Some things I’ve been thinking about lately:

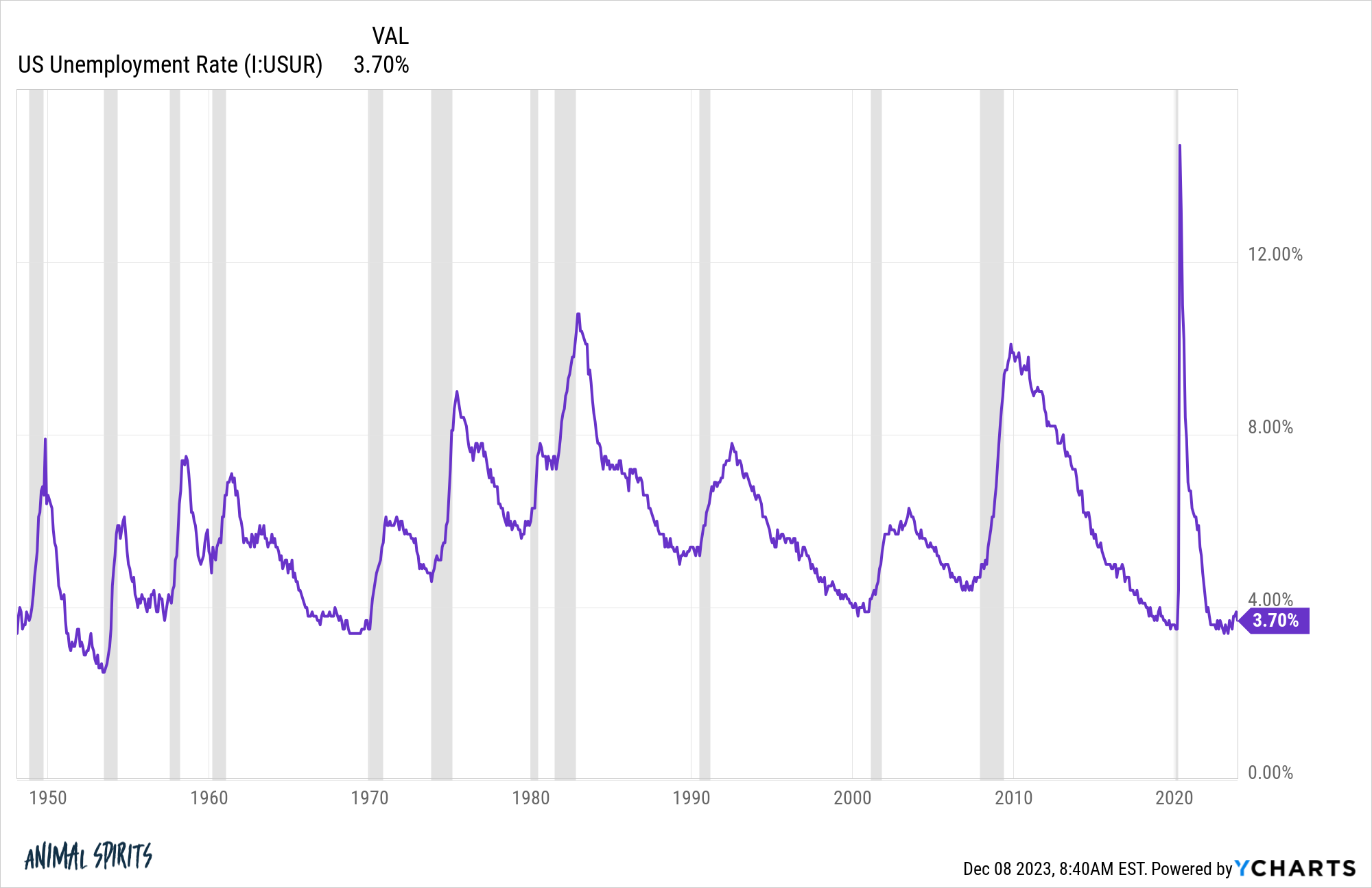

1. I think this is the strongest labor market we’ll see in my lifetime. Since the Fed began raising rates in March 2022, the U.S. economy has added more than 6 million new jobs. This year we’ve added 2.5 million jobs.

The whole idea of rate increases was to slow consumer demand which would cause companies to cut back which would lead to job cuts which would slow inflation.

And yet…

We’ve now experienced 22 months straight with the unemployment rate below 4%.

That hasn’t happened since the 1960s. The unemployment rate was never below 4% even once during the 1970s, 1980s or 1990s.

We might never see a labor market like this again for a long time.

Enjoy it while it lasts.

2. I think we could see much higher consumer sentiment numbers in 2024. Economists have been heavily debating why consumer sentiment is so wretched despite a resilient economy.

As fun as this debate has been, I’m hopeful 2024 will see a spike in consumer sentiment towards the economy.

Gas prices are falling. The inflation rate is steadying. Mortgage rates are falling (and will hopefully fall further). The Fed is probably going to cut rates in the first half of 2024. Wages are growing faster than inflation again.

Assuming we avert a recession yet again, I’m bullish on consumer sentiment in 2024.

3. I think the perfect number of beers in one night is 3. Just a random thought I had on Twitter:

Deep thoughts with Ben.

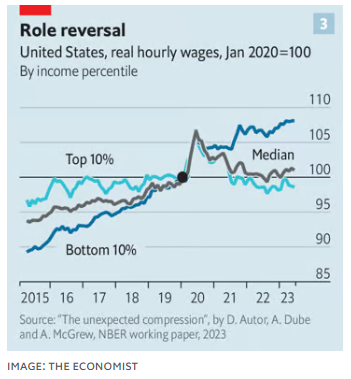

4. I think no one could have predicted a pandemic would reduce inequality. The Economist shared the results of a new research paper that shows an unintended consequence of the strong labor market from the pandemic is a reduction in income inequality:

In a recent paper, Mr Autor and colleagues demonstrate that tight American labour markets are leading to fast wage growth, as workers switch jobs for better pay, and that poorer employees are benefiting most of all (see chart 3). The researchers reckon that, since 2020, some two-fifths of the rise in wage inequality over the past four decades has been undone.

Here’s the chart mentioned:

Wage growth for the bottom 10% has outpaced wage growth from the top 10% since 2020 by a healthy margin.

I know things aren’t perfect but this is a good thing!

5. I think pizza is a wonderful hedge against inflation. One of my favorite parts of having kids is introducing them to family traditions and starting new ones.

We watch Home Alone together every year now.

I’ve seen it so many times now that I’m always looking for minor details to keep me entertained.

There’s this interaction at the beginning of the movie when the Little Nero’s delivery man shows up with 10 pies for the McCallisters:

Peter McCallister: Honey, the pizza boy needs $122.50 plus a tip.

Kate McCallister: For pizza?

Uncle Frank: Ten pizzas times 12 bucks.

This movie came out in 1990. A decent pizza was 12 bucks more than 30 years ago. Adjusted for inflation, that’s nearly $30.

You can get a high-quality pizza for something like $15-20 these days. Dominos still sells a quality pizza for $7.99.

How is pizza still so relatively inexpensive?

A huge win for the consumer.

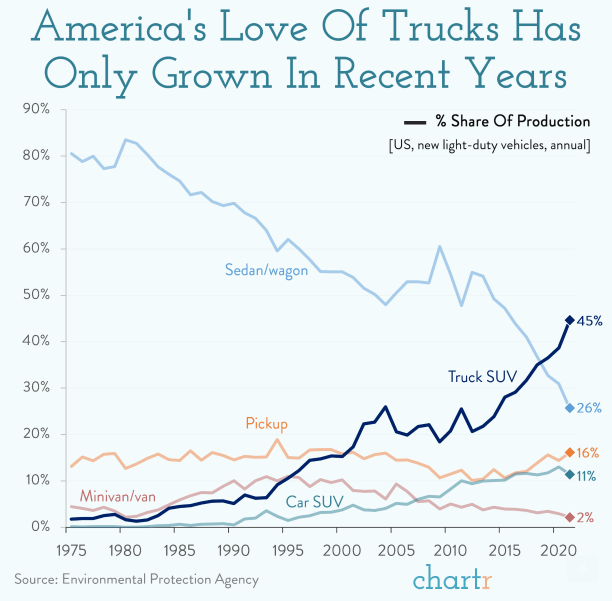

6. I think we buy too many trucks and SUVs in this country. Look at this chart:

The crazy thing here is people had more kids back in the 1970s and 1980s than we do now. Somehow they survived without one of those huge boats with three rows and a massive trunk.

The biggest SUVs and trucks can run $70k or $80k. It’s ridiculous!

I know I’m a broken record on this topic but I think people are crushing their finances to finance vehicles they don’t need.

Some people obviously need a truck or giant SUV but far too many consumers are paying way too much for their vehicles.

Full disclosure: I drive an SUV! I’m (kind of) a hypocrite.1

7. I think now is not a bad time to buy a house (if you can afford it). I’m not a fan of timing the housing market.

If you can afford the monthly payment along with the ancillary costs and you want/need to buy a house you should do it. A house is unlike any other financial asset because it’s the roof over your head.

But I’m sure many potential homebuyers are figuring out the best time to buy considering the awful affordability numbers right now.

It’s tough because supply is so low, making it difficult to find the house you want. But if mortgage rates fall to 5% or 6% we’re going to see a flood of activity from pent-up demand and pent-up supply from those who didn’t want to sell.

There are going to be multiple offer situations again.

If you could buy now and refinance later, you’re probably in a better negotiating position than you’d be in if/when rates fall.

The housing market is still very unhealthy but just some food for thought if you’re in the market.

8. I think now is a great time to increase your charitable giving if you can afford it. Regardless of the strong labor market and economy, there are people out there who are hurting.

If your net worth is at new all-time highs and inflation is not putting a major dent in your budget, the holidays are a wonderful time to give back or reconsider your charitable giving.

A number of years ago I automated my charitable giving to various organizations but it’s probably time to increase those amounts.

I’m not looking for a pat on the back or anything, but if your finances are in a good position, now is a good time to give to those less fortunate.

Further Reading:

5 Questions I Have About the Economy

1To be fair, I drive a Ford Explorer. That’s like the Honda Accord of SUVs.