A reader asks:

I am in my mid-40s and have been running my own RRSP (Canadian 401k) for a while now. I have almost no exposure to bonds. I ran it by an advisor and her reply was why would you want bonds? They had been paying next to nothing for years. They don’t seem to even go up when stocks are going down. I can see her point. Instead of bonds I have been buying ETFs with a covered call component for what would be the “fixed income” portion of my portfolio. In the US an example would be JEPI. They pay a nice 6-10% distribution and looking at charts seem to be more secure than even a bond ETF with the cover call limiting the losses when the stocks go down and of course limiting the rise when they go up. I am not expecting to make a massive amount of capital gains from the value of the individual shares but using a drip and watching the shares multiply over time seems like a much better play than making almost nothing on a bond ETF? Does this make sense? Have the changes in rates changed this line of thinking?

We keep a running Google doc with all of the questions that come into our inbox and segment them out by category. Over the past 12 months or so the investing category has been filling up with questions about covered call strategies.

A number of investors swear by this strategy. Others are simply interested because a number of covered call funds outperformed the market last year.

Some people might not understand how covered call strategies work so it probably helps to give a quick tutorial here.

A call option is a contract that gives the buyer the right to purchase a security at a predetermined price at some point on or before a predetermined date. The seller of that call option has an obligation to sell the security at that predetermined price if it happens to make it there by the predetermined date.

If the stock never reaches the strike price in that time frame, the buyer is only out the premium paid while the seller keeps the option premium regardless.

For example, let’s say you own 50 shares of a stock that’s currently trading for $20. Call options with a strike price of $25 cost 50 cents a piece so you would earn $25 in income on your $1,000 position. That’s good enough for a yield of 2.5%.

But now your upside is limited to a 25% gain (going from $20 to $25) plus that 2.5% option premium.

If the stock goes to $30 or $35 you’re out those excess gains over and above $25 and the option buyer is out their $25 in premiums.

In a covered call strategy, you are the seller of call options on your individual holdings or an index.

Thus, this is the type of strategy that should underperform in a rip-roaring bull market. The income from the sale of options can help but in a hard-charging bull market but you’ll likely miss out on some gains and lag the overall market.

However, in a bear market, this strategy should outperform the market because the option income acts as a buffer. Plus, in a bear market, volatility spikes which should actually increase your income since volatility plays a large role in the pricing of options.

Essentially you are reducing both upside and downside volatility with this strategy.

Many covered call strategies target less volatile stocks and sectors which also helps lessen the blow from stock market losses.

This is one of the reasons so many investors are clamoring for covered call strategies right now — they’re less volatile and they outperformed last year.

Still, I wouldn’t go so far as to call this type of strategy a replacement for bonds. Many investors try to say this with dividend stocks as well.

That’s a stretch.

These strategies still carry equity risk. That risk might be blunted in comparison with the rest of the market but it’s still there. If stocks crash these strategies are going to get dinged too.

It’s also a stretch to compare option premiums to fixed-income yields. I’m not a fan of comparing option income with fixed income yields because those option premiums are far more volatile and not set in stone.

This kind of strategy can act as a form of diversification but not necessarily a bond or cash substitute as far as my risk tolerance is concerned.

Bonds had a dreadful 2022 but I don’t think one bad year is reason to give up on them completely. I’m not a fan of the term perfect storm when it comes to the markets but last year was like a hurricane mixed with a tornado with a tsunami on top for the bond market.

The pandemic drove bond yields to their lowest levels in history. Ten year treasury yields were less than half a percent at the lows. That was unsustainable even before we had 9% inflation.

There was no margin of safety built into bond yields so when the Fed went on one of their most aggressive rate hikes in history and inflation rose to levels not seen since the 1980s, bonds got killed.

Things that never happened before seem to happen all the time in the markets but what happened last year really was a one-off when it comes to historical bond returns.

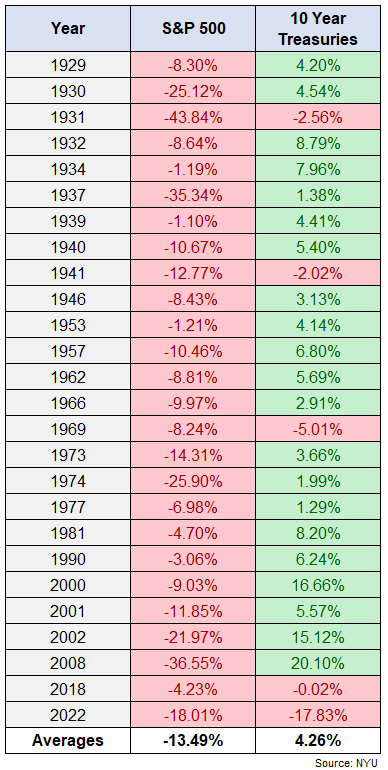

By my calculations, the S&P 500 has had 26 down years since 1928. The average loss for stocks in those down years was a decline 13.5%. The average return for 10 year treasuries in those down years for stocks was a gain of 4.3%:

And that average includes last year’s massacre in bonds. The biggest loss in bonds during a down year for stocks before last year was just 5%. Bonds have been up in 21 out of the 26 years that stocks have fallen.

That’s not a perfect record but it’s still pretty darn good protection. Nothing works always and forever in the markets. There are always exceptions to the rules.

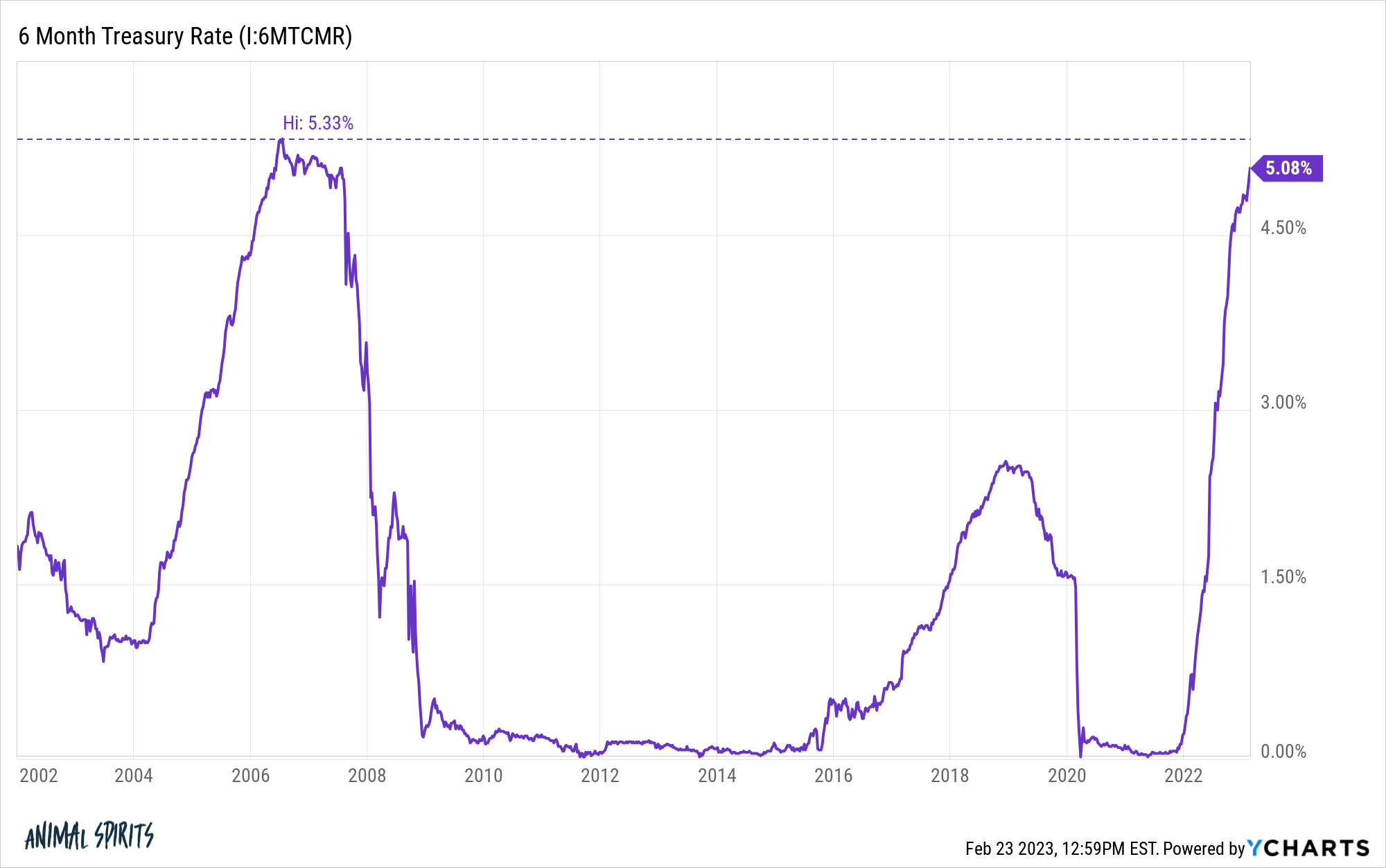

Yields could always move higher from here but investors are now looking at yields on U.S. government bonds of 4-5%. You can get 5% right now on a 6 or 12 month T-bill which means you basically have zero interest rate or duration risk.

Yes, inflation is still high but bonds are far more attractive now in terms of nominal yields than they have been in nearly 20 years.

I understand people not wanting to be involved in bonds when rates were less than 1% but that’s not the world we live in anymore.

Listen, bonds aren’t for everyone. Some investors prefer taking more risk. Some investors don’t think bonds are worth the hassle.

But going further out on the risk curve is simply trading one risk for another.

Just remember any income strategy that promises to pay a higher yield ALWAYS comes with higher risk.

I’m not going to talk anyone into or out of a covered call strategy as long as you go into it with your eyes wide open and understand how it works before investing.

We covered (get it?) this question on this week’s edition of Portfolio Rescue:

Barry Ritholtz joined me on the show to talk about questions on when it’s OK to turn off your 401k contributions, HELOCs vs. home equity loans, the housing market and how demographics could impact the markets going forward.

Further Reading:

Fight the Last Bull & Bear Market