People have been predicting a housing market crash ever since prices took off like a rocketship early in the pandemic.

Housing is a bubble!

Just wait for all of the Airbnb hosts that are forced to sell!

Rising mortgage rates mean housing has to crash!

It’s the big short all over again!

Who knows maybe housing prices will fall or even crash eventually. I can’t predict what’s going to happen next in this crazy market.

But so many people talk about falling housing prices as if it would be a bad thing, like a repeat of the 2008 crash. I actually think housing prices falling would be a good thing.

Think about it.

Tons of people have locked in ultra-low interest rates. Home equity is through the roof. Homeowners in this country have never had a bigger margin of safety for falling prices.

In fact, I’d argue falling housing prices would be a boon to the economy. There is surely pent-up demand in the housing market from the millions of young millennials looking to settle down and buy a place of their own.

If prices were to fall, I believe you would see a huge upswing in homebuying activity.

More people would list. More people would buy. Inventory numbers would rise. And when there is activity in the housing market, people spend money. Lots of it — moving, furniture, decorations, lawncare, renovations, etc.

The worst-case scenario for the housing market is if mortgage rates stay relatively high and housing prices refuse to fall.

In that case, affordability stays high and we have an entire generation of people who are either boxed out from ever owning a home or forced to pay an ever-increasing portion of their budget on a home.

You get into a situation of haves and have-nots in the housing market. The only ones who can afford are people who make a lot of money, already own a home or get help from their parents.

Plus a huge part of the economy is basically benched.

That’s unhealthy and unfair for young people who have done nothing wrong besides entering their prime household formation years during a terrible, no-good time to buy a home.

There is precedent for an unhealthy housing market becoming even unhealthier.

Canada is a prime example I’ve written about on this blog in recent months (here and here). Canadian home prices went crazy in the 2010s but then somehow found another gear and went to ludicrous levels in the 2020s.

This also happened the last time we had a large demographic enter their household formation years in the United States as well.

The 1970s were a horrible decade for financial assets. Stocks and bonds each technically showed gains on a nominal basis but lost money after accounting for inflation.

Housing was the only financial asset that beat inflation on behalf of the middle class.1

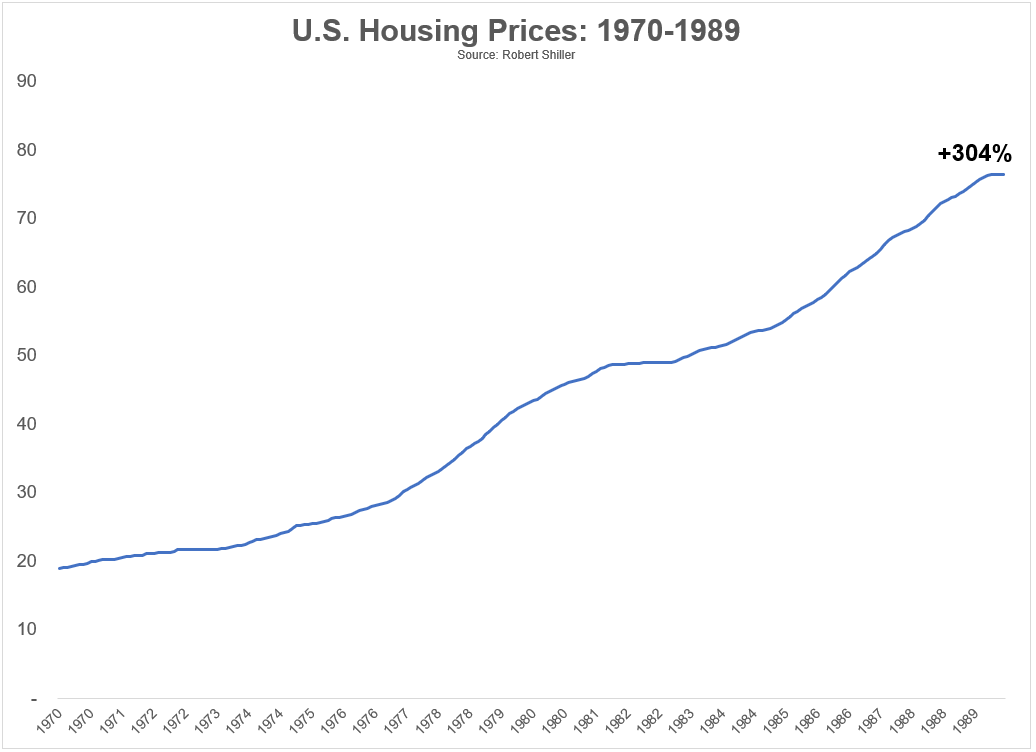

According to data from Robert Shiller, national housing prices were up nearly 130% in the 1970s. Even after accounting for sky-high inflation that decade, housing prices were up double-digits on a real basis.

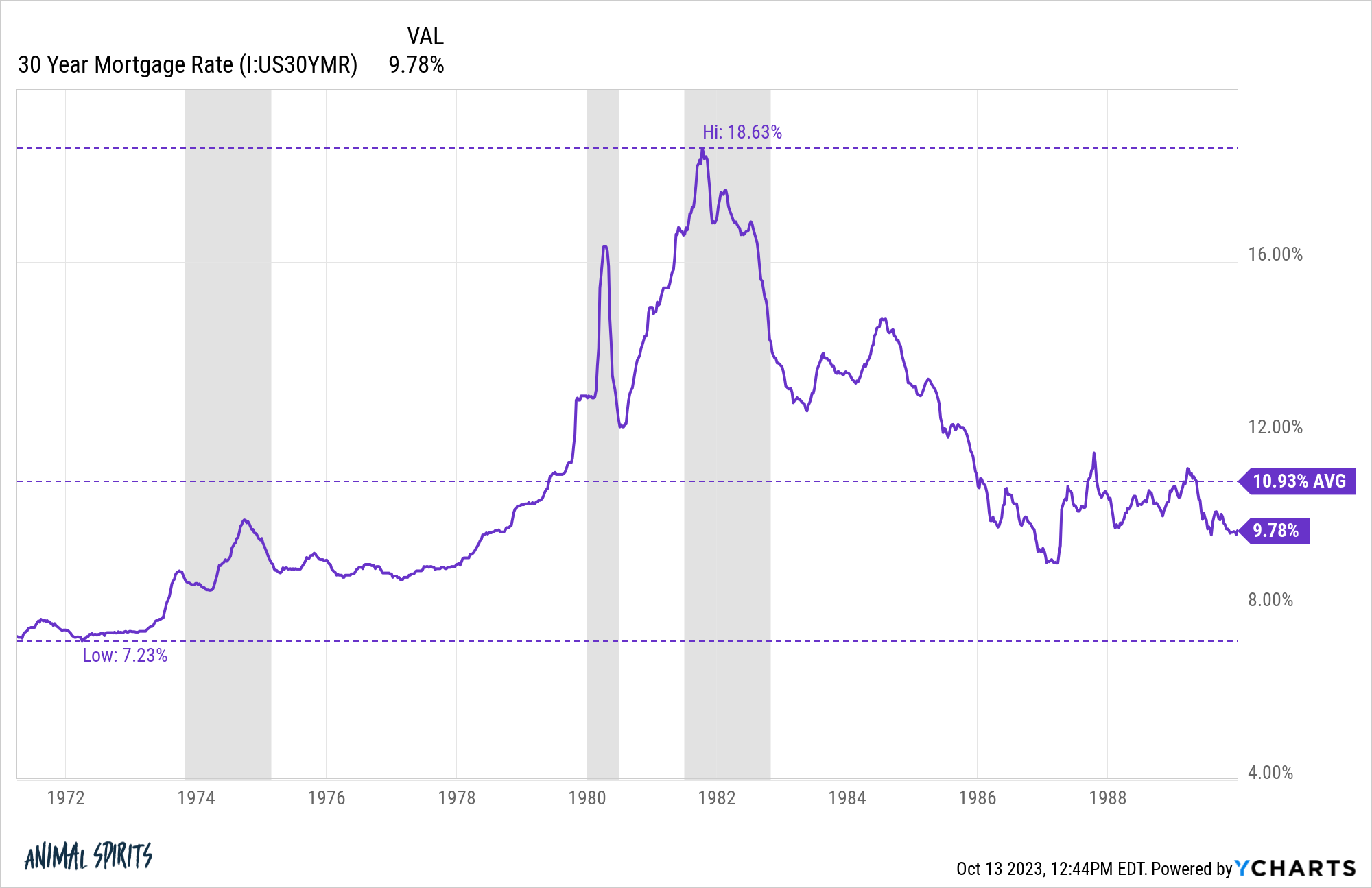

The problem for homebuyers is mortgage rates were rising too:

For a 30 year fixed rate mortgage, the lowest borrowing rate was a little more than 7%. By the end of the 1970s you were looking at 12% mortgages. As Paul Volcker’s Fed tried to snuff out inflation, mortgage rates topped out at nearly 19% by 1981.

Sure, housing prices were much lower back then but affordability in monthly payments in the early-1980s experienced a similar spike as what we’ve witnessed today, through a combination of both rising housing prices and an insane spike in borrowing rates.

The problem for homebuyers back then, much like today, is housing prices refused to come down. Here’s a look at housing price growth in the 1970s and 1980s:

Yes, things were more muted on an inflation-adjusted basis but the combination of ever-rising prices coupled with double-digit mortgage rates couldn’t have been easy to stomach.

Housing prices took a little breather in the early-1980s until mortgage rates finally came back down a bit but it’s not like you saw falling prices even after mortgage rates went into the stratosphere.

No two economic or market environments are ever the same but a similar dynamic playing out in the housing market today is the nightmare scenario.

It would be far healthier if we did see prices fall to spur housing activity and offer some relief to buyers who have been priced out of the housing market.

The worst-case scenario for the housing market is not a drop in prices.

Quite the opposite.

The worst-case scenario for the housing market is a continuation of the current environment where owning a home becomes unaffordable for a larger and larger subset of the population through no fault of their own.

People who already own their homes would be happy to see prices continue going up but it would be more beneficial to the economy and make for a healthier housing market in the long run if prices went down a little.

Further Reading:

Where the Housing Bubbles Are

1Gold was far and away the best-performing asset in the 1970s but let’s be honest — it was basically impossible for regular investors to buy gold back then unless they wanted to store gold bars in a safe. There was no GLD to invest in.