I like to look at both sides of things because so many aspects of life have some sort of balance.

You don’t get the good without the bad, the reward without the risk, the pleasure without the pain or the bull markets without the bear markets.

This past week I looked at some of the reasons the stock market can make you feel terrible all the time.

And while it’s true the stock market can be unforgiving in the short-run, even over relatively short periods of time the stock market can be a fun place too.

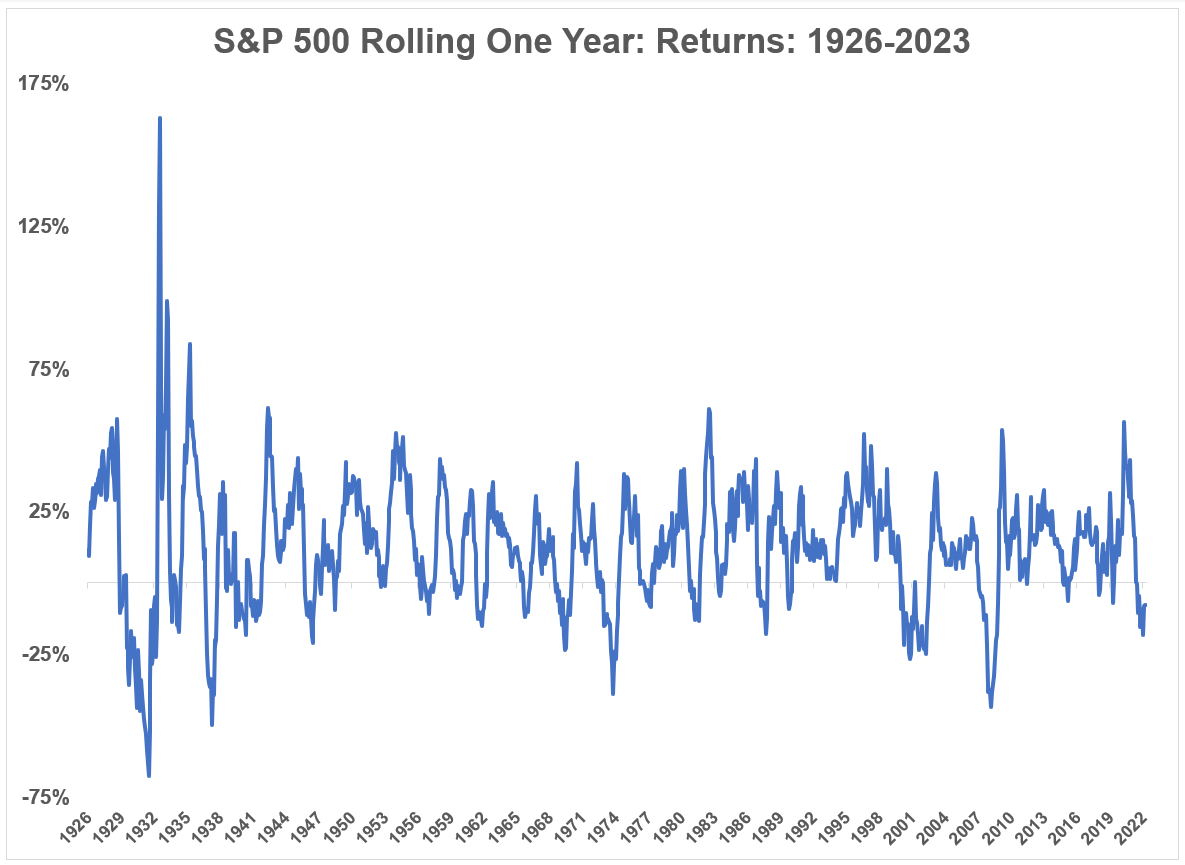

Here is a look at rolling one year returns for the S&P 500 back to 1926:

Plenty of bad times to be sure but the stock market has been up in 75% of all rolling one year returns in this time.1

You don’t have to be Sherlock Holmes to deduce the fact that this means the market has been down 1 out of every 4 years (on average).

Those are pretty decent odds. The bad times are painful but the good times more than make up for it.

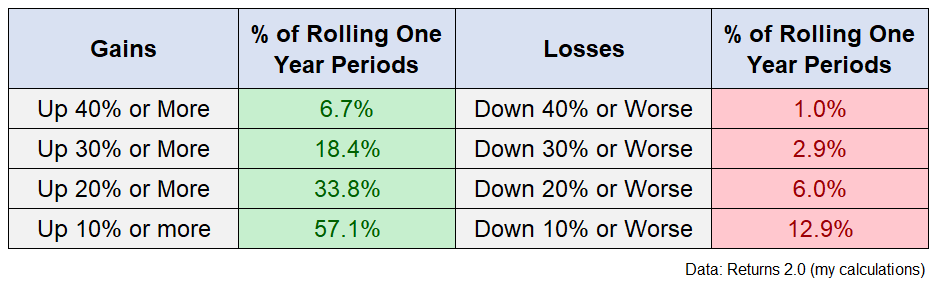

To emphasize this point, it can be helpful to go beyond just positive or negative returns and look at different magnitudes of performance over these one year periods.

For instance, the S&P 500 has been down 10% or worse in around 13% of all rolling one year periods. But the market has been up by 10% or more 57% of the time.

The gains outweigh the losses at other magnitudes as well:

The stock market is down 20% or worse 6% of the time but up 20% or more almost 34% of the time over rolling one year periods.

Nearly one out of every five one year periods is up 30% or more while the market is down 30% or worse less than 3% of the time.

Forty percent moves over a one year time frame are rare but even then the gains outweigh the losses by a factor of almost 7-to-1.

The latest 12 month return through the end of March is a loss of around 8%. Losses of 8% or worse have only occurred in 15% of historical one year returns.

Most of the time things are better than the current market environment but I guess that’s the rub when investing in stocks.

Most of the time things are pretty good and sometimes they’re pretty bad.

You don’t get one without the other.

Further Reading:

Why the Stock Market Makes You Feel Bad All the Time

1The best 12-month rolling return of 162% for the month ending in June 1933 followed the worst 12-month rolling return of -68% in the month ending June of 1932. A depression can have that effect on markets.