Today’s Animal Spirits is brought to you by YCharts:

Go here to check out YCharts’ latest research on which portfolios and asset classes perform best during Fed Rate Hike Cycles.

On today’s show, we discuss:

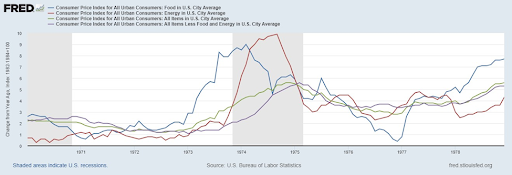

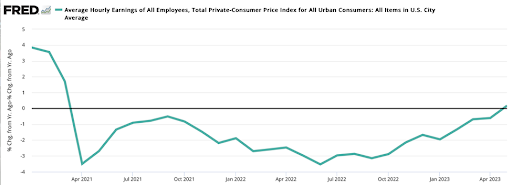

- Is the Inflation Battle Won? Not Yet.

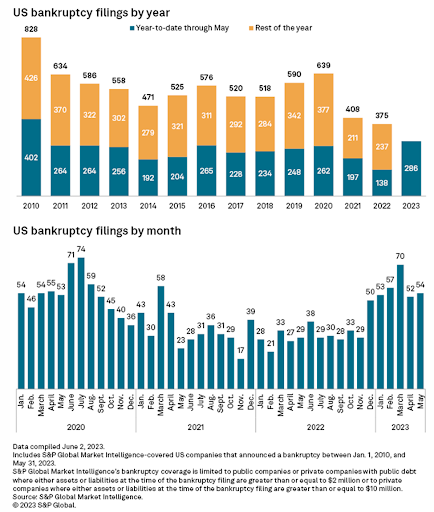

- Where’s the Recession We Were Promised?

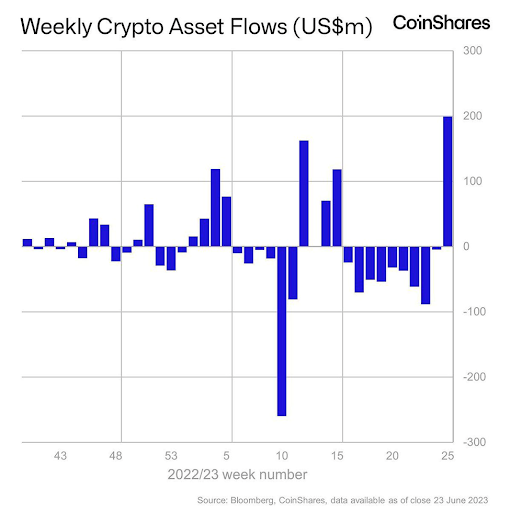

- Bitcoin Bonanza on Tap if BlackRock ETF Is Approved

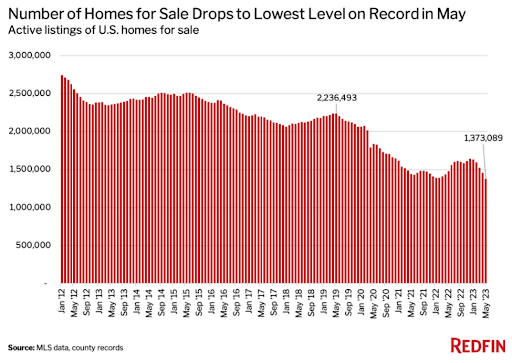

- There Were Fewer Homes for Sale in May Than Any Other Month on Record

- Colorado’s housing market was moving in favor of buyers, but not anymore

- A couple who retired early with $4.3 million says the FIRE lifestyle is wearing thin: ‘We don’t want to just keep throwing money on the pile and keep being cheap

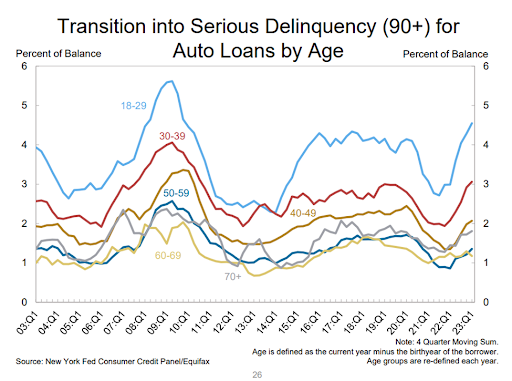

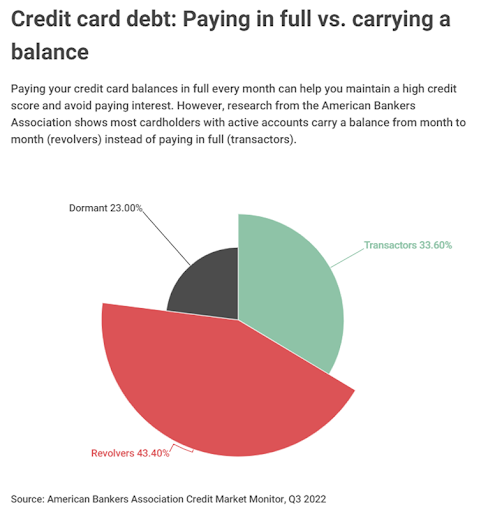

- Jaw-Dropping Stats About the State of Debt in America

Future Proof:

Listen Here:

Recommendations:

Charts:

Tweets:

Year to Date: $AAPL, $MSFT, $AMZN, $NVDA, and $META have added a combined $3 trillion in market cap since the start of the year.

5 stocks added more market cap in the first 6mo than the GDP of India or the UK, and more than the sum of South Korea and Australia's GDPs combined. pic.twitter.com/0iExtIb2JI

— The Compound (@TheCompoundNews) June 22, 2023

Apple's App Store now generates $1.1 trillion in billings and sales on a global basis, making it larger than the annual GDP of all but 16 countries and larger than the GDP of countries like Saudi Arabia, Turkey, Switzerland, and Taiwan.

— Bespoke (@bespokeinvest) June 26, 2023

Bond traders are now convinced that the Fed won't cut rates this year

That's been a contrarian opinion for most of this year, though pic.twitter.com/KD4Gz21BRh

— Callie Cox (@callieabost) June 25, 2023

Credit investors rejoice!

62% of new junk bonds issued are secured, the highest rate in recent history

Good thing, as defaults are rising. The trailing 12-month, speculative-grade default rate was 3.07% (up from 1.22% in early 2022) pic.twitter.com/oTsVeWvyj5

— Julian Klymochko (@JulianKlymochko) June 25, 2023

The numbers don’t make sense. Something is off kilter.

— Elon Musk (@elonmusk) June 21, 2023

So now the asset managers who thought #Bitcoin was cooked are jockeying to secure a position before the ETFs go live.

But 70%+ of the supply is already in the hands of psychos who didn't even flinch when FTX blew up.

Look at me in my laser eyes. The bidding begins at $1000K.

— Stack Hodler (@stackhodler) June 21, 2023

$10 trillion BlackRock CEO: The hits on our website was 3k for monetary policy, and 600k for #Bitcoin

“Many people are fascinated about it, many people are excited about it.” pic.twitter.com/2VZMbSLqeT

— Bitcoin Magazine (@BitcoinMagazine) June 23, 2023

Another potentially small crumb signifying the SEC is lightening up their adversarial stance towards Bitcoin… I wrote about this fund last week and looks like it might actually launch on 6/27. https://t.co/Rhz4xqxHnY pic.twitter.com/Ux2fJc5DHZ

— James Seyffart (@JSeyff) June 23, 2023

last week marked a shift in sentiment and flows, with nearly $200M of inflows into crypto products, the biggest week thus far this year

from our @CoinSharesCo research team 👇https://t.co/mcmbtBrhdp pic.twitter.com/MsgCoJ8uyq

— Meltem Demirors (@Melt_Dem) June 26, 2023

Housing starts rose more than 20% MoM in May for only the 5th time in the last 20 years. pic.twitter.com/rOKBTlt1Rj

— Bespoke (@bespokeinvest) June 21, 2023

Thru May, number of multi-family housing units under construction rose again and is now tied for record set in 1973 pic.twitter.com/oInHBnCVwM

— Liz Ann Sonders (@LizAnnSonders) June 21, 2023

Opendoor bought this home in January 2023 for $670k, and almost immediately sold it for $582k—or 13.2% below its purchase price. https://t.co/DUm3taxIzh pic.twitter.com/5Sls15ioSW

— Lance Lambert (@NewsLambert) June 26, 2023

WHOA. The FDIC accidentally posted an un-redacted document showing that the big VC firm Sequoia had $1 billion on deposit at SVB when it collapsed https://t.co/hCbcHZ0yev pic.twitter.com/Ys1qbHnvDr

— Joe Weisenthal (@TheStalwart) June 23, 2023

"We estimate the hit to disposable income from the end of the student loan moratorium lowers real PCE this year by 8-12bp and real GDP by 6-9bp…" – Morgan Stanley

— Sam Ro 📈 (@SamRo) June 22, 2023

So it used to be the case that you could book hotels and stuff through Chase using your points, and you'd save something like 25%.

Now it seems like they mark everything up 30+% and offer fewer benefits than if you were to book direct 🤨

— Jake (@iamjakestream) June 20, 2023

If you bought Netflix in 2018 because you thought they had won streaming…

You would have been right and you would have made no money pic.twitter.com/plrOOCKr3u

— BuccoCapital Bloke (@buccocapital) June 23, 2023

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Wealthcast Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.