Today’s Animal Spirits is brought to you by Spear Funds:

See here for more information on the Spear Alpha ETF

On today’s show, we discuss:

- Mcdonalds earnings

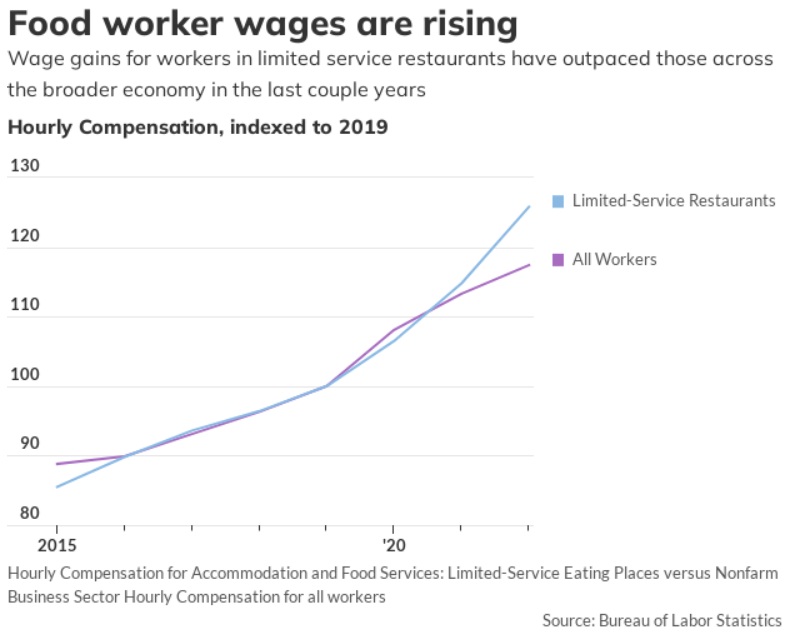

- Yes, that Big Mac meal may cost $18 – but there’s one good reason for it

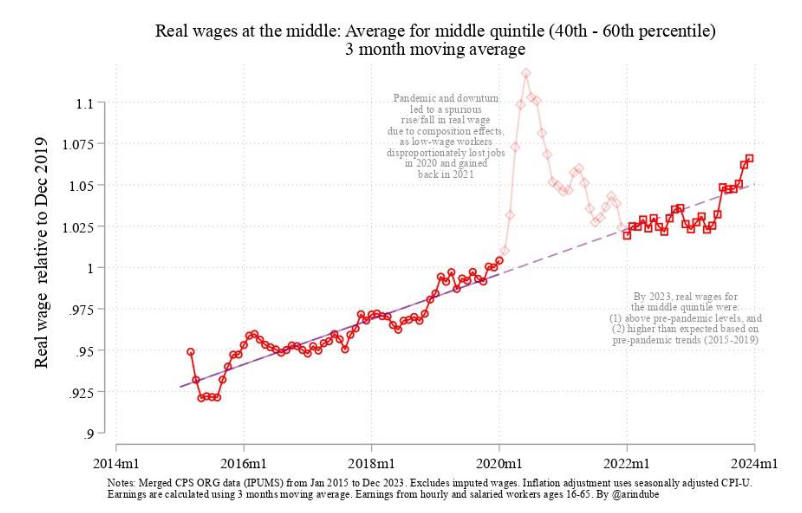

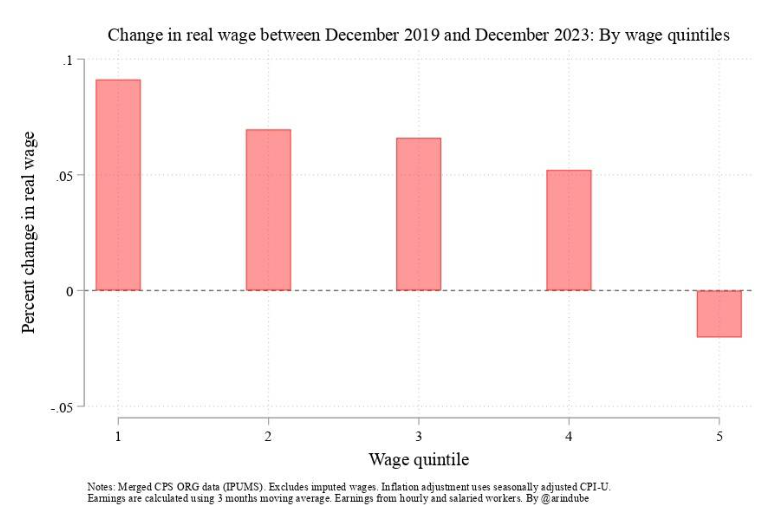

- Credit Bidenomics for rising US wages

- Maybe we’re thinking of the P/E ratio all wrong

- NVDA is now worth as much as the whole Chinese stock market

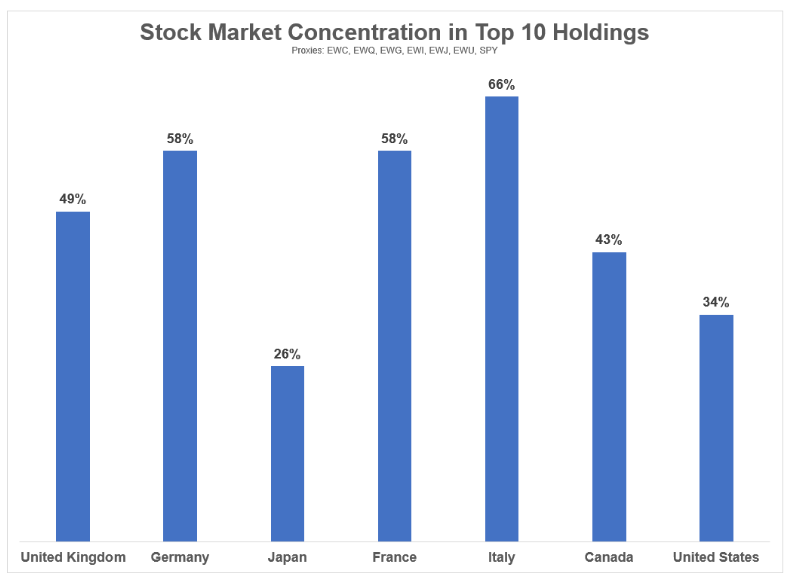

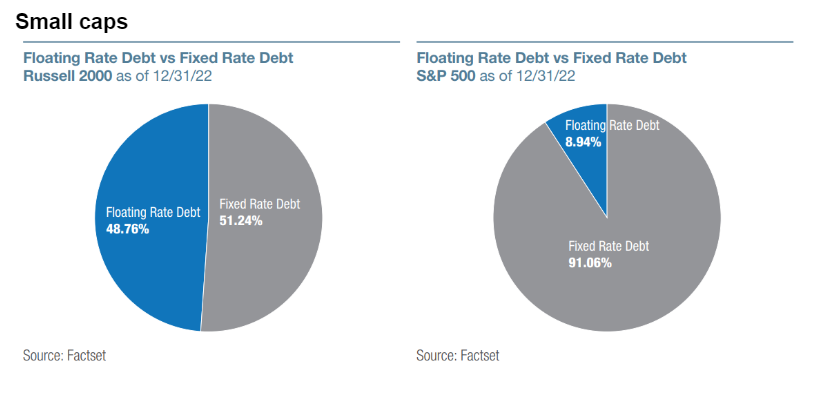

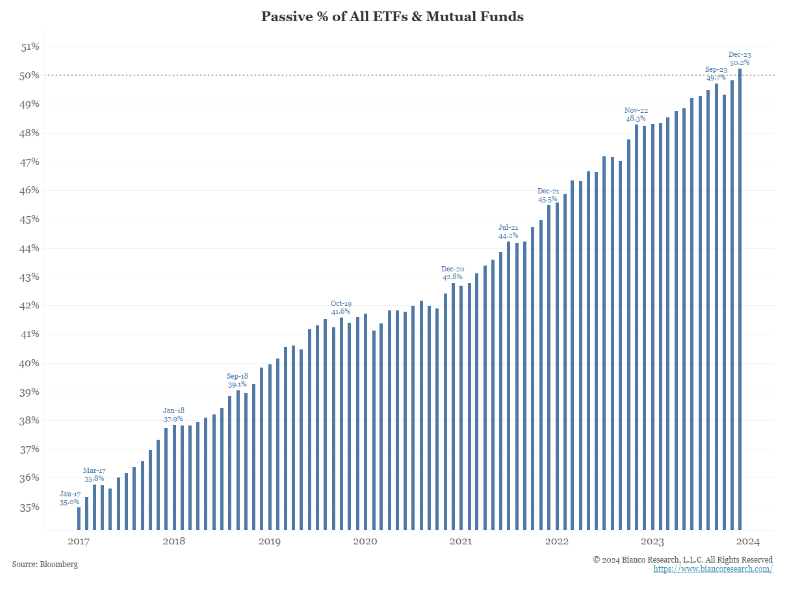

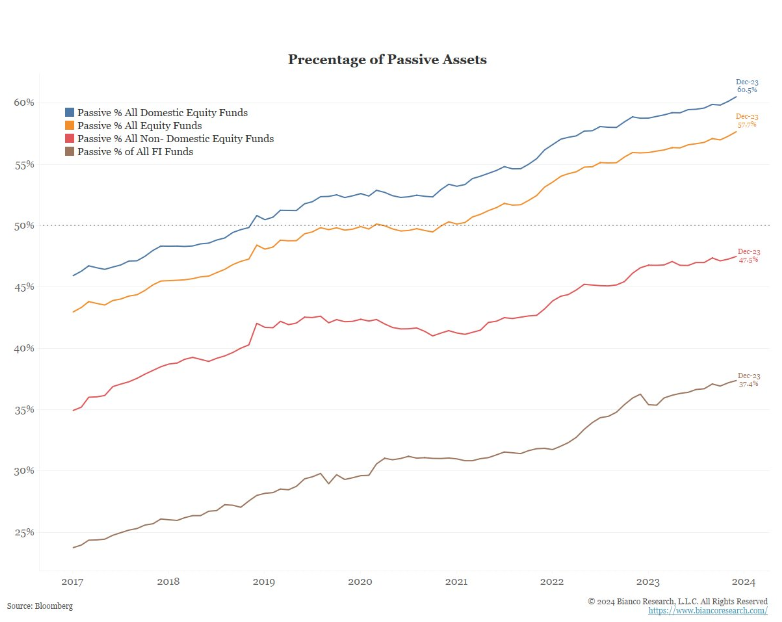

- David Einhorn on passive investing

- The rich list: The 22nd annual ranking of the highest-earning hedge fund managers

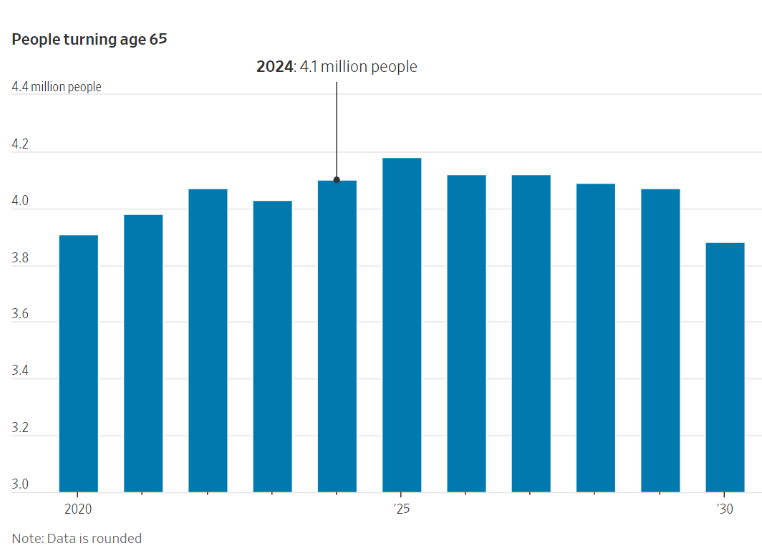

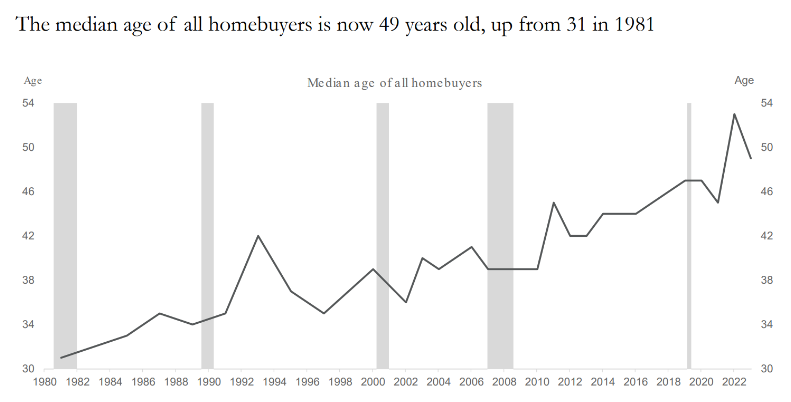

- America has never had so many 65-year-olds. They’re redefining the milestone

- Yellen says commercial property is a worry, but regulators are on it

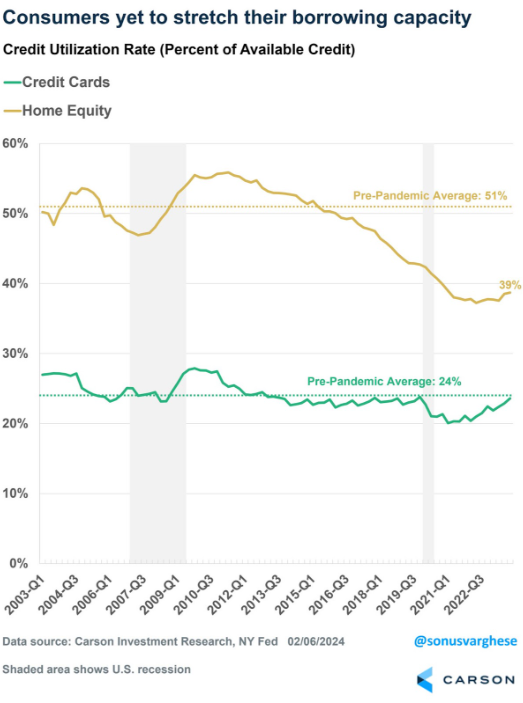

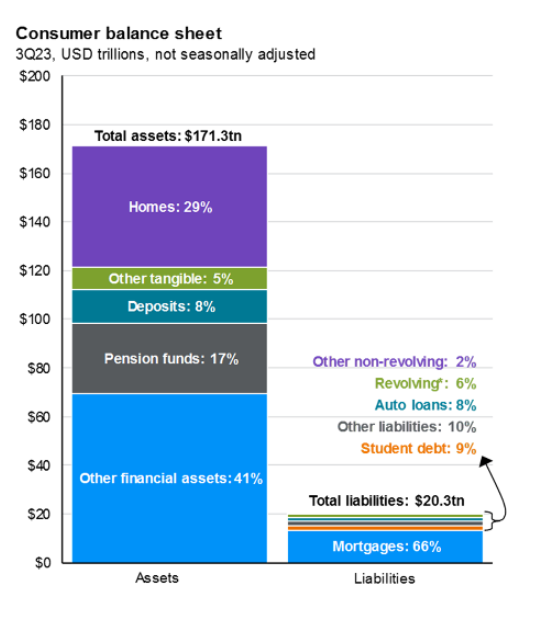

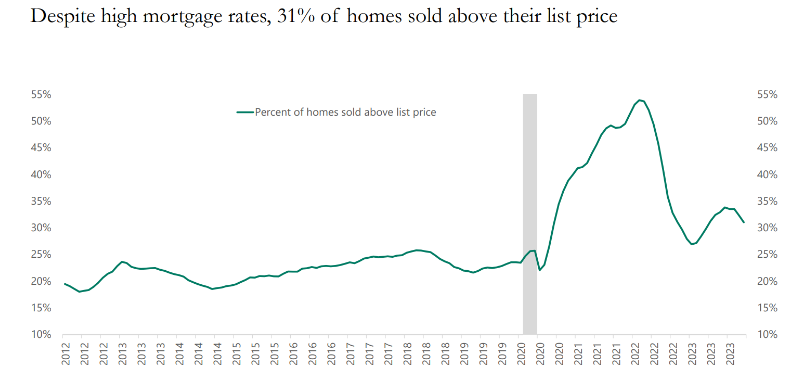

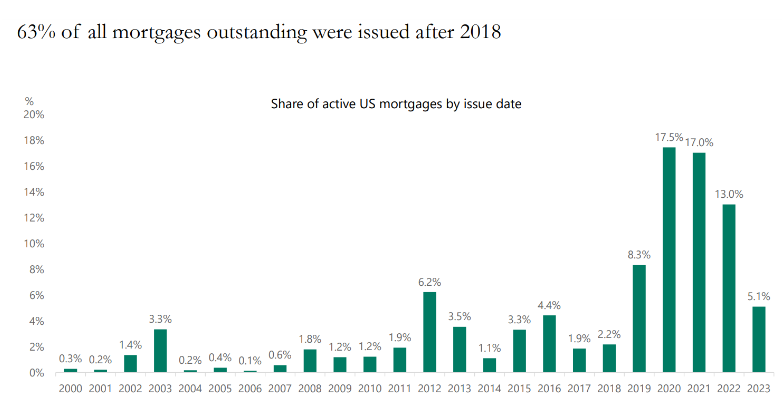

- Apollo on the US Housing outlook

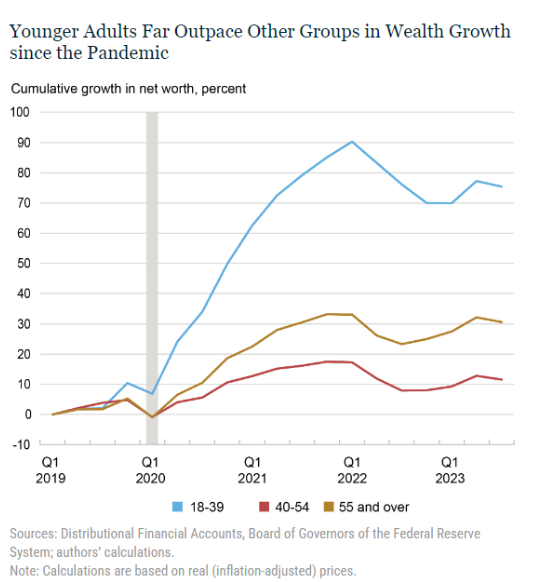

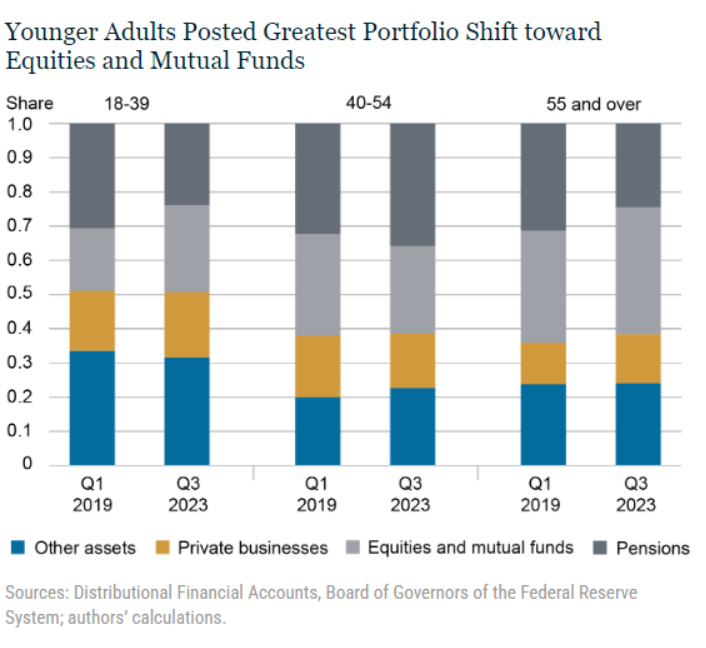

- Wealth inequality by age in the post-pandemic era

- Macro is hard

- Thoughts after 40 hours in the vision pro

Listen here:

Recommendations:

Charts:

Tweets:

Bears: Stocks are a bubble b/c all the returns are from multiple expansion (ME).

Truth: S&P 500 total return past 4 yrs was 58%. Did you know 51% was from earnings and divs, while only 7% was ME?

Yeah, they don't always tell you that part. @sonusvarghese keeps busting myths. pic.twitter.com/AKez1HaE9m

— Ryan Detrick, CMT (@RyanDetrick) February 8, 2024

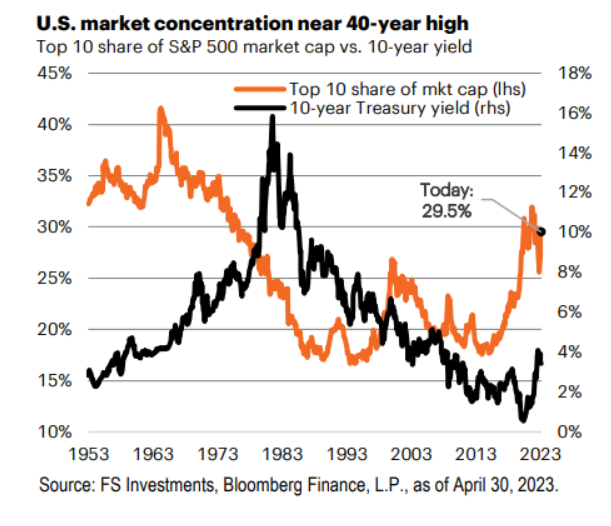

Can it get more extreme? Anything is possible.

Internet Services went up 257% over three months in 1999. pic.twitter.com/R2ck25YNjn

— Dean Christians, CMT (@DeanChristians) February 9, 2024

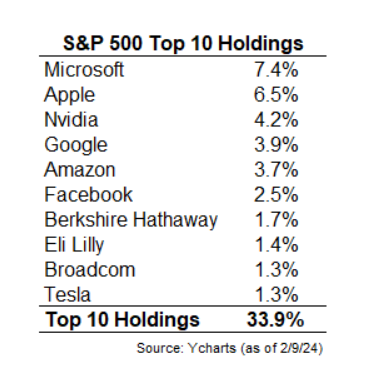

Do index $$ impact valuations? Of course.

But I’d note the biggest bubbles of the last 5 years were:

SPACS

Direct listings

Private rounds

Crypto / NFTs

Collectibles

Self storage

Private creditOne thing all of them have in common?

They were never (or barely) in index funds.

— Jake (@EconomPic) February 10, 2024

One of the biggest mistakes by finance idiots* is to conflate tail risk awareness with bearishness.

Believing in Black Swans ≠ Permabears.

* Short for fucking idiots. pic.twitter.com/Jd3uWPgqJg

— Nassim Nicholas Taleb (@nntaleb) February 7, 2024

Lowest outflow day yet for $GBTC — $51.8 million https://t.co/YK5Wplyil8

— James Seyffart (@JSeyff) February 9, 2024

First time in four years, McLaughlin finds more Americans say America isn't in a recession than is in one pic.twitter.com/JaQuQE0Wvg

— Polling USA (@USA_Polling) February 7, 2024

After hearing @awealthofcs speak on the Vision Pro with @michaelbatnick I thought of the following. Ben is in the endgame now. pic.twitter.com/6R6N7AgLYD

— Webster (@Web_IV) February 8, 2024

Contact us at animalspirits@thecompoundnews.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.