Today’s Animal Spirits is brought to you by YCharts:

See here to register for YCharts webinar discussing this quarter’s top 10 visuals for clients and prospects.

See here for more information on our live event, live from the Nascar Hall of Fame!

On today’s show, we discuss:

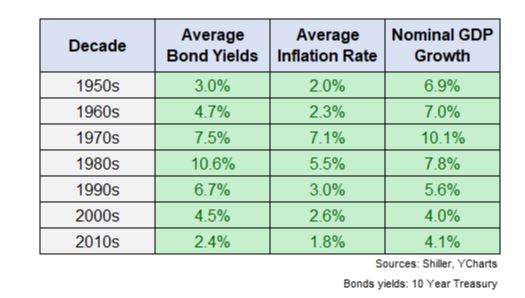

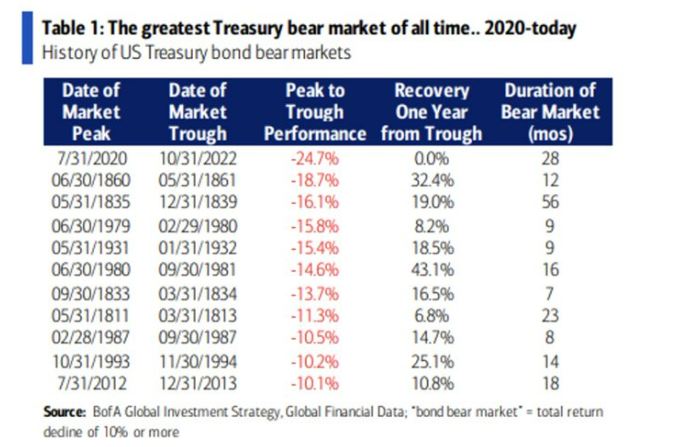

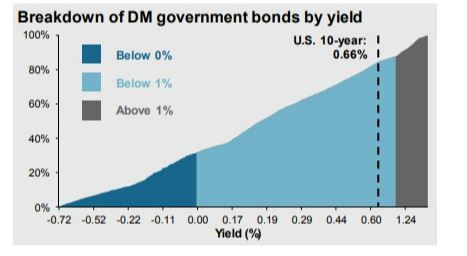

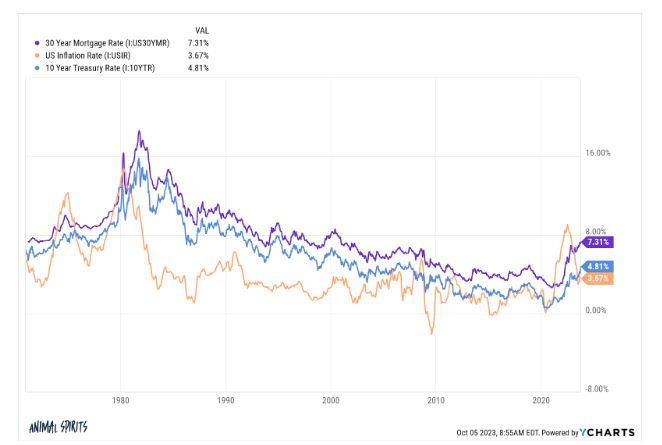

- Are bond yields too high, or too low?

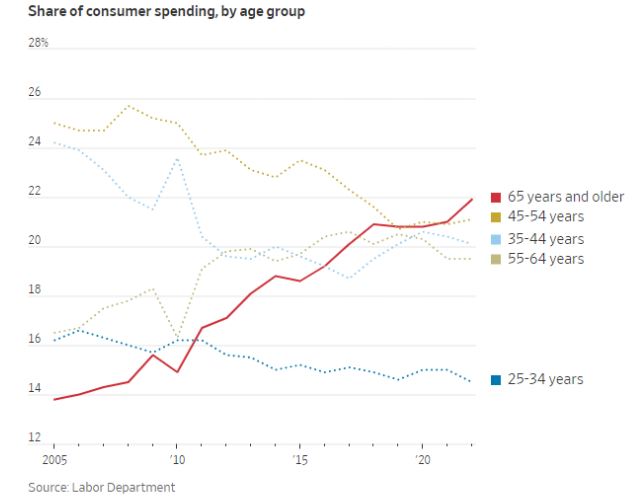

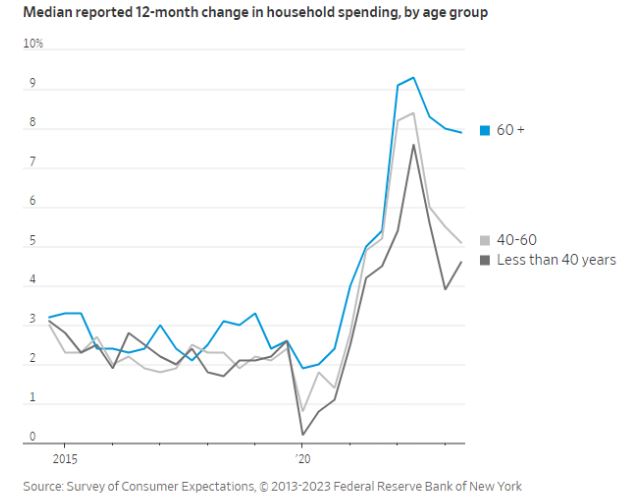

- The US economy’s secret weapon: Seniors with money to spend

- Investors are yanking cash from stock funds, fast

- Airlines are just banks now

- Millennials on better track for retirement than Boomers and Gen X

Listen Here:

Recommendations:

Charts:

Tweets:

Yeah, the tell is the Dollar Index. If yields were rising because of “bond vigilantes” the Dollar Index would be lower. But the Dollar Index has been rising which tells us yields are rising because of higher expected economic growth (and hence higher long term rates). https://t.co/OPGekF3L6o pic.twitter.com/Iouhm4ZWS9

— Cullen Roche (@cullenroche) October 6, 2023

This "curve is steepening, recession is coming" trope needs to die.

Yes, the yield curve has suddenly steepened before (and during) recessions, BUT because the Fed has cut rates (which brings the short end of the curve down).

Not the same situation right now. pic.twitter.com/54vzXrSm1Z

— Callie Cox (@callieabost) October 4, 2023

Normally at the end of Fed tightening cycles, bonds rally.

This time has been different: investors had priced in—and are now pricing out—a recession with a quick turn towards rate cuts https://t.co/eVS4bt42K4 pic.twitter.com/oscOvSQc1D

— Nick Timiraos (@NickTimiraos) October 4, 2023

Do Rising Treasury Yields Make Stocks unattractive and too expensive?

The nominal equity risk premium comparing earnings yields to the 10-year treasury yield is at lowest levels in about 20-years.

Yet stocks are real assets… the more appropriate comparison is vs TIPS pic.twitter.com/U0i6AFQxPi

— Jeremy Schwartz (@JeremyDSchwartz) October 5, 2023

TIPS yields surging past 2.25% for the 10-year this week are providing some 'real' alternatives -but even a 2.4% 10-year TIPS yields takes 30-years to double purchasing power.

A 5% earnings yield (and real return) would double purchasing power in ~14 years. pic.twitter.com/NDQHkIrkIK

— Jeremy Schwartz (@JeremyDSchwartz) October 5, 2023

A 3% equity risk premium vs TIPS is consistent with long-term 3% edge of stocks vs bonds from over 200 years of data (via Stocks for the Long Run).

Both bonds and stocks are expensive according to 200-year history, but both by very similar amounts. pic.twitter.com/hAva9PiFOc

— Jeremy Schwartz (@JeremyDSchwartz) October 5, 2023

Value vs growth, 3-year annualized returns pic.twitter.com/nfMrNiE5lc

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) October 10, 2023

First reaction to jobs numbers: Shock

Second reaction: Nervousness

Further reflection: This could be quite good

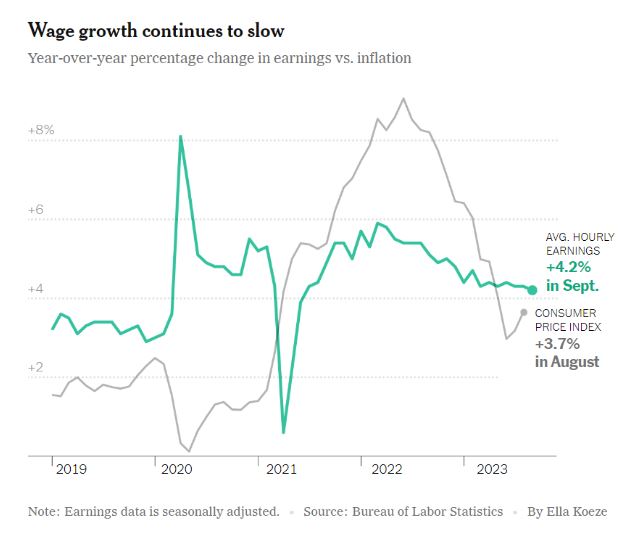

336K jobs, participation remains high, wage growth moderated further. We could be in the middle of a sustainable increase in labor supply. pic.twitter.com/OskUVo2z9g

— Jason Furman (@jasonfurman) October 6, 2023

Average hourly earnings rose by 0.2% for a year/year rate of 4.2%. Tame wage gains relative to size of payroll gains. pic.twitter.com/DqyOHLsbJD

— Kathy Jones (@KathyJones) October 6, 2023

Average hourly earnings up 0.2%, +4.2% year-over-year. Lowest 12 month print since June 2021. Sure doesn't look like a wage-price spiral.

— Neil Irwin (@Neil_Irwin) October 6, 2023

Fed Fight has transformed bond ETFs into cash incinerators.. $TLT has come out of nowhere to hit #3 on our Top 20 Cash Burnin' ETFs list (lifetime flows minus aum today) w/ over $10b lost. Top of list used to be -2x/-3x, VIX, cmdty ETFs. Now its vanilla bond ETFs via @psarofagis pic.twitter.com/kXA77qCfOy

— Eric Balchunas (@EricBalchunas) October 9, 2023

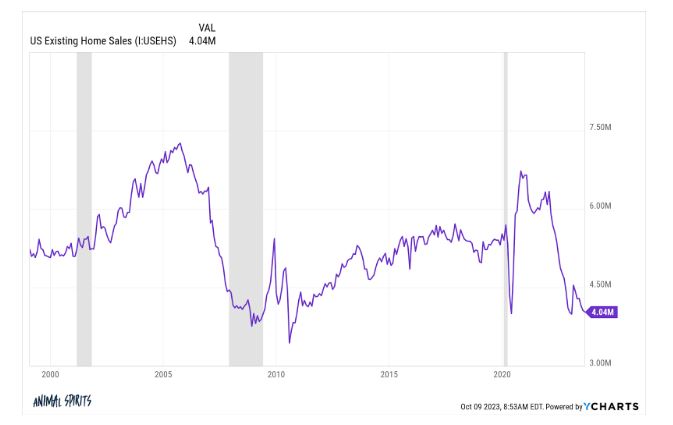

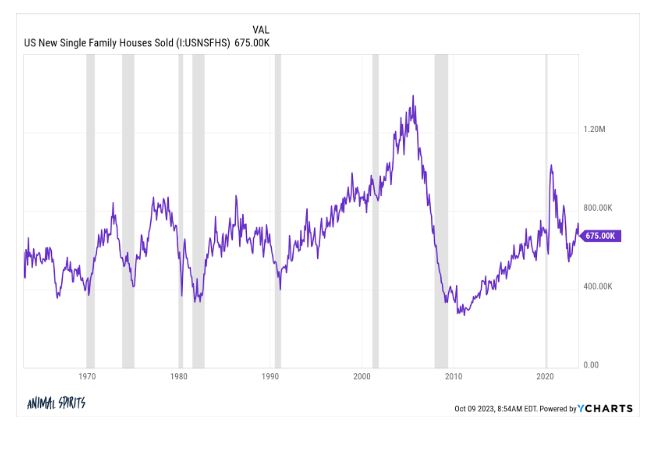

We’d return to pre-pandemic housing affordability IF one of these 3 things happened…

U.S. incomes spike 55%

U.S. home prices fall 35%

Mortgage rates fell 4 percentage points

says Andy Walden at @Black_KnightInc

— Lance Lambert (@NewsLambert) October 4, 2023

If someone asks you to define "chutzpah," you no longer need to say "like when a guy who killed his parents asks for clemency because he's an orphan."

You can say, "like private equity providing loan-shark liquidity to investors in illiquid PE funds."https://t.co/PDhrCSSVXd

— Jason Zweig (@jasonzweigwsj) September 29, 2023

🔸 Redfin Survey: 59% of Recent Homebuyers Say Purchasing a House Is More Stressful Than Dating

Millennials, Gen X Are Most Likely to Think Homebuying Is More Stressful Than Dating. Baby Boomers Are Most Likely to Think the Opposite.

— *Walter Bloomberg (@DeItaone) October 4, 2023

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.