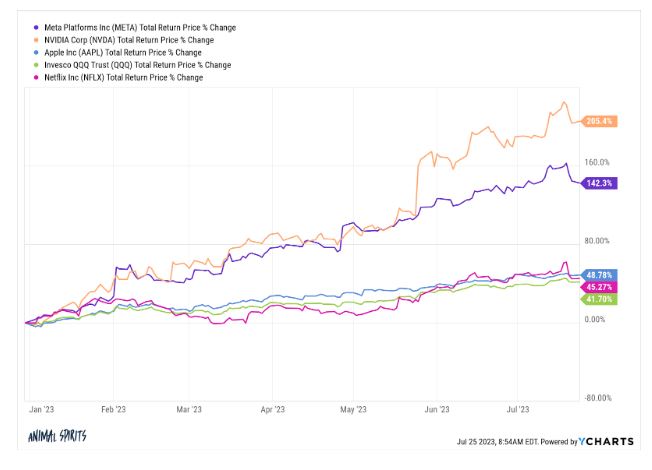

Today’s Animal Spirits is brought to you by YCharts:

Submit your email here to receive 20% off a YCharts subscription for new clients

On today’s show, we discuss:

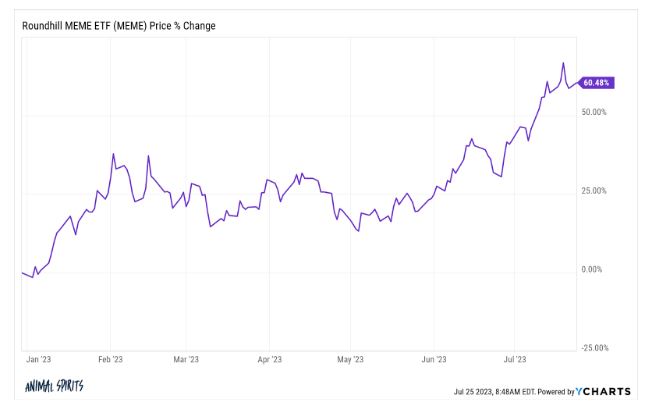

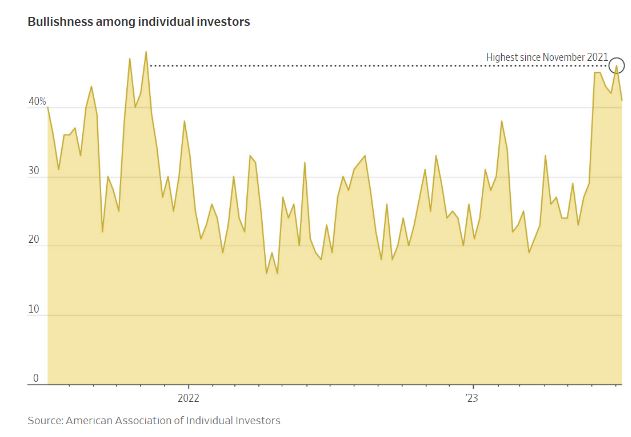

- Tech stocks, meme stocks, crypto: Investors are feeling bold again

- The return on hassle spectrum

- ‘We were wrong'” Morgan Stanley’s Wilson offers stocks mea culpa

- A ‘soft landing’ and is Powell the most successful Fed chair ever?

- What does an inverted yield curve tell us?

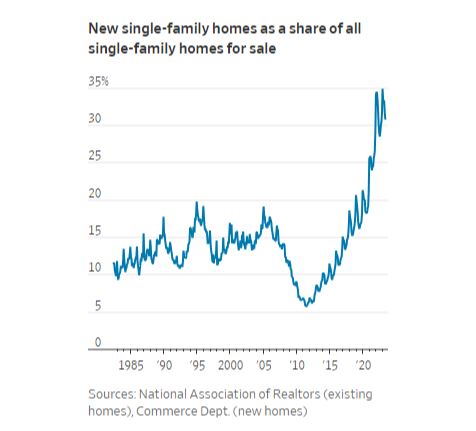

- Homeowners don’t want to sell, so the market for brand-new homes is booming

- Loan officer: I’m seeing middle-class homebuyers take on $7,000 mortgage payments thinking they can ‘always refinance when rates come down in the future’

- How much do you need to earn to afford a $500,000 home? Here is the answer.

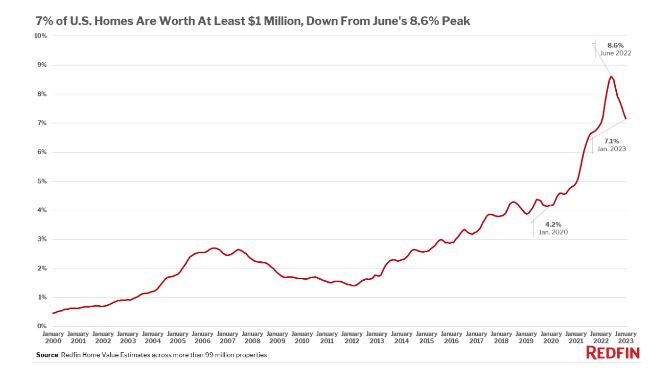

- Million-dollar homes are becoming less common as high mortgage rates cool the market

- Netflix earnings

- Who is wealthy? Schwab study highlights US wealth paradox

- America is becoming a nation of early birds.

- How nuclear submarines make oxygen

Tropical Bros Shirts:

Listen Here:

Recommendations:

Charts:

Tweets:

Some context to the $ARKK mass exodus articles. Here's daily flows YTD, a whole lot of in and out, just like normal, albeit it does net to -$284 million, but that is 3% of aum, which is $9b, a solid amt esp after epic decline. For context, $DXJ hit $1.6b after its fall to Earth. pic.twitter.com/pQJOSKVmoJ

— Eric Balchunas (@EricBalchunas) July 18, 2023

A story in three parts.

The lessons:

1) Real estate twitter is the worst.

2) 6 years in and you’re netting $30k total on the side for all that hard work and hustle. Hard, hard pass. pic.twitter.com/4jchUrqMJg

— fed_speak (@fed_speak) July 21, 2023

Nothing changes sentiment like price. pic.twitter.com/QHwugIyhEo

— Stocktwits (@Stocktwits) July 19, 2023

Nice piece by @awealthofcs.

Tells you so much about what’s happening when you see that consumption has held up even without consumers stretching borrowing capacity.

Incomes really have held strong and now even the savings rate is ticking up. pic.twitter.com/hMrmR75M63

— Sonu Varghese (@sonusvarghese) July 22, 2023

McDonald's CEO on how AI will impact their business: pic.twitter.com/gwcUR4dYAb

— The Transcript (@TheTranscript_) July 24, 2023

86.1 million owner-occupied housing units in the US and only 1 million available for sale (close to lowest ratio ever).

Analysis back to 1983 starts 20 seconds in on video and was eye-opening, namely disconnect around 2012-2013.

Big part of why home prices are rising AGAIN. pic.twitter.com/BWmawV92CM

— Rick Palacios Jr. (@RickPalaciosJr) July 24, 2023

Just heard this incredible stat from James Egan on Odd Lots. “1/3 of all homes in this country are owned by people age 65 or older and 50% of those homes were bought before the year 2000” 😮. Now consider Case-Shiller is up 3X since 2000, 4X since 1990

— Kyle Kovats (@KovatsMultiFam) July 24, 2023

Another way to look at low inventory: there are 600K more realtors than homes for sale right now. Must be a lot of bored realtors out there… pic.twitter.com/ng1jkMceKs

— Alex Thomas (@housing_alex) July 21, 2023

S&P: “.. Global private equity dry powder soared to a record $2.49 trillion around the middle of 2023 .. a greater than 11% increase over the December 2022 total ..”@SPGMarketIntel 👀 pic.twitter.com/SyVBOPo87L

— Carl Quintanilla (@carlquintanilla) July 20, 2023

Budgets of the 5 latest MCU movies/shows 💰 #SecretInvasion pic.twitter.com/cj3s4ZMvaU

— MCU Report (@MCUReport) July 14, 2023

Amazon Is Paying A World Record FIFTY MILLION DOLLARS To The Rock To Star In A Christmas Movie https://t.co/L1kizgdBtI pic.twitter.com/p7BrB8Le4A

— Barstool Sports (@barstoolsports) July 19, 2023

$AMZN CEO: "In the case of Prime Video, I’m very bullish on where we’re headed. The content continues to get better and better…While Prime Video is really good at driving our Prime value for our consumer business, I also think it will have good standalone economics."

— The Transcript (@TheTranscript_) July 18, 2023

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.