The housing market wasn’t supposed to remain this strong.

People were forecasting for a 20% drop in housing prices in 2022.

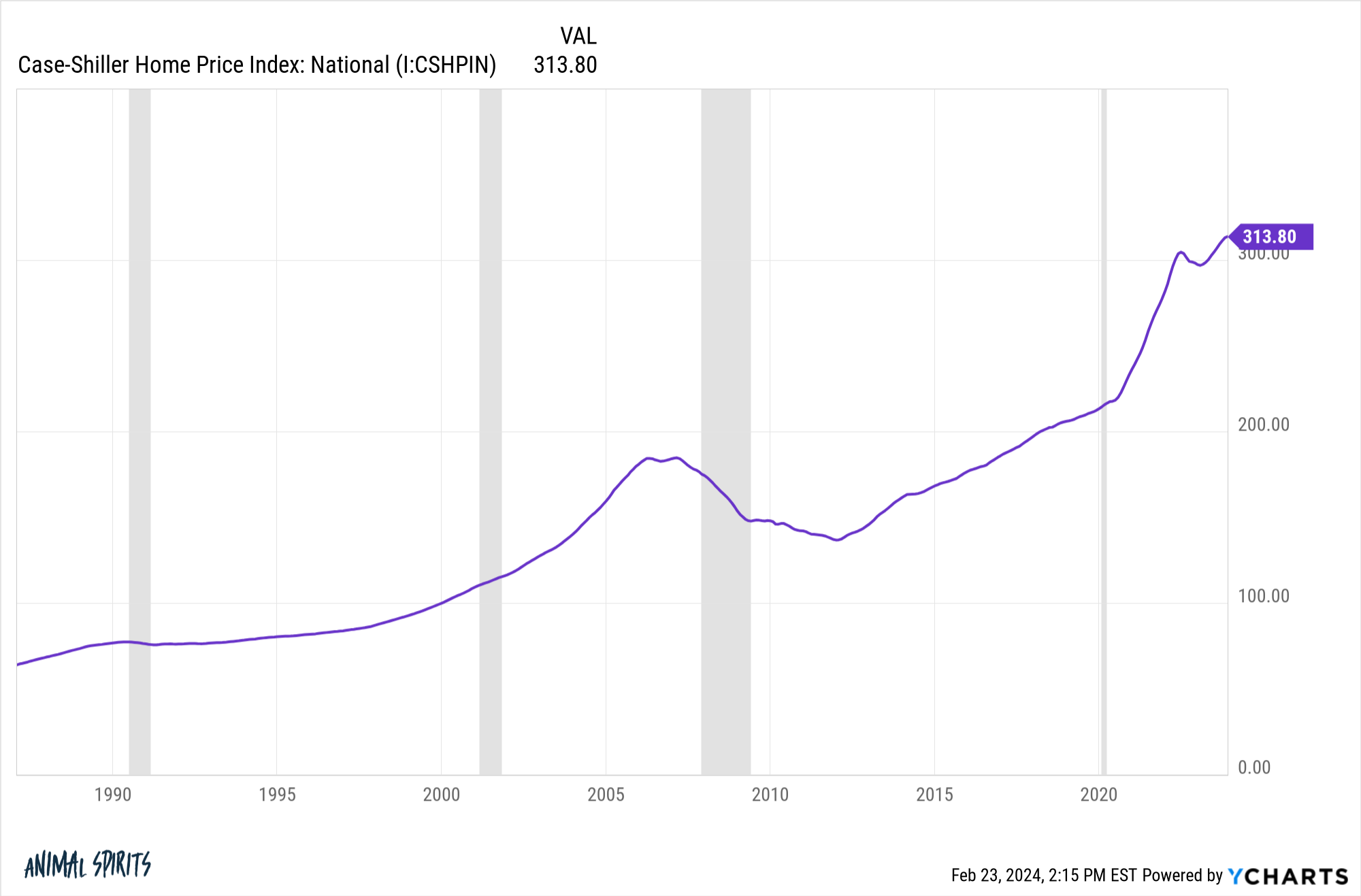

It made sense at the time. Everyone was predicting a recession. Prices had shot up 50% in three years. The Fed was jacking up interest rates. Mortgage rates went vertical.

And all we got was a wimpy 2-3% dip in prices.

I cannot predict the future but it’s hard to come up with a bearish thesis on the housing market at the moment.

If 8% mortgage rates didn’t do it what will?

Let’s go through a quick rundown of charts to see where things stand in the U.S. residential real estate market.

Mortgage rates fell a bit after briefly touching 8% but are still around 7%:

Despite rising rates, we still hit new highs in national housing prices:

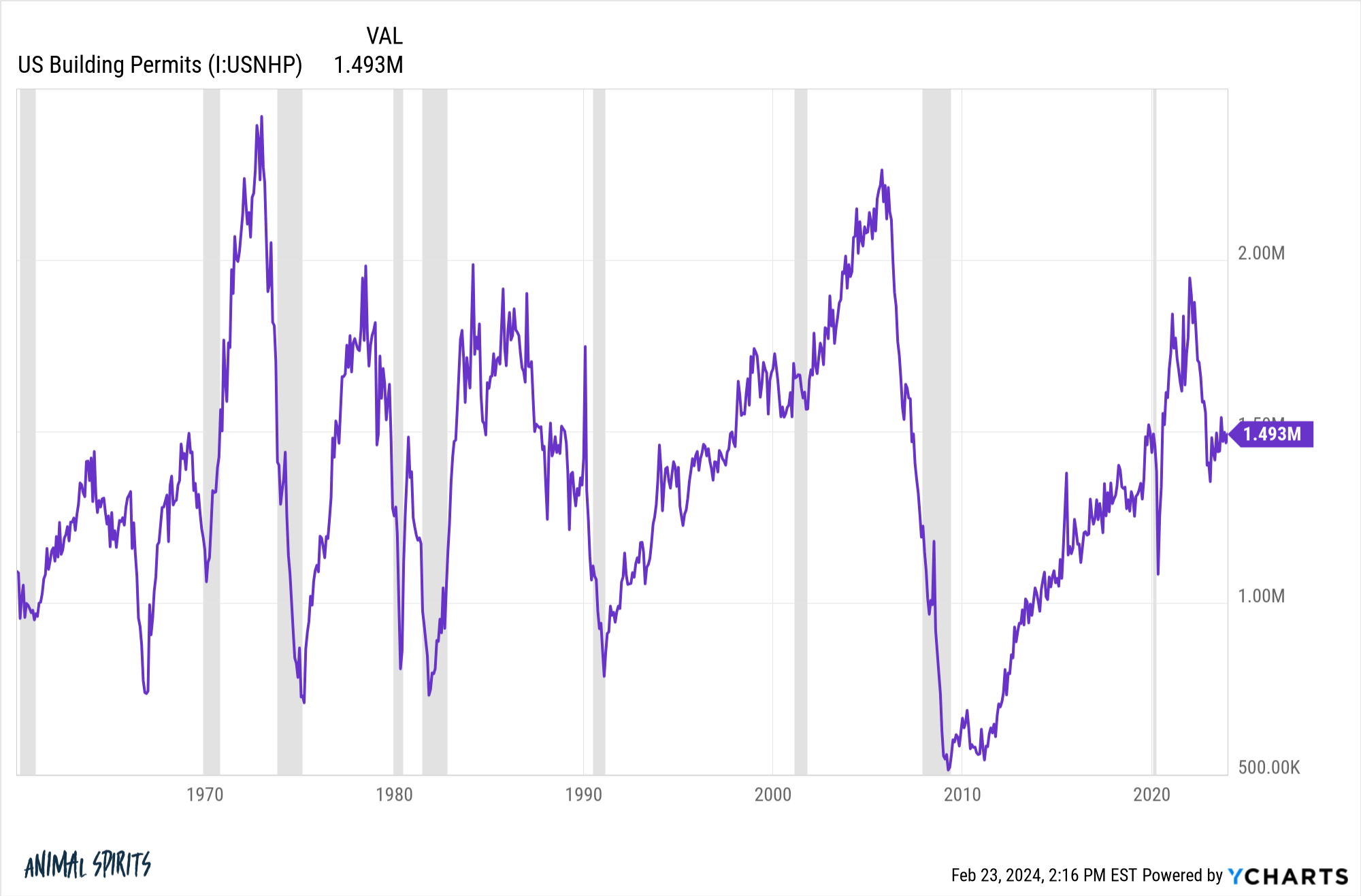

There was a nice uptick housing construction from the boom but higher rates slowed that down in a hurry:

We’re still not building enough homes and short of government intervention I don’t know when we will.

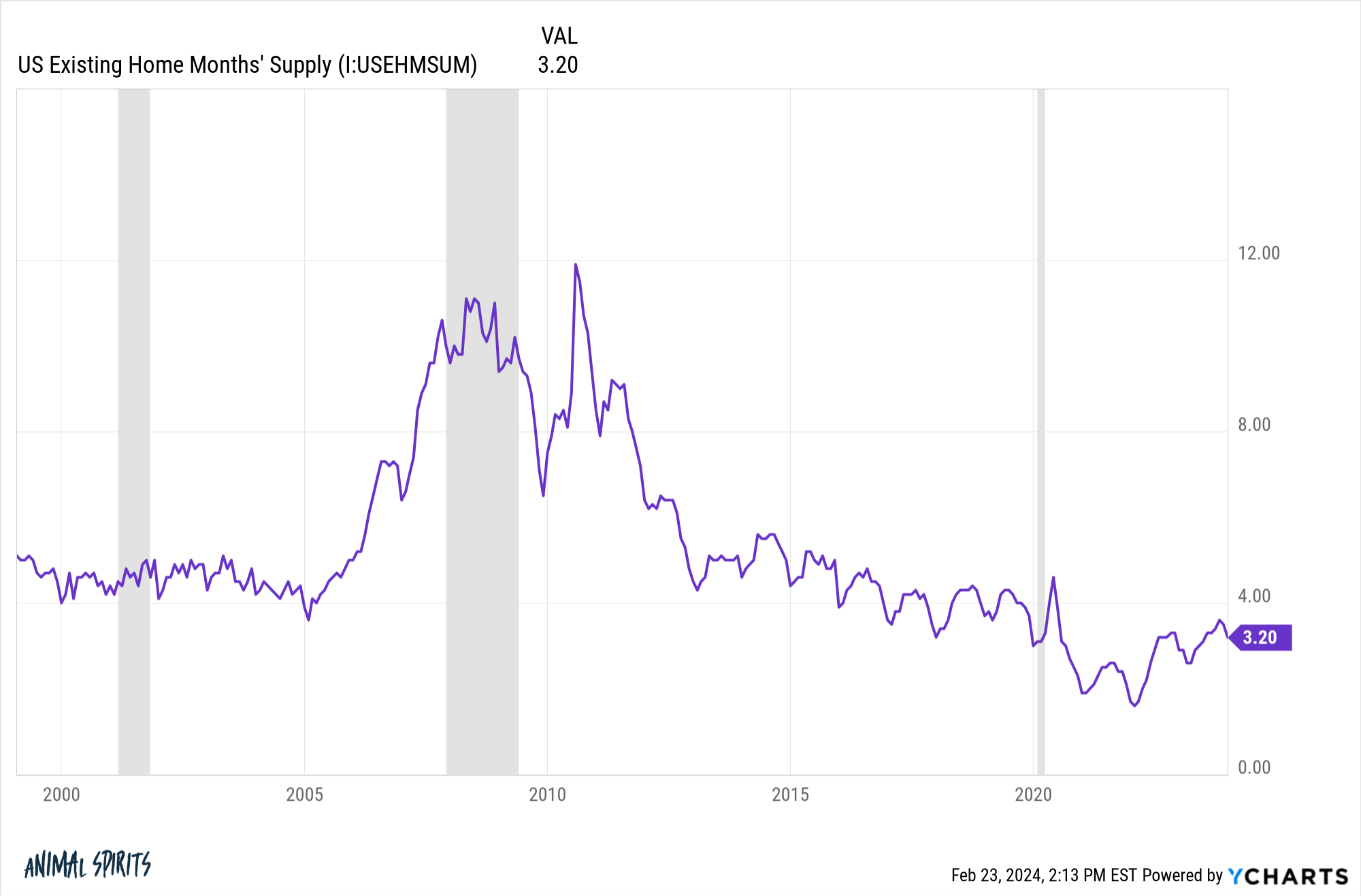

New builds have helped a little but there remains a dearth of supply on the existing home side of things:

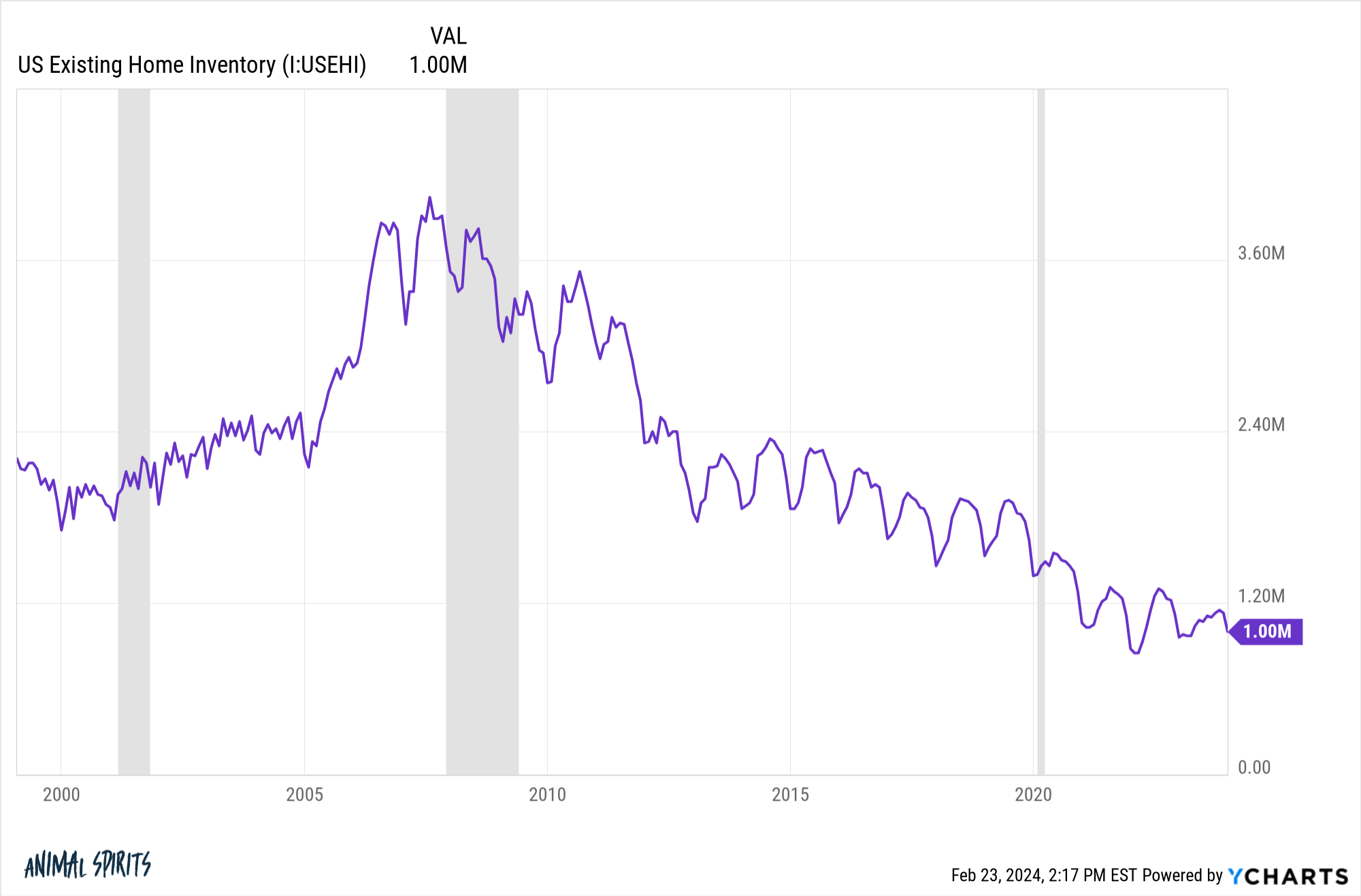

Just look at how low the inventory numbers are:

All of those 3% mortgage holders don’t want to sell because it’s so much more expensive to buy a new house with rates at 7% but people are also living in their houses for longer.

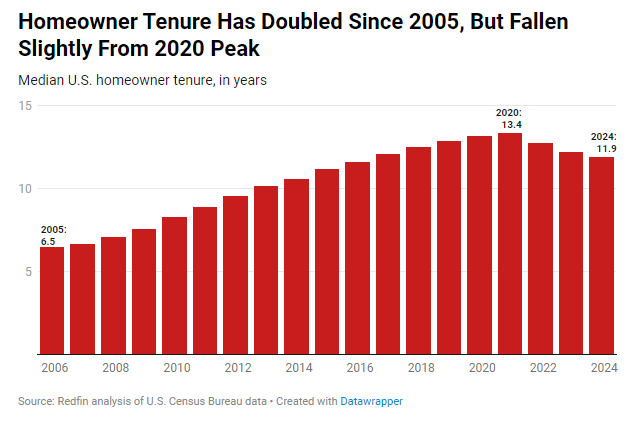

Redfin notes homeowner tenure has been rising for years:

This is actually a good thing from a financial perspective. It’s expensive to move considering all of the frictions involved. The longer you stay in your home the better.

But it’s not great for prospective homebuyers.

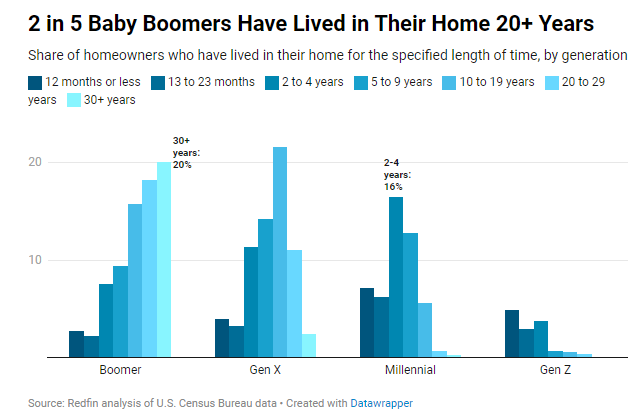

Two-thirds of all baby boomers have lived in their homes for at least 10 years. Nearly 40% have been in their residence for 20 years or more.

Almost 80% of boomers own a home.1

I know some people think the baby boomers will sell all of their stocks and houses the day they retire but that’s just not realistic.

Some will sell eventually but it will be more of a slow burn than a flood of homes hitting the market. Baby boomers are more than content to stay in their homes for the long run.

The problem is this low supply is happening in the face of strong demand. Kevin Oakley shows that while people might be biding their time until mortgage rates fall, there is demand on the sidelines waiting to pounce:

I’m not saying housing prices will continue to skyrocket like they did during the pandemic. We pulled forward years of returns that were coming one way or another from the millennial demographic boom.

Housing prices could (and probably should) stagnate for a while if mortgage rates remain high. It’s also not a foregone conclusion housing prices will boom if mortgage rates fall and buyers come off the sidelines.

Either way, it’s hard to come up with a good reason for prices to fall substantially like so many people have been hoping for.

Maybe a nasty recession? Even then, so many homeowners have locked in low rates with an enormous amount of home equity. And 40% of people already own their homes free and clear.

It could always be something out of left field. No one predicted a pandemic would come along and spur a massive amount of housing demand in a short period of time.

These things are cyclical. There will be a time again when the housing market isn’t so strong.

I’m just having a hard time coming up with a bearish thesis right now.

Use me as a contrarian indicator if you’d like but I’m trying to be realistic.

You might have to wait a while for the housing prices to fall considerably.

I also wouldn’t try to time the housing market.

The best time to buy a house is when you find one you want to live in for 5+ years and can afford to service the debt.

Further Reading:

What is the Historical Rate of Return on Housing?

1It’s 72% for Gen X, 55% for millennials and 26% for Gen Z.