Think back to the economic set-up at the end in September 2022.

The stock market was down 25% on the year. The latest inflation reading was still well over 8%. Interest rates had shot up. The Fed was raising rates aggressively. A recession was all but consensus.

And why wouldn’t it be?

That’s what the Fed was telling everybody!

Jerome Powell gave a press conference at the time that echoed the dire sentiment in the economy. In fact, Powell hinted people needed to lose their jobs to bring down inflation:

We’re never going to say that are too many people working, but the real point is this, inflation, what we hear from people when we meet with them is that they really are suffering from inflation. And if we want to set ourselves up really light the way to another period of a very strong labor market, we have got to get inflation behind us. I wish there were a painless way to do that, there isn’t.

There was a prevailing theory that the only way to bring down inflation was through economic pain. When asked how long that pain would last, here’s what he said:

How long? I mean it really depends on how long it takes for wages and more than that, prices, to come down for inflation to come down.

Here’s what I wrote at the time:

Please allow me to translate each of these statements:

-

- The Fed wants the unemployment rate to rise to slow inflation.

- They want wages to fall to slow inflation.

- They are willing to throw us into a recession to slow inflation.

In some ways, I understand why the Fed is so hell-bent on slowing rising prices. People REALLY don’t like sky-high inflation.

But in other ways, I think what the Fed is doing is INSANE.

What are they doing?!

We certainly needed more price stability, but I didn’t see the need to cool off the best labor market in decades to get there, especially since the pandemic is what caused the inflationary spike to begin with.

A couple of weeks later, CNBC was out with this headline about legendary trader Paul Tudor Jones:

Here’s what he had to say at the time:

“I don’t know whether it started now or it started two months ago,” Jones said Monday on CNBC’s “Squawk Box” when asked about recession risks. “We always find out and we are always surprised at when recession officially starts, but I’m assuming we are going to go into one.”

Since Powell gave his speech we’ve added over 4.1 million jobs in this country. Economic growth has accelerated. Inflation fell. Wages have continued to grow. We didn’t come close to going into a recession.

In June of 2021 the Fed Board predicted the Fed Funds Rate would be 0.6% by the end of 2023. Instead it was more than 5%.

Tudor Jones came out with his recession and stock market prediction just two days before the bear market bottomed. The stock market is up more than 40% since he said we were already in a recession and stocks had more to fall.

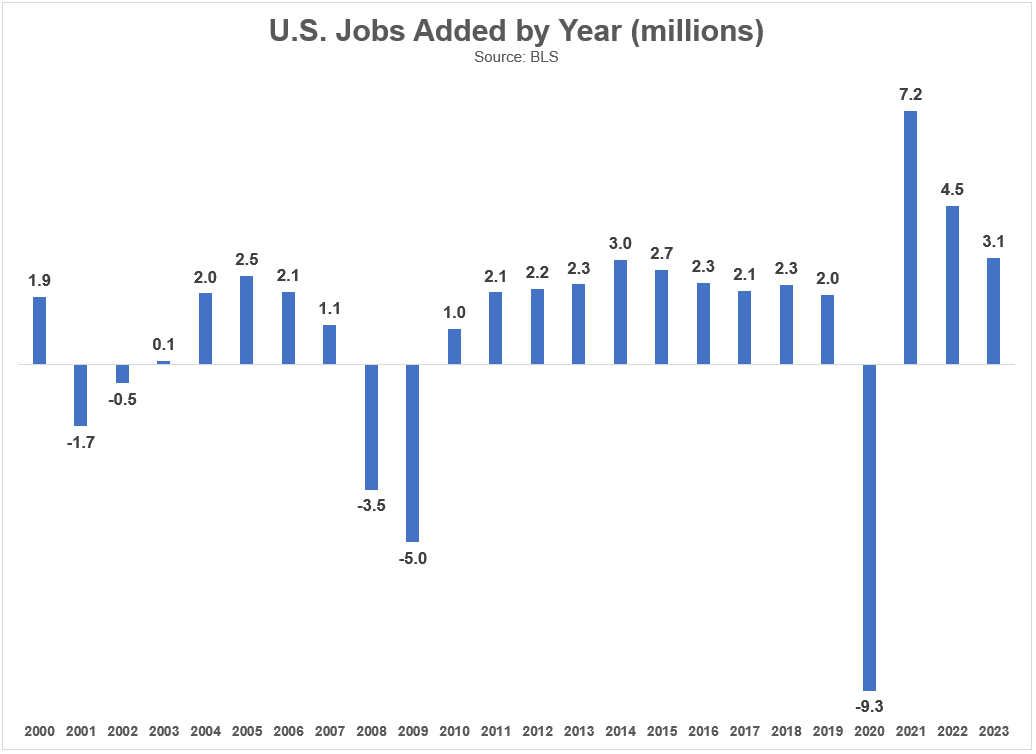

Not only did we avoid a painful labor market with job loss like Powell predicted but the labor market has been in beast mode. I looked at the annual number of jobs added by year going back to the turn of the century:

Take out the 2021 number because that was simply a reversal of the massive 2020 job loss from the pandemic. You could even partially take out the 2022 number because that was still making up for some of the 2020 job loss as well.

But by 2023 we had more than made up for the Covid job losses. Last year’s 3.1 million jobs added were the most in any year this century outside of 2021 and 2022. There wasn’t a single year where we added as many jobs in the 2000s or the 2010s as we did in 2023.

The Fed has access to more economic data than finance nerds such as myself could even dream of. Hedge fund managers like Paul Tudor Jones have teams of people who research and model this stuff on a daily basis.

These are smart people.

And they couldn’t have been more wrong about the U.S. economy.

Tudor Jones is still worried about the U.S. economy. Here was a new headline from this week:

Maybe he’ll be right this time, maybe not.

The U.S. economy will slow at some point because it’s cyclical. Recessions are a feature, not a bug.

I’m not one of these anti-forecasting people who says you should ignore the economy completely. I find the U.S. economy fascinating to track. I just don’t allow my thoughts on the economy to dictate my investment stance.

It’s fine to have views on the economy. It’s fine to listen to other people’s views on the economy.

It’s rarely helpful to act on those views when it comes to your portfolio.

Yes the macroeconomy can have an impact on your financial situation. But your portfolio decisions should be driven primarily by your own personal microeconomy — your risk profile and time horizon.

Macro is hard.

Most of us shouldn’t be using it to make investment decisions.

Michael and I talked the Fed, macro and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

You Are Not Stanley Druckenmiller

Now here’s what I’ve been reading lately:

- Tracy Chapman’s surprise performance at the Grammys (Rolling Stone)

- You’re never too old to start exercising (Peter Attia)

- The most overrated things in personal finance (Of Dollars & Data)

- The reality of the Danish fairytale (Hey World)

- Managing money vs. managing wealth (A Teachable Moment)

- 25 investment mistakes to avoid (Darius Fox)

Books: