Today’s Animal Spirits is brought to you by TBIL and the US Benchmark Series:

See here for more information on investing in TBIL and the US Benchmark Series

See here to register for The Compound Insider

Listen here:

On today’s show, we discuss:

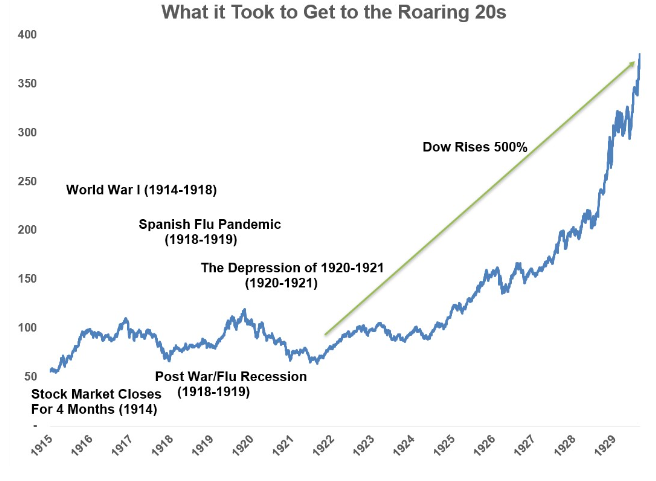

- Why the roaring twenties left many Americans poorer

- Lots more on the big can kick in commercial real estate

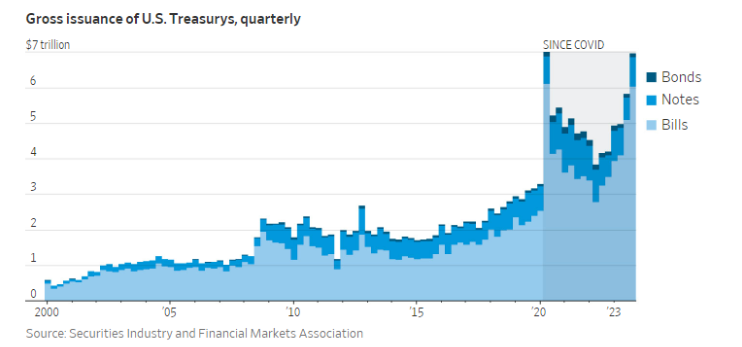

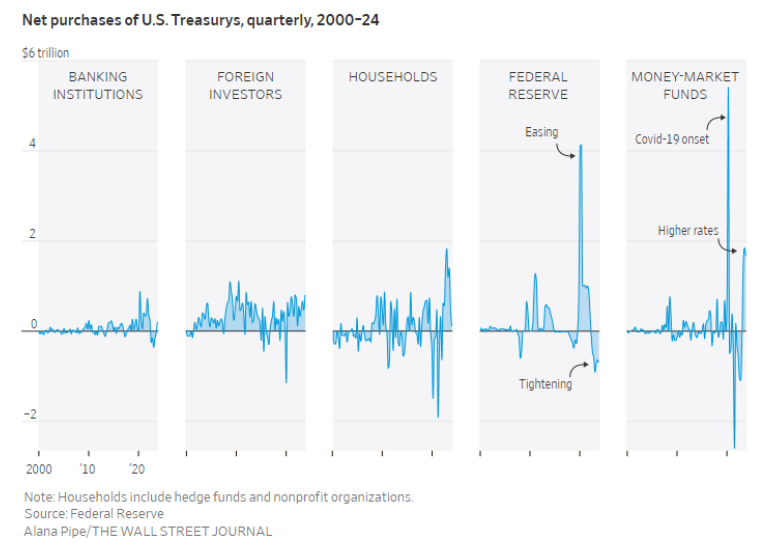

- The $27T Treasury market is only getting bigger

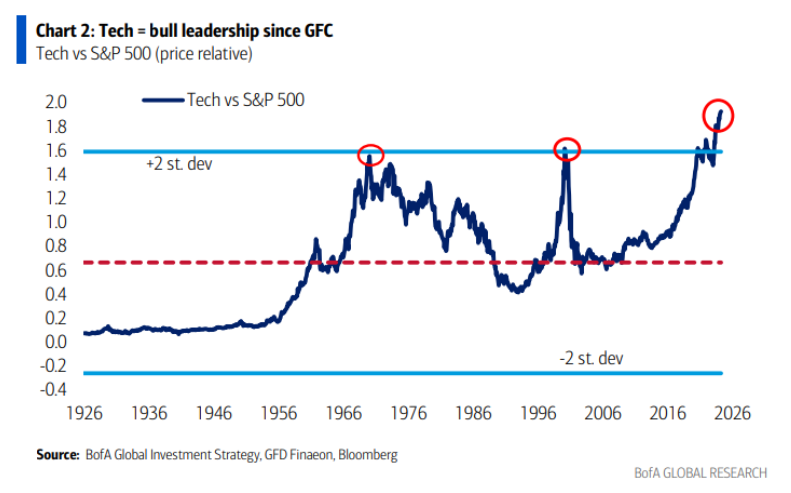

- Hey ChatGPT, why isn’t my AI fund up like Nvidia?

- Want to know if AI will take your job? I tried using it to replace myself

- US homebuyers expecting $10,000 savings face tough reality

- Are homebuyers hit hardest by landmark realtor lawsuit?

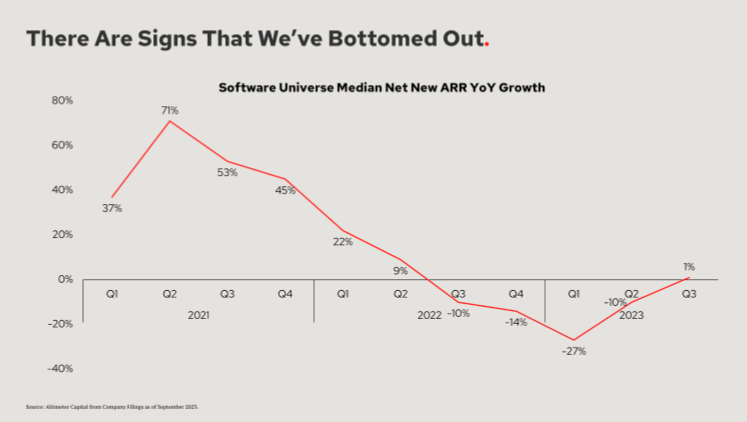

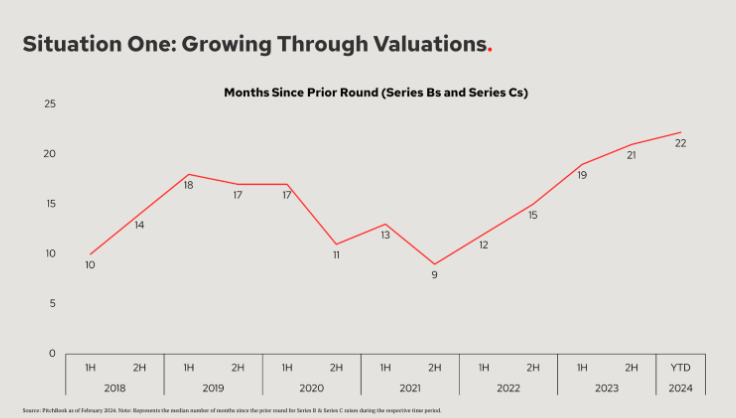

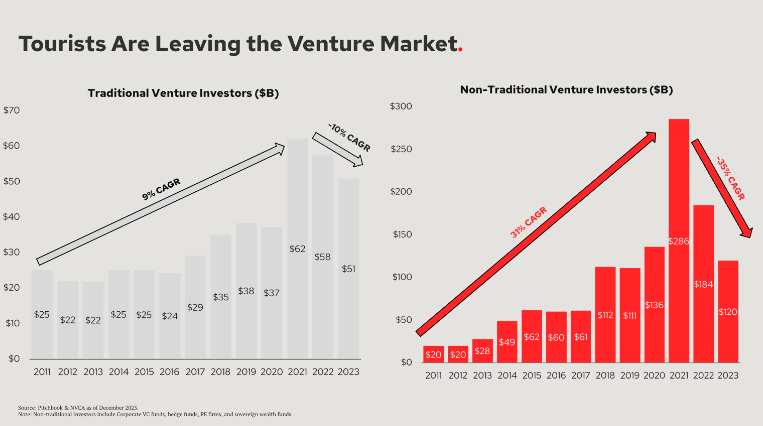

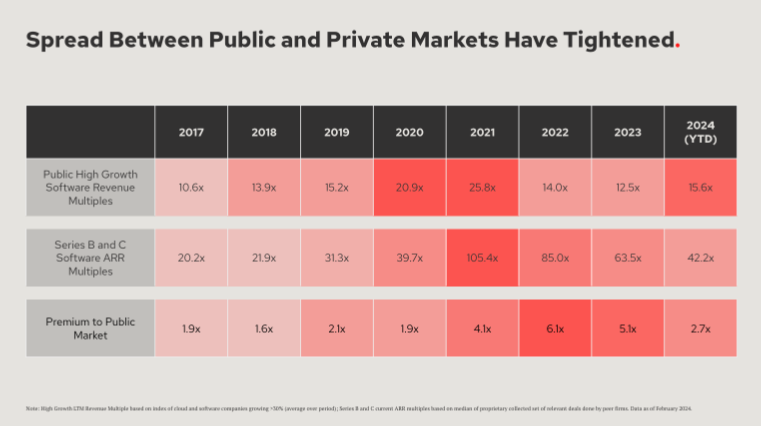

- Redpoint AGM Market Overview

- Benchmark to lead investment in AI video startup HeyGen at $440M valuation

Recommendations:

Charts:

Tweets:

US AIRLINE PASSENGER TRAVEL WILL SET RECORD IN MARCH AND APRIL, UP 6% OVER 2023 LEVELS — AIRLINE GROUP

— *Walter Bloomberg (@DeItaone) March 19, 2024

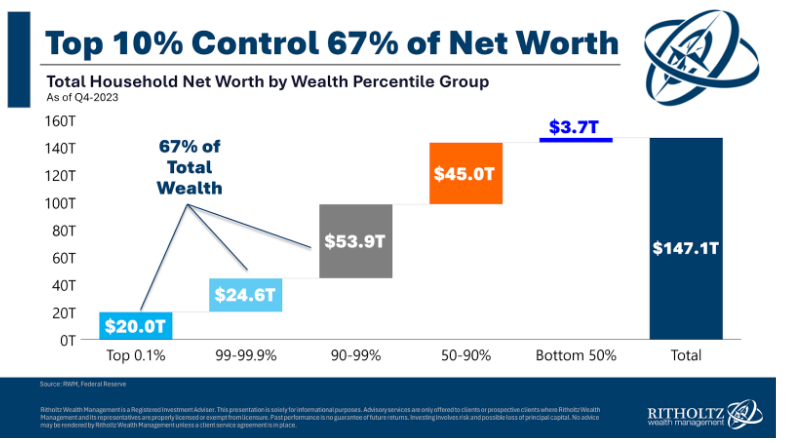

Net worth is at all-time highs

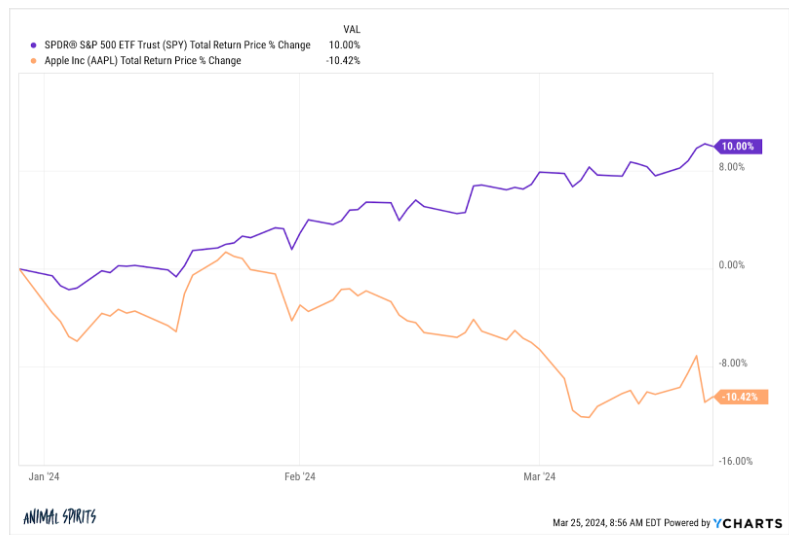

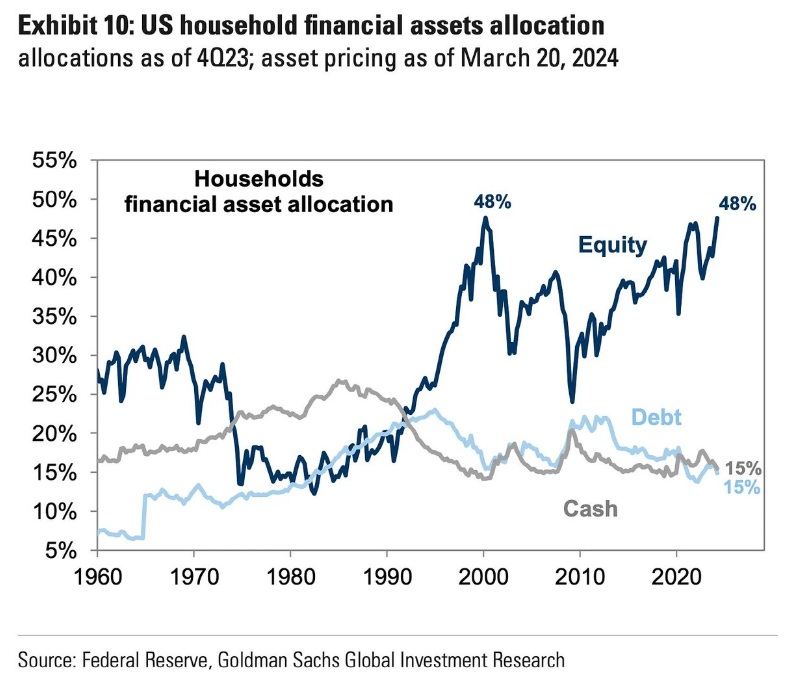

Stock prices are at all-time highs

Housing prices are at all-time highs

Economic activity is at all-time highs

Air travel is at all-time highs

You can earn 5% on your cashI know ppl don't like good news but this is the roaring 20s (w/o the vibes)

— Ben Carlson (@awealthofcs) March 21, 2024

Yesterday saw a new high in new highs. As shown in the chart, yesterday our reading on stocks making new 52-week highs in the S&P 500 broke out above the prior high from late last year. pic.twitter.com/0t8XHRBUoC

— Bespoke (@bespokeinvest) March 22, 2024

52wk highs on SPX hit 23% yesterday, the highest in 3-years. Rarely do we see internal highs peak with prices, they usually lead $SPX. pic.twitter.com/gSv4BFyqCW

— RenMac: Renaissance Macro Research (@RenMacLLC) March 22, 2024

Even with inflation adjustment, Americans are just spending way more on food than we did pre-pandemic — either eating more, buying more expensive stuff, or relying more on restaurants & delivery. pic.twitter.com/ehOqnoIpXB

— Matthew Yglesias (@mattyglesias) March 21, 2024

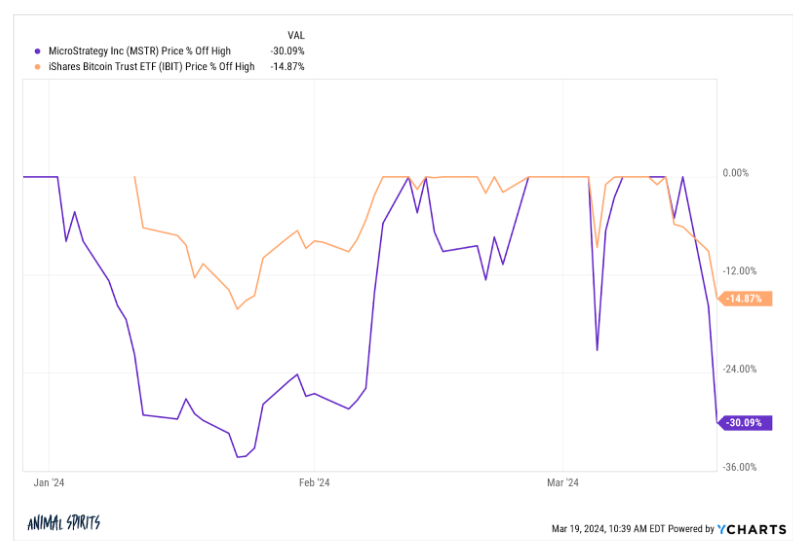

honestly wild pic.twitter.com/2ueqPdbItJ

— Derek Thompson (@DKThomp) March 19, 2024

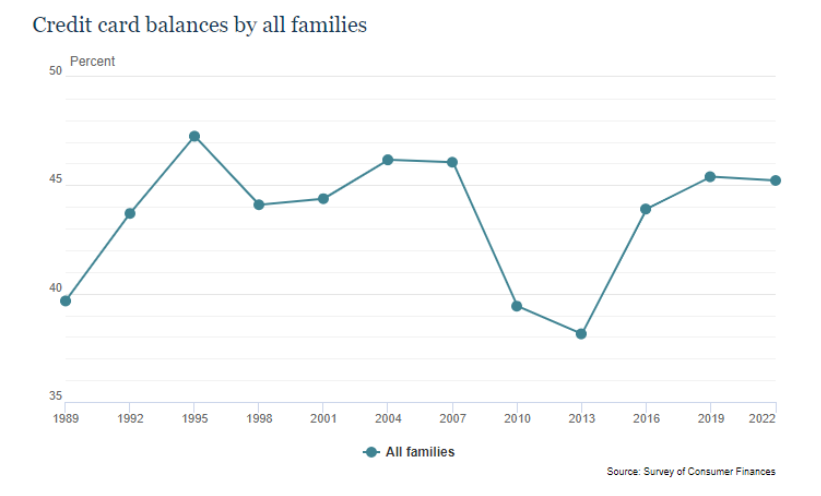

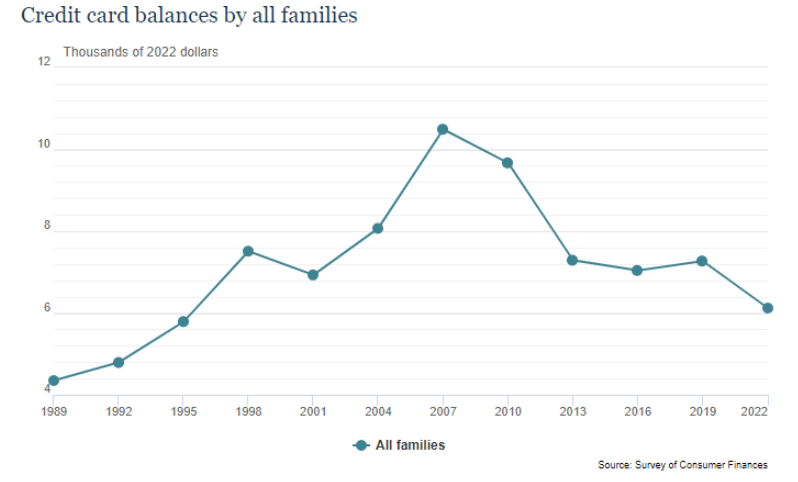

Want to know what the median credit card debt is among U.S. households?

$0.

While some struggle with credit card debt, this isn't the case for the majority of Americans, even if the headlines suggest otherwise.

— Nick Maggiulli (@dollarsanddata) March 21, 2024

$IBIT and $FBTC have now taken in cash for 49 straight days, something only 30 other ETFs have ever done (and none of them did it right out of gate). Among active streaks they 4th after $COWZ $CALF (which are over 100 days, damn) and $SDVY. Great chart from @thetrinianalyst pic.twitter.com/CUxFNFa7tN

— Eric Balchunas (@EricBalchunas) March 22, 2024

Monday housing data!

Available inventory of homes on the market is growing and will continue to grow until we’re finally in an environment of falling interest rates. The market could peak at 40% inventory growth over last year.

There are 9 million fewer people locked-in to 3%…

— Mike Simonsen 🐉 (@mikesimonsen) March 11, 2024

Here is a more detailed take on why I think Zillow loses:

~50% of Zillow’s revenue comes from selling leads to buyer agents.

Zillow is a public company. You can verify this. Their buyer lead program is called “Premier Agent”

Zillow has been trying to capture listing leads to… https://t.co/8RhTnZWEtA

— Nick El-Tawil (@tawillionaire) March 18, 2024

Contact us at animalspirits@thecompoundnews.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound, Inc., an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.