A reader asks:

Can you speak to if you think the market is skewed toward benefiting the large players more than the small players if not being downright rigged against the small players?

There’s a movie coming out this fall about the Gamestop saga called Dumb Money:

Pretty good cast here — Seth Rogen (as Gabe Plotkin), Paul Dano (as Roaring Kitty), Pete Davidson (as Roaring Kitty’s brother), Shailene Woodley (as Roaring Kitty’s wife) and Nick Offerman (as Ken Griffin).

Based on the trailer it looks like a movie about the stock market being rigged against the small players and in favor of the big whales like hedge fund managers Ken Griffin, Steve Cohen and Gabe Plotkin.

But this story is about how the little guy took on the big guy and won! A real heartwarming tale.

I’m sure the movie will be fine if not a little embellished but the premise is a tad flawed.

Yes, the little guy did win.

In this case, Roaring Kitty made millions on his Gamestop trade.1 And Plotkin was forced to shutter Melvin Capital after losses mounted from shorting Gamestop shares.

David took down Goliath.

The problem is Goliath is still doing pretty well for himself these days.

I saw the following headline last month:

Wait who owns a majority stake in the Charlotte Hornets?!

Plotkin is now a majority owner of an NBA franchise. He’s probably still worth hundreds of millions of dollars even after the short squeeze debacle.

I’m guessing that part won’t make it into the movie.

The problem with hedge fund fees is they don’t get clawed back if your fund blows up. Sure, he was humiliated by a bunch of Reddit traders but still walked away with all that money.

It feels like heads I win, tails you lose.

So are the markets really stacked against the little guy?

In some ways, yes.

You’re never going to get sweetheart deals from Goldman Sachs or Bank of America like Warren Buffett during the financial crisis.

You’ll never be able to invest in the best hedge funds, venture capital funds or private equity deals.

You’re never going to earn a 2% management fee along with 20% of any profits on your investment ideas.

If you try to take on Ken Griffin in high frequency trading, he’s probably going to win regardless of what happens to your position.

Wall Street will always have better technology, research capabilities and access to people or deals than you.

In that sense, it does seem like the markets are stacked against the little guy.

But in other ways, the individual investor has all sorts of advantages over Wall Street.

You get to invest in index funds if you want to at low fees that basically guarantee you’ll outperform at least 75-90% of professional investors in the stock market.

You get to ignore short-term performance numbers.

You don’t have to worry about how your portfolio looks compared to some short-term benchmark. The only benchmark that matters for you is whether or not you achieve your financial goals.

There are no investment committees or outside investors breathing down your neck because you underperformed last quarter.

You don’t have any alumni or donors forcing you to invest in an expensive fund that is going to underperform because they went to school with the portfolio manager.

You can set it and forget it.

You can ignore macro predictions.

You can stop looking at your statements if you’d like.

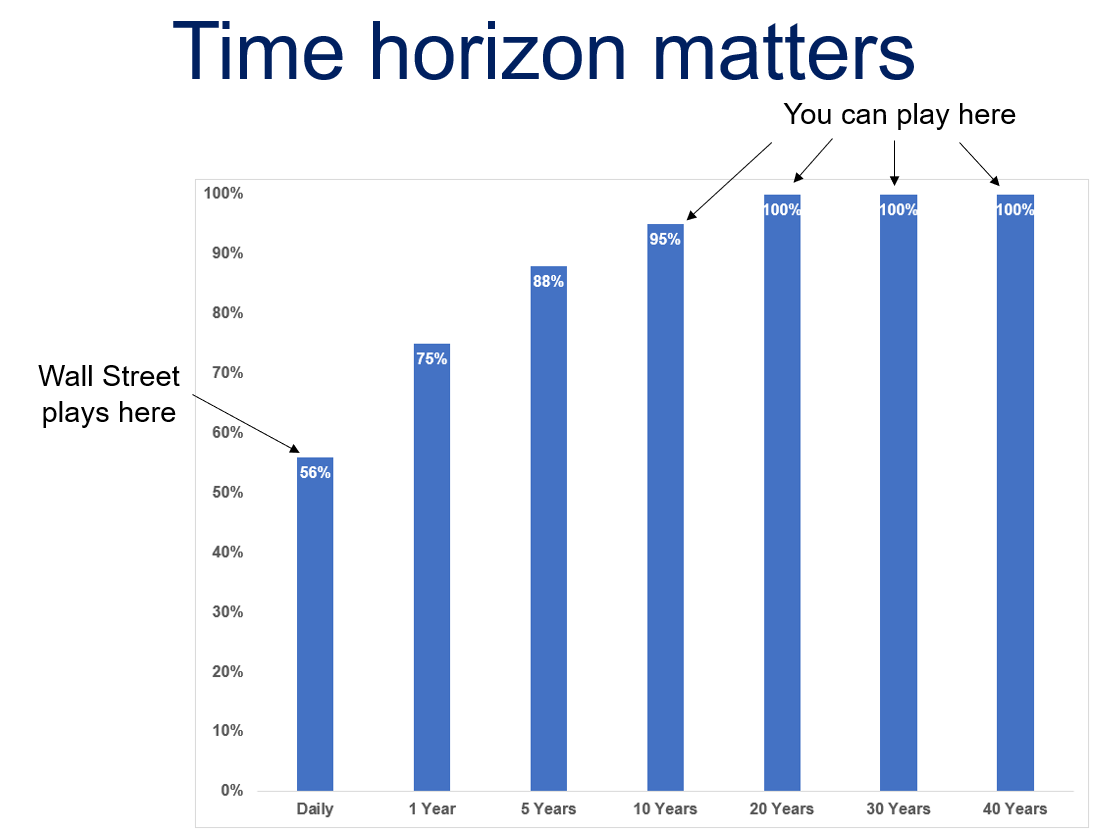

And perhaps the biggest advantage you have as an individual investor over the behemoth institutional investors is the ability to think and act for the long-term:

The longer your time horizon, the higher your probability of success in the markets.

I know plenty of endowments and foundations that manage hundreds of millions or billions of dollars with a time horizon that is essentially endless. They were set up to last in perpetuity. Yet they are consumed by their levels of over- or under-performance to some benchmark or their peers.

My biggest problem with the institutional asset management industry is the obsession with quarterly or annual performance numbers when their time horizons are measured in multiples of decades.

That’s your advantage as a little guy in the markets.

If you try to play the short game like Wall Street you are likely to lose unless you just get lucky.

The good news is you aren’t forced to play that game. You can play the long game which increases your probability for success.

In some ways, the markets don’t seem fair since there are billionaires who seemingly win no matter what happens.

In other ways, you have the upper hand if you are willing and able to play a different game than Wall Street by keeping your costs low, your trading to a minimum and your time horizon as long as possible.

We talked about this question on this week’s Ask the Compound:

Nick Sapienza joined me on the show to go over questions about expected returns in financial markets, setting expectations for your financial plan, the tax implications of stock grants from your company and more.

Further Reading:

Some Friendly Reminders About Day Trading

1I hope he cashed out most of it.