I enjoy studying market history not because it makes it any easier to predict the future but because it can set helpful baseline assumptions.

For example, there have been permabears predicting a massive financial crisis and stock market crash every single year since the Great Financial Crisis in 2008.

A crash is always a possibility, of course. But there have only been five crashes in the 50% or worse range over the past 100 years.

Crashes happen but they’re rare. It doesn’t make sense to spend 100% of your time preparing for something that might happen 5% of the time.

I’m not dismissing market crashes. That would be a mistake. I’m just recognizing they don’t happen as often as some people would have you believe.

Bear markets and corrections happen far more often than a systemwide panic.

Plenty of pundits think we could be setting ourselves up for a bear market right now. The stock market was up big in 2023. A handful of mega-caps have produced most of the gains for the market. If those stocks stumble the market could fall as well.

I wouldn’t rule it out.

Here’s the thing though — we’ve already experienced two separate bear markets this decade. During the Covid crash, the S&P 500 fell 34%. The 2022 bear market saw the S&P drop 25%.

That was two bear markets in the span of three years, which is pretty rare.

If we had another bear market in 2024 that would be three in five years.

Has that ever happened before?

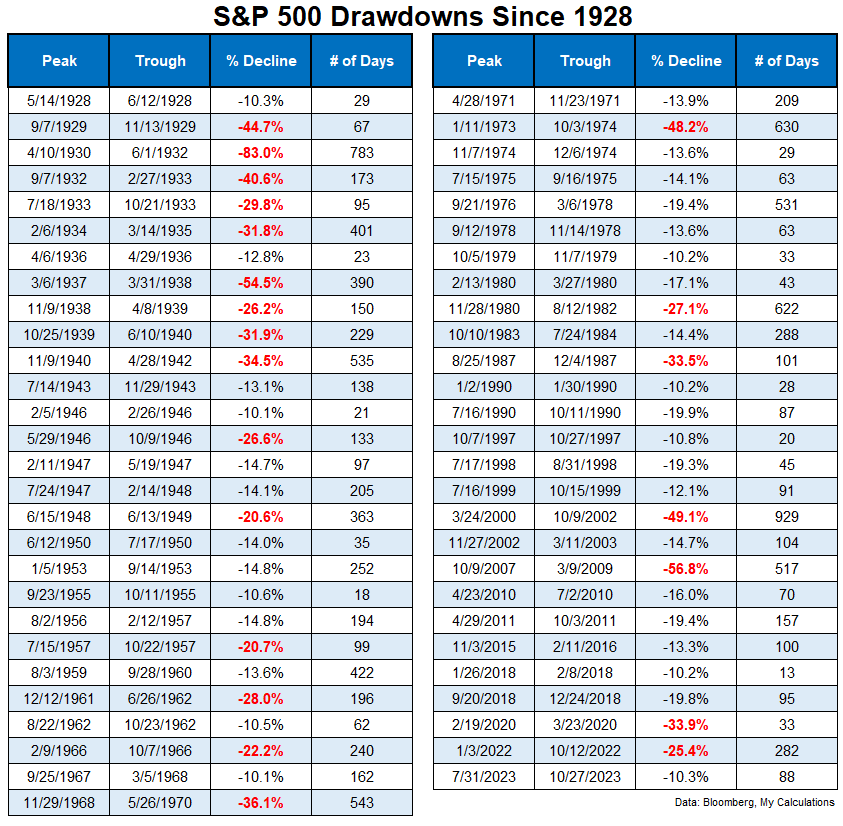

Let’s take a look at the historical double-digit drawdowns of the S&P 500 going back to 1928:

This is a lot of numbers so let’s dig in.1

The bear markets are highlighted in red.

By my count there have been 55 double-digit corrections including 22 bear markets with losses of 20% or worse.2

This would mean the U.S. stock market has experienced a double-digit correction once every year-and-a-half or so and a bear market once every four years, on average.

We haven’t seen back-to-back-to-back bear markets in a really long time — not since the Great Depression and its aftermath.

The Great Depression is obviously the worst volatility we’ve ever seen in the stock market but that late-1930s into the early-1940s time frame was no joke either.

First there was the 1937 echo-crash after everyone assumed the worst of the Great Depression was behind them. Then you had bear markets beginning in 1938, 1939 and 1940.

There were countertrend rallies in between those downturns but that sounds like no fun for investors.

So it is possible to experience multiple bear markets in succession in a short period of time.

Of course, the only time this kind of thing happened was during the Great Depression and its aftermath, running directly into World War II.

It’s no wonder the stock market saw bone-crushing volatility back then.

Using history as a guide, you would have to assume the prospect of another bear market coming again in short order would be improbable.

The counter to this argument would be that cycles are happening faster and faster these days because of technology and the speed of information.

The least satisfying answer ever is I could see it both ways.

The baseline assumption that bear markets and crashes are rare is a good starting point.

I also respect the fact that outlier events and things that have never happened before tend to happen on a regular basis in the markets.

Another bear market this year would be rare but not impossible.

Investing would be a lot easier if you had the ability to know when poor outcomes would occur in advance.

The truth is no one has the ability to predict this stuff.

You could try but I prefer to create an investment plan that builds downturns into it.

Bear markets will happen…you just don’t know when.

Further Reading:

A Textbook Non-Recessionary Bear Market

1A note on the drawdown calculations here — I restarted the drawdowns after gains of 20% or more (which would be considered a new bull market). The Great Depression downturn was one big crash in the grand scheme of things but there were tons of countertrend rallies within that crash before new highs were made. Quibble if you wish but at least I’m consistent.

2There were also five times when stocks fell 19% and change so if you want to round up a little we’re looking at more like 27 bear markets.