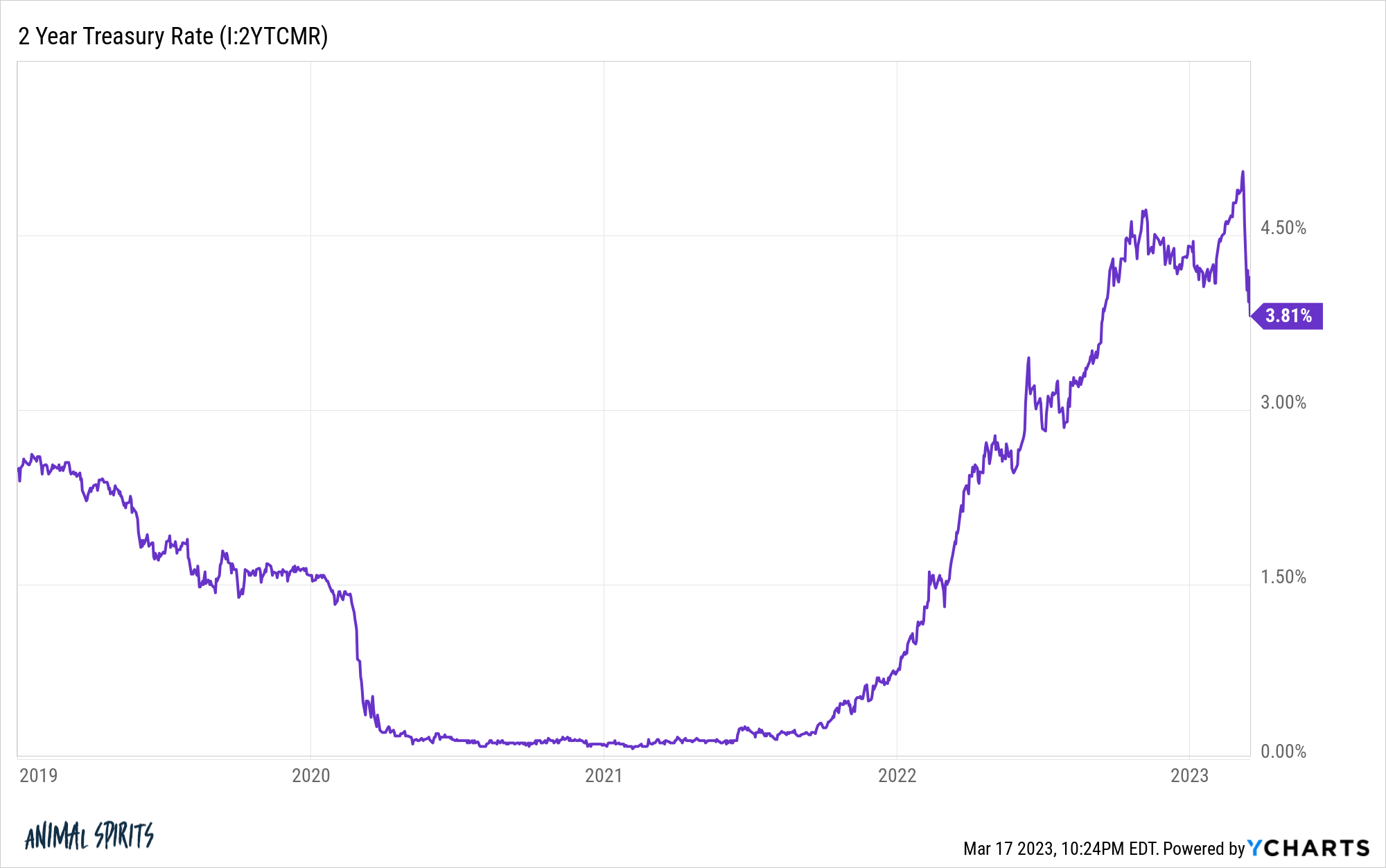

Last week Wednesday two year treasury yields closed the day at 5.05%.

It was the highest level since the summer of 2006.

That’s a pretty juicy yield for short-term government bonds.

Unfortunately, it didn’t last.

Look at the plunge in rates since the banking crisis took hold late last week:

It looks like a stock market crash.

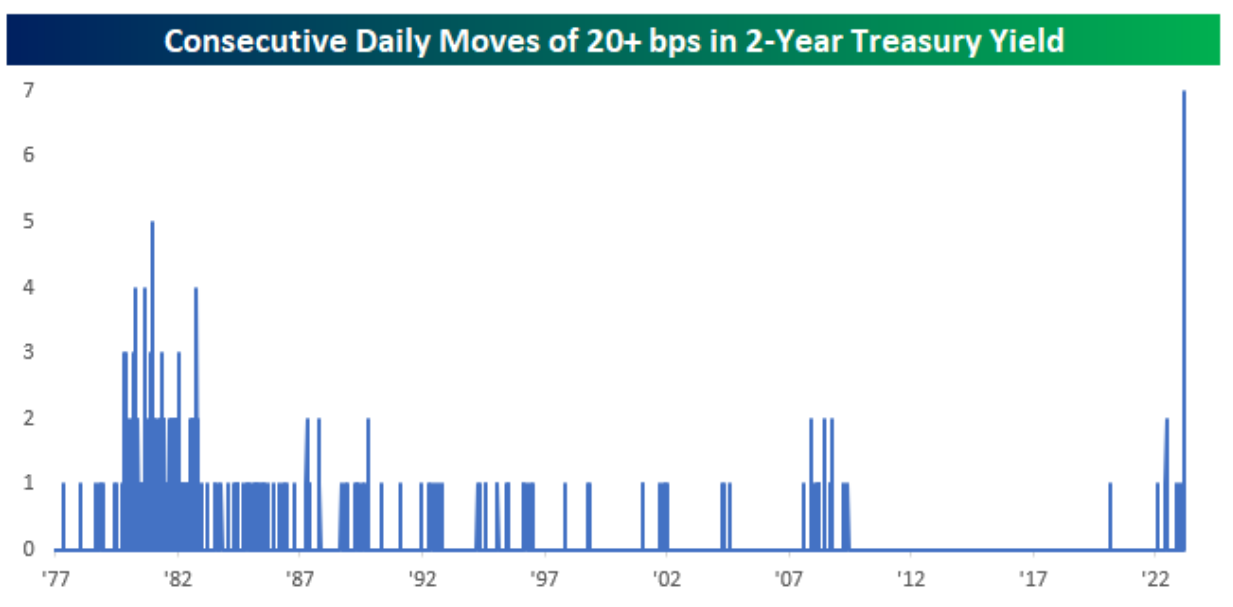

This is not normal. And it’s not just the drop in rates that stands out. The volatility is out of control.

Bespoke posted a chart that shows we’ve seen the most consecutive moves of 0.2%+ over the past four-plus decades:

Twenty basis points may not seem like a big move relative to the stock market but it’s a lot for short-term bonds.

Between last Friday and Monday two year yields crashed from 5% to 4%. Tuesday they shot back up. Wednesday they fell below 4%. Thursday they went back over 4%. Friday’s yields declined under 4% yet again.

Short-term bond yields are trading like a meme stock.

It’s hard to believe but the stock market is actually up since Silicon Valley Bank went down last Friday.

In the past 6 days, the S&P 500 is up almost 3%. The Nasdaq 100 has risen more than 6% in that time.

I don’t put a lot of stock into short-term market moves.

The stock market is not the economy, especially in the short-run. And most of the explanations we try to attach to the moves in financial markets are simply post-hoc narratives to make us feel better about the ups and downs.

But it sure does feel like it’s always something.

Right now we have volatility in the banking system, volatility in price levels (inflation) and volatility in rates.

I’ve been thinking a lot lately about the fact that my entire adult life seems like it’s gone from one crisis to the next.

I entered college right as the dot-com bubble was bursting. I was a sophomore in college when 9/11 happened.

Just a few short years out of college it was the housing market crash and Great Financial Crisis. Then there was the European debt crisis in 2010-2011.

Now we’ve experienced a pandemic, the highest inflation in four decades that followed and whatever this bank run thing is.1

In some respects, it feels like we’re living through a period of elevated volatility in geopolitics, markets and the economy.

But as someone who enjoys reading about financial market history I can attest that this is the norm. History is chock-full of panics, crises, crashes, ups, downs and the unexpected.

I’ve been in the finance industry for close to 20 years and it feels like we’ve lived through every type of environment imaginable — booms, busts, rising rates, falling rates, 0% rates, low inflation, high inflation, deflation, bull markets, bear markets and everything in-between.

Even though it feels like I’ve lived through every economic or market environment imaginable, I know there will be plenty of stuff that happens in the future that will surprise me.

The past 3 years or so have felt like an unprecedented time. And it has been in many ways.

In other ways, this is par for the course. There are periods of relative calm followed by period of heightened tension and volatility.

That’s kind of how things have always worked.

William Bernstein once wrote, “In the world of finance, the only black swans are the history that investors have not read.”

The rare and unexpected occur more often than you think.

Further Reading:

No One Knows What Will Happen

1I don’t know if this banking crisis will be a minor blip or lead to more pain down the road. Regardless of the outcome, this feels like the kind of ordeal that will have a long-lasting impact.