Today’s Animal Spirits is brought to you by Amplify ETFs:

See here to learn more about Amplify’s free cash flow focused ETFs

Register here for Episode 1 of The Smoke Show, on November 15th at 2PM Eastern

On today’s show, we discuss:

- Why ‘Bidenomics’ falls flat

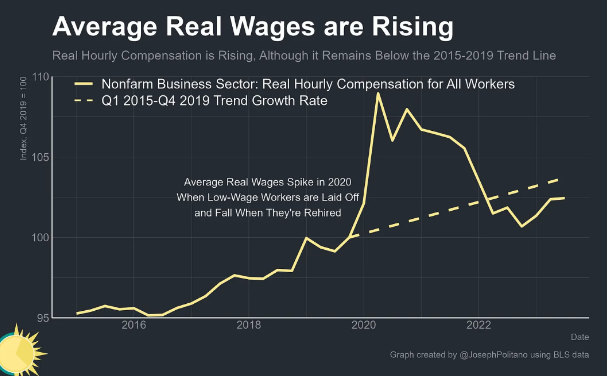

- Are real wages rising?

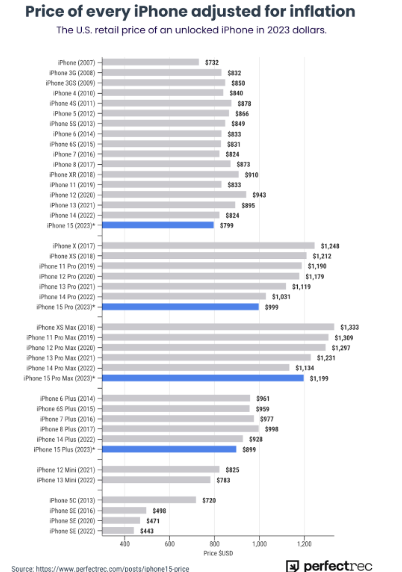

- Confirmed: The iPhone 15 is the most affordable iPhone since 2007

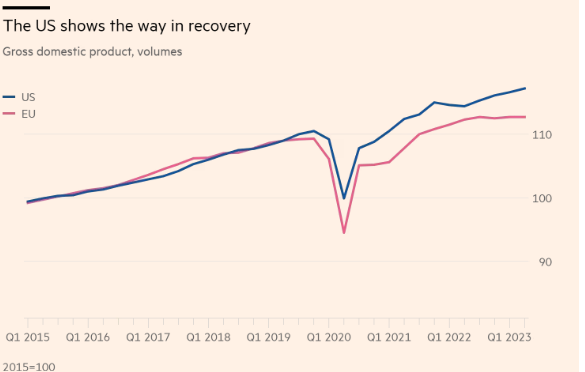

- What the US got right that Europe did not

- 2021: America’s workers are leaving jobs in record numbers

- Today: The new headache for bosses: Employees aren’t quitting

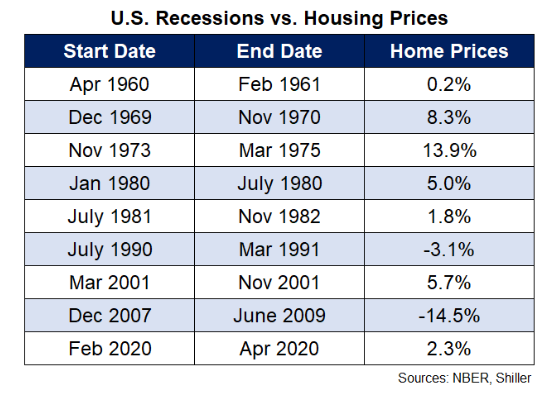

- Why home prices won’t crash in the next recession

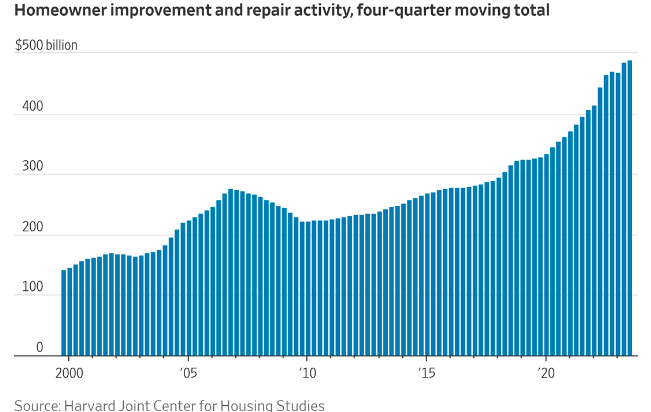

- Buying a home isn’t happening, so they’re spending and saving differently

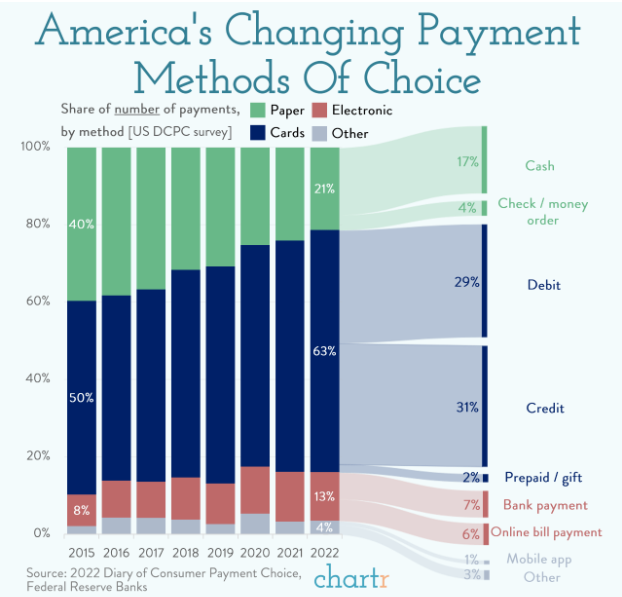

- Americas changing payment methods of choice

- We need to talk about your retirement ‘spending’

- Americans are pulling money out of their 401(k) plans at an alarming rate

- Iger lays out vision for Disney’s future

Listen here:

Recommendations:

- David Spade on the Pete & Sebastian Show

- The Curse

- Candy Cane Lane

- Old Dads

- When Evil Lurks

- Best movies for the rest of the year

- Ghostbusters: Frozen Empire

Charts:

Tweets:

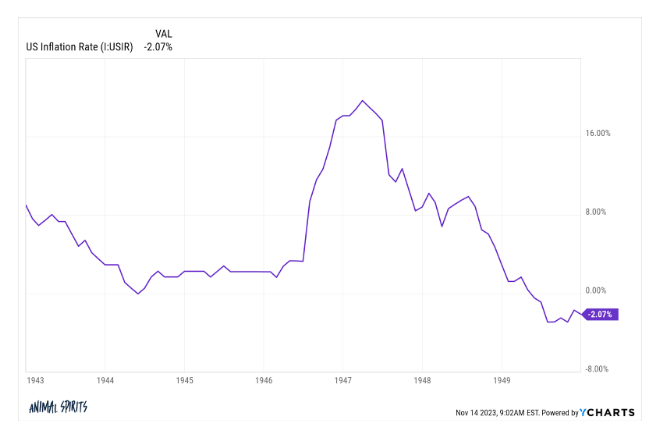

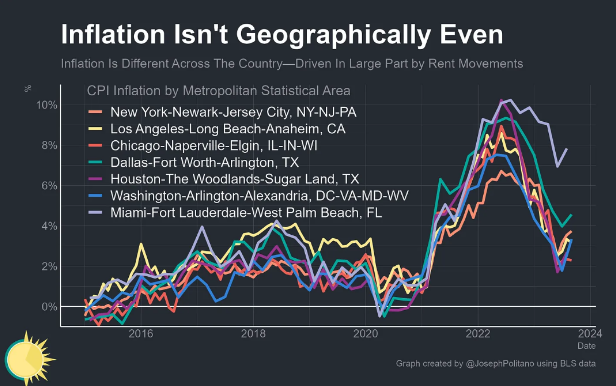

THE OCTOBER CPI REPORT

Inflation slowed down again

Gas prices are working in your wallet's favor again

Services inflation is…picking up again?

The trend is clear(ish), a good sign if you're worried about rates pic.twitter.com/ku54FC3eUs

— Callie Cox (@callieabost) November 14, 2023

WALLER: WHAT PEOPLE HAVE IN MIND NOW IS FOR PRICES TO RETURN TO EARLIER LEVELS, AND "THAT IS NOT GOING TO HAPPEN"

— *Walter Bloomberg (@DeItaone) November 7, 2023

the median voter wants double-digit deflation, a booming economy, a tight labor market except for low-level service workers, and rising home prices except when they want to buy and frankly, is that too much to ask for?

— Ben Walsh (@BenDWalsh) November 14, 2023

MORGAN STANLEY: “We initiated our soft landing call in March 2022, maintained that call for 2023, and are rolling it forward” for 2024. We see core PCE falling to 2.4% in 2024, with the Fed cutting rates beginning in June.

“Four 25bp cuts in 2024 and eight in 2025 ..” [Zentner] pic.twitter.com/xOVFAYmQ6I

— Carl Quintanilla (@carlquintanilla) November 12, 2023

BofA: Consumer spending moderated in October with total card spending falling 0.2%.

Aggregated credit and debit card spending per household fell 0.5% year-over-year pic.twitter.com/yzskIj2An1

— Mike Zaccardi, CFA, CMT

(@MikeZaccardi) November 9, 2023

NY Fed's Global Supply Chain Pressure Index fell in October https://t.co/4uuIS9Jodm pic.twitter.com/RnhroGPzYu

— Sam Ro

(@SamRo) November 6, 2023

2) The Sahm rule is: when the three-month moving average of the national unemployment rate rises by 0.50 percentage points or more relative to its low during the previous 12 months, we are in a recession.

— Claudia Sahm (@Claudia_Sahm) November 3, 2023

For all the talk of a recession, job openings in "virtually every industry" are above 2019 levels. Both the layoff rate and initial jobless claims are still low –Goldman pic.twitter.com/zQrzHe0fMT

— Gunjan Banerji (@GunjanJS) November 12, 2023

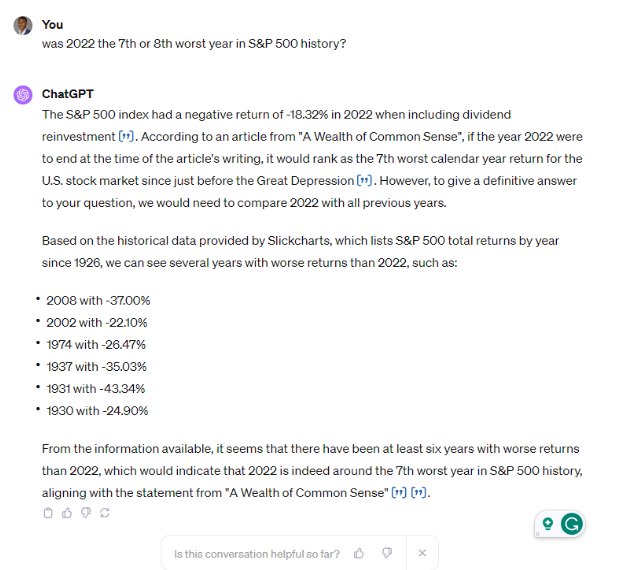

The S&P 500 has gone 467 trading days without making a new all-time high.

After the Great Depression it went more than 6,000… pic.twitter.com/98h4KhEUUK

— Bespoke (@bespokeinvest) November 12, 2023

We officially saw a super rare Zweig Breadth Thrust today. Thanks to @NDR_Research for the data.

This rare signal is simply stocks moving from very oversold to overbought in less than two weeks.

All you need to know is since WWII, the S&P 500 is higher a year later every time. pic.twitter.com/4iAaf3nsSY

— Ryan Detrick, CMT (@RyanDetrick) November 3, 2023

Russell 3,000 names by cumulative short PnL over the past decade. Shorts made about $80 billion of dollar profits on about 30% of names, and lost $900 billion total across all names over 10 years. pic.twitter.com/KQ3snfsdCT

— Quantіan (@quantian1) November 6, 2023

Small-caps now represent less than 4% of the total US equity market.

via Jefferies pic.twitter.com/XomHVD2lg6

— Daily Chartbook (@dailychartbook) November 10, 2023

In the coming week, the Russell 2000 will have gone 500 trading days, nearly two full years, since it last closed at a 52-week high. That's the 3rd-longest streak in the index's history. Learn more: https://t.co/2XJ9j5GtBl @jasongoepfert

— SentimenTrader (@sentimentrader) November 4, 2023

Russell 2000: "Cheapest our absolute valuation model has been since Dec. ‘12." $IWM $RUT

– Jefferies pic.twitter.com/EFkVaZD6rX

— Daily Chartbook (@dailychartbook) November 13, 2023

2020: no one wants to work

2021: The Great Resignation

2022: quiet quitting

2023: no one wants to quit anymore

these are all weird ways for the media to describe the hottest labor market we've experienced in like 40 years

— Ben Carlson (@awealthofcs) November 6, 2023

Bitcoin's market demand has outpaced its supply, a clear sign of robust positive momentum.

In just one day, a whopping 700,000 new BTC addresses joined the network. This expansion is considered one of the most reliable indicators for price predictions.

With fewer BTC coins… pic.twitter.com/zAcgFc9LkS

— 𝗡𝗲𝗴𝗲𝗻𝘁𝗿𝗼𝗽𝗶𝗰 (@Negentropic_) November 6, 2023

The craziest thing about someone bidding $3,000,000 just now for something that’s actually — finally — totally worthless is the owner wont even accept it. pic.twitter.com/5wWd2HLoqN

— Stats (@punk9059) November 11, 2023

(Bloomberg) – The average 30-year mortgage rate plunged last week by the most in more than a year, helping generate the biggest advance in home purchase applications since early June.@business $XHB @LiveSquawk https://t.co/pGOdFIPkKP

— Carl Quintanilla (@carlquintanilla) November 8, 2023

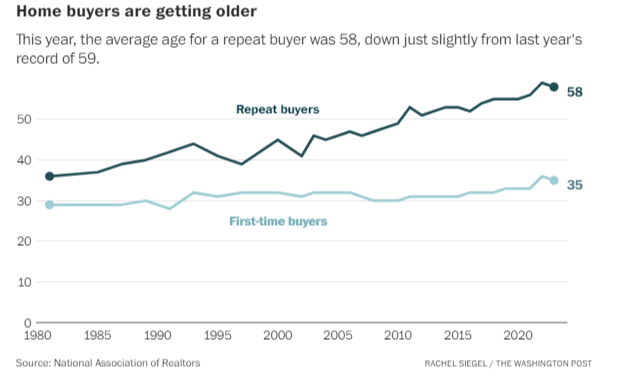

First-time buyers made up 32% of all home buyers, up from last year’s historic low of 26%, but still below the average of 38% since 1981. #NARHBS

— NAR Research (@NAR_Research) November 13, 2023

Actually, no. It sold for $875,000… in 1989! Seven times the median home sale that yearhttps://t.co/G8WheWQ5cJ https://t.co/Tr6U7cCHiu

— Jeremy 'adjusted for inflation' Horpedahl

(@jmhorp) November 12, 2023

Expedia CEO on the consumer: "We haven't seen really anything on the consumer side. We keep looking…you'd have to squint it really hard and look by sub subregion to try to and cut it by price point and a lot of things to really see anything noticeable"

— The Transcript (@TheTranscript_) November 5, 2023

Ad markets picking up from the lows.

News Corp CEO: "Specifically at Dow Jones, advertising was down 3%, which was a marked improvement after a 14% decline in the prior quarter. Both digital and fringe reported improvement in trend lines"$NWSA

— The Transcript (@TheTranscript_) November 11, 2023

64% of Americans would welcome a recession if it meant lower mortgage rates, per USA Today.

— unusual_whales (@unusual_whales) November 11, 2023

Who's missing their credit card payments?

Answer: Millennials**Millennial credit card delinquencies are now higher than pre-pandemic**, NY Fed data shows.

Credit card delinquencies are rising particularly quickly for those with auto and student loanshttps://t.co/4vKXs5X9QC pic.twitter.com/j9o2gjUrSH

— Heather Long (@byHeatherLong) November 7, 2023

Record-high share of US consumers planning to go on vacation to a foreign country within the next six months.

(Via Apollo/Slok) $JETS $XAL pic.twitter.com/M9F4Qv0mjo

— Carl Quintanilla (@carlquintanilla) November 12, 2023

Paramount said streaming subscribers will see even more price increases moving forward — a trend that's permeated throughout the entire media industry. https://t.co/Sq9yxcDP52 pic.twitter.com/gdgB6VKnIl

— Yahoo Finance (@YahooFinance) November 5, 2023

‘THE MARVELS’ earns $21.3M in the film’s domestic opening day, the lowest in MCU history.

Read our review: https://t.co/QKIzAqo1Dz pic.twitter.com/dtAZpULPD5

— DiscussingFilm (@DiscussingFilm) November 11, 2023

Contact us at animalspirits@thecompoundnews.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.