A reader asks:

I’m in my late-30s so I know I should look at this environment as an opportunity to buy at lower prices but I’m sick of the bear market. I got caught up investing in tech in 2020 and 2021 so I’m down way more than the S&P 500 (probably down 25-30% from my previous highs).

It would help to hear your best and worst-case scenarios between new all-time highs this year and a 1970s environment where we go sideways for years to come.

I feel this question.

Sometimes your head and your heart don’t align when it comes to the stock market.

Your head knows that lower prices in the short-run are a good thing when you’re going to be a net saver for years to come.

But your heart would like to see the balance of your current portfolio move up and to the right at all times.

If only it were that easy.

The last 3 years or so probably have a lot to do with this mindset. We all became accustomed to the stock market being an event, not a process.

Following a long and winding bull market throughout the 2010s, the pandemic hit and the stock market went into a 30% bear market at its fastest rate in history. From there the stock market saw its quickest doubling from a bear market low in history.

2021 was another banner year for stocks. Then the Great Inflation hit and 2022 was a nasty bear market.

We’ve lived through a series of tops and bottoms.

And now…we’re kind of in the middle. The middle of what? I don’t know.

The S&P 500 is still well off all-time highs but we’ve experienced a nice sustained bounce from the lows as well:

By definition, most of the time we simply cannot always be near a top or a bottom. You’re not going to find a generational buying or selling opportunity once every month.

The stock market doesn’t work like that.

Sometimes you just have to be patient.

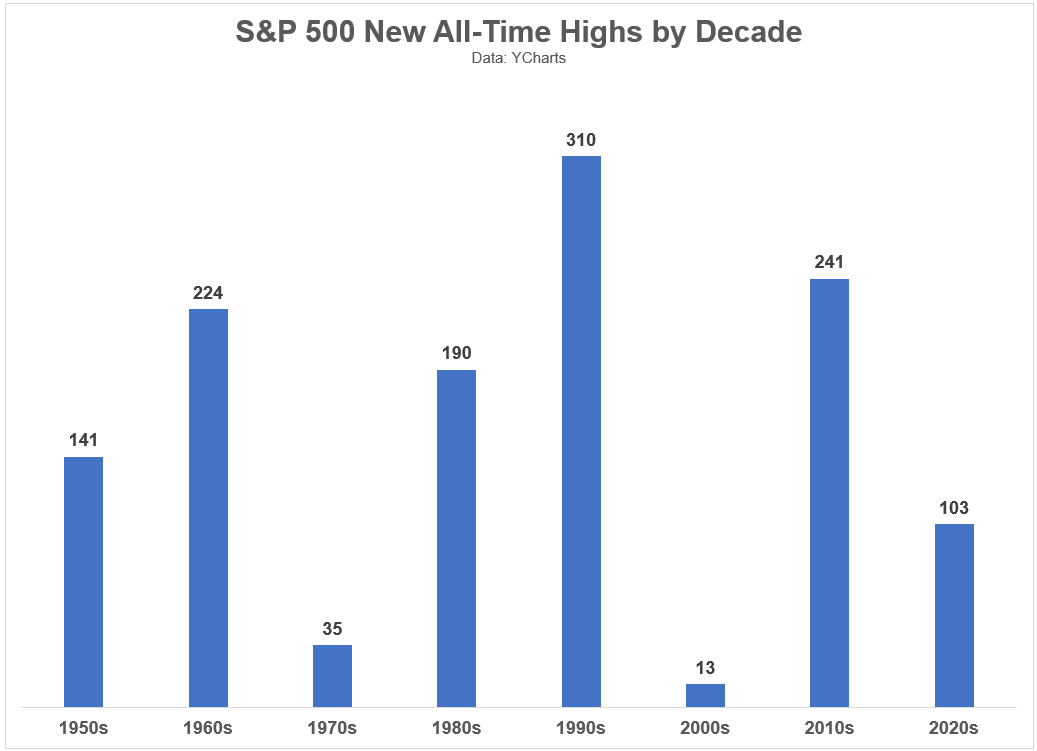

Here’s a look at the number of new all-time highs by decade1 going back to 1950:

There are roughly 2,500 trading days for the stock market over the course of a decade. So if we add all of these new all-time highs up, we can get a better sense of how often they occur.

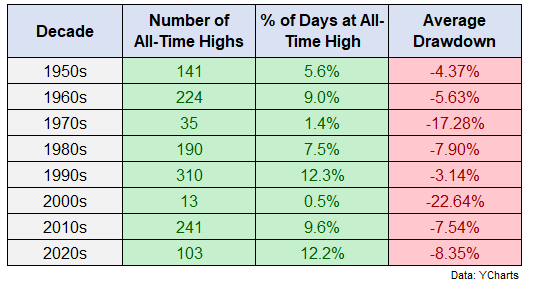

Here are those numbers along with the average drawdown on any given day during each of these decades:

We have a range of less than 1% of trading days in the 2000s to more than 12% in the 1990s and 2020s (it’s still early in this decade).

My reader mentioned the 1970s and you can see it’s the second worst on this list behind the 2000s in terms of fewest new highs and average drawdown. It is worth noting that while the 1970s weren’t a great decade for financial markets, the S&P 500 was up nearly 6% per year in that time.

Foreign stocks (MSCI EAFE) were up more than 10% per year.

Much of that return was eaten up by inflation but the stock market still went up in the 70s.

Overall, new highs were reached on roughly 6% of all trading days over the past 70+ years. This means the majority of the time stock market investors were in a state of drawdown from previous all-time highs.

In fact, the average drawdown from all-time highs since 1950 is -9.7%. That’s probably worse than most investors would assume.

It’s no fun being a stock market investor if you’re constantly anchoring to previous peaks because it’s going to happen a lot.

If I had to boil down risk preference in the stock market into one question it would be this:

When do I need the money?

Personally, I’m not going to touch my retirement savings for anywhere from 25 to call it 50 years. It’s more fun when stocks are in a bull market but my future retirement portfolio will be forged during the downturns when I continue to make contributions to my 401k and IRA.

Investing in the stock market would be easier if we could just get some clarity or resolution exactly when we want it.

Unfortunately, investing in the stock market can be hard. It doesn’t always do what we want when we want it to.

It’s important to remind yourself that long-term returns are the only ones that matter.

And buying when stock prices are lower is one of the best ways to improve your long-term returns.

We covered this question on the new and improved Ask the Compound show (formerly Portfolio Rescue):

Josh Brown joined me this week to discuss questions on credit card debt, auto loans, marriage finances and selling call options on your individual stocks.

1I have data going back to the 1930s but there were no new all-time highs in the 1930s or 1940s. The 1929 high level in the stock market wasn’t breached again until 1954.

Podcast version here: