On this week’s Animal Spirits with Michael and Ben…

We discuss:

- The impact of the coronavirus on the markets

- Why influenza is such a scary virus

- Why the low-cost brokerages won

- How many more takeovers will there be in the asset management space?

- Why wealth management is taking over for stock-picking

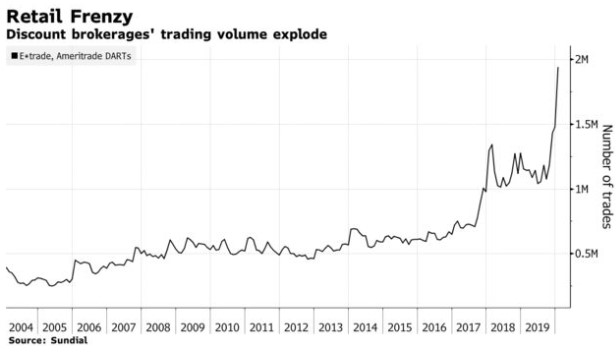

- Are people trading more since the advent of free trades?

- Why the top 1% isn’t static

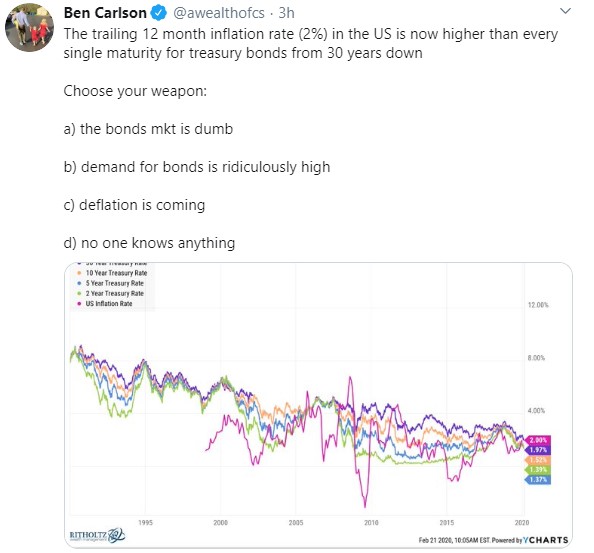

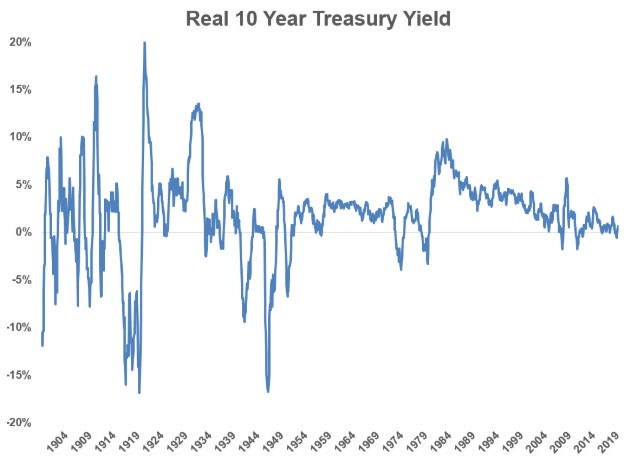

- Why are bond yields so low?

- Why the paradox of thrift is a pipe dream

- Are there more billionaires or FIRE people?

- Maybe this isn’t the longest economic expansion in U.S. history

- How many people understand the concept of diversification?

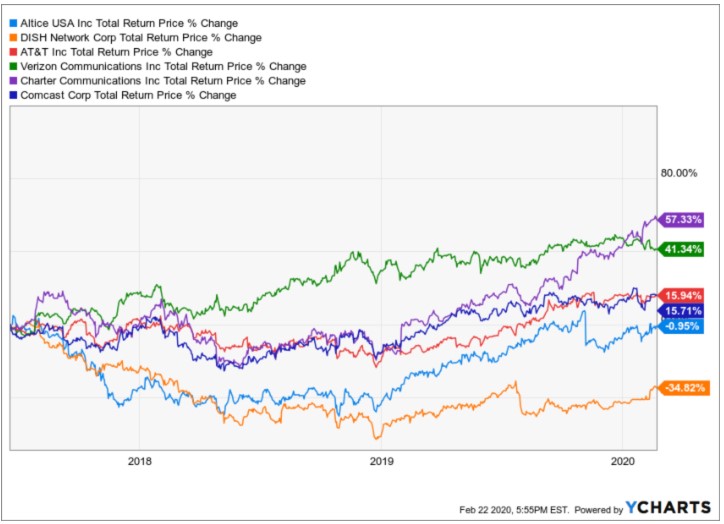

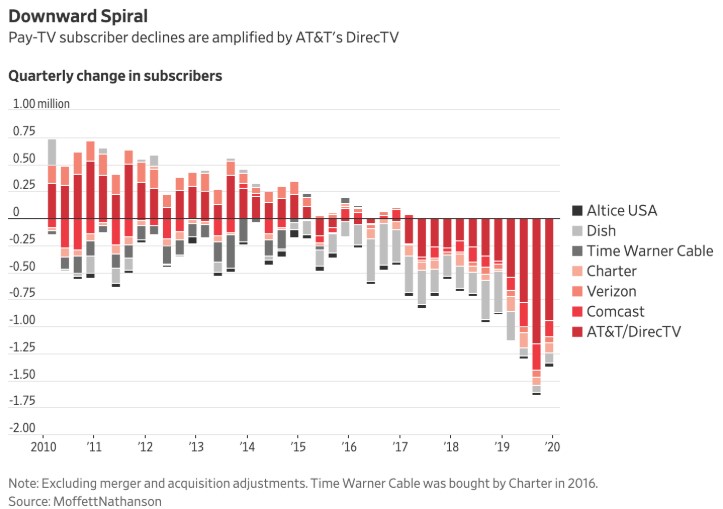

- Why aren’t cable stocks doing worse if “everyone” is cutting the cord?

- Why buying Knicks season tickets is the worst investment Michael ever made

- Why it’s so hard to automate investing in the real estate market

- Denominator blindness in debt statistics

- Why temperament is more important than smarts in the markets

- Does it make sense to cash out your 401k to pay for business school?

- Should you buy a home if you’re going to move in 3 years?

- Should financial advisors eat their own cooking?

- Dustin Hoffman, Gene Hackman, Robert Duvall and more

Listen here:

Stories mentioned:

- Morgan Stanley to buy E-Trade for $13 billion

- Morgan Stanley is betting on smaller customers

- Mom and pop are on an epic buying spree with free trades

- High turnover among America’s rich

- How millennials could make the Fed’s job harder

- America’s first great moderation

- Meb Faber and Joe Davis

- 50% of Americans don’t understand diversification

- The current media landscape

- Zillow is losing millions selling houses

- Credit card debt in the U.S. rises to record $930 billion

Books Mentioned:

- The Great Influenza by John Barry

- The MVP Machine by Ben Lindbergh

- Life Isn’t Everything by Ash Carter

- The Devil’s Chessboard by David Talbot

Charts mentioned:

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here: