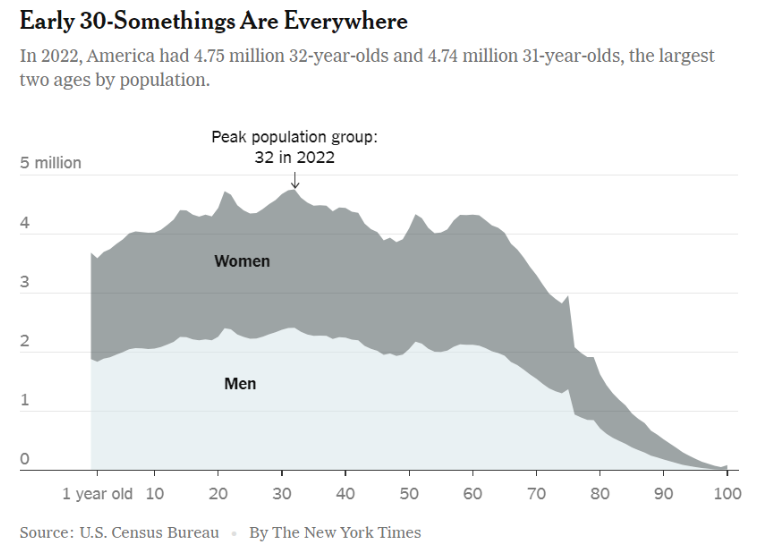

- It’s me, hi, I’m the problem. I’m 33

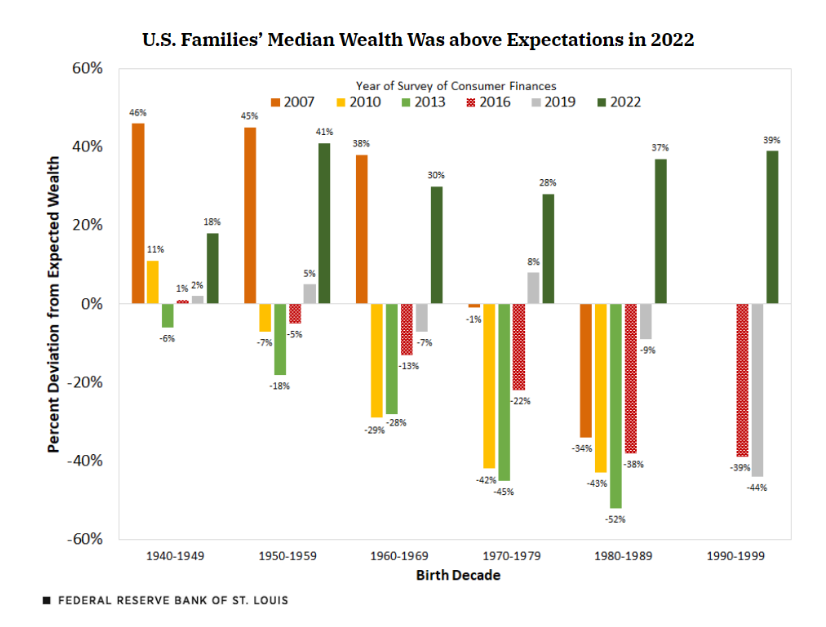

- Millennials on course to become ‘richest generation in history’

- Millennials and older Gen Zers made significant wealth gains in 2022

- Klarna says its AI assistant does work of 700 people after it laid off 700 people

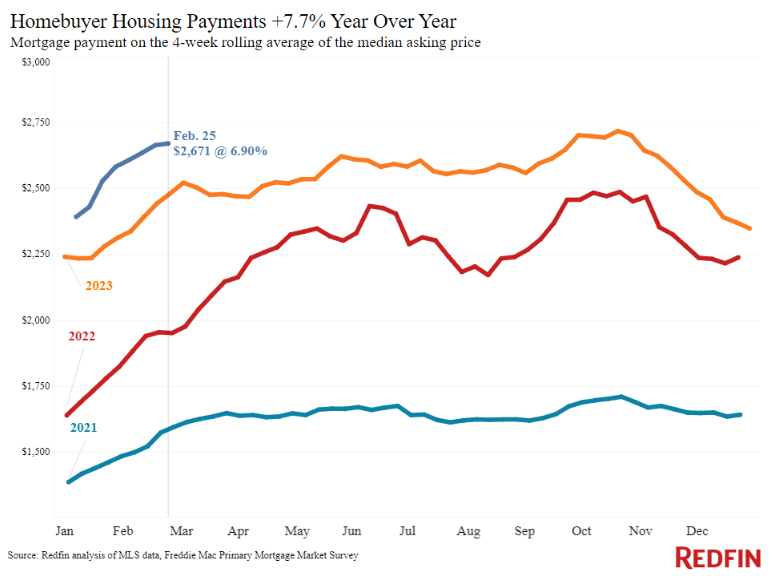

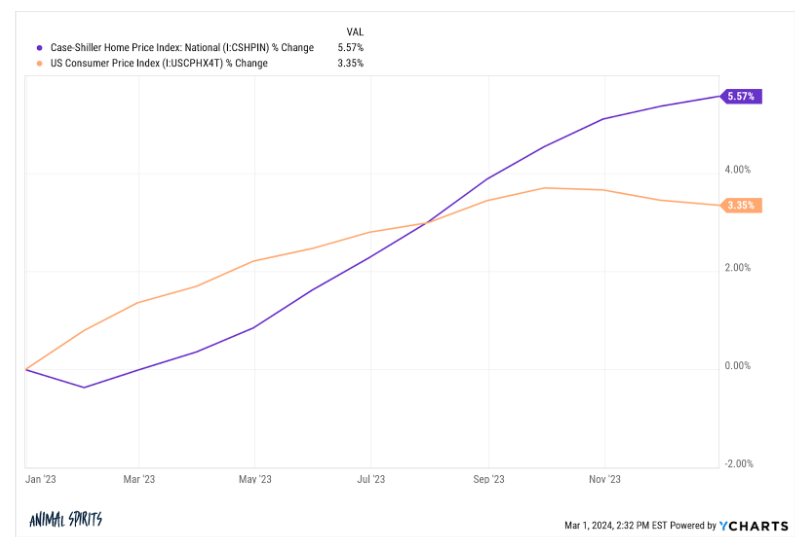

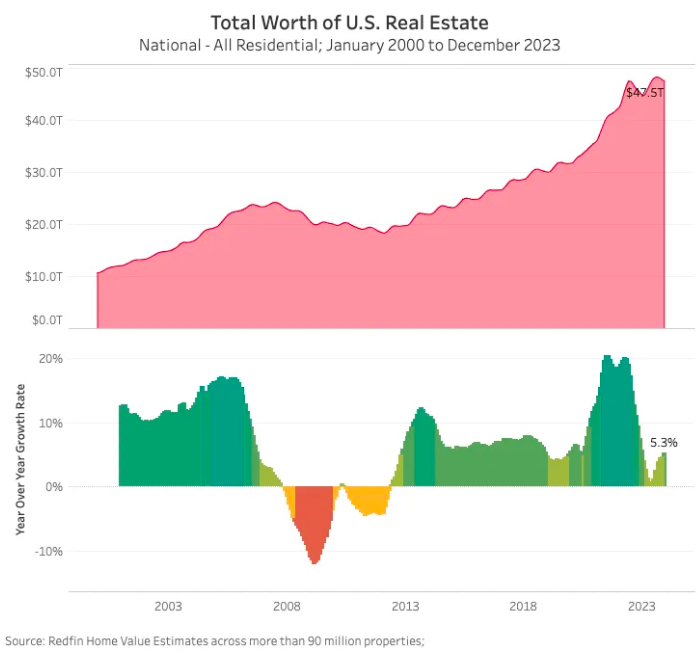

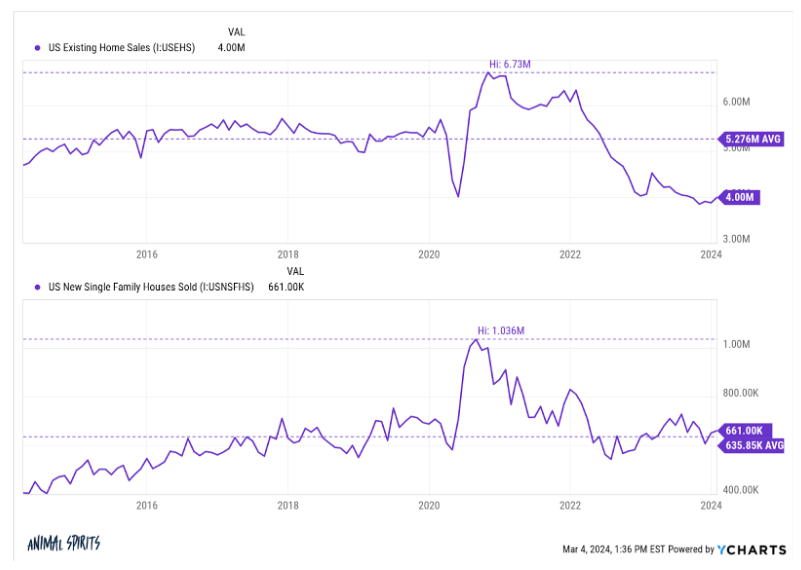

- Housing market update: New listings post biggest uptick in nearly 3 years, but buyers show restraint as rates rise

- You think you’re doing fine in life, until you hear a friend is doing better

Listen here:

Recommendations:

Charts:

Tweets:

S&P 500 returns:

2010 +14.8%

2011 +2.1%

2012 +15.9%

2013 +32.2%

2014 +13.5%

2015 +1.4%

2016 +11.8%

2017 +21.6%

2018 -4.2%

2019 +31.2%2010s annualized: +13.4%

2020 +18.0%

2021 +28.5%

2022 -18.0%

2023 +26.1%

2024 +8.2%2020s (so far) annualized: +13.6%

Not bad

— Ben Carlson (@awealthofcs) March 4, 2024

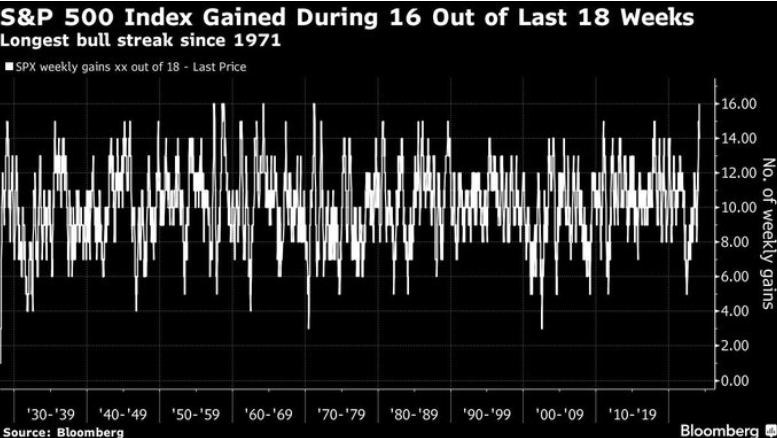

"Bull markets should be boring, and that’s exactly how stocks have been behaving over the last year."@DataTrekMB pic.twitter.com/MJLpUoSKBk

— Daily Chartbook (@dailychartbook) February 29, 2024

The number of stocks hitting 52-week highs hit a 52-week high yesterday. pic.twitter.com/9ByC6GFz7p

— Bespoke (@bespokeinvest) March 5, 2024

Terrible Inflation milestone reached – My first $85 breakfast for one at a NYC hotel. After signing this bill, I have decided NEVER AGAIN. #Biden #Inflation @SecYellen @federalreserve pic.twitter.com/C3FS67fT7I

— 🇺🇸 Kyle Bass 🇹🇼 (@Jkylebass) February 28, 2024

The average hourly wage in 1986 was $7.87, meaning it took slightly more than 1 hour of labor to buy this meal.

The average hourly wage today is $29.66, and you can buy this same meal for $27.19 at my local BK — less than 1 hour of labor. https://t.co/zexCfHOkt3

— Jeremy 'adjusted for inflation' Horpedahl 📈 (@jmhorp) March 3, 2024

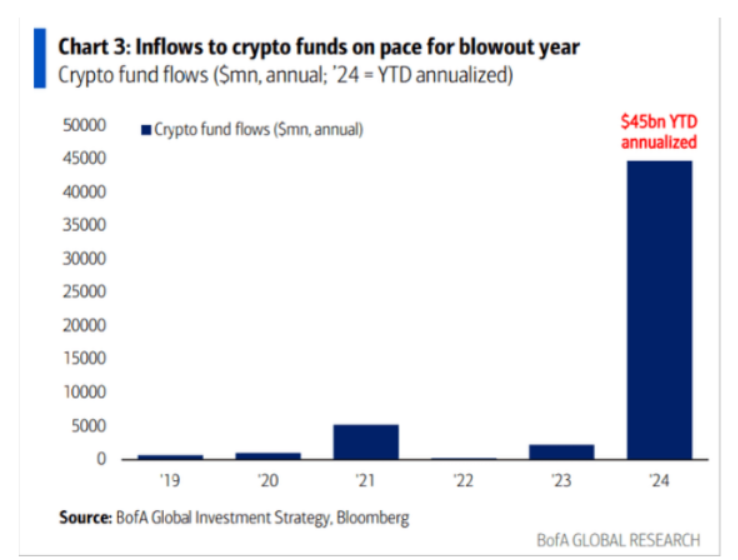

We are dealing with a LARGE surge of traffic – apologies for any issues you encounter. The team is working to remediate.

— Brian Armstrong (@brian_armstrong) February 28, 2024

Fidelity strong w/ +$400m today, it's biggest one day haul, Bitwise had 3rd best day.. Anything $IBIT brings is just padding the net net number. Throw in rally and the ten will likely hit $50b in aum tmrw. More than halfway to passing gold etfs less than two months in. https://t.co/jmgIPmwVNe

— Eric Balchunas (@EricBalchunas) March 5, 2024

Someone just paid 4500 ETH ($16,032,959.47) for this. pic.twitter.com/Z38GddANyK

— Zeneca 🔮 (@Zeneca) March 4, 2024

this monke just sold for $567,000.

this penguin just sold for $531,000.

this punk just sold for $16,000,000.

crytpo animal spirits are back. pic.twitter.com/dy7jbTfjeE

— Corey Hoffstein 🏴☠️ (@choffstein) March 4, 2024

"After first 2-3 millions, a paid off home and a good car, there is no difference in qualify of life between you and Jeff Bezos"

Agree or disagree? pic.twitter.com/lljT12vOq3

— Austin Rief ☕️ (@austin_rief) February 28, 2024

Contact us at animalspirits@thecompoundnews.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.