A reader asks:

I manage my investment portfolio, largely with a very boring mix of three funds: U.S. index fund, international index fund and a total bond fund. Looking at the yield on my bond index fund, it looks like I may be able to get I better yield in a money market fund. Is there any reason to keep my bond allocation where it is rather than moving it into a money market fund?

I love the 3 fund index portfolio. Simple, diversified, low-cost. I’m a fan.

It makes sense investors are considering making a swap from a total bond market index fund to some sort of cash equivalent — T-bills, CDs, money market funds, online savings accounts, etc.

You can get yields in the 4-5% range in cash-like vehicles and you don’t have to worry about duration or volatility from changes to interest rates.

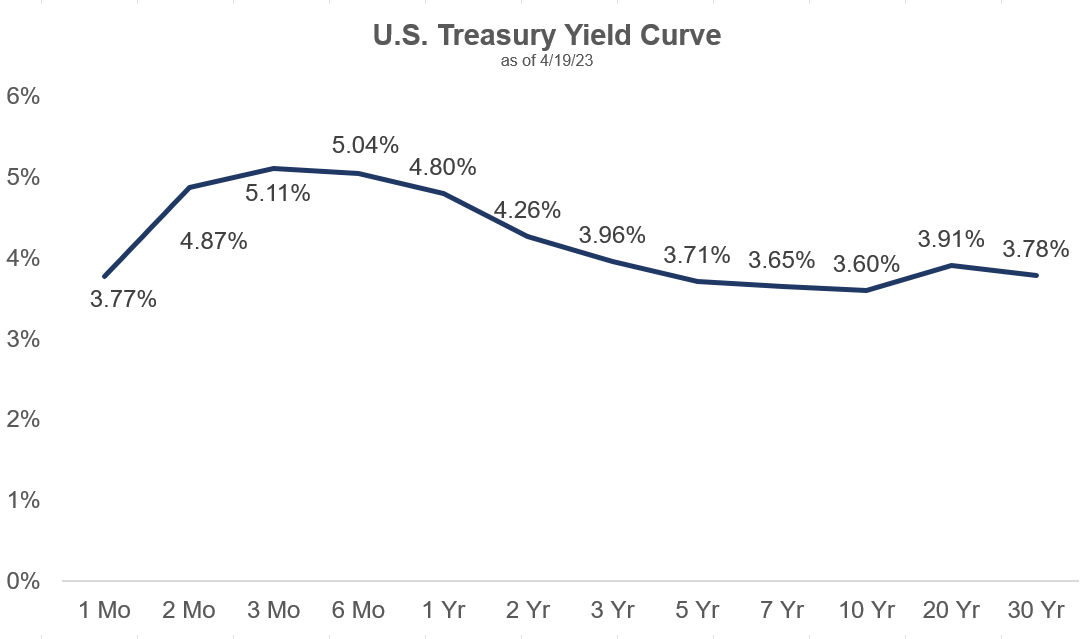

The 10 year treasury currently yields around 3.6% while you can get 5.1% in 3-month T-bills. And if the Fed raises rates at their next meeting we should actually see these short-term yields move a little higher.

Moving your fixed income or cash allocation into short-duration assets feels like a no-brainer at the moment. Savers are no longer being forced out on the risk curve to find yield.

If anything, savers are being tempted into taking less risk now than they’ve had to in well over a decade.

There is some personal preference involved here though.

I prefer to take my volatility in the stock market and look to fixed income as a portfolio stabilizer. I don’t like taking much risk when it comes to bonds or cash.

My optimal portfolio looks something like a barbell with risky assets on one side and more stable assets on the other.

Equities can enhance returns while diversification into short-duration assets can help mitigate risk and provide a ballast to the portfolio.

Each asset class involves trade-offs.

The higher expected returns in stocks come with more fluctuations and potential for losses in the short-run.

Short-duration fixed income has much lower expected returns but can provide income and a level of stability.

Even when cash-like investments didn’t provide much in the way of the yield over the past 10-15 years, the asset class still played a vital role in portfolio construction if it allowed you to stay invested in stocks or avoid worrying about your short-term spending needs being met. Stable assets can also allow you to lean into the pain and reinvest when stocks are down.

Now you can have that stability with a 4-5% yield as a kicker. That’s a pretty good deal.

Sitting in cash or short-term bonds or money markets or CDs seems like a no-brainer right now but there are still some risks to consider before you move your entire bond exposure to short-duration assets.

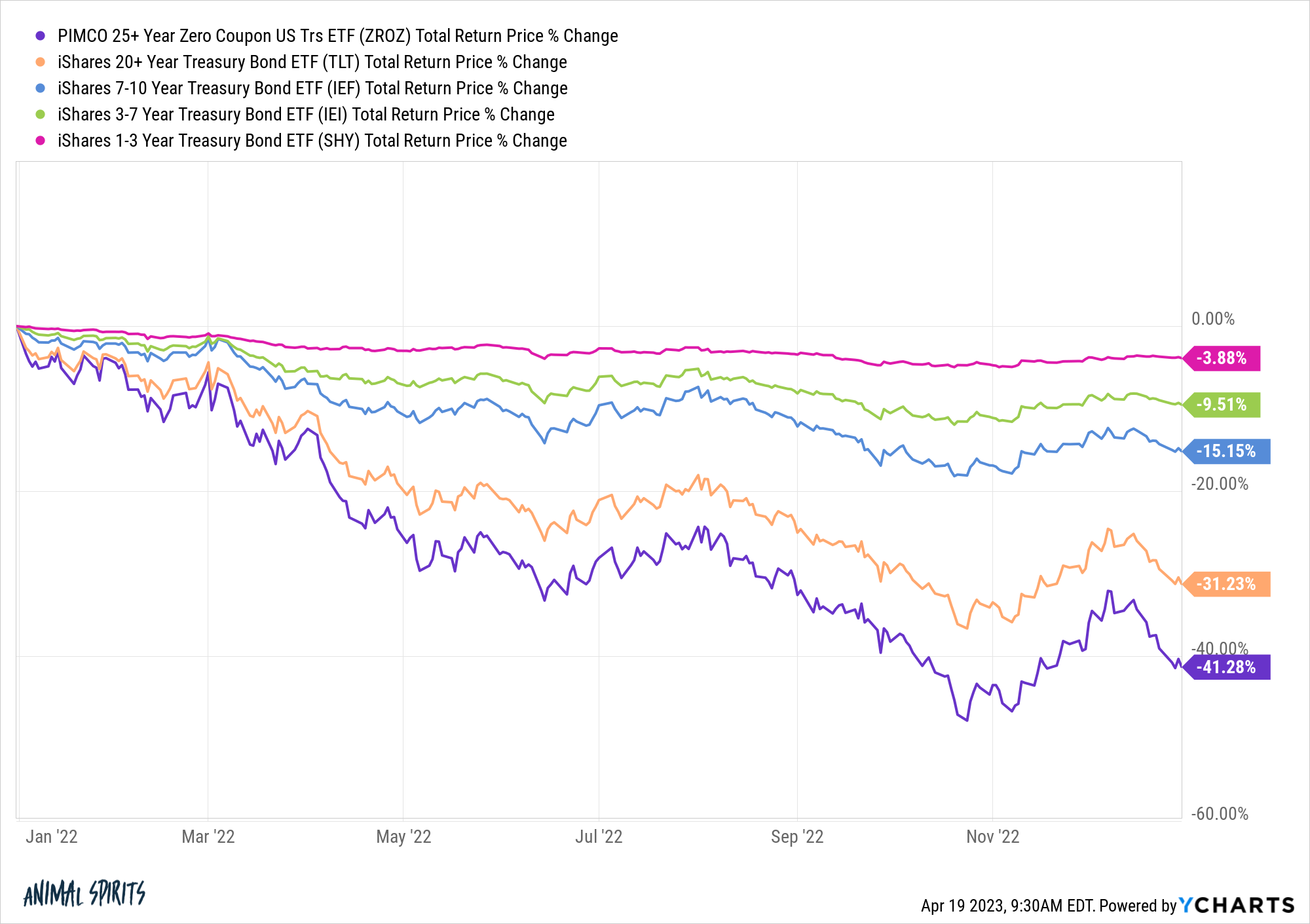

Interest rate risk works in both directions. Last year when interest rates rose, long-duration bonds got hammered while short-duration bonds held up relatively well:

If you’re in CDs or money market funds you don’t have to worry about interest rate risk at all. You don’t see the value of your holdings go down if rates rise.

But you also don’t see any gains if interest rates fall. If you already lost some money in bonds from rising rates, you could potentially miss out on some gains if rates fall a great deal.

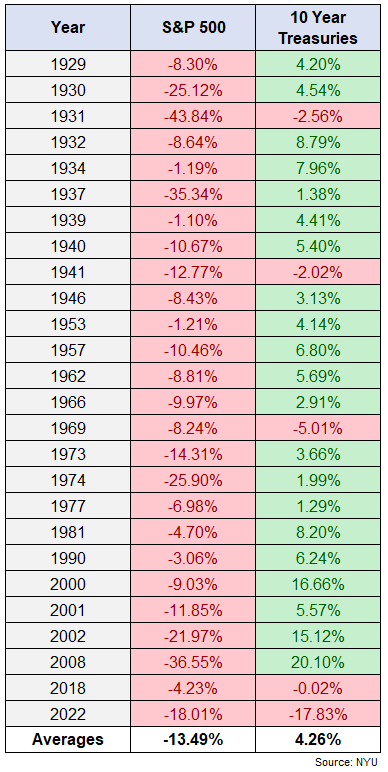

I’ve shown this before but it bears repeating:

U.S. government bonds tend to see outsized relative gains when the stock market is down.

If we go into a recession and the Fed cuts rates or yields in the bond market fall, bonds with higher duration will provide more bang for your buck.

Reinvestment risk would also present a potential problem in this scenario.

Let’s say the Fed overplays its hand, we get a recession and inflation falls. Short-term rates probably go from 5% to 2% or 3% (depending on the severity of the downturn).

In short-term bonds or cash or money markets you don’t get price appreciation from rates falling like you would in longer-duration bonds. You still get whatever your yield is in the meantime, but no additional gains.

Plus, your 5% yield is now 2% or whatever the Fed lowers rates to during the next slowdown.

You’ll probably have plenty of heads-up from the Fed when it comes to rate moves but the bond market won’t wait around for you.

So if you’re going to hide out in short-term fixed income you have to ask yourself if you’re willing to miss out on the potential gains from the bond market if and when rates do fall.

Bonds seem fairly straightforward right now in a way they haven’t for the past 15-20 years.

But things could get more complicated if inflation falls and/or we go into a recession and short-term rates go down.

We discussed this question on the latest Portfolio Rescue:

Bill Sweet joined me yet again to go over questions on starting your own business, Roth IRAs vs. SERPs, ordinary vs. qualified dividends and how often you should be dollar cost averaging into the stock market.

Remember if you have a question email us: askthecompoundshow@gmail.com