When Slack co-founder Stewart Butterfield was on the How I Built This, Guy Raz asked him what it was like to become insanely rich (Forbes has Butterfield pegged at $1.4 billion).

Butterfield told Raz, “Beyond a certain level of wealth it doesn’t make your life any better.”

He framed it in terms of 3 levels of wealth:

Level 1. I’m not stressed out about debt.

Level 2. I don’t worry about what stuff costs in restaurants.

Level 3. I don’t worry about what a vacation costs.

These levels are subjective in many ways but the idea makes sense to me.

If vacation spending is the ultimate level of wealth it appears many people are doing pretty well for themselves these days.

Is it just me or does it seem like everyone is taking more vacations these days?

I was not surprised at the travel boom we experienced following the pandemic. So many people put their vacations on hold which provided a good reminder that experiences are worthwhile investments.

The problem is that investment is now much more expensive than it was in the pre-Covid days.

I’m not sitting on the sidelines when it comes to this vacation boom either. My family is on Spring Break this week in Florida.

All things travel are noticeably more expensive.

Flights are pricey. Hotels/Airbnb rates are up. Car rental rates are much higher (and still hard to come by in certain areas). Restaurants have raised prices. Drinks are pricier. Tickets for shows, events or theme parks seemingly have no ceiling.

This all makes sense considering we had a supply chain shock coupled with the hottest labor market and inflation rate in decades.

I’m just surprised at how long the travel boom has lasted.

Airplanes remain full. Disney is packed despite being the most expensive magical place on the planet. Resorts are overflowing and people are still spending on vacations like there’s no tomorrow.

The Wall Street Journal had a story about one of the newest must-haves for poolside vacation stays:

For an Easter weekend getaway, the Phoenician resort at the base of Arizona’s Camelback Mountain will set you up in a poolside cabana for $550 to $600 a day depending on location. (The kid-free zone costs the most.) At the beachfront Hotel del Coronado just outside San Diego, a premium cabana goes for $400 a day. Loews Miami Beach Hotel is renting its two-story cabanas with air conditioning, showers and an ocean-view deck for $1,200 a day. Food, drink and tips are extra.

Veteran hotelier Mutluhan Kucuk, managing director at Loews Miami Beach, says cabana prices at the resort’s cabanas are up about 15% to 20% from a year ago and still regularly sell out. The guests renting them spend 35% to 40% more on food and drinks than other pool-goers.

I’m not here to judge when it comes to spending on vacations.1

Spending money on experiences is a big priority in my family’s budget.

Both the anticipation you get leading up to a trip as well as the memories you create can last a lifetime. I’m a big proponent of spending on experiences over material possessions as a general life strategy.

I do worry that lots of people are overextending themselves right now and that goes beyond vacation spending.

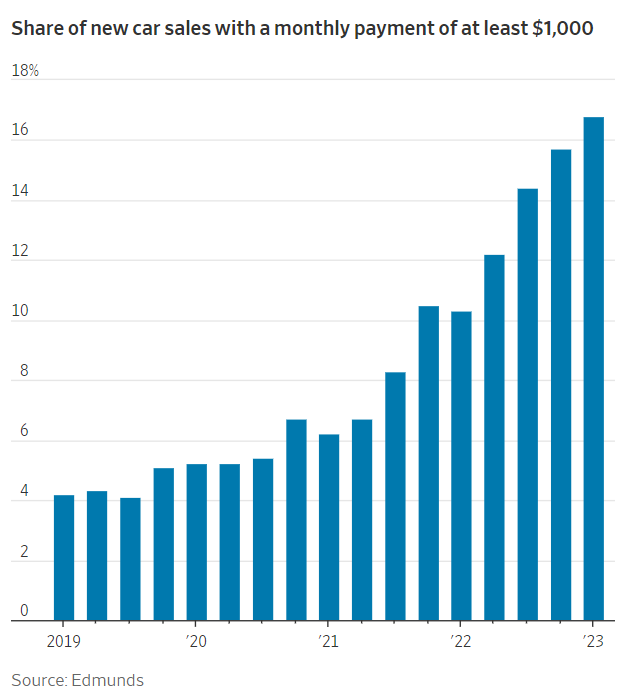

Look at the share of new auto sales with a monthly payment of $1,000 or more (via the WSJ):

Almost one in five new vehicles purchased in the first three months of the year came with monthly payments of $1,000 or more.

More expensive vehicles and higher interest rates have made this one of the worst times ever to buy a car, new or used.

Higher costs in certain areas are going to make it harder for people to get ahead in other aspects of their finances.

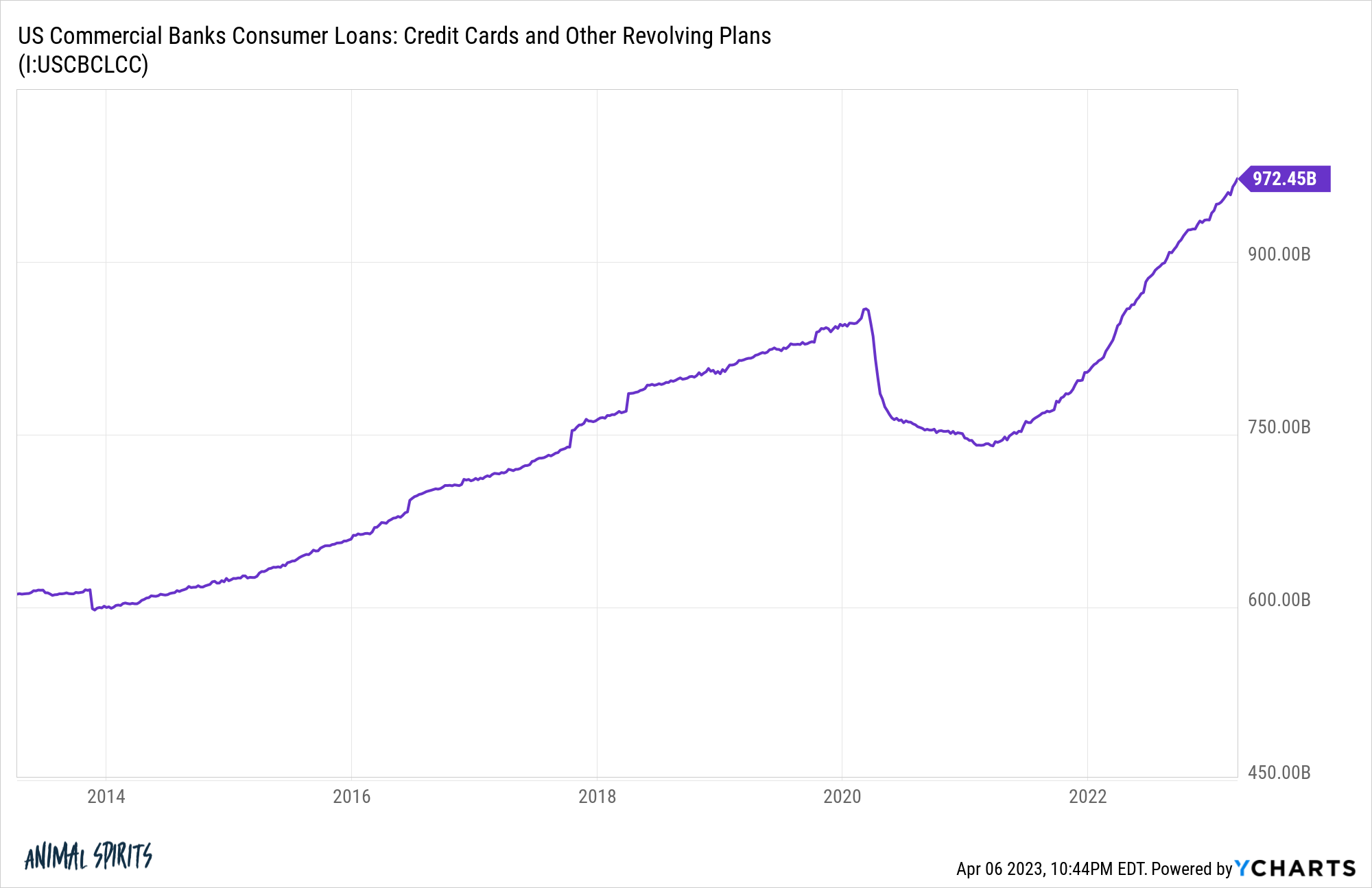

One of the unintended benefits of the pandemic is so many households were able to repair their balance sheets. People actually paid down their credit card debt in a big way.

It didn’t last:

There was a crash and now we’ve filled the gap.

The good news is we’re basically only back on the pre-pandemic trendline.

The bad news is with inflation remaining high and households spending down their excess pandemic-related savings, credit card debt is probably heading to above-trend levels.

Listen, I don’t want to be one of those personal finance spend-shaming people who want everyone to save all of their money all of the time and never enjoy themselves.

I do, however, worry that higher interest rates, inflation and spending levels are going to wreak havoc on the personal finances of those who are spending beyond their means.

I enjoy spending money on certain things in my life that bring me joy. What’s the point of working hard and earning a living if you’re not going to enjoy the fruits of your labor?

But you can’t get to the third level of wealth if you don’t have the first one locked up.

Unless you’re insanely rich like Stewart Butterfield, getting ahead financially involves trade-offs. We can’t have it all, unfortunately.

I like to pay for my trips in advance through some combination of credit card points, airline miles and a saving account that is set up specifically for vacation spending.

It’s much easier to enjoy yourself on vacation when you don’t have a large credit card bill waiting for you when you get home.

Being wealthy isn’t just about having a lot of money.

Being wealthy is about not worrying about money all of the time, especially when you’re on vacation.

Michael and I talked vacations and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

The 3 Levels of Wealth

1OK, I’ll judge a little for $1,200 a day for some shade and a TV by the pool.