Today’s show is brought to you by Teucrium

We had Sal Gilbertie, CEO of Teucrium on the show to get an update on global commodity markets in 2023.

On today’s show, we discuss:

- Where the name Teucrium comes from

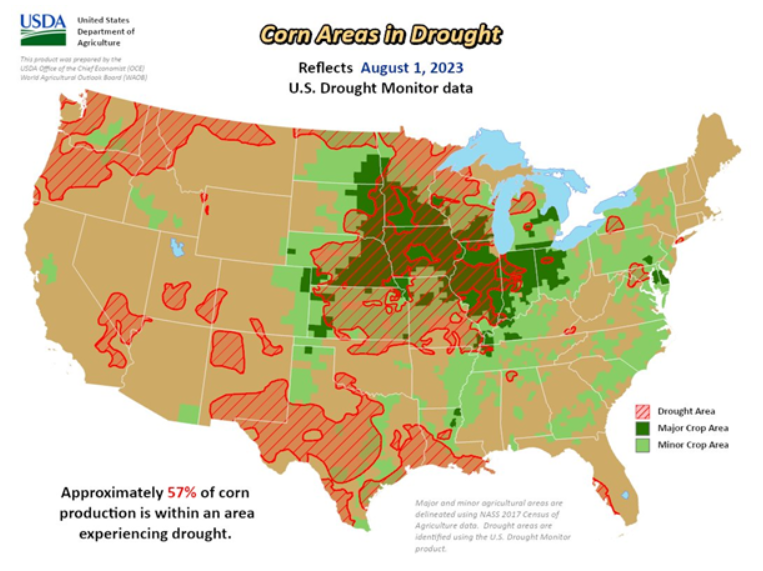

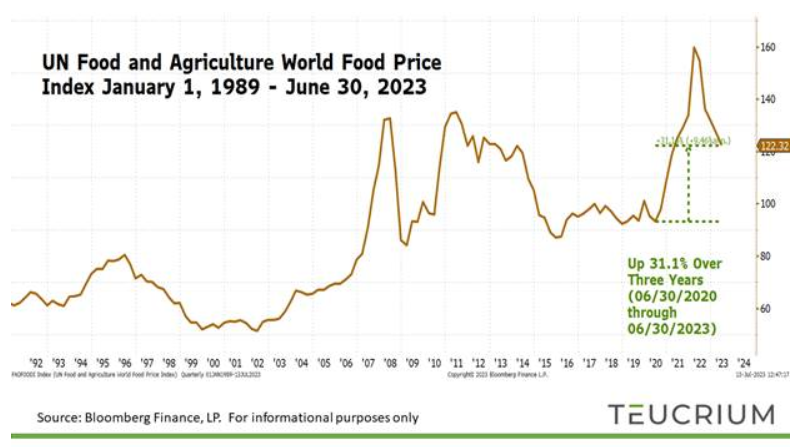

- An update on supply and demand dynamics in agricultural markets

- The golden grain cycle

- The cost of production and expected returns for commodities

- Teucriums long short agricultural fund

- How everyone got the price of oil wrong

- How commodity ETFs utilize futures, and what that does to returns

- Supply and demand within the Bitcoin market

- How the US Dollar fits in the commodity market

Listen here:

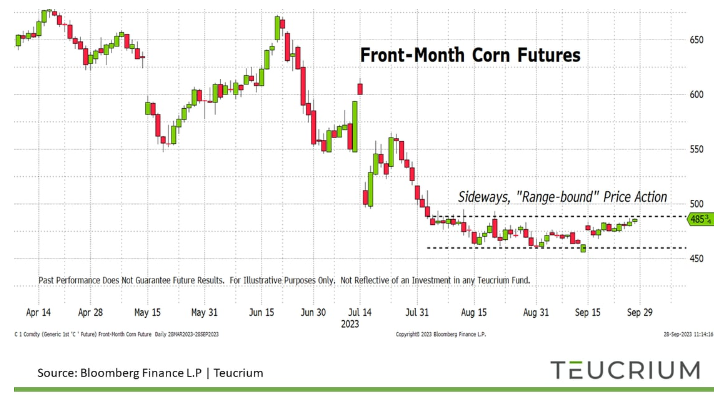

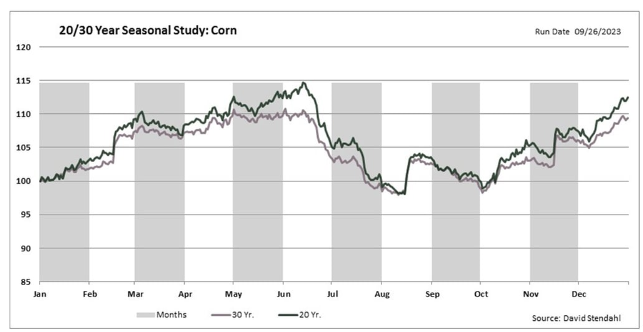

Charts:

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship, or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.